1. Introduction

We have all experienced this scenario, where we entered a position, be it long or short, setting our stop-loss in a favourable position only for the market to move against our prediction, down to our stop-loss regions, close the trade, and then move back to gain momentum in the direction of our initial prediction. The market phenomenon described here is the classic stop-loss hunt market manipulation technique. Which is one of the hurdles retail traders, face when trying to trade the financial market, and be profitable.

1.1. Why Does This Happen?

Assuming an institutional trader wants to fill in an order worth over $50,000,000 for an AMC stock priced at $2.30 for reasons best known to them. If they approached it similarly as most retail traders executing a market order, their action will drive the market by nearly 10%-40% of its initial pricing, causing a major price spike, and also buying at market order, is always buying at the worst price possible. So what other ways can they fill in their positions?

- By using iVWAP/iTWAP, but this does not stop them from entering at a worse price, and it also increases price gradually even though it eliminates the sudden spike in price, and each split order is filled at a worse price than the previous one.

- Dark Pool comes with its own limitations, that is, finding a counterpart with 27.1M shares to sell at once, so it’s not an option when it comes to filling a large order instantly within days.

- Market manipulation (scenario). They locate retail clusters, force price to that cluster, and trigger their stop-losses, thus creating enough liquidity in the market for them to enter a position easily and at a better price. They don’t mind losing a thousand dollars just to get their position filled at that better price. After all, the end goal of all traders is to make money.

Fig 1.1: Institutional traders identifying stop-loss clusters

The above scenario paints the reality of the financial market, be it forex, stock, or crypto market. So, as retail traders, to stay profitable in the market and not get hunted by institutional traders, we need to find novel ways to keep our position alive while we trade. That means not only focusing on finding the next 100% win-rate strategy but also a way to keep our position alive during the market manipulation phases.

2. How Can We as Retail Traders Evade Institutional Stop-Loss Manipulation?

To answer this question, an experiment was done on four different exit strategies that retailers can utilise to keep their positions alive, survive various market manipulation techniques, and also close positions when there is a shift in market momentum against our initial prediction. The exit strategies considered in this experimental article are:

- Classic stop-loss + 10% allowance

- Classic stop-loss + ATR (20) strategy

- RSI stop-loss strategy (momentum-based)

- MFI stop-loss strategy (volume-based)

To experiment with these exit strategies, an entry strategy needs to be developed. The entry strategy utilised for this experimental article is the simple iMACD cross trading strategy. The strategy entails that, to enter a position, a series of trend, momentum, volume, and volatility confirmations all need to align. This ensures that the strategy enters trades only when market conditions strongly favour bullish or bearish continuation. The primary logic of the strategy follows a top-down confirmation flow:

- Trend Direction: The first condition for opening a position is the presence of an established trend. This is determined by using two moving averages: the 50-period iEMA (short-term trend), and the 200-period iEMA (long-term trend). A buy setup is only considered when iEMA50 is greater than the iEMA200 and vice versa for a sell setup. This indicates that price is making progressively higher highs and higher lows, for a buy setup and lower highs and lower lows, for a sell setup, meaning market structure is trending. The strategy ignores any buy or sell signals when this condition is not met, ensuring that trades are aligned with the dominant market flow.

- Momentum Confirmation: Once trend direction is established, the system evaluates momentum using the iMACD indicator. Two additional conditions must be met: the iMACD line must be greater than the iMACD signal line, and both lines should be above the zero line for a buy setup and vice versa for a sell setup. This indicates that a crossover signal has taken place (momentum shift upward/downward), and that the market has momentum overall, not just a temporary spike. This helps filter out weak pullback rallies that can occur during consolidations.

- Volatility and Market State: The iADX indicator is used to ensure that the market is trending with sufficient strength and not trapped in sideways, low-volatility conditions, and that means the iADX must be greater than or equal to 20. The iADX must also be less than 25 to prevent entries where the market is potentially overextended or at risk of exhaustion. In other words, 20 ≤ iADX < 25 is a healthy trend that is present without excessive volatility.

- Volume Confirmation: Volume flow is used as the final technical validation. The iOBV must be trending; it must be positioned above its own moving average (i.e, iOBV 20-period iEMA) for buy setup and vice versa for sell setup, and it must move in alignment with price. This confirms that market participants are actively involved in how the asset’s price plays out, and the volume flow is not contradicting price action. Since price often follows volume, this acts as a high-quality filter against false signals.

- Hedge Management: Divergence Logic (Not Implemented)

Now that our entry strategy is fully implemented, we can now proceed with our quest to determine, how retail traders can evade institutional stop-loss hunts, by testing each of our exit strategies to see which is the best exit strategy that not only evades market hunt manipulation, but is also profitable at the end of the day.

Below are fixed EA parameters and trading data that will be used for testing both the entry strategy and each individual exit strategy.

Parameter | Value | Start | Step | Stop |

|---|---|---|---|---|

% Amount to risk | 0.02 | 0.02 | 0.002 | 0.2 |

Moving Average Trend | 200 | 200 | 1 | 2000 |

Moving Average for Trend Direction | 50 | 50 | 1 | 500 |

iMACD Fast | 12 | 12 | 1 | 120 |

iMACD Slow | 26 | 26 | 1 | 260 |

Signal Line | 9 | 9 | 1 | 90 |

iADX Value | 20 | 20 | 1 | 200 |

iADX max for range detection | 25 | 25 | 2.5 | 250 |

iOBV lookback for divergence | 14 | 14 | 1 | 140 |

iOBV MA period for trend | 20 | 20 | 1 | 200 |

Enable position hedging on divergence | false | false | – | true |

Hedge ratio | 1.0 | 1.0 | 0.1 | 10.0 |

Maximum lot size allowed | 10.0 | 10.0 | 1.0 | 100.0 |

Minimum lot size allowed | 0.01 | 0.01 | 0.001 | 0.1 |

The backtesting was done with the following parameters below:

Metrics | Value |

|---|---|

Starting capital | $10,000 |

Risk per trade | 2% |

Period | 1-hour chart |

Timeframe | 10 years (2015-2025) |

Now that we have all the parameters and data set, let’s work through each of the exit strategies to see the one that is most effective in withstanding stop-loss hunts, and also becomes profitable at the end of the testing. For each exit strategy, we will look at the setup, the results from our backtesting, explain the reason for the result, and our final verdict on the strategy.

2.1. Classic Stop-Loss + 10% Allowance

This exit strategy involves the use of a fixed stop-loss position set on price action with a 10% allowance rule. The 10% allowance is to help us avoid unnecessary stop-loss hunting when the market is volatile.

The Setup:

- Find the lowest low of 20 candles for a buy position or the highest high of 20 candles for sell position and store its value as current-SL.

- For buy setup, subtract the current-SL value from the Ask-Price, while for a sell setup, subtract the Bid-Price from the current-SL. Multiply it by 10%; this will give us the allowance.

- Finally, for a buy setup, subtract the allowance from the lowest low of 20 candles, while for a sell setup, add the allowance to the highest high of 20 candles.

Example:

For buy;

NewST = CurrentSL - (ASK-CurrentSL)*0.10;

NewST = 1.35767-(1.37766- 1.35767)*0.10 = 1.355671;

For sell;

new Stoploss = currentSL + (currentSL + Bid-price)

new Stoploss = 0.2310 + (0.2310-0.2168)*0.10 = 0.23242

After backtesting this exit strategy for a period of 10 years, below is the result gotten and what was discovered:

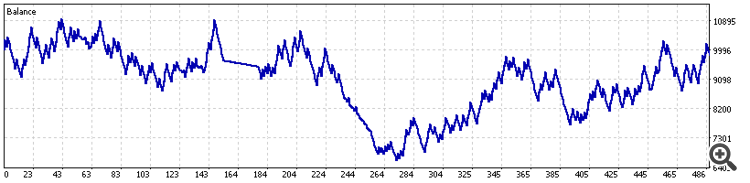

Fig 2.1: Fixed stop-loss + 10% allowance equity curve

Metrics | Value |

|---|---|

Total Net Profit | -171.92 |

Profit Factor | 1.00 |

Expected Payoff | -0.35 |

Gross Profit | 46,743.00 |

Gross Loss | -46,914.92 |

Net | -171.92 |

Max Balance DD | 4,321.18 (39.50%) |

Max Equity DD | 4,458(40.55%) |

Absolute DD | ~ 3,400 |

Average Profit | 251.31 |

Average Loss | -156.91 |

Maximum consecutive wins | 4 |

Maximum consecutive losses | 32 |

Minimal position holding time | 0:00:01 |

Maximal position holding time | 1946:40:32 |

Average position holding time | 86:13:03 |

From the table above, the profit factor is 1.00. A profit factor of 1.00 means the system breaks even; gross profits and losses cancel out. But after spreads, commissions, swaps, and slippages, the equity becomes negative. Also, the drawdowns are dangerously high. Any drawdown above 30% is high-risk. A max balance drawdown of 40% tells us that we are 40% away from blowing our account. The recovery factor at –0.04 tells us that the system did not recover from drawdown. Comparing the profit and loss, the strategy had a good profit of approximately 1.6× larger than the loss, but the win rate was too low to balance the losses. And finally, the strategy suffers a 32 consecutive losses in a row. This tells us that the strategy is very prone to institutional stop-loss hunting and market manipulation.

Overall, the system recording 32 consecutive losses, strongly suggests that the stop-losses are frequently placed around liquidity zones where the market sweeps stops before reversing. This pattern is consistent with stop-loss hunts, where price moves to clear retail stop clusters before continuing in the intended direction.

Our verdict is that our initial hypothesis was correct: retail stop-losses are indeed being hunted by institutional traders, because this strategy is the go-to strategy for most retail traders in the market, and as a retail trader using this strategy for risk management, you will always be targeted.

2.2. Classic Stop-Loss + ATR (20) Strategy

This exit strategy involves the use of a fixed stop-loss position set on price action and the iATR indicator of period 20. Instead of using the 10% allowance that was used in the previous strategy, it was replaced with the iATR indicator value. This is to help us avoid unnecessary stop-loss hunting when the market is volatile. How do we calculate the stop-loss + ATR (20)?

The setup:

- Find the lowest low of 20 candles for a buy or the highest high of 20 candles for a sell position and store its value as current-SL.

- Get the second latest value of the iATR (20) because the first value is not fully formed yet

- For a buy setup, subtract the iATR (20) value from the current-SL, while for sell, add the iATR (20) to the current-SL. This will give us our new stop-loss value.

{ double atr[]; ArraySetAsSeries(atr, true); CopyBuffer(ATR, 0, 0, 200, atr); double stopLoss = stoplossforBuy(20) - atr[1]; double stopLossDistance = MathAbs(Ask - stopLoss); } { double atr[]; ArraySetAsSeries(atr, true); CopyBuffer(ATR, 0, 0, 200, atr); double stopLoss = stoplossforSell(20) + atr[1]; double stopLossDistance = MathAbs(stopLoss - Bid); }

Similar to the previous strategy, after backtesting this exit strategy for a period of 10 years, the following result was what we got.

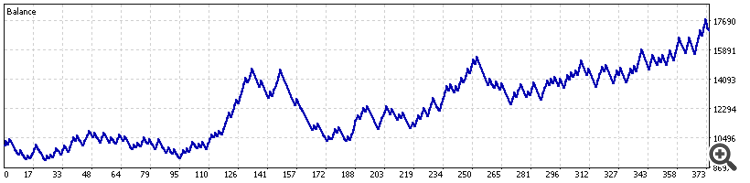

Fig 2.2: Fixed Stop Loss + ATR(20) Equity Curve

Metrics | Value |

|---|---|

Total Net Profit | 7,037.58 |

Profit Factor | 1.14 |

Expected Payoff | 18.87 |

Gross Profit | 58,882.25 |

Gross Loss | -51844.67 |

Net | +7,037.58 |

Max Balance DD | 4,443.54 (30.18%) |

Max Equity DD | 4,671.54 (31.46%) |

Absolute DD | ~ 870 – 974 |

Average Profit | 363.47 |

Average Loss | -245.71 |

Maximum Consecutive Wins | 4 |

Maximum Consecutive Losses | 8 |

Minimal Position Holding Time | 0:00:58 |

Maximal Position Holding Time | 1947:10:25 |

Average Position Holding Time | 121:56:50 |

From the table above, the strategy yields a profit factor of 1.14. A profit factor above 1.0 means the system is profitable. However, the profit factor of 1.14 is considered moderate, meaning the system makes 14 cents profit for every $1 of risk, good but not strong. The drawdowns are still high, though significantly safer than your previous strategy, but unlike the previous test, it survived the drawdowns, it recovered fully, and it achieved long-term profitability. That’s because of its recovery factor of 1.51. In terms of profitability, the strategy earns roughly 1.48× more per winning trade than it loses per losing trade. This favourable risk–reward compensates for the win rate of 43%. Finally, the ratio of consecutive wins to losses is relatively safer than your previous strategy, which had 32 consecutive losses. The absence of extremely long losing streaks shows the stop-loss keeps losing streaks manageable, and it successfully evaded institutional manipulations.

Overall, this exit strategy appears to be more stable, more profitable, and less prone to extended losing streaks. But looking at the drawdown of 30%, and the minimum position holding time of just 58 seconds, this tells us a different story: that the strategy, although good at evading stop-loss hunts, still gets hit by stop-loss hunts on some occasions.

Our verdict on this strategy is that it passed our stop-loss evasion by getting just 8-consecutive losses compared to our previous strategy and also ending with a 70% ROI from our $10,000 investment.

2.3. RSI Stop-Loss Strategy (Momentum-Based)

This exit strategy involves the use of a momentum based oscillator instead of a fixed price actions stop-loss. The idea behind it is using the highest/lowest price momentum value, as the support or resistance point. When the current momentum crosses these points, and profit is negative, it triggers closing off the trade. It simply means that the price momentum is currently strong in the opposite direction of our trade, so we need to exit our position. The momentum-based indicator used for this experiment is the RSI indicator with a period of 16. How do we determine the stop-loss?

- For buy, look for the lowest RSI value from the latest 40 RSI values that will be the RSIStopLine, while for sell, look for the highest instead.

- The RSIStopLine will act as the support or resistance line. When the current RSI value crosses the RSIStopLine, it triggers closing off the trade.

Similar to the previous strategy, after backtesting this exit strategy for a period of 10 years, the following result was what we got.

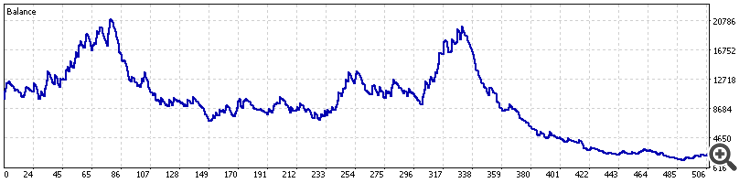

Fig 2.3: RSI Stop Loss Equity Curve

Metrics | Value |

|---|---|

Total Net Profit | -7,620.15 |

Profit Factor | 0.92 |

Expected Payoff | -15.09 |

Gross Profit | 92,555.25 |

Gross Loss | -100,175.40 |

Net | -7,620.15 |

Max Balance DD | 19,402.17 (92.44%) |

Max Equity DD | 20,193.65 (92.74%) |

Absolute DD | ~ 8,413 – 8,418 |

Average Profit | 571.33 |

Average Loss | -292.06 |

Maximum Consecutive Wins | 4 |

Maximum Consecutive Losses | 19 |

Minimal Position Holding Time | 0:59:59 |

Maximal Position Holding Time | 864:00:00 |

Average Position Holding Time | 60:19:39 |

From the table above, the strategy had a profit factor of 0.92. A profit factor below 1.0 means the system is not profitable in its current configuration. A profit factor of 0.92 implies the system loses 8 cents for every $1 of risk, which is a negative expectancy. The long-term outcome shows that the strategy fails to sustain profitability over the 10-year period, mainly due to loss clustering and extreme drawdowns. For the drawdowns, it’s at the extreme and catastrophic. A 92% drawdown indicates the account was nearly wiped out. This level of drawdown is well beyond acceptable risk parameters and suggests the strategy is structurally unsafe. Unlike the previous strategy, this system did not recover, holding a −0.38 recovery factor, and the drawdowns consumed most of the account. For profitability, it is actually strong on a per-trade basis (reward ≈ 1.95× risk), but it cannot overcome the very low win rate (32%). Finally, the strategy has a losing streak of 19 trades. This was because RSI introduced a new issue: it made the system too sensitive to short-term price movements, causing trades to be stopped prematurely. Instead of allowing positions to survive the stop-hunt and recover with the trend, the RSI-driven exits forced early stop-loss closures, preventing the system from mitigating stop-loss hunts and severely hurting overall performance.

Overall, this system is heavily exposed to stop-hunt volatility and further weakened by an RSI exit mechanism that closes trades before the true move plays out. Major improvements in exit logic are needed before the strategy can become viable.

2.4. MFI Stop-Loss Strategy (Volume-Based)

This exit strategy involves the use of a volume-based oscillator instead of a fixed price action stop-loss or momentum-based oscillator. The idea behind it is using the highest/lowest MFI volume value, as the support or resistance point. When the current MFI value crosses these points, and profit is negative, it triggers closing off the trade. It simply means that the volume is currently strong in the opposite direction of our trade, so we need to exit our position. How do we determine the stop-loss?

- For buy, look for the lowest MFI value from the latest 40 MFI values that will be the MFIStopLine, while for sell, look for the highest instead.

- The MFIStopLine will act as the support or resistance line. When the current MFI value crosses the MFIStopLine, it triggers closing of the trade.

After backtesting this exit strategy for a period of 10 years, the following result was what we got.

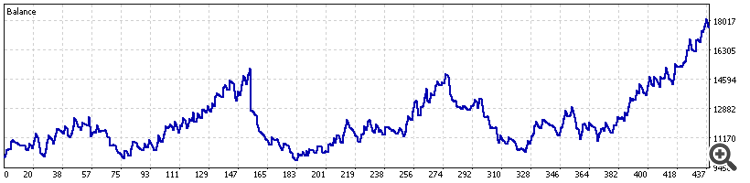

Fig 2.4: MFI Stop Loss Equity Curve

Metrics | Value |

|---|---|

Total Net Profit | 7,598.45 |

Profit Factor | 1.16 |

Expected Payoff | 17.43 |

Gross Profit | 55,539.50 |

Gross Loss | -47,941.05 |

Net | +7,598.45 |

Max Balance DD | 5,315.04 (35.00%) |

Max Equity DD | 5,495.84 (35.90%) |

Absolute DD | ~ 130 – 2,224 |

Average Profit | 310.28 |

Average Loss | -186.54 |

Maximum Consecutive Wins | 4 |

Maximum Consecutive Losses | 13 |

Minimal Position Holding Time | 1:00:00 |

Maximal Position Holding Time | 2111:00:00 |

Average Position Holding Time | 87:50:40 |

From the table above, this exit strategy yields a profit factor of 1.16. A profit factor of 1.16 is modestly strong; the system makes about 16 cents of profit for every $1 of risk. Over a 10-year horizon, this demonstrates a genuine but moderate edge. A recovery factor of 1.38, indicates that the system can recover from drawdowns. Recovery factor > 1 is acceptable and shows resilience. In terms of profitability, the strategy earns roughly 1.66× more per winning trade than it loses per losing trade. That reward-to-risk helps compensate for the sub-50% win rate (~41%).

Overall, looking at the minimum and maximum position holding time, it suggests that this strategy was able to hold a position much longer. Incorporated with the highest win-rate, it can be concluded that this strategy also passes the stop-loss evasion test.

2.5. Final Verdict

A strategy that truly evaded institutional stop-loss hunts is the one with, HIGH Recovery Factor (RF) and HIGH Minimal/Maximal Position holding time. Let’s break it down clearly.

Why do a high recovery factor and high minimal/maximal position holding time, means “evaded stop-loss hunts”? A strategy that gets hunted will have a very low recovery factor, can’t recover from constant SL hits, and a low minimal and maximal position holding time because of the constant stop-loss hits.

A strategy that survives stop-loss hunts tends to:

- hold positions longer,

- ride deeper price sweeps,

- survive volatility spikes,

- recover strongly after hunts,

- and produce large drawdowns but also a strong rebounds, and high recovery factor.

So therefore, from our experiments, the strategy that best “evaded stop-loss hunt” is the MFI stop-loss strategy (volume-based). Due to the following reasons;

- Higher drawdown (35%): It sits through big institutional sweeps.

- High Recovery Factor (1.38): It bounces back extremely well.

- Institutions tried to shake it out, but it survived and recovered by holding position longer.

- Its profit is also the highest (7,598.45), which confirms endurance.

The runner-up (also evaded but with lower DD) strategy is the classic stop-loss + ATR(20) strategy.

- Lower drawdown (30%) but highest recovery factor (1.51)

- Very stable

- Good at avoiding stop hunts but not necessarily sitting through the deepest ones

So to answer the question, how can we as retailers evade institutional stop-loss hunt manipulations? The short answer is, retail can either make use of volume-based oscillators as an exit strategy, or the volatility-based exit strategy. Both performed well in evading stop-loss hunts.

3. When To Utilise the MFI and ATR (20) Exit Strategy?

When it comes to markets prone to liquidity sweeps, which are the crypto market (i.e., altcoin trading), tiny stocks with low market cap, the MFI stop-loss strategy is the best exit strategy to utilise. This is because most stop-loss hunts in these markets are not backed by volume, and prices move quickly because of the low market cap of the security.

For high-volume traded markets like the stock market, forex market, and even the crypto market, the classic stop-loss + ATR (20) exit strategy should be utilised. This is because enough volume will be needed to manipulate price to close a position, so making use of the volatility-based exit strategy is the best option for this market when it comes to evading institutional stop-loss.

4. Conclusion

Through this 10-year backtest of these four exit strategies, the data reveals a clear truth, and that is, traditional stop-loss placement makes retail traders easy targets for institutional manipulation. The classic stop-loss + 10% allowance strategy’s 32 consecutive losses and 40% drawdown weren’t random; they were evidence of systematic liquidity hunting.

In contrast, the MFI and classic stop-loss + ATR(20) strategies achieved approximately 70-76% ROI while avoiding catastrophic losing streaks. This is because strategies that survive stop-loss hunts accept higher drawdowns but maintain strong recovery factors above 1.3. This shows resilience, not weakness.

So, for retail traders, the key takeaway is to use MFI-based exits for thin, manipulation-prone markets where stop hunts lack volume support and ATR(20) for highly liquid markets where institutions need substantial volume to execute sweeps.

Trading success isn’t about perfect entries or 100% win rates, but it’s about surviving long enough for your edge to compound. The difference between a 70% ROI over 10 years and a blown account often comes down to one decision: whether your stop-loss strategy acknowledges institutional manipulation or ignores it entirely.

Adapt your exit strategy to account for institutional behaviour, or remain liquidity fodder for those who do.

www.mql5.com (Article Sourced Website)

#StopLoss #Hunt #Surviving #Institutional #Market #Manipulation