![]()

I have a very out of consensus opinion. I think that at some point in the next couple of months, the market is going to catch on that the US housing industry is bottoming and housing stocks are going to take off.

I know, there are lots of reasons to think this won’t happen. It is a long list: high inventory, high prices, low sales, and most important – high interest rates.

Things couldn’t get much worse for housing! In fact, it won’t. And there are a couple of big catalysts that could make that turn much faster than anyone is pricing in.

Right now, the market isn’t pricing in any turn at all.

The obvious group, the home builder stocks, are just plain cheap. Much cheaper than the market.

While the stock market makes new highs every day, the S&P Homebuilders ETF (XHB – NASDAQ) are still struggling off their April bottoms.

Source: Stockcharts.com

The nation’s biggest home builder DR Horton (DHI – NASDAQ) reported earnings last week. The stock was up more than 15% on the day, even though the results were anything but stellar.

All DR Horton said was that things weren’t getting worse. That’s all the market needed to hear.

The reason the market was so sanguine was because DR Horton is just so cheap – with expected earnings of $12 per share it trades at 13x PE on this year’s earnings and just 12x on next years earnings.

That is well, well below the market multiple, which is 22x at current levels.

Yeah, but they are a home builder and home builders are always cheap right?

Well consider that DR Horton had a return on equity of 16% last quarter. They are guiding for sustained 20% return on equity over the long run.

That’s not a bad business!

What’s more, these are trough earnings. During the COVID home building “boom” (I put this in quotes because we have been chronically underbuilding homes at the time – more on that shortly), DR Horton did $16 per share of EPS.

DR Horton has taken advantage of the downturn in its stock price and has been buying back stock like crazy. In the last year has repurchased 12.5M shares, reducing their share count by 9%. On top of that they pay a $1.60 per share dividend.

Talk about shareholder friendly!

You can see why there is plenty of room for the stock to go up.

So what’s the catalyst? There are a few of them.

WHY THE TIDE IS TURNING

There are two big reasons for the home builders to do well.

The first is all about interest rates. We all know how much housing depends on rates. Houses are financed with mortgages and the lower the cost of the financing, the cheaper the cost of housing.

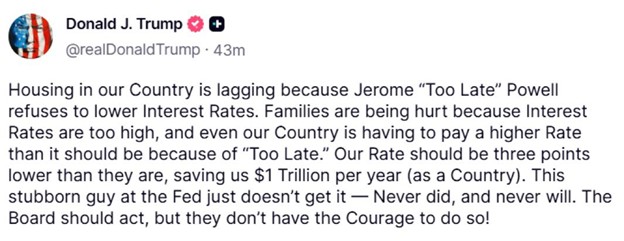

Rates have been high, but Trump is demanding they come down. He has been relentlessly attacking the Federal Reserve to drop interest rates to as low was 1%.

Trump seems to be very aware that higher rates are holding back housing.

Source: Truth Social

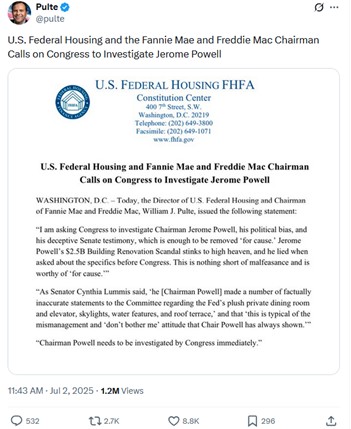

He has back up. A second cheerleader in the Trump administration has been Bill Pulte.

The first thing to be said about Pulte is that this is the Pulte of Pulte Homes. His Grandfather founded Pulte Homes, now PulteGroup (PHM – NASDAQ), the 3rd largest home builder in the US.

Pulte has been on the board of directors of PulteGroup in the past, and obviously has a soft spot for home building.

Pulte has also been relentless with his attacks on Powell and the refusal to drop rates. He even went so far as to call on Congress to “immediately” investigate Powell.

Source: X.com

Just last week we found a third voice has chimed in. Speaker of the House Mike Johnson said he’s being disenchanted with Powell.

Source: Bloomberg

It’s pretty clear that the writing is on the wall. The Administration wants change!

Who would replace Powelll? Lately there has been a chorus of calls for Pulte to be the next Fed chair. I don’t really have a clue how Pulte would fare in the role, but I’m pretty sure it would mean lower short-term rates.

But honestly, it doesn’t really matter who it is. Every prospective replacement for Powell is going to be hand picked by Trump. Maybe the single most important requirement of that person is going to be their view on rates.

But wait – isn’t it long-term rates that matter to housing?

That is true. And ideally, we’d like both short and long rates to come down.

Even short-term rates are going to be positive for housing at the margins. More homeowners will choose a variable rate mortgage. Builders and developers will reach for short-term loans to finance a new build.

Moreover, it isn’t clear that if short-term rates go down, long rates won’t follow.

The argument that long rates have to stay up is simple – inflation! But this seems like recency bias. We had zero rates for years before COVID and it certainly didn’t lead to inflation. This may be much-ado about nothing.

Bottomline, it’s more likely that rates are going to come down regardless of whether the economy needs it or not. And maybe quite a bit.

TRUMP NEEDS HOUSING

TO GET ON TRACK

Trump is focusing on rates and housing for good reason: because he needs housing to juice the economy.

We just had the Big, Beautiful Bill pass. While it may or may not be big or beautiful, it certainly is going to increase the deficit.

That means that if Trump is to have any hope of bringing down the deficit, there is only one way to do it – economic growth.

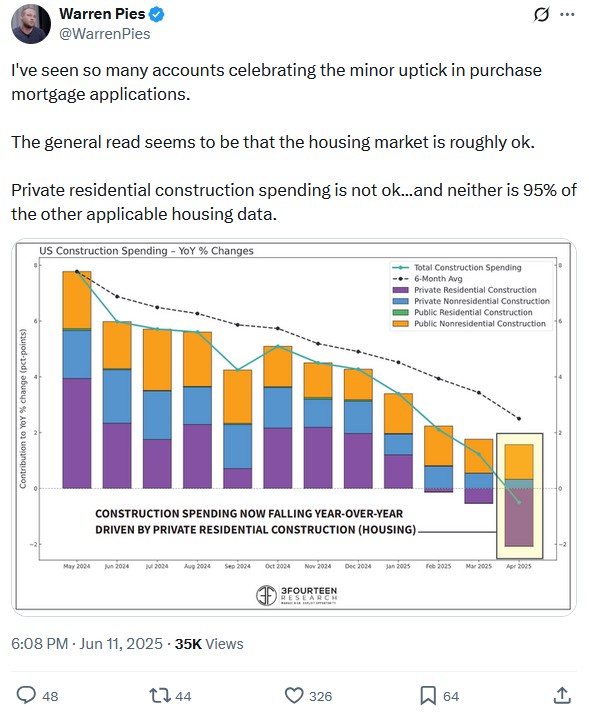

3Fourteen strategist and co-founder Warren Pies has been saying for a long time that housing is everything for this economy. Without housing, economic growth will lag.

Pies has said numerous times on CNBC and on podcasts that the US economy floats and sinks with residential construction jobs. Trends in permits, starts and homebuilder sentiment are cues of where the economy is headed.

Lately, that data has been weak.

Source: X.com

Mark Zandi, Chief Economist for Moody’s Analytics, has echoed the same thing.

This week, Zandi said in a Twitter thread that it is homebuilders that have been holding up home sales through rate discounts and by lowering credit scores for borrowers.

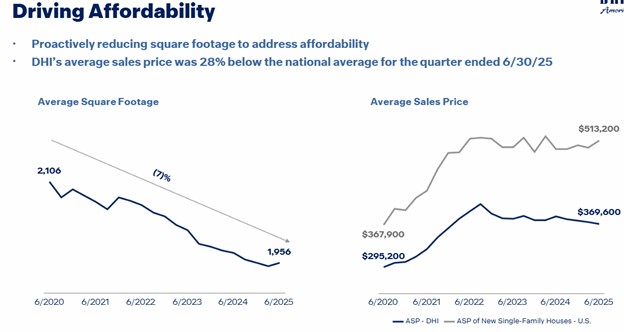

After listening to DR Horton, I can tell you they agree. They are also reducing square footage to keep prices down while adding bells and whistles to drive demand.

Source: DR Horton Q2 Presentation

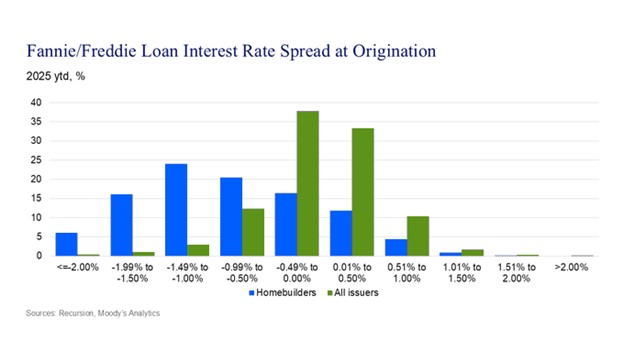

The chart below shows that the majority of mortgages taken out on new homes via builders are getting at least some break on the rate they pay. More than 20% of loans are getting >1.50% less than the going Fannie/Freddie rate.

Source: Mark Zandi/Moody Analytics

DR Horton’s results backed up what Zandi said, as they admitted on their call this week that “borrowers originating loans with DHI Mortgage this quarter had an average FICO score of 720 and an average loan-to-value ratio of 90%” – that is 5 points down year-over-year.

But all of this can only work for so long.

All this is to say that things aren’t great in the home building business, and they aren’t any better in the resales business.

Which is what I bet Trump knows and wants to change. But we have one more hump to get over first.

TARIFF THREAT IS AN OVERHANG

The homebuilding business has actually been a worse year for homebuilders than it was last year, even though rates are about the same.

The reason is uncertainty–about tariffs and the economy.

It is a triple whammy: the economy is slow, rates are high, and no one is sure what tariffs will bring.

People are nervous. A home purchase is a big deal, maybe the biggest in your lifetime, and it is especially unnerving that home prices are high even with the uncertainty that is out there.

Of course, that could all change on a dime. We are beginning to see tariff deals come in. It almost doesn’t matter to home builders what the tariffs come in at so much as that there is price certainty.

THE US IS FALLING BEHIND!

I know I’m throwing out a lot of negatives but believe me, it adds up to a big positive.

While the short run is an oversupply of homes, in a longer time horizon we are building way too few of them.

The United States is structurally underbuilding single-family homes. They have been doing so for years.

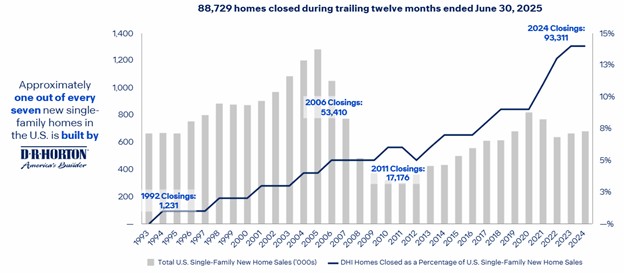

Consider this crazy chart from DR Horton, which used it to show their growing market share. But what I found interesting were the grey bars, which showed total new home sales in the United States.

Source: DR Horton Q3 Investor Presentation

New home sales have lagged pre-2007 levels for almost 20 years!

At some point that has to change, and when it does, even at the margin, homebuilder stocks are going to soar.

Right now, we are in the “bottoming” phase of the recovery. The stocks are up off their lows. We are starting to see breakouts but we aren’t getting the follow-through.

Source: Stockcharts.com

When the market settles on the idea that Trump is going to get his lower rates and puts that together with Trump needing (and knows he needs!) home building to drive the economy, that follow-through will happen and the rally will get some juice.

I don’t think it is that far away.

ZILLOW – THE TRANSACTION TRADE

The homebuilders are one obvious beneficiary. I mention DR Horton because A. they are the biggest and B. they just reported earnings. You can go to Toll Brother (TOL – NYSE) or PulteGroup or go down the stack to the smaller niche builders.

But there are other parts of the housing market that are going to benefit from lower rates just as much.

Zillow Group (ZG – NASDAQ) may be the top dog to benefit outside of the homebuilders. Zillow operates the largest real estate marketplace in the United States. I’ve seen it called a “housing super-app”. It covers almost every element of the real estate lifecycle – buying, selling, renting, financing, and home services.

Zillow is not a cheap stock. It trades at 30x this year’s earnings.

But here’s the thing. I always like to try to sum up an idea in a single, key metric. One thing that will drive the top and bottom line.

If you step through Zillow’s businesses and take a close look at how they make money, you will find that virtually every revenue stream that Zillow brings in has one common element.

All of their growth is tied to the growth in housing transactions.

Zillow has done a good job of keeping its head above water, growing the top line, making a profit, in a housing market that has been not good at all.

Put Zillow’s business in a good housing market? With increasing transactions? Zillow should hit it out of the park.

One other name that I almost have to mention is Opendoor Technologies (OPEN – NASDAQ). Buyer beware.

Opendoor buys and sells houses. In all honesty, what they do doesn’t seem like a great business to me. These guys haven’t been able to make money even as they scale.

I see Opendoor as a pure meme stock. The fundamentals aren’t there and that doesn’t seem to matter.

But Opendoor will get a nice tailwind if housing begins to drive growth again. Buying homes into a rising market is a lot easier than into a falling one.

Mull it over. I will too. While I’m not 100% convinced that this thesis will pan out, I am confident if it does, there are lots of ways to play it and lots of money to be made. All we need to do is wait for interest rates to turn.

oilandgas-investments.com (Article Sourced Website)

#HOUSING #STOCKS #BIG #WINNER