Viper Energy (VNOM) presents a compelling case for investors seeking exposure to the energy sector through a mineral rights business model.

The company is about to complete a transformative “Drop Down” transaction with parent company Diamondback Energy (FANG) that promises to significantly reshape Viper’s production profile in 2025. This is a transaction that was discussed at the Hart Energy Conference I attended a year ago. It was finally signed in January 2025 and will complete in Q2 2025.

In short, the dropdown is intended to help reduce debt for Diamondback after they purchased Endeavor Energy. For Viper, it is a bit riskier as the buyer of assets, but it offers a big upside should oil and gas prices rise.

My understanding, having listened to some of the players speak candidly at the Hart Energy conference, is that Diamondback is feeding Viper good assets and terms, which is also supported by Diamondback executives taking big positions in Viper.

Viper SWOT

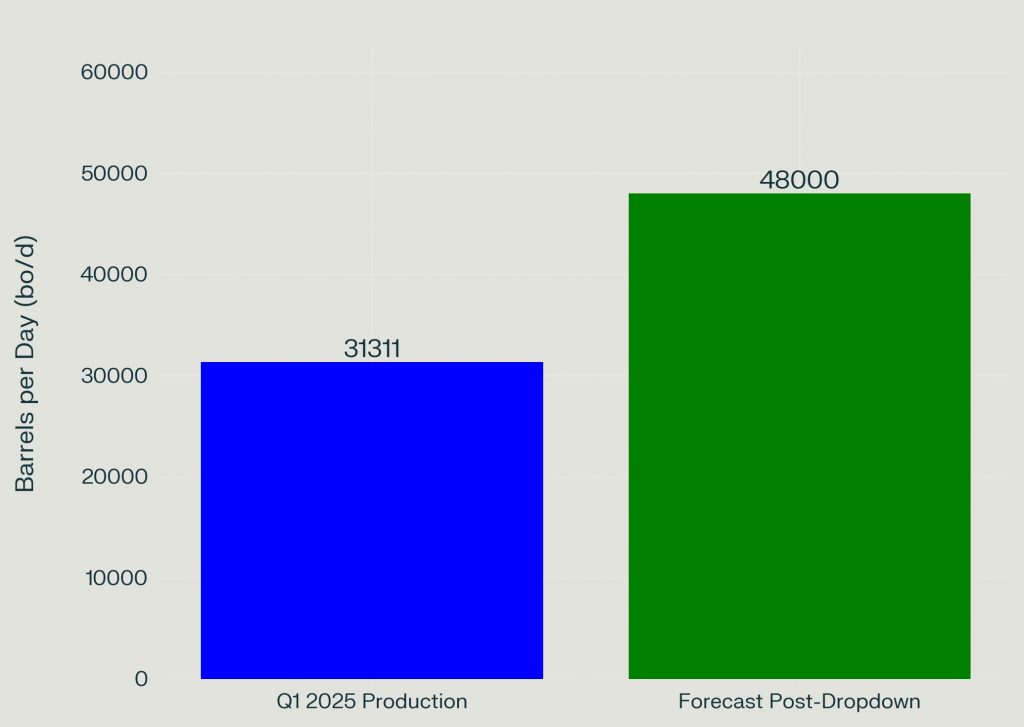

Viper Energy delivers strong operational results, with Q1 2025 oil production of 31,311 barrels per day and industry-leading gross profit margins of 92.92 percent. Its royalty-focused, asset-light model stands out versus traditional E&Ps like Diamondback, offering high efficiency and lower risk.

Viper’s hedging program has been particularly effective, generating $9.1 million in Q1 2025 gains—especially by locking in higher natural gas prices than the market. The company also maintains significant financial flexibility, with $427.6 million authorized for share repurchases and recent buybacks reflecting management’s confidence in intrinsic value. Close ties with Diamondback Energy provide Viper with strong visibility into future development, as 867 gross wells are currently being developed on Viper acreage, supporting near-term growth.

Viper’s complex corporate structure—including OpCo units and multiple share classes—creates analytical challenges and may deter some investors who see it as a weakness. Some shareholders have criticized the company’s capital allocation, preferring higher distributions over buybacks. Viper’s reliance on Diamondback, which operates over 70 percent of its Midland Basin royalty acres, introduces concentration risk and could limit flexibility if Diamondback’s priorities shift. Weak natural gas prices ($2.08/Mcf unhedged in Q1 2025) also weigh on overall realized prices, despite oil’s dominance in revenue.

The upcoming $4.45 billion “Drop Down” deal with Diamondback is transformative opportunity. Expected to close in Q2 2025, it will boost Viper’s daily production to 47,000–49,000 barrels, a 61 percent increase over Q4 2024 levels, and immediately increase cash available for distribution per share by over 10 percent. Post-deal, Viper will have exposure to 75 percent of Diamondback’s planned wells over five years, with a 6 percent net royalty interest. The recent Quinn Ranch acquisition and a pipeline of 1,191 future development wells further expand Viper’s footprint and growth prospects.

Commodity price volatility remains the biggest risk and threat: a drop in oil or gas prices would hit revenues and cash flow, especially if hedges roll off. Regulatory changes—such as new taxes or drilling restrictions—could impact operators and royalty streams. Competition for mineral assets is increasing, which may drive up acquisition costs and compress returns. Finally, integrating the large Drop-Down acquisition brings some financial risk, especially regarding leverage, which Viper aims to keep below 1.0x by year-end 2025, assuming stable prices.

Viper Before And After Dropdown (Kirk Spano)

Viper Fundamental Analysis

The trajectory for Viper Energy appears strongly positive, with production expected to increase by more than 50 percent following the close of the Drop-Down transaction in Q2 2025. The company maintains its commitment to return at least 75 percent of cash available for distribution to shareholders, suggesting distribution growth should follow production growth.

From Diamondback’s development plans, Viper expects its Diamondback-operated production to increase from approximately 27,000 bo/d in 2025 to approximately 31,000 bo/d in 2026 on a pro forma basis. This visibility into future production growth represents one of the key advantages of Viper’s business model and relationship with Diamondback.

For investors seeking exposure to oil and gas production with lower operational risk than traditional E&P companies, Viper’s royalty model continues to offer an attractive alternative with exceptional margins and visible growth. While the capital allocation debate between buybacks and distributions will likely continue, the company’s overall financial position and growth trajectory remain compelling.

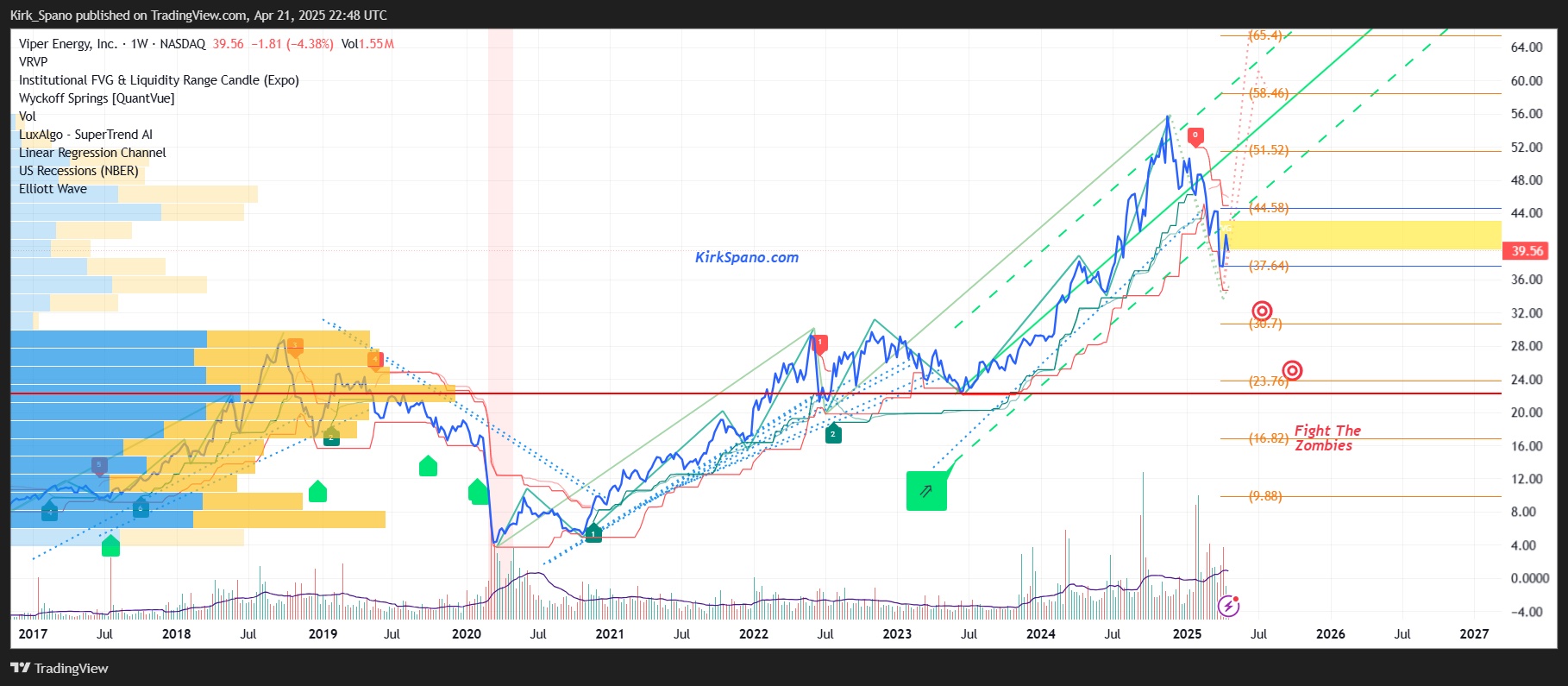

The forward P/E becomes attractive in the teens, so a price in the lower $30s would make this a compelling buy, in my opinion. A price in the $20s would be a gift and a price below $20 would get me to fight zombies for more shares.

VNOM Technicals and Buy Targets (Kirk Spano)

Technical Analysis

The stock becomes very attractive around $30 per share. If it heads into the $20s there is likely a follow-through towards the lower $20s.

In my second chart, you can see the fair value gaps and volume weighted heavy support near each other, called convergence, which is pretty powerful. Any follow-through below the red line is panic and you should be buying hand over fist down there.

I think middle to lower $20s is more likely than usual. So, my inclination is to sell cash-secured puts if it gets to the lower $30s but keep some powder dry. From there I will look for signs of seller exhaustion.

Kirk Spano

For disclaimers and deeper dives, please visit my investment letters at FundamentalTrends.com or MOSInvesting.com or my Registered Investment Advisor firm Bluemound Asset Management, LLC.

A financial analyst and investment advisor, Kirk Spano is published regularly on MarketWatch, Seeking Alpha, and other platforms.

The post Viper’s Royalty Model: Worth a Look appeared first on Permian Basin Oil and Gas Magazine.

pboilandgasmagazine.com (Article Sourced Website)

#Vipers #Royalty #Model #Worth