Rove Miles is a relatively new rewards program that lets you earn a flexible points currency from online shopping and travel bookings, then redeem those miles for flights and hotels or transfer them to airline and hotel partners.

Think of it as a mash-up of an online shopping portal, an OTA, and a transferable points program — but without needing a co-branded credit card to get in on the action.

In this introductory guide, we’ll cover what Rove Miles is, how it works, where it shines (and where it doesn’t), and how a points-savvy traveller might incorporate it alongside traditional programs.

What Is Rove Miles?

Rove Miles is a standalone loyalty program launched in 2025 that issues its own rewards currency, simply called Rove Miles.

It positions itself as a “universal airline mile,” aggregating multiple airline and hotel programs under one roof and making it easier for people, especially those without premium credit cards, to earn and use miles for travel.

In many ways, Rove behaves like a hybrid of travel tools most Canadians already use. Part shopping portal, part travel booking site, part transferable currency platform — just with its rough edges still showing.

If you’ve used Aeroplan eStore, Rakuten, Expedia, or a fixed-value rewards program like Scene+ points, you’ll recognize the structure instantly.

The intention is clear: make earning travel rewards accessible to people who aren’t ready for, or aren’t eligible for, the usual lineup of rewards credit cards.

At its core, Rove lets you:

- Book hotels and earn up to 25x Rove Miles (up to 50x during promotions) per dollar spent.

- Book flights and earn 1–10x Rove Miles per dollar spent.

- Earn miles via an online shopping portal and Chrome extension at over 7,000–13,000 merchants, depending on the source and timing.

- Redeem miles for flights and hotels directly through Rove, or transfer them to 13 airline and hotel partners.

The big selling point: all of this stacks on top of your usual airline miles, hotel points, and credit card rewards, so you are “triple‑dipping” on many transactions.

How is Rove Different from Other Programs?

On the earn side, Rove behaves a lot like Rakuten, TopCashBack, or airline shopping portals combined with OTAs like Expedia and Hotels.com.

The twist is what you earn. Rather than locking you into a single airline or offering simple cash back, Rove funnels your rewards into a transferable currency with airline and hotel partners.

That puts it more in line with bank-issued transferable programs, just without the bank card.

You click through, earn a percentage back in Rove Miles instead of cash or a specific airline currency, and can book flights and hotels directly on Rove’s website.

The difference here is that with Rove, you earn Rove Miles on top of the airline loyalty points you would earn if you booked through other channels. Normally, you could attempt something similar by clicking through a cash back portal like Rakuten and then booking via Expedia.

Historically, however, the cash back earned through these portals is often slim enough that it’s not worth the added complexity. If plans go sideways, you can easily end up stuck between the OTA and the airline, each pointing at the other.

Hotel bookings are where Rove truly stands out.

As miles and points collectors and elite status chasers, one of the main reasons we avoid OTAs is that bookings through third-party platforms typically do not earn elite qualifying nights or points.

For example, if you are a Marriott Platinum member and book a JW Marriott Parq through Expedia, you are not only ineligible for Platinum benefits like complimentary breakfast, executive lounge access, or late checkout, but you also won’t earn points or elite qualifying nights.

This is why we choose to book directly with hotels, even when OTAs offer slightly cheaper rates. The value lost from forfeiting elite benefits and progress toward status usually outweighs the savings.

This is the problem Rove is attempting to solve.

Loyalty-Eligible Hotel Bookings

Rove has introduced a loyalty-eligible booking option that allows you to receive elite benefits and qualifying activity even when booking through Rove’s portal.

Moreover, payment is settled directly with the hotel, despite the booking being made through Rove. This means you can still earn elevated rewards when using hotel co-branded credit cards, such as the Marriott Bonvoy® American Express® Card, Hilton Honors Aspire Card, or World of Hyatt Credit Card.

The trade-off is that loyalty-eligible rates do tend to be slightly higher than comparable rates offered directly on hotel websites.

That said, after some experimentation, the difference appeared fairly modest, and the overall value proposition can make sense once you factor in the Rove Miles earned on the stay.

In short, Rove behaves like bank transferable currencies

Rove is arguably most comparable to things like Citi ThankYou or, in some respects, Marriott Bonvoy, according to third‑party reviewers. It has a roster of airline and hotel partners, mostly with 1:1 transfer ratios, and a dedicated portal for searching and booking flights and hotels.

However, there are some notable differences:

- You do not earn Rove Miles from everyday card spend; there are no financial products affiliated with Rove, so you earn them from shopping and booking through Rove.

- Rove includes some partners that other major currencies do not, which could create unique value propositions for specific routes or cabins.

For a Canadian points collector who already has programs like Aeroplan, Amex Membership Rewards, and RBC Avion in the toolkit, Rove looks more like a diversification and stacking tool than a foundational currency, but it has interesting angles.

How Does Rove Make This Possible?

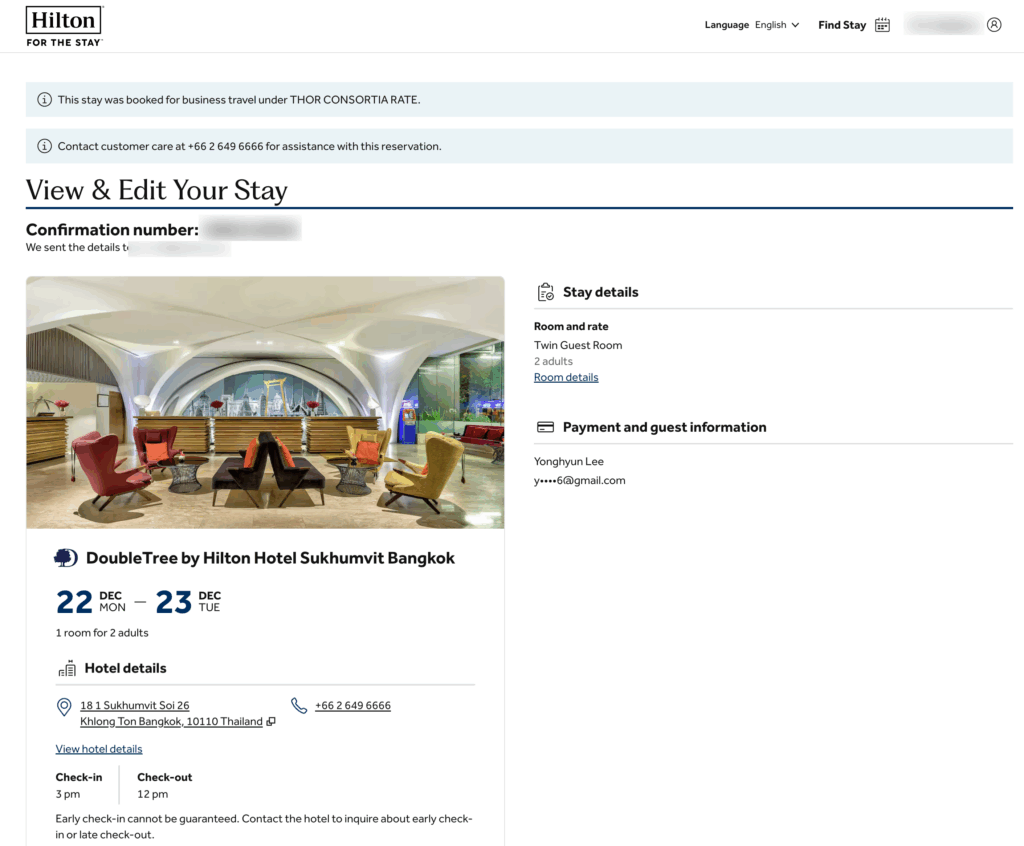

Out of curiosity, I went a step further and made an actual booking through Rove, although the stay itself has not yet been completed. (I’ll report back once my stay is complete).

I booked DoubleTree Bangkok Ploenchit just to test the platform.

During the booking process, you are presented with two types of rates: Rove rates and loyalty-eligible rates.

Rove rates are typically slightly cheaper and earn higher Rove Miles multipliers, but they do not come with hotel loyalty benefits. These may suit travellers without elite status or those staying at independent or boutique properties.

Since I hold Hilton Honors Diamond status and wanted to receive my usual benefits, I selected the loyalty-eligible rate.

After completing the booking, the reservation appeared immediately in my Hilton account.

One interesting observation was that the booking showed up as a Hilton for Business rate. From prior experience, this rate type is often 5–7% cheaper than publicly available member rates, which may help explain how Rove can afford to offer elevated mileage earnings.

That said, without full visibility into Rove’s commercial arrangements with hotel chains, there is a reasonable question around how these bookings are structured behind the scenes.

The last thing we want to witness is our accounts being closed due to unintended misuse.

Hopefully, I’ll be able to follow up with Rove directly to clarify how these loyalty-eligible bookings are set up and whether they are fully sanctioned by hotel partners.

How to Earn Rove Miles

Rove offers two primary ways to earn miles: online shopping and travel bookings.

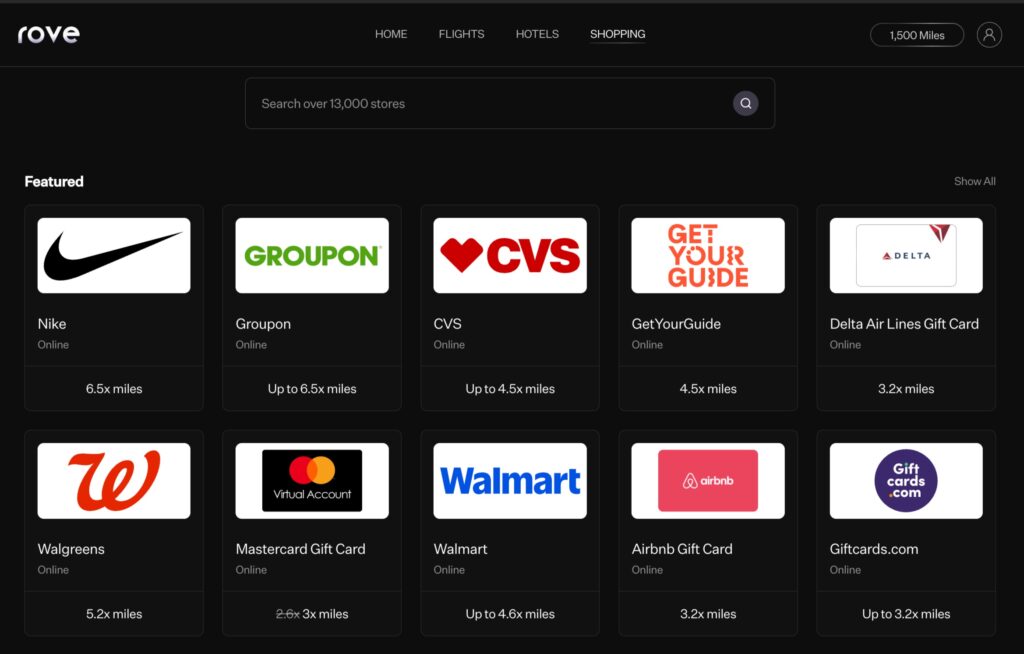

Online Shopping

Rove operates an online shopping portal and Chrome extension that functions similarly to Aeroplan eStore or Rakuten.

You can browse participating merchants directly through Rove’s website or activate earnings automatically via the browser extension when visiting eligible retailers.

Rove claims participation from thousands of merchants, with figures ranging from 7,000 to over 13,000 depending on the source. Earn rates vary by retailer and category, and Rove has periodically run promotions, including elevated earn rates on gift cards.

As with other shopping portals, you still earn rewards on your credit card, and in some cases can stack issuer offers or merchant promotions on top of Rove Miles earnings.

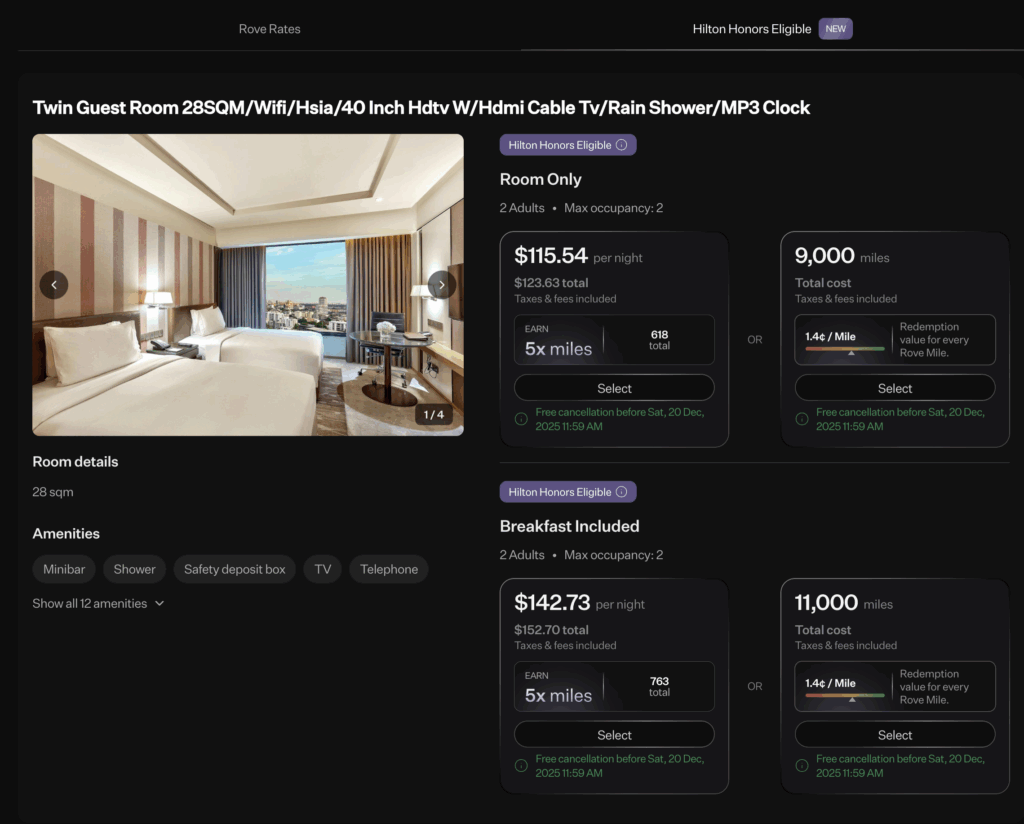

Hotel Bookings

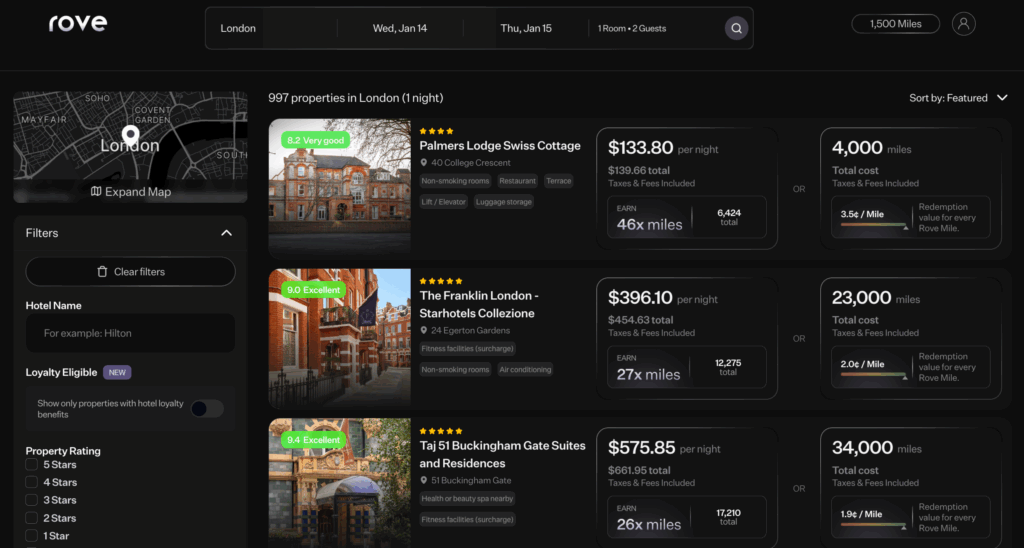

Hotels are where Rove advertises its most eye-catching earn rates and where the platform arguably delivers the most interesting value.

When you book hotels through Rove, you can earn up to 25x Rove Miles per dollar spent at over 200,000 properties worldwide. Actual earn rates depend on the property, rate type, and any active promotions, but they are often meaningfully higher than what you’d see through traditional OTAs or bank travel portals.

One important distinction is between standard “Rove Miles” rates and loyalty-eligible rates. Rove Miles rates tend to be slightly cheaper and earn higher Rove Miles multipliers, but do not qualify for hotel loyalty benefits or elite credit.

Loyalty-eligible rates, on the other hand, allow you to earn hotel points, elite qualifying nights, and receive on-property benefits, provided you enter your loyalty number during checkout.

For non-refundable hotel bookings, Rove Miles are typically credited shortly after booking rather than after the stay is completed, which can be useful if you plan to reuse those miles on a subsequent trip.

Crucially, for loyalty-eligible bookings, payment is settled directly with the hotel. This means you can still earn bonus points from hotel co-branded credit cards, making it possible to stack hotel points, elite credit, credit card rewards, and Rove Miles on a single stay.

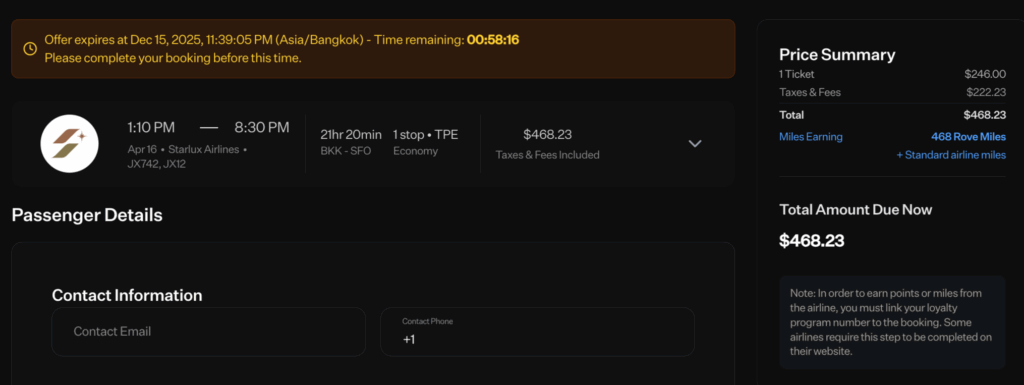

Flight Bookings

Rove also allows you to earn miles on flight bookings made through its platform, with advertised earn rates ranging from 1x to 10x Rove Miles per dollar spent.

In practice, the base earn rate appears to start at 1x, with higher multipliers available in certain cases depending on the airline, route, or promotional structure. Unlike hotels, the exact earn rate is not always visible at first glance and may only appear later in the booking flow.

After booking a flight through Rove, you receive both a Rove booking reference and the airline’s PNR. You can then retrieve the booking directly on the airline’s website or app and add your frequent flyer number if it is not already attached.

Rove confirms that flight bookings earn airline miles and elite credit as usual, meaning you can stack airline miles, credit card rewards, and Rove Miles on the same ticket. While flight earn rates through Rove are generally less impressive than hotels, the ability to layer an extra rewards currency on top of an otherwise normal cash booking can still add incremental value.

How to Redeem Rove Miles

Once you have earned a stash of Rove Miles, you have two main redemption paths: booking travel directly through Rove, or transferring to partner programs.

Direct Booking via the Rove Portal

For flights, Rove offers dynamic pricing, typically delivering around 1.3–1.5 cents per mile in value. You redeem miles directly, receive a standard airline ticket, and check in as usual.

For hotels, Rove supports redemptions at over 200,000 properties worldwide. Redemption values are often higher than flights, with some bookings offering upwards of 2 cents per mile. Rove displays a cents-per-mile indicator during search to help identify stronger-value redemptions.

Redeem on Flights

When you search flights with miles toggled on, Rove shows you options labelled as “direct booking” and “transfer booking.” Direct bookings are flights that Rove itself tickets, using a dynamic mileage price typically in the range of 1.3–1.5 cents per mile in value. You redeem Rove Miles directly, get a booking confirmation and PNR, and then check in with the airline like any other ticket.

The appeal of direct booking is simplicity: no need to understand partner award charts or routing rules, you just pick the flight and pay with miles at the displayed rate. Rove sometimes runs transfer or redemption bonuses that sweeten the value further.

Redeem on Hotels

Hotel redemptions through Rove are generally more compelling than flights.

Rove allows you to redeem miles at over 200,000 properties worldwide, with reported average values ranging from roughly 1.5 to over 2 cents per mile, depending on the property and timing. In some cases, higher values are possible, particularly at expensive properties during peak periods.

One helpful feature is Rove’s cents-per-mile indicator, which appears during the search process and gives you a quick sense of whether a redemption is relatively strong or weak. This nudges users away from poor-value redemptions and makes it easier to compare options without doing manual math.

At checkout, you can typically choose to pay entirely in miles or use a mix of cash and miles. As with most dynamic hotel portals, not every redemption will be a good deal, but the interface makes it fairly easy to identify when using miles makes sense.

Transfers to Airline and Hotel Partners

The more advanced (and often more lucrative) way to use Rove Miles is to transfer them to partner loyalty programs and book awards there.

Rove supports transfers to 13 airline and hotel programs, covering all three major alliances and the Accor hotel ecosystem. Help‑centre documentation and Rove’s blog list partners such as:

- Air France–KLM Flying Blue

- Air India Maharaja Club

- Aeromexico Rewards

- Cathay Pacific Asia Miles (coming next month)

- Etihad Guest

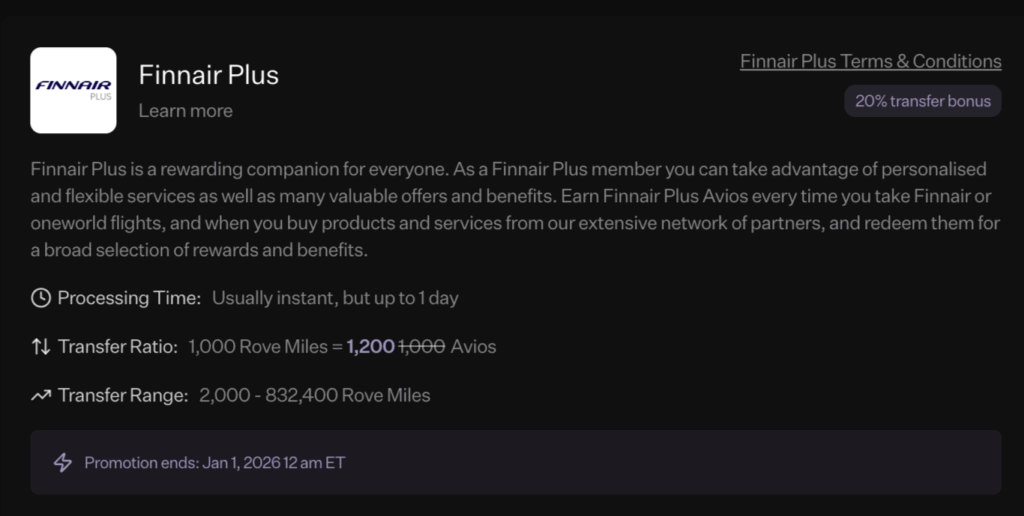

- Finnair Plus

- Hainan Airlines Fortune Wings Club

- Lufthansa Miles & More

- Vietnam Airlines Lotusmiles

- Qatar Airways Privilege Club

- Thai Airways Royal Orchid Plus

- Turkish Airlines Miles&Smiles

- ALL Accor Live Limitless

All partners transfer at a 1:1 ratio except Accor Live Limitless, which uses a 1.5:1 ratio (1.5 Rove Miles to 1 Accor point). That weaker ratio can still make sense in specific “sweet spot” scenarios or during Accor promotions, but it is less straightforward value than 1:1 airline transfers.

Rove also occasionally runs transfer bonuses, which can meaningfully improve the value you get from your miles. For example, at the time of writing, Rove is advertising a 20% transfer bonus when you transfer Rove Miles to Finnair Plus Avios, which effectively turns a 1:1 transfer into 1:1.2 while the promo is live.

Rove does uniquely offer transfer access to some programs that are not accessible with a typical transferable bank currency, such as the Aeromexico Rewards and Lufthansa Miles & More, and Vietnam Airlines Lotusmiles.

That gives Rove some niche redemption angles that might appeal to advanced travellers. And if, by some chance, they ever onboard Atmos Rewards, that would be huge news for Canadians, since we currently have no way to earn it after MBNA phased out its co-branded card.

How Much Are Rove Miles Worth?

Like most flexible rewards currencies, the value of Rove Miles depends entirely on how you redeem them.

Rove’s own materials suggest that miles can deliver solid value when used for travel, particularly on hotel bookings and premium cabin flights booked via partner programs. Independent estimates tend to be more conservative, generally placing Rove Miles somewhere in the middle of the transferable currencies rather than at the very top.

From a Canadian points perspective, the most sensible way to think about Rove Miles is through its transfer partners.

When transferring to airlines like Finnair Plus Avios, which we typically value at around 2.0 cents per point, or Flying Blue, which we value closer to 2.2 cents per point, Rove Miles can comfortably reach that same range when used well.

On the hotel side, redemptions through Rove’s own portal tend to land a bit lower, but still above what you’d expect from fixed-value travel points in many cases.

Taking into account airline partner transfers, hotel redemptions through the Rove portal, and the occasional transfer bonus, a reasonable working valuation for Rove Miles is around 2.0 cents per mile.

That puts Rove Miles ahead of simple cash-back or fixed-value travel currencies, while still leaving room for upside if you target strong airline redemptions.

As with any transferable program, lower-effort redemptions will usually sit near the bottom of that range, while thoughtful partner bookings can push value higher.

Strengths and Limitations of Rove Miles

Rove Miles has a few clear strengths that make it worth paying attention to, particularly as a stacking and diversification tool.

The most obvious upside is earning potential, especially on hotels. Earning up to 25x Rove Miles per dollar spent is well above what most OTAs or bank travel portals offer, and when combined with hotel points, elite qualifying nights, and credit card rewards on loyalty-eligible bookings, the returns can add up quickly.

Stackability is another key advantage. In many cases, Rove Miles are earned on top of airline miles, hotel points, and credit card rewards, making Rove an incremental layer rather than a replacement for existing programs.

Add in a growing list of airline and hotel partners, including some niche options that are otherwise difficult for Canadians to access, and Rove offers genuine flexibility when it comes time to redeem.

That said, there are limitations to keep in mind.

Loyalty-eligible hotel rates are often slightly higher than booking directly, which means you need to do a quick value check rather than assuming Rove is always the cheapest option.

As with any third-party booking platform, there is also added complexity if plans change, since Rove introduces an extra layer between you and the airline or hotel.

Finally, the platform itself is still clearly a work in progress. In practice, the website isn’t fully optimized yet, search results can be slow to load, and loyalty-eligible rates can sometimes take multiple attempts to appear.

These aren’t deal-breakers, but they are reminders that Rove is still early in its development.

Used thoughtfully, Rove Miles works best as a complementary tool rather than something to rely on exclusively.

Who Should Consider Using Rove Miles?

Rove Miles will appeal to different travellers in different ways, depending on where they are in their points journey.

For beginners or travellers without access to premium credit cards, Rove offers a relatively approachable entry point into flexible travel rewards. You can earn meaningful miles through online shopping and paid travel without needing to apply for a new card or meet minimum spend requirements.

For intermediate users, Rove works well as a stacking tool. If you already earn airline miles, hotel points, and credit card rewards, Rove can sit quietly in the background and add an extra layer of value on purchases and bookings you would be making anyway.

For advanced points enthusiasts, the appeal is more niche. Rove’s hotel earn rates, loyalty-eligible bookings, and access to certain transfer partners that aren’t easily reachable through Canadian bank programs can create situational value, especially when transfer bonuses are available.

For most Canadians, Rove is unlikely to replace core programs like Aeroplan or bank-issued transferable currencies. Instead, it makes the most sense as a complementary program — one that you use selectively, when the earning rates, stacking potential, or partner options justify the extra step.

Conclusion

Rove Miles is best understood as a supplemental rewards currency rather than a standalone strategy.

When earning rates are strong, loyalty-eligible bookings are available, or transfer bonuses come into play, it can add meaningful incremental value on top of rewards you’re already earning elsewhere.

It’s still an evolving program, and one that rewards a bit of attention and selective use. But for travellers willing to run the numbers and pick their spots, Rove Miles is a program worth keeping on the radar.

princeoftravel.com (Article Sourced Website)

#Rove #Miles #Prince #Travel