In his latest Forbes article, Shale Magazine’s Editor-in-Chief Robert Rapier explores how nuclear power just hit an all-time global high in 2024—yet the numbers reveal a split reality. Some nations are investing heavily in new capacity as part of their energy security and climate strategies, while others are phasing out nuclear entirely.

Shale Magazine takes a deeper dive into Robert’s insights, adding our own industry perspective on what this means for the energy sector, investors, and policy makers.

Global Output Hits New Heights

Global Output Hits New Heights

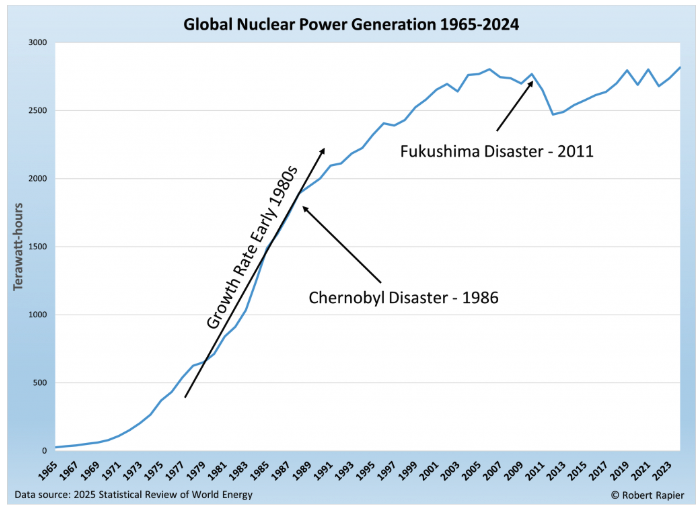

The Statistical Review of World Energy reports that nuclear power generation climbed to 2,817 terawatt-hours (TWh) in 2024, surpassing the previous record from 2021. While the growth rate—2.6% annually over the past decade—seems modest, it marks a decisive recovery from the post-Fukushima slump.

However, the growth story isn’t evenly shared:

Non-OECD countries have averaged a 3% annual growth rate, fueled by large-scale new plant construction.

OECD nations remain flat or declining, offsetting gains in some regions with retirements in others.

Asia Pacific Becomes the New Nuclear Hub

No region has shifted the nuclear landscape more dramatically than Asia Pacific, now producing over 28% of global nuclear power—a share that’s more than doubled in just ten years.

China leads this transformation:

Output surged from 213 TWh in 2014 to more than 450 TWh in 2024—a blistering 13% annual growth rate.

This growth is part of a deliberate state-driven energy policy aimed at cutting coal use while boosting reliable baseload generation.

India and South Korea also posted consistent gains, reinforcing the region’s position as the center of gravity for nuclear innovation and expansion. For global energy markets, this means Asia—not Europe or North America—will likely set the pace for nuclear technology development and supply chain dominance in the decades ahead.

North America: Stability with Pockets of Growth

The United States still produces more nuclear power than any other nation—around 850 TWh annually, nearly 30% of the global total. Yet beneath the steady output lies a story of an aging fleet, regulatory hurdles, and decades of stalled new construction.

A rare exception to that trend:

Vogtle Units 3 and 4 in Georgia—the first new U.S. nuclear reactors in over 30 years—came online in 2023 and 2024.

Together, they add 2,200 megawatts of capacity, enough to power more than a million homes, and serve as a proof point that new nuclear is possible in the U.S., despite cost overruns and construction delays.

Canada’s output slipped from 106 TWh in 2016 to 85 TWh in 2024, largely due to plant refurbishments and shifting policy priorities. Mexico remains a small but unpredictable player, with output varying widely from year to year.

Europe: A Continent Divided on Nuclear

In Western Europe, nuclear energy is losing ground:

France, once the gold standard for nuclear reliability, has seen output drop from 442 TWh in 2016 to 338 TWh in 2024, plagued by maintenance challenges and political indecision.

Germany has completed its nuclear phase-out, shutting down its last reactors in 2023.

Other nations like Belgium, Switzerland, and Sweden are split between early retirements and extending plant lifespans.

Meanwhile, Eastern Europe tells a different story:

The Czech Republic, Hungary, and Slovakia are ramping up production.

Ukraine, remarkably, continues producing over 50 TWh annually despite ongoing war, highlighting the resilience of nuclear infrastructure under extreme conditions.

Emerging Regions: Rapid Growth from a Small Base

While their output is comparatively small, emerging nuclear players are making notable moves:

United Arab Emirates: From zero generation in 2019 to over 40 TWh in 2024 thanks to the Barakah plant—one of the fastest nuclear buildouts in recent history.

Brazil and Argentina: Stable production in Latin America, with incremental gains in Brazil.

South Africa: Still Africa’s only nuclear producer, holding steady at about 13 TWh annually.

The Outliers: Reversals and Retirements

Japan: Restarting reactors after Fukushima, but still far below pre-2011 levels—84 TWh in 2024 vs. 300+ TWh in 2010.

Taiwan: Actively phasing out nuclear, dropping from 42 TWh in 2016 to just 12 TWh in 2024.

Pakistan and Iran: Quiet but steady growth.

Why This Matters for the Energy Future

The record year for nuclear power underscores a broader truth: the future of nuclear energy is increasingly being written outside traditional Western markets. Countries in Asia and the Middle East are making long-term, state-backed investments in nuclear capacity as a pillar of both energy security and decarbonization strategy.

For energy investors, this shift has several implications:

Supply chain dominance may tilt toward Asia, especially in reactor construction and fuel cycle services.

Policy frameworks will determine whether the U.S. and Europe can re-enter the global nuclear growth race.

Carbon reduction goals stand to benefit as nations like China replace coal generation with nuclear baseload power.

Bottom Line

2024’s record-setting nuclear output is not just a statistical milestone—it’s a signpost for a shifting global energy order. The next wave of nuclear expansion will likely be led by nations willing to commit billions in capital, embrace long-term planning, and build public trust in the technology.

Stay In The Know with Shale

While the world transitions, you can count on Shale Magazine to bring me the latest intel and insight. Our reporters uncover the sources and stories you need to know in the worlds of finance, sustainability, and investment.

Subscribe to Shale Magazine to stay informed about the happenings that impact your world. Or listen to our critically acclaimed podcast, Energy Mixx Radio Show, where we interview some of the most interesting people, thought leaders, and influencers in the wide world of energy.

Subscribe to get more posts from Robert Rapier

shalemag.com (Article Sourced Website)

#Record #Year #Nuclear #Energy #Means #Future #Global #Power #Shale #Magazine

Global Output Hits New Heights

Global Output Hits New Heights