The Pi Network price continues to hover dangerously close to its all-time low (ATL), raising concerns within the community about the future of the blockchain-based project.

After peaking near $3, the Pi Network Coin has slipped to around $0.54, losing significant value over recent months. Yet, as technical indicators flash oversold conditions, many traders wonder whether a turnaround could be on the horizon.

Pi Network Price Nears Crucial Support

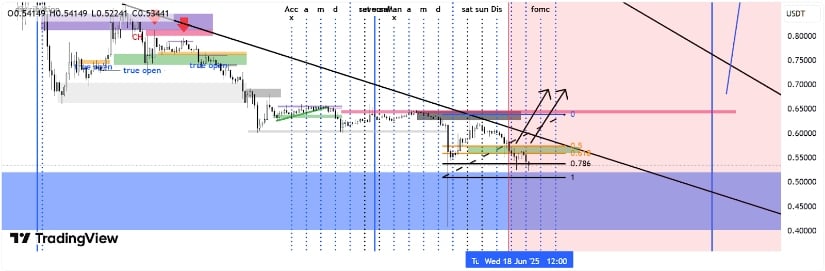

The PI Coin price has been trading inside a descending triangle pattern, a structure typically seen before bearish breakdowns. At present, the token clings to horizontal support at $0.55—a critical threshold for bulls.

Despite the breakout above the descending trendline, the weak retest suggests limited bullish conviction, potentially signaling a further bearish move. Source: Bullcrypto_1235 on TradingView

Technical indicators such as the Relative Strength Index (RSI) and the Money Flow Index (MFI) both point to an oversold market. With RSI near 35 and MFI dipping below 20, market analysts suggest a rebound could be imminent. These indicators historically precede price recoveries, particularly when followed by a volume spike.

“If the RSI crosses below 30, it often marks a reversal zone,” one analyst commented. “Right now, PI is skating close to that territory.”

Trading Volume Collapse Clouds Recovery

Despite oversold signals, recovery seems difficult due to a dramatic fall in Pi Network trading volume. At its peak in February, the coin saw over $3 billion in daily volume. Today, that figure has plummeted to under $100 million, according to CoinMarketCap data.

Pi is trading at $0.62 amid declining trading volume and growing correlation with Bitcoin’s dips, as lack of project development fuels bearish sentiment. Source: @pinetworkmember via X

This decline in volume underscores waning interest in the Pi cryptocurrency, a worrying trend for bulls. Without renewed buying activity, the Pi crypto price may struggle to breach resistance at $0.85, let alone reclaim the $1 psychological barrier.

“The strength and power to go up is gone with an always decreasing trading volume,” a user wrote on X.

Exchange Supply Surge Raises Sell Pressure

Adding to bearish concerns is the increasing number of PI Coin stored on centralized exchanges (CEXs). Recent on-chain data shows that CEX holdings have jumped by over 30% since March—from 263 million to nearly 347 million tokens by mid-June.

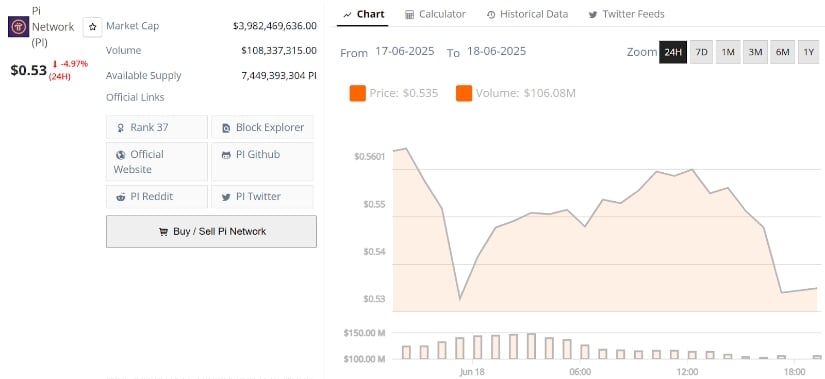

Pi Network was trading at around $0.53, down 4.97% in the last 24 hours at press time. Source: Brave New Coin

Gate.io leads with 163.2 million PI tokens, followed by Bitget and OKX. Net outflows from these exchanges continue, but the inflows are arriving faster, indicating a potential buildup in sell-side pressure.

Exchange balances rising while trading activity falls is often seen as a bearish divergence. The cumulative dollar value of PI held across CEXs now exceeds $187 million.

Whale Activity Sparks Mixed Reactions

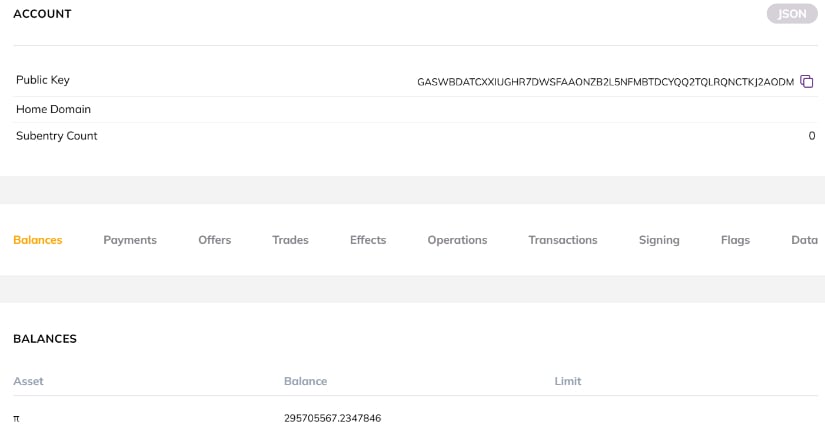

Interestingly, a Pi Network whale has acquired over 290 million tokens in just three months—valued at approximately $150 million. While some in the community view this as a bullish sign, possibly hinting at confidence ahead of a major listing like Pi Network Binance, others worry about increased concentration of wealth and its impact on the Pi Coin market.

A major investor has accumulated approximately 290 million Pi (PI) coins over the past three months, marking one of the largest acquisitions in the project’s history. Source: blockexplorer/minepi

The whale’s acquisition spree began on March 6 and continued through mid-June. Some analysts speculate the move could signal preparations for the Pi mainnet going live or for other upcoming project milestones.

“If PI returns to its ATH of $2.98, this whale’s holdings would be worth nearly $900 million,” noted a market tracker. “Even at $1, the valuation would be staggering.”

Barriers to Recovery Remain

For now, the Pi Network Coin price hovers around $0.54, with resistance at $0.57 and stronger levels at $0.61 and $0.71. If bulls reclaim $0.57, the Pi token may rally toward those levels, especially if accompanied by an uptick in volume and momentum.

The Squeeze Momentum Indicator has started flashing green bars on the histogram, indicating a possible build-up of bullish pressure. Black dots on the chart suggest volatility is compressing, which may soon result in a sharp price movement.

Yet, if PI fails to hold the $0.51 support level, the Pi Coin value could fall further, potentially revisiting the $0.40 ATL. The Bull Bear Power (BBP) remains negative, signaling that sellers are still dominating the Pi Network market.

Community Sentiment and Pi’s Future

Amid all the market action, Pi Network’s vibrant community—known as Pioneers—remains committed to the project. Many still peg the Pi cryptocurrency value to the Global Consensus Value (GCV) of $314,159, a symbolic figure used in in-app barter trades rather than on exchanges.

Pi Network still holds potential for a bullish reversal, provided the price maintains support above the $0.50 level. Source: Chad_Sniper on TradingView

Still, frustration lingers over the Pi Core Team’s silence. The lack of clarity around a Pi mainnet launch, utility, and Pi wallet functions has led to skepticism about the project’s future.

“Price doesn’t reflect our faith in Pi,” a longtime Pioneer commented on Reddit. “But we need action from the Core Team to regain momentum.”

Final Thoughts

With the Pi crypto value teetering on critical support levels and technicals flashing mixed signals, the short-term path for PI remains uncertain. While indicators suggest a possible rebound, collapsing volume, surging exchange supply, and community frustration may hold back any sustainable rally.

For now, traders and Pioneers alike are keeping a close eye on price action, waiting to see whether the current dip becomes a historic buying opportunity—or a prelude to new lows.

bravenewcoin.com (Article Sourced Website)

#Network #Price #Prediction #Network #Struggles #ATL #Oversold #Signals #Hint #Turnaround #Brave #Coin