[ad_1]

As the U.S. natural gas market continued to assess winter supply risks in the context of exorbitant European energy costs, forwards eased lower during the Aug. 25-30 trading period, https://www.naturalgasintel.com/news/forward-look/”>NGI’s Forward Look data show.

Fixed price trading for October delivery at benchmark Henry Hub shed 25.8 cents during the period to end at $9.047/MMBtu. For most Lower 48 hubs, discounts were in line with the national benchmark.

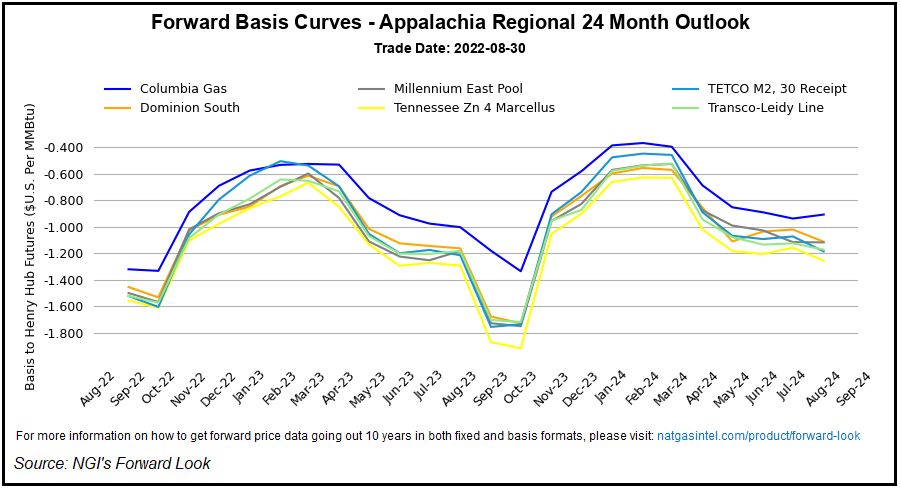

Notable exceptions were in Appalachia and the Southeast, where hubs posted smaller discounts. Fixed price declines at West Texas hubs, meanwhile, outpaced the rest of the country.

[Decision Maker: A real-time news service focused on the North American natural gas and LNG markets, NGI’s All News Access is the industry’s go-to resource for need-to-know information. Learn more.]

In the Northeast, Eastern Gas South October basis picked up 11.0 cents for the period to end at minus $1.533. As for West Texas, El Paso Permian October basis dropped to a $2.179 discount to Henry Hub, a 34.0-cent swing lower.

Nymex futures also skidded lower during the Aug. 25-30 period, dropping from $9.330 to $9.042 as analysts pointed to easing premiums in Europe as a key influence on domestic price trends. The September contract recovered 8.5 cents to settle at $9.127 on Wednesday.

European Storage Refilling

Natural gas markets in Europe were “taking a sigh of relief” amid signs the continent is ahead of schedule in refilling storage inventories, according to a note Wednesday from Rystad Energy analyst Wei Xiong.

“European gas prices this week recorded their biggest drop since April as healthy storage levels in Germany and the rest of the continent in part soothed supply concerns over maintenance on the Nord Stream 1 gas pipeline from Russia — although a risk remains that flows may not return on schedule,” Xiong said.

Retreating gas prices in Europe have helped to calm electricity markets there, but not in time to prevent August from becoming the most expensive month on record for European power prices, according to Rystad.

“European policymakers are now considering market intervention to curb the skyrocketing prices and protect European private consumers and businesses,” Rystad analysts Fabian Rønningen and James Ryan Kronk said in a separate note. “European electricity prices accelerated further over the last week, and it’s now clear that August will be the most expensive month ever for electricity in all major European markets.

“The fresh record for July was crushed in Italy, France, Germany and the UK, with Italy being the first market ever to record a monthly average spot price above €500/MWh, as the average for August was €547.”

As for developments in the Lower 48, the European weather model as of Wednesday was forecasting “neutral to slightly bullish” temperatures for the 15-day outlook period, according to NatGasWeather.

“It will remain impressively hot over the West with highs of 90s to 110 degrees, including record heat over California and the Mountain West,” the firm said. “Texas will see swings in temperatures, with rather nice highs of 80s later this week, along with areas of showers, then warming back into the 90s next week. The South, Southeast and up the Mid-Atlantic coast will be very warm with highs of 80s to near 90 most days.”

On the other hand, the Great Lakes, Ohio Valley and Northeast are on track for comfortable conditions through the first half of September, tamping down national demand compared to earlier in the cooling season, NatGasWeather added.

Another variable to consider in the weather outlook, the tropics were becoming “much more active” as of Wednesday, with a number of systems poised to strengthen into tropical storm or hurricane status in the Atlantic over the weekend, according to the firm.

However, “none pose a threat to U.S. interests for at least seven days, if at all,” NatGasWeather said.

Tropics To Awaken In September?

The Atlantic hurricane season has gotten off to a sleepy start in 2022, but that could belie future trends, as the season has yet to enter its peak, according to a recent analysis from RBN Energy LLC analyst Sheetal Nasta.

What’s more, the already heightened volatility in natural gas markets this year could mean outsized impacts should any major cyclones threaten U.S. energy interests, the analyst observed.

“The tropics seem to have awakened in recent days and are likely to ramp up in September — the peak month for tropical storm activity,” Nasta said. “Forecasters are still predicting an above-average season, calling for as many as 10 hurricanes and up to five major ones. That would mean greater volatility for energy markets in any year, but the stakes are arguably higher this year than any time in recent memory — especially for natural gas.”

Heading into the shoulder season, natural gas markets face tight supply/demand balances both at home and abroad, the analyst said. Europe remains dependent on U.S. LNG exports amid geopolitical tensions with Russia.

“What happens when you add to that the prospect of hurricane-related disruptions to Lower 48 production or LNG exports, or both?” Nasta said. “Much of that will come down to the timing, path and strength of any impending storms. That’s a lot of unknowns, and where there is that much uncertainty, volatility is sure to follow.”

Even with the prolonged outage at the Freeport liquefied natural gas terminal hampering U.S. LNG takeaway capacity this fall, Nasta estimated more than 9 Bcf/d of consistent feed gas demand out of the Gulf Coast that could be threatened by tropical cyclone activity.

“That’s substantial baseload demand at risk for the Lower 48 balance — and significant supply risk for Europe — if a major hurricane strikes,” the analyst said. “That’s not even accounting for power outages and the cooling effects of storms as they move inland.”

Storm activity could also bring extended disruptions to production, either offshore or onshore, exacerbating domestic storage adequacy concerns, Nasta added.

https://www.naturalgasintel.com/u-s-market-continues-to-eye-europes-energy-crisis-as-natural-gas-forwards-retreat/”>