Carbon capture and storage grows technology, but legal and geological questions remain.

Carbon capture and storage grows technology, but legal and geological questions remain.

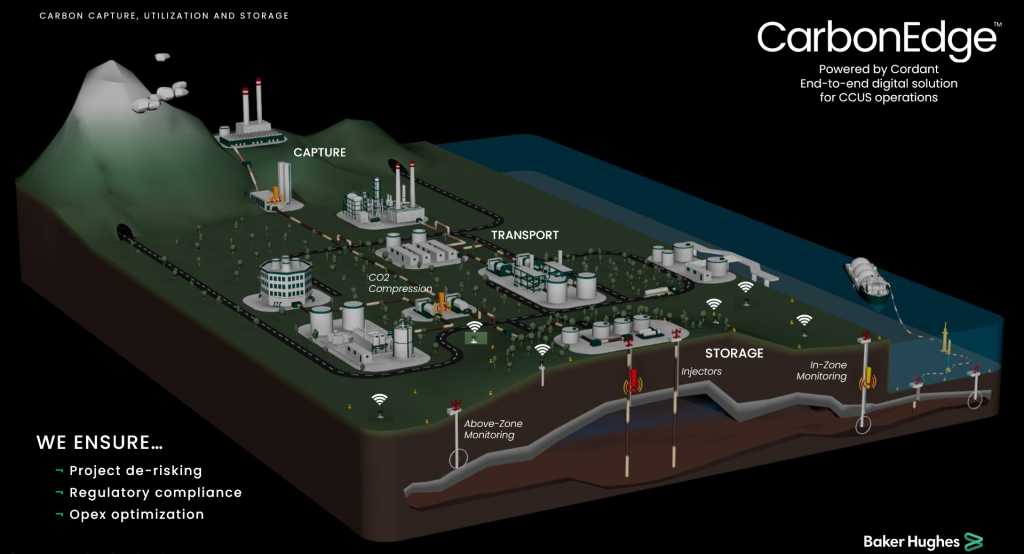

BakerHughes’ new CarbonEdge “digital end-to-end solution” utilizes artificial intelligence.

The old saying about change and things staying the same may itself need to change, especially in the energy sector. “The more things change, the more they continue to change,” would better codify the rapid acceleration of new technologies and landscapes. And with carbon capture, use, and storage (CCUS) ramping up in response to environmental concerns, there are whole realms of change. That includes not only the technology, but also questions of cost, location, ownership, responsibility, and unintended consequences. Some issues are being addressed in the lab, others in the boardroom, and yet others may require the courts.

This report will address some legal issues, a current CCUS project near Odessa, new technology to economically repurpose abandoned wells and formations, and a digital approach to unitizing and managing CCUS data, also with streamlining in mind.

Questions about Ownership and More

Who owns the CO2, what happens to the remaining oil when that CO2 is injected into partially depleted oil formations, and how long will there be government money to pay for it? Those are among the questions being investigated by lawyer and UTPB Instructor Stuart MacDonald.

“The real Achilles heel of the whole thing is that the market is completely artificial,” he declared, alluding to the fact that this niche leans heavily on government-mandated carbon credits and Inflation Reduction Act funding to cover costs. Some believe in the need for carbon sequestration and some don’t. “Which means that the people who don’t could kill it any time they wanted to.” With recent elections putting an oil-and-gas-friendly government in place, this change could be sooner than later,” he said.

With the new administration, “We’re in a moment where a lot of sacred cows are getting gored.”

Stuart MacDonald

The bottom line in his thinking is, well, the economic bottom line: Is it worthwhile to risk huge investment capital in something whose viability changes with the political climate? Investing billions of dollars in something that could take a decade to pay off, when that investment is at risk every four years involves “a whole lot of risk-taking on this theory [the need for CCUS] that you’re not supposed to question. Which makes no sense because, if you can’t question it, it’s not science, it’s an article of faith.

“That’s problem number one.”

Problem number two in MacDonald’s view involves ownership of the CO2 once it’s stored. Does it belong to the surface owner or the minerals owner? Texas and Oklahoma are dealing with it in different ways, but “Particularly in Texas, it’s not real clear who owns the Porsche,” he said.

A likely result, he believes, is “it probably ends with one person owning the minerals and one person owning the pore space.” To minimize the confusion, MacDonald sees many large projects in which the carbon capturer focuses on formations where the minerals have not been severed from the surface rights. “That reduces your risk greatly if you do that.”

A third issue for him is that, in basins like the Permian, CCUS projects inject into oil formations that are no longer viable for production—at least, not with today’s technology and pricing. The thought seems to be that the way in which the injection of CO2 affects any remaining oil doesn’t matter because that oil can’t be produced anyway.

But, he noted, the shale revolution should remind everyone that shale oil was considered “unrecoverable” for decades—until technology and pricing changed. The problem is that no one really knows, yet, what CCUS injection will do to the crude that remains in the receiving formation, or more interestingly, in the leases adjoining the injection zone.

The problem is that if the CO2 injection affects surrounding formations, it likely involves another party’s lease. The mystery involves what exactly happens to that oil in the injection and storage process. “I think it’s going to vary from formation to formation, but you’re definitely moving other people’s property around,” he said.

In fact, CO2 is widely used for exactly that purpose—to lighten the oil and help it flow out of the formation. For enhanced oil recovery (EOR) it goes in a known direction, into the pipeline.

Should the CCUS operation move a nearby lease’s oil out of reach, this could lead to litigation, MacDonald said. “When I start moving all this oil around [on a nearby lease] and put it out of reach forever and the people who own the residual mineral interest get nothing, you see the potential for litigation,” he said.

Seen here are two 14” Oil States Enform formConnect assemblies on their way to the field.

Repurposing Onshore Wells for CCUS

The “carbon capture” part may be costly, but at least it’s simple. The “utilization and storage” can get tricky, and even more costly in some forms. The latter is why longtime service provider Oil States is finding more efficient ways to store CO2 by efficiently repurposing abandoned or plugged wells—holes that already exist—to push the carbon underground.

Named “Enform,” the system is currently in use offshore, but Enform Product Line Manager for Oil States Mike Jones says its primary application will be onshore, in places like the Permian Basin. Several steps are involved in order to prepare existing wells for carbon storage.

Once a reservoir is depleted, with no further recoverable oil, the target reservoir can be properly described as a mature asset. That being so, as Jones noted, it “frequently has already been plugged and abandoned. This means we are working with old well architecture and infrastructure that is at the end of its design life.”

Enform works by hydroforming existing casing into an overshot protector. This lets Oil States technicians connect a new upper casing or wellhead to a stump of cut-out casing below the surface, to make a seal equivalent to the original premium casing connections in axial load and pressure sealing ratings.

There are two ways to apply this: in the injection well is one. Depending on how it was plugged, “the well may no longer be in a condition capable of withstanding the new increased pressures or may not even have been constructed for gas transport,” Jones said. Or age may have deteriorated the seals and casing, so Enform upgrades the casing to the new requirements.

But wait, there’s more. In a depleted field there will be other abandoned and plugged wells. If they weren’t properly plugged, the increasing formation pressure from the insertion of CO2 could cause those wells to blow out. Said Jones, “Although these wells will not be active in the CCUS operation, they will now be required to withstand the newly applied reservoir pressure from the CO2 injection. Being able to connect cut and plugged casings back to surface with full integrity allows the existing cement plugs to be drilled out safely, and the upgraded P&A operations to be completed.”

One of Enform’s advantages is that it is 100 percent deployed below the wellhead. “As such,” Jones explained, “the physical implementation and application of this technology is little impacted by its location. Onshore or offshore, the considerations are mostly the same. Perhaps the biggest differentiator between onshore and offshore locations for CCUS is the surface infrastructure. The source of CO2 to be disposed of will always be onshore, so onshore disposal is closer to the source and would therefore most likely incur lower surface infrastructure costs.”

BakerHughes’ new CarbonEdge “digital end-to-end solution” utilizes artificial intelligence.

STRATOS Progresses on Schedule

Under construction since 2023, Oxy announced in November of 2023 that it was forming a joint venture with BlackRock to develop STRATOS, “the world’s largest Direct Air Capture [DAC] facility,” according to the Oxy press release from that time. It continued, “Through a fund managed by its Diversified Infrastructure business, BlackRock has signed a definitive agreement to form a joint venture with Occidental through its subsidiary 1PointFive that will own STRATOS.”

When completed it will capture up to 500,000 tons of CO2 annually. The project is on task to basically meet its original start-up schedule of mid-2025, said an Occidental spokesman in an email interview. Sometime in Q3 they plan to ramp up the plant’s initial 250,000 tons, with the plant reaching full capacity in mid-2026.

“We phased construction of STRATOS to incorporate the latest advancements from our research and development efforts at the Carbon Engineering Innovation Center that will help reduce costs and increase reliability,” the spokesman said.

Once that carbon is captured from the air, there are several options for its handling, he said. One is to offer carbon dioxide removal credits [CDRs] for sequestering the CO2 in saline reservoirs. Another option, he noted, is CO2 flooding. “Occidental also has pathways to generate low carbon products, such as net-zero oil through enhanced oil recovery. The ultimate use of captured CO2 will be driven by customer preference.”

While some are concerned about CO2 capture being economically viable on its own, Oxy says they have no such concerns. “Long-term U.S. energy dominance depends on carbon capture for CO2-enhanced oil recovery [EOR] to maximize production from oil reserves.” The Occidental spokesman pointed out that without EOR, most production methods only access about 10 percent of in-place oil. With CO2 EOR, the spokesman said, recoverable oil can reach 20 percent, and in some cases 60 percent.

When used this way, there are two payoffs—more oil produced and less CO2 in the air. “The oil produced through EOR using CO2 captured from Direct Air Capture not only extends the life of the reservoir but can also be used to produce a net zero barrel of oil. This is because the volume of CO2 that is injected to produce the barrel is equal to the emissions it creates.”

He continued, “Net zero oil is the most scalable, affordable way to meet the growing demand for lower-carbon liquid fuels by using existing fossil fuel infrastructure.”

Baker Hughes Releases CarbonEdge

Baker Hughes describes CarbonEdge as a “digital end-to-end solution to mitigate risk, optimize operations, and streamline reporting for CCUS projects.” Useful in all phases of a project, from planning to implementation to operation, it assimilates data from all aspects of the CCUS operation to supply a complete picture. That helps mitigate risks and reduce costs—both being issues for an operation that does not sell a product from which a profit can be realized.

Prem Saini

Prem Saini, product leader of CarbonEdge at Baker Hughes, explained, “CarbonEdge connects to real-time data and meta data from all sub-surface and surface sensors and connects to industry standard data protocols to record and utilize the data in its workflows. It simplifies and expedites reporting through an embedded Measurement Monitoring and Verification [MMV] plan. This measurement efficiency and accuracy is crucial for compliance and essential for reporting and realization of carbon credits, such as the 45Q tax credits in the United States and tradable credits in voluntary markets.”

He added that it uses AI to analyze well and reservoir integrity risks, involving real-time analysis of anomalies. It can suggest mitigating steps as well.

Three main areas need assessment in a CCUS, involving “injectivity, conformance, and containment.” Further, “CCUS has many dependent subsystems and possibly different owners for each part. Integrating them all together along with monitoring and managing them is critical to the owners of the subsystems,” he said. This assessment needs to start at the beginning of the project, and Saini said CarbonEdge does exactly that.

Released in Q3 of 2024, CarbonEdge is applicable to oil and gas and other industries, although the oilfield service giant has yet to implement it in the Permian Basin yet, as it is “currently undergoing strategic pilot deployments with various customers across the globe.”

In truth, any system using AI has the benefit of always improving itself through gaining and analyzing further knowledge, so CarbonEdge will always be moving forward.

Reducing costs and risks is the key to the future of CCUS projects, and CarbonEdge is in that game, Saini said. “CarbonEdge aims to substantially reduce storage cost through deployment of various digital solutions that allows AI-based storage stimulation and injection. CarbonEdge also targets considerable improvement in productivity through efficiency gains from an integrated digital platform connecting surface to subsurface.” It also helps with regulatory compliance for carbon accounting.

CCUS is a huge market, he said, noting that “Fortune Business Insights valued the CCUS market at $2.69 billion in 2023 and forecasts a 19.3 percent CAGR from 2024 through 2032, projecting the CCUS market to hit $14.5 billion by the end of the period.”

So, unless there is a huge sea change with the new administration and congress, and so long as legal and regulatory issues work through the system, CCUS in the Permian and elsewhere hope to gain clarity and efficiency as time goes along.

Paul Wiseman

Paul Wiseman is a longtime energy writer.

The post Taking Carbon Captive appeared first on Permian Basin Oil and Gas Magazine.

pboilandgasmagazine.com (Article Sourced Website)

#Carbon #Captive