This week, Donald Trump made a move that should make every lithium investor sit up and take notice.

Read these two headlines, which are in chronological order:

Source: Bloomberg

The US President is renegotiating the $2.3 billion loan for Lithium Americas’ massive Thacker Pass lithium project.

But here’s the kicker.

Trump doesn’t just want to adjust the terms.

He wants an equity stake of up to 10% for the US government.

This isn’t about getting a better deal for taxpayers.

This is about control.

Raw, strategic control over one of America’s most important lithium assets.

And it signals we’ve entered a new phase in the lithium market.

One where economics take a back seat to geopolitics.

I saw this coming last year when I was visiting a lithium processing lab in Arizona.

I was chatting with one of the main guys who did Lithium Americas’ definitive feasibility study for Thacker Pass.

We were deep in conversation about extraction techniques when he spotted someone walking onto the property.

He only half-joked, “might be a spy.”

But you could tell he wasn’t really joking.

That moment crystallized something for me.

This isn’t just about mining anymore.

It’s about national security.

It’s about energy independence.

It’s about who controls the raw materials that power the future.

China figured this out decades ago.

While Western companies focused on quarterly earnings and return on investment, Beijing was playing a different game entirely.

They bought up lithium assets across Argentina, Chile, and Australia not because the numbers looked pretty on a spreadsheet.

They did it because they understood that whoever controls the lithium supply chain controls the energy transition.

Today, China processes anywhere from 65% to more than 75% of the world’s lithium into battery-grade materials.

They’ve turned raw materials into geopolitical leverage.

And now the West is finally waking up.

Trump’s move on Thacker Pass is the clearest signal yet that lithium projects in the Western sphere have transcended traditional investment metrics.

When the US government is willing to take direct equity stakes in mining projects, you know we’ve crossed the Rubicon.

This isn’t about whether Thacker Pass can compete with Chinese producers on price.

It’s about America having its own lithium supply, period.

The economics don’t matter when national security is at stake.

Because when you’re in a strategic competition with China over the materials that power everything from electric vehicles to military equipment, cost becomes secondary.

This creates a fascinating investment environment.

Traditional mining economics suggested many Western lithium projects would struggle against low-cost Chinese competition.

Lithium prices crashed from their 2022 highs, making marginal projects look uneconomical.

But that analysis misses the bigger picture.

We’re not in a free market anymore.

We’re in a strategic materials race where governments are picking winners and losers based on geopolitical alignment, not just economics.

I reckon projects like Thacker Pass will get built regardless of the economics because they serve a strategic purpose.

And if the US government is willing to take equity stakes to make it happen, other Western governments will follow suit.

Australia’s already investing heavily in domestic lithium processing through its “Lithium Valley” initiative in Western Australia.

The EU is scrambling to secure its own supply chains.

Canada is pushing critical minerals as a foreign policy tool.

What does this mean for lithium investors?

Simple.

I think projects in friendly jurisdictions that can secure government backing are about to become much more valuable.

Not because their economics improved overnight.

But because they’ve become strategic assets in a global competition for energy security.

The spy joke at that Arizona lab wasn’t really a joke.

It was a preview of where this industry is heading.

And in a world where economics don’t matter, the projects that matter are the ones governments need to control.

If you want to read about my lithium thesis, and the three companies I’ve recommended to readers of Australian Small Cap Investigator click here.

Regards,

Lachlann Tierney,

Australian Small-Cap Investigator and Fat Tail Micro-Caps

***

Murray’s Chart of the Day –

S&P 500

Source: Tradingview

[Click to open in a new window]

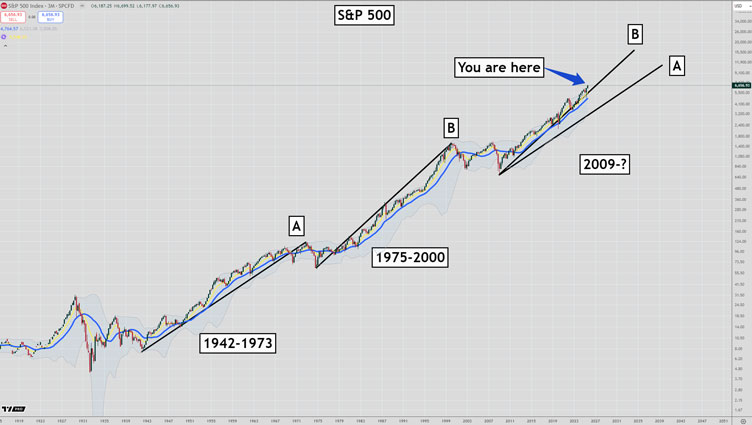

I have shown this chart before, but I think it is worth repeating for those that haven’t seen it.

It is a chart of the S&P 500 going back to 1900.

I have used a logarithmic scale so we can look at similar percentage moves over time.

A nominal scale doesn’t work over very long time frames when the price changes dramatically.

For those that don’t know what a logarithmic scale is, it is just an adjustment to a scale that ensures distances up the X-scale are an equivalent percentage move.

So the distance from four to eight, for example, will be the same as the distance from eight to 16. They are both 100% jumps in price.

I have cloned the rallies from 1942-1973 and 1975-2000 and placed them with a start date at the bottom of the crash in 2009.

Based on that crude analysis the current rally could see the S&P 500 top out at 11,000-16,000 between 2034 and 2039.

The chart above is a quarterly chart, which means each candle is three months of trading.

The blue line is a 20-period simple moving average (5-years).

When prices dip below the 5-year moving average there is cause for concern.

Currently the 5-year moving average is at 4,764 which is 28% below current prices.

Until we see a major failure below that level corrections are buying opportunities.

I think we all get caught up in the daily gyrations and forget to look at a bird’s eye view regularly.

The stock market has been rallying in a straight line since April and looks overstretched.

A correction could unfold at any time.

But when you consider the big picture you realise that a correction doesn’t mean the bull market is over.

Regards,

Murray Dawes,

Retirement Trader and International Stock Trader

The post The Lithium Imperative: When Economics Don’t Matter appeared first on Fat Tail Daily.

daily.fattail.com.au (Article Sourced Website)

#Lithium #Imperative #Economics #Dont #Matter