3 Stocks Seasoned Investors Should Watch

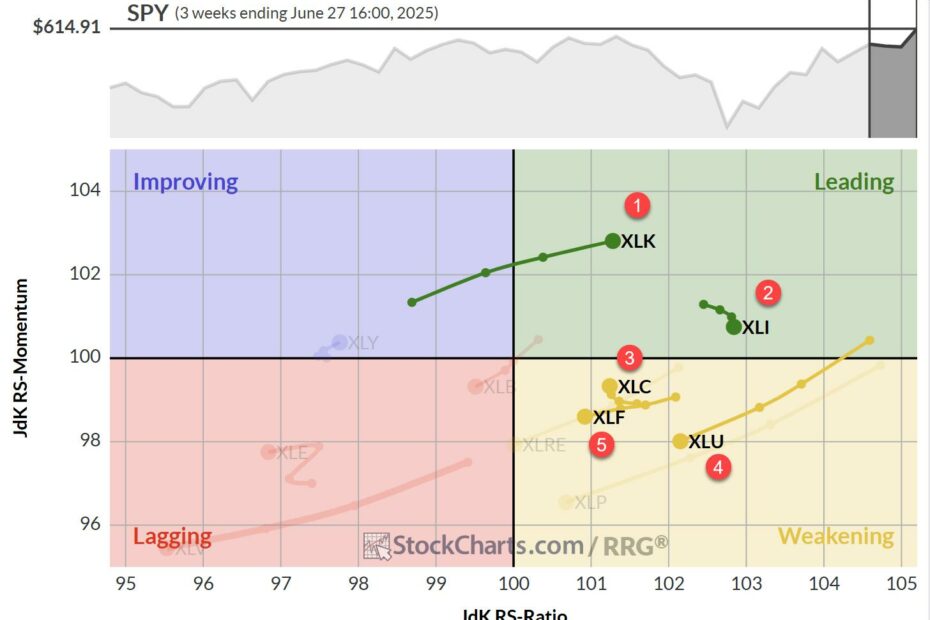

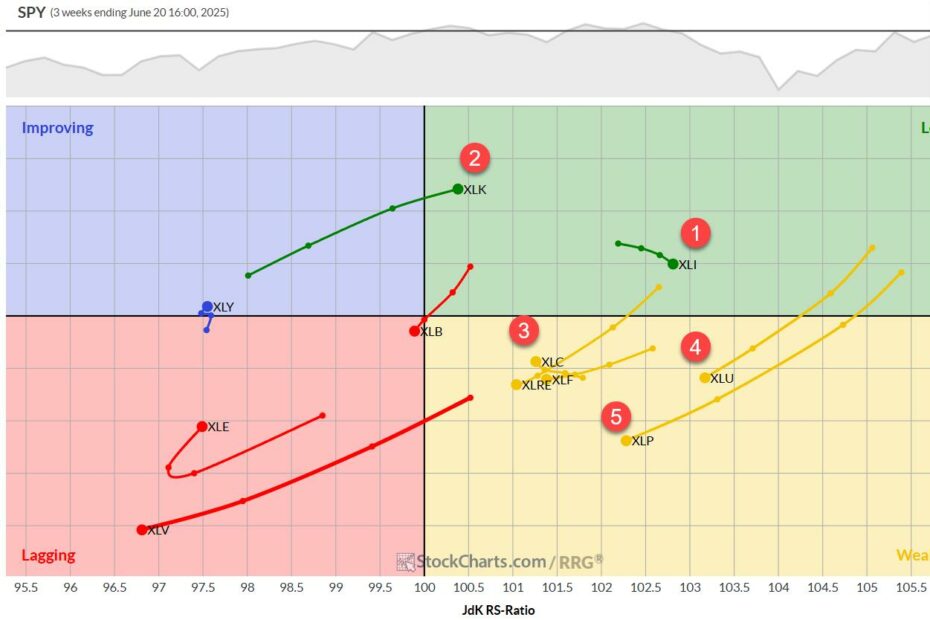

KEY TAKEAWAYS The Financial sector shows strong technical momentum potentially signifying continued growth. Goldman Sachs (GS) presents strong upside and potential entry opportunities on pullbacks.… Read More »3 Stocks Seasoned Investors Should Watch