New You Plan Blog

Never Miss Out On a Bargain With Our New Buy Now Pay Later Service!

As you may know, here at New You, we like to offer you big savings on all your products, but in order to do that, we have to sell items in bundles. And although the bundles are bargains, it usually means paying over £50 each time. If only you could buy now pay later?

Well now you can! We know you’re all feeling the pinch with the cost of living crisis in full swing (will the bad news ever stop?) and that finding the funds just at the right time can be tricky. So BNPL is the perfect solution.

Now, before you start thinking that BNPL comes with hefty interest, and you don’t want to pay even more on your products – stop! Our BNPL facility is INTEREST-FREE!

So what’s the catch? There is none! We genuinely just want to make life easy for you. We don’t want money to become a barrier to achieving your transformation.

How Does It Work?

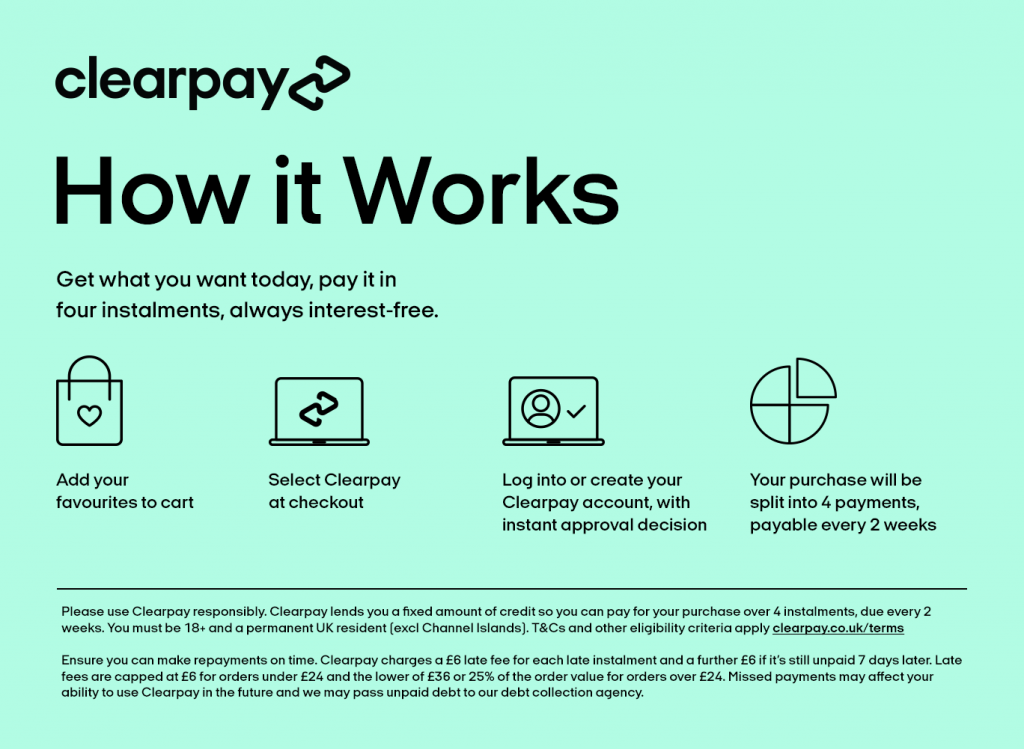

Just for you, New You have teamed up with the buy now pay later payment service, Clearpay. You may have heard of them before and even taken advantage of their service. But don’t worry if you haven’t as we’re gonna tell you everything you need to know.

It’s really simple to use! Fill your basket on our website or app as usual and just click Clearpay as your way to pay. When you do that, you will be directed to the Clearpay website to register or log in. It’s here that Clearpay cleverly breaks down your basket total into 4 equal instalments. You will then be required to pay your instalments every 2 weeks until it’s all clear.

Small Print Made Large

Of course, there’s always small print! But we’ve broken it down for you to give you maximum clarity:

- Clearpay is only available to permanent UK residents aged 18+ (excluding Channel Islands) with a UK billing address.

- Customers with international billing addresses will not be able to use Clearpay or create a Clearpay account.

- The exact amounts and payment dates will be made clear before you commit to the loan.

- If you’re feeling flush one week, you can make an additional payment without charge.

- There are late charges, so try not to miss a payment. Clearpay will give you until 11 pm on the following day to make your repayment and then you will incur a late fee if you are still not able to make the payment by then. This will be an initial £6 and a further fee of £6 if the missed payment is not made within 7 days. If your order is less than £24, the total late fee will be £6. If your order is £24 or over, the total late fees will not exceed 25% of the total order or £36, whichever is less.

- The maximum limit on a Clearpay account is £1000.

- If you would like more details you can visit the Clearpay website here for a comprehensive list of FAQs, Clearpay Terms of Service here, and Privacy Policy here: https://www.clearpay.co.uk/en-GB/privacy-policy”>https://www.clearpay.co.uk/en-GB/privacy-policy

So next time we’ve got a mega offer on or you just need to top up your products and pay day can’t come quick enough, then take advantage of BNPL so you don’t miss out.

https://blog.thenewyouplan.com/never-miss-out-on-a-bargain-with-our-new-buy-now-pay-later-service/”>