For more than a decade, B2B marketers have relied on metrics like Share of Search (SoS) to assess brand demand, understand visibility and track whether people actually care enough to look them up. It’s a dependable measure and still one of the strongest indicators of brand health.

But the way B2B buyers research has changed. And it’s changed dramatically.

Today’s decision-makers aren’t starting with Google as often as you think. Increasingly, they’re going straight to Large Language Models (LLMs) like ChatGPT and Gemini to get quick answers, compare vendors and kickstart shortlists before they ever land on your site.

It’s a shift that raises a big question. If buyers are asking LLMs for advice, how do you know whether your brand shows up?

This is where Share of LLM comes in, being a new metric that reveals how visible and trusted your brand is inside AI-generated answers. And if you’re a B2B marketer, it’s now impossible to ignore.

So let’s break down what Share of LLM actually means, why it matters and what our research uncovered when analysing B2B brands across multiple sectors. Most importantly, we’ll explain what you can do now to strengthen your presence in AI-driven search.

What is Share of LLM?

Share of LLM (SoLLM) measures how often a brand appears in AI-generated answers when users ask questions relevant to its market.

Think of it as the proportion of mentions, citations or references a brand receives across a large set of LLM responses. For example:

- “Best HR software for mid-size companies”

- “Top payment processing platforms for ecommerce”

- “Which manufacturing suppliers specialise in sustainable materials?”

If a brand consistently appears in the LLM’s answers, it means the model recognises it as a credible source. If it’s absent, the model either doesn’t know it or doesn’t trust it enough to include it.

Put simply, Share of Search tells you who the audience knows. Share of LLM tells you who the AI trusts. And, as more research shifts into AI-powered environments, that trust becomes a critical competitive advantage.

Why Share of LLM matters for B2B marketers

SoLLM isn’t just another headline metric. It reflects a fundamental change in how information is gathered and interpreted.

To understand its value, you only need to look at how buyers behave:

- They want answers faster.

- They want information without sifting through sites.

- They want summaries, comparisons and recommendations instantly.

- And they’re increasingly comfortable getting that from AI.

If your brand isn’t represented in the content the model draws on, you won’t be included in its answers. But your competitors may very well be.

Three reasons SoLLM now matters as much as SoS

1

LLMs are being used earlier in the buying journey

Buyers use LLMs to ‘sanity-check’ the market before they ever hit your website. If you’re not in that first round of exposure, you start at a disadvantage.

2

AI search is more competitive than Google

In traditional search, a brand can dominate 60 or 70% of demand in a category. In LLMs, it’s almost impossible. Visibility is more evenly distributed, which means every mention counts.

3

AI-generated answers influence real decisions

LLMs synthesise huge amounts of information to present the ‘most likely’ or ‘most trusted’ recommendations. Appearing in that output directly affects brand perception.

If your buyers trust AI’s answers, even partially, you need to know whether you’re part of the conversation.

How Share of LLM relates to Share of Search

Our research shows a clear link between a brand’s Share of Search and its performance in Share of LLM. In sectors like HR software, the alignment was almost perfect.

Why? Because brands with strong SoS typically have:

- A large volume of relevant content

- Strong backlink profiles

- Lots of branded mentions

- Higher authority across topics

- A wide digital footprint

These are exactly the signals LLMs use to decide who to reference. So search dominance still matters. And it matters a lot.

But there’s an important caveat.

Search strength isn’t always enough

Some brands performed extremely well in search but underperformed in LLM visibility. This gap shows that brand awareness alone isn’t a guarantee of AI authority.

LLMs reward:

- Breadth of topic coverage

- Semantically-rich content

- Clear internal linking

- Updated and trustworthy information

- Credibility through reputable mentions

If your content ecosystem doesn’t demonstrate this depth, you may lose out, even if you dominate in traditional search.

What our data revealed across four B2B sectors

We analysed Share of Search vs Share of LLM across four major B2B industries:

- HR software

- Digital transformation

- Manufacturing

- Fintech

Each included four representative brands, tested against a large set of long-tail, high-intent and comparison-based prompts.

Here’s what the data shows.

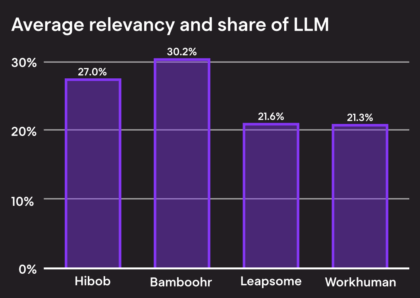

HR software

Perfect alignment between SoS and SoLLM

This sector was the cleanest example of search strength carrying straight through to AI authority, with brands like HiBob and BambooHR appearing exactly where you’d expect in LLM results based on their Share of Search.

The standout was HiBob, which didn’t dominate position one rankings but appeared in the top two positions 86% of the time, showing that consistency matters more than occasional wins.

Key insight

In categories with mature content strategies and strong topic coverage, established brands tend to maintain their authority inside LLMs.

What B2B marketers can learn

You don’t need a handful of ‘hero pages’. You need consistent coverage across every topic buyers care about.

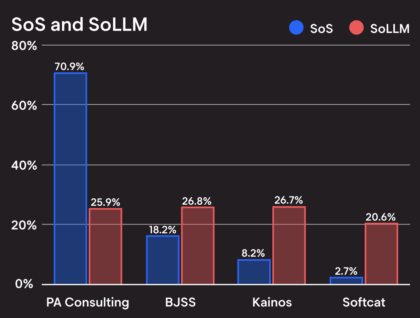

Digital transformation

Where search dominance breaks down

This sector showed the biggest mismatch between Share of Search and Share of LLM. PA Consulting, the strongest in traditional search, ranked only third in AI visibility, while BJSS and Kainos outperformed expectations. The gap exists because LLMs evaluate the substance of content, not the volume of search activity around a brand.

Softcat’s performance was even more volatile, swinging between first and fourth place depending on the prompt. This is the danger of over-specialisation. If you’re not covering a broad enough range of topics, the model fills the gaps with someone else.

Key insight

LLMs reward breadth. If you leave topic gaps, your competitors will occupy them.

What B2B marketers can learn

Your mid-tier rankings matter more than your occasional wins. If you’re consistently present (even in positions two–three), AI learns to trust you.

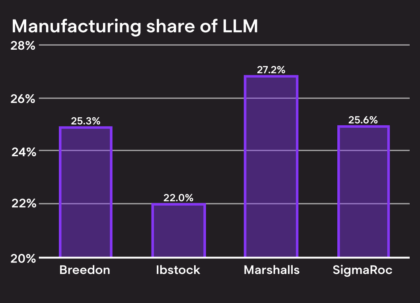

Manufacturing

The most competitive sector

Manufacturing brands were tightly clustered, making this the most competitive category in the analysis. Marshalls emerged as the overall leader with 27.2% Share of LLM, driven by broad and stable performance across a wide range of manufacturing-related themes.

Other brands took a more specialised approach. Ibstock performed strongly in key areas but was weaker elsewhere, while Breedon Group and SigmaRoc focused on topic-led content that delivered consistent mid-tier visibility rather than dominant positions.

Key insight

In competitive markets, breadth is essential. Every brand is visible, but only those with the widest topic coverage stand out.

What B2B marketers can learn

You need both depth and breadth. Focusing on niche strengths alone creates volatility.

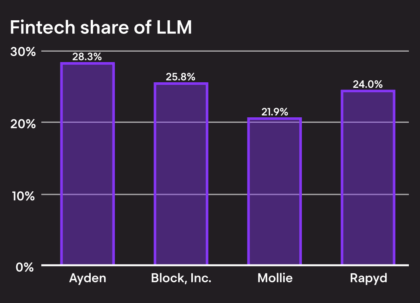

Fintech

Hierarchy as expected

Fintech showed the most predictable results, with Adyen, already the category leader, dominating both Share of Search and Share of LLM. Smaller brands such as Mollie struggled to gain traction, reinforcing a hard truth about LLM ecosystems. If a brand has not yet built authority, AI will not create it on its behalf, although there is still a route in.

Key insight

LLMs mirror known hierarchies, unless a challenger creates exceptional content in under-served niches.

What B2B marketers can learn

If you can’t beat dominant players on breadth, focus on narrow, specialist areas where your expertise is strong and competitors are absent.

What influences Share of LLM?

Several factors affect how often a brand appears in AI-generated responses. None of them are quick wins, which is exactly why they matter.

Depth and breadth of content

LLMs don’t rely on keywords. They rely on meaning. So your content needs to:

- Cover a wide range of relevant subtopics

- Demonstrate depth across those topics

- Use clear internal linking

- Form a coherent, semantically rich ecosystem

Strong brand signals

Branded web mentions are becoming more important than backlinks. LLMs use them to determine whether your brand is widely referenced, which is another way of saying trust.

Topic clusters, not one-off pages

Fragmenting content (‘chunking’) weakens authority. LLMs prefer pages that thoroughly cover user needs.

E-E-A-T as a foundation

Expertise, experience, authority and trustworthiness now influence not just Google rankings but how AI decides which sources to use.

Technical soundness

Poor technical SEO means your pages may be crawlable by Google but less discoverable to the broader systems that feed LLMs.

How to improve your Share of LLM

SoLLM isn’t something you ‘optimise’ for with quick tweaks. It’s earned through long-term strategic improvements. But there are practical steps you can take now.

Build a coherent content ecosystem

Your content should work together, not as isolated pieces. So focus on:

- Strong topical clusters

- Clear internal linking

- Well-structured pages (clean H2s and H3s, one H1)

- High semantic relevance

This isn’t about quantity. It’s about coverage.

Strengthen branded signals

Invest in digital PR and thought leadership to build reputation. LLMs look for:

- Brand mentions

- Expert quotes

- Reputable coverage

- Social credibility

These signals show the model you’re not just producing content but are recognised beyond your own site.

Keep content updated

LLMs favour sources that stay current. Stale content dilutes authority, especially in evolving sectors like fintech or digital transformation.

Focus on mid-tier rankings

You don’t need to dominate position one. Regular appearances in positions two–three show stability, which LLMs reward.

Check whether your audience actually uses LLMs

Not every sector leans into AI tools equally. Use audience intelligence platforms like SparkToro to validate whether LLM optimisation should be a priority.

Why B2B marketers can’t ignore SoLLM

We’re at the start of a fundamental shift, with AI-assisted discovery becoming mainstream and buyers increasingly trusting models to filter information for them.

That puts Share of LLM at the heart of future visibility.

- It shows whether your brand appears in buyers’ earliest research moments.

- It reveals gaps your competitors can exploit.

- It goes beyond traditional SEO to measure real authority.

- And it helps future-proof your presence as search behaviour changes.

What this shift really means

Share of Search still matters and remains a strong indicator of brand demand, while Share of LLM reflects a different kind of visibility. If you want to influence tomorrow’s buyers, you need to understand whether your brand exists in the places they’re already looking.

What happens next

While AI won’t replace marketers, it will replace those who ignore how buyer behaviour is changing. As AI-powered research becomes more common, brands need to understand how and where they appear when buyers ask questions.

Share of LLM gives B2B marketers a way to measure and influence visibility in these environments. It shows whether your expertise is being seen, cited and trusted in the places that increasingly shape early buying decisions.

For brands willing to act early, this creates a genuine opportunity. Competition is closer, trust is earned differently and small improvements can make a meaningful difference over time.

If you want to understand how your brand appears in AI search, we can help. We measure Share of LLM, benchmark performance and support brands in improving their visibility, clearly and with confidence.

Download our full whitepaper Share of Search vs Share of LLM: The new measure of authority for B2B brands here.

The post What is Share of LLM and why is it the new metric B2B marketers can’t ignore? appeared first on Hallam.

hallam.agency (Article Sourced Website)

#Share #LLM #metric #B2B #marketers #ignore