Social media is a complex beast. It is simultaneously useful, annoying, addictive, helpful, destructive, and a hundred other things. It is tying humanity into knots. Many people, including yours truly, often deride it as a cesspool of bots and trolls and agitators for hire. All that is true.

At the same time most of us, including yours truly, head there reflexively to see what our various symbiotic factions are up to.

There are multiple reasons for that. Foremost is that social media delivers mental comfort food, the unceasing algorithms feeding us what it thinks we want to hear or see (unless of course you are, ahem, weird as hell, and the list of characters whom you follow is so eclectic and disjointed and odd that the algorithm parks you in a pile labeled “No obvious revenue stream here”, and when that happens the algo feed is tentative and guesstimated and pathetic).

Having said that, another huge reason for social media’s popularity is the blinding usefulness of it, whether for professional reasons or just sheer curiosity.

Let’s say you’re a total gear head, fascinated by materials science. Along comes a guy like Jordan Taylor on Twitter/X, who, for free and because he can, posts fascinating mini-lessons, in very digestible format, such as: “1/This is a thread about metallurgy’s secret cheat code, and how it’s used by the aerospace industry to accomplish things that no material should. In particular, how that cheat code is enabled on the humble, but amazing, jet engine turbine blade…2/This is our friend, the high pressure turbine blade. It lives inside your everyday turbofan engine and helps you go on holiday. It also casually takes 20,000G of force and operates about 200C above it’s own melting point. I have a separate thread about that, but I digress.”

People like that have a way of knocking us off our “social media is stupid” soap boxes as would a speeding dump truck.

On the topic of energy, consider this tweet, one of many, from a guy named Dan Tsubouchi: “321 crack spreads were -$0.28 WoW to $29.45, BUT crack spreads near $30 still provide big margins for refineries ie, big incentive to maximize runs & buying crude & support for WTI.”

Dan, and others like him (Rory Johnson – oil, Sergio Chapa – LNG, Meredith Angwin – power…as a few examples) provide, for free, a source of technical trade information that is amazing in depth and analysis and speed. Dan’s tweets delve into, for example, what oil prices are doing, factors that might be impacting moves, and what a normal expectation might be. These sources are instantaneous and invaluable to your field of interest. You don’t have to read far to exclude the “shill” label that jerks love to hang on people; it’s just info. (And don’t rag on me because I missed your fav, feel free to drop it in the comments section below. It’s a big web out there folks.)

Another example is right here at the BOE Report. Check out the astonishing depth of information provided in this oil/gas field review. Consider that oil is the lynchpin of the global economy, and that much of the world’s production come from fields that provide nowhere near this level of detail. And yet here you have it, in an independent website, for free.

Contrast that with two other former heavyweights of such info flow. First up is legacy media, which in the past has done a decent job of covering, say, oil markets. But as competition intensified, the legacy media accentuated their natural tendency to only go where there was a story. If there’s no story, they just don’t care, which is why you can sometimes (as I have) open a page like Reuters commodity markets and see consecutive headlines like “Oil up on rising geopolitical tensions” and immediately below it “oil falls on latest employment news”. Is everyone asleep over there? Or too busy being politically correct to worry about the content? Neither headline is necessarily wrong and what is happening is that often the stories refer to different timeframes – one might be referring to a weekly move, the other the last half hour of trading – but nevertheless such antics render the page generally useless for getting a cursory, quick glance at the latest information, and it just looks inept.

Most of these big media organizations will listlessly report on, say, changes in rig counts, comparing this week’s numbers to last week’s, and to last year’s, with just the feeblest of context. They mechanically grab the output from the Baker Hughes rig count on a Friday morning, and just go through the massive spreadsheet to compare to other periods, then generally attach a generic narrative similarly plucked from the complex world.

“Oil rig count falls on lower prices” is a fairly typical comment. There’s nothing necessarily wrong with such a statement, but it’s just…fluff. It’s like AI puke. It’s a sweeping oversimplification that adds a false sense of implied precision and/or wrong implications. No one drops rigs because the price of oil fell in the week. Adding or subtracting rigs is tied to a complex web of factors, and decisions to add or subtract rigs move on far longer wavelengths than the price of oil in a given week. The oatmeal commentary just seems lazy and disinterested, which it probably is, because most large news organizations have placed climate reporting as their mast to cling to, which by definition necessitates a downplaying of the oil/gas sector.

Beyond that, one could argue that such large mainstream media outlets’ job is to boil down the macro trends into soundbites because the average reader is not oil/gas sophisticated. But one could just as successfully argue that doing so is the reason no one pays attention to mainstream media anymore. People really interested in why oil/gas rig counts moved one way or another will find far more substantive sources like Dan T, or the BOE Report’s in-house generated information, which is amazingly in-depth and light-years beyond what bigger new organizations even attempt. By following these sources of expertise, one quickly realizes that there are many factors at play, and that it is best to listen to people that actually care about the nuances.

Another former source of info, included mostly for irony and humour here, is the petroleum industry itself. Since time immemorial, or at least the 1970s, the oil industry has been routinely dragged onto the carpet to explain gasoline prices. No one cares about the oil market unit it impacts gasoline prices, and when it does, all hell breaks loose.

For decades, angry politicians have grilled Big Oil execs and set up committees to demand answers as to why gasoline prices go up, particularly when not linearly with oil price movements, and as far as I know in every instance the investigators have reached the conclusion that they’ve found no evidence of corporate malfeasance in the localized pricing of gasoline.

And the industry seems to consider that a victory! They found no evidence, yay! And the problem remains, because the preening corporate weasels head back to their mahogany offices like Monty Burns and order Lobster Thermidor for lunch, and the issue is never resolved. It just goes away until the next cycle.

Meanwhile, a guy named Patrick De Haan, in one tweet, educates the public on gasoline price movements more than the entire industry does in a year A tweet for example: “With #gasprices surging along the West Coast- some light at the end of the tunnel. Wholesale prices are down significantly today, which likely means price increases will soon fade, and price decreases could happen soon.” If the general population followed Patrick, maybe there would be far fewer apoplectic heart attacks from enraged consumers, because they would understand gasoline price movements.

Another irony: a guy named Stephen Stapczynski posts excellent stuff on Twitter, such as this tweet header: “LNG exporters are turning into importers due to falling domestic production”. An interesting bit of news, which Stapczynski sources to the Jakarta Post. What makes it super interesting is that Sapczynski is a reporter for Bloomberg, which is generally focused on accelerating the energy transition… Recall that Mike Bloomberg is throwing hundreds of millions to anti-hydrocarbon groups working tirelessly to strangle the sector. He has spent over $500 million on a singular effort to eradicate coal from the marketplace. You think you’re going to get objective energy info flow from Bloomberg? Could you build a better disinformation machine than that? And yet Bloomberg is “the news’ to many. Full credit to Stephen for showing commitment to actual reporting, but that is something he does on his own time.

Regularly I am inundated with polls and statements and claims from the legacy media that trust is more important than anything, that they value our trust, they strive for it. If their pollsters do, they better wander down the hallway and see what the thought police are up to, because it sure as hell isn’t building trust…

Now, of course, the big news feeds do provide a certain level of information that is at times unique and useful. What they need to realize though, and soon, is that there is an entire army of earnest enthusiasts on pretty much any subject that is mopping the floor with them. These independent people and websites are singular in purpose (Rory Johnston, oil market commentator extraordinaire, father of a young family, tweeting on a Sunday evening because it is what he does: “Crude opens the week down ~$1/bbl. Brent just holding onto $90 atm.”), and aren’t filtered or controlled by messaging agendas – they say what it is.

Such free-wheeling commentary infuriates some, who decry “misinformation” and “disinformation” on places like Twitter/X. Funny thing though: the legacy media now universally employs teams of “fact checkers”. These groups are often as controversial as anyone; they are not so much fact-checking as making sure the subject matter adheres to the most politically correct narrative (for example, Associated Press fact checkers declared in September 2020 that Covid-19 was not manufactured in a lab, as did dozens of “news organizations” at about the same time. They declared it a “fact”. Yet a month ago the Wall Street Journal ran a story entitled “Where did Covid come from? New documents bolster the theory that it not only escaped from a laboratory but was developed in one.” Now, I know it’s a controversial topic and I’d rather talk about world-record hemorrhoids than Covid issues, but the real fact is that the fact checkers destroyed their own credibility in 2020, and they can’t undo that).

In the social media domain, true fact checkers are constantly on the prowl, and have one clear mark of superiority over the legacy media fact checkers: the social media pundits have to get in the ring. They have to engage, they have to source, they have to rebut, whereas legacy media fact checkers pontificate and then move on, no matter where they are on the actual truth spectrum. And you would be correct in pointing out that social media critiques/rebuttals/fact checks are no guarantee of correctness, but here’s the beauty: it quite often becomes obvious if someone is acting in bad faith. People in general hate bullies, charlatans, mindless propagandists, and say so. Witness the spectacular pummelling of a pompous BBC journalist by the President of Guyana when the BBC gadfly attempts to climate-guilt the President (Guyanese President, expecting the blow and countering with a one-punch KO: “Let me stop you right there. I am going to lecture YOU on climate change!”), a video clip seen tens of millions of times around the world, and the comments sections are almost invariably supportive, because they know true justice when they see it.

Social media is about what you choose to let into your viewfinder. Thanks to the hard-working new information warriors who devote considerable time to disseminating quality information, often for free. Beyond them, it really isn’t that hard to smell the rats, either the legacy behemoths who don’t seem to care, or the nasty rats that just troll the web to be vicious and bite ankles. It’s not hard to avoid them, and life is so much better if you do.

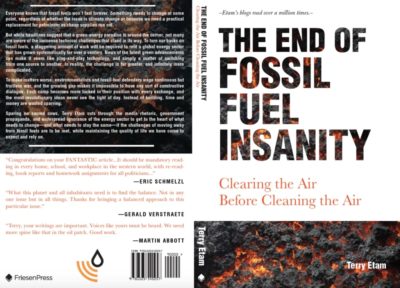

Like a fine wine, getting better with age… Energy meets humour in “The End of Fossil Fuel Insanity”, a timeless classic that should be on every book shelf alongside classics such as War and Peace, The Adventures of Huckleberry Finn, and The Idiot, none of which was selected lightly. Available at Amazon.ca, Indigo.ca, or Amazon.com. Thanks!

Read more insightful analysis from Terry Etam here, or email Terry here.

https://boereport.com/2024/04/10/textbook-examples-of-why-new-media-beats-old/”>

#Textbook #examples #media #beats #BOE #Report