Pros

- Lower trading fees compared to other exchanges

- PancakeSwap users can earn a variety of Non-Fungible Tokens (NFTs)

- Yields range from 23.52% to 378%, which is higher than the yields on other exchanges

- PancakeSwap provides lottery entry, with the prize of 50% of the lottery pool

- Users are highly rewarded for contributing to the exchange’s liquidity

- Several BEP20 tokens can be exchanged on PancakeSwap

- The ability to develop your own projects in the BSC community

Cons

- Not suitable for beginners

- No native wallet and complicated BSC process

- Complicated staking process

PancakeSwap is one of the most popular decentralized exchanges (DEXs) on Binance Smart Chain that employs an automated market maker mechanism to facilitate the secure BEP-20 token swaps.

PancakeSwap debuted in 2020 as a more affordable and faster automated market maker (AMM) than Uniswap. While PancakeSwap Exchange originated as a fork of Uniswap on Binance Smart Chain, it has grown to be a significantly more popular platform than Uniswap.

PancakeSwap’s daily transaction volume has topped $100 million, making it one of the most popular DApps ever. Furthermore, in less than a year, it has also eclipsed Binance’s own Binance DEX, becoming the most popular DEX on Binance Smart Chain (BSC). So what makes PancakeSwap Exchange so unique and accounts for its extraordinary success?

Read on for our PancakeSwap review to learn everything you need to know about PancakeSwap Exchange, including its key features, fees, pros and cons, security, and the Pancakeswap token.

Let’s jump right in!

What Is PancakeSwap

https://pancakeswap.finance/” target=”_blank” rel=”noreferrer noopener nofollow”>PancakeSwap is a decentralized exchange (DEX) on the Binance Smart Chain (BSC) that uses an automated market maker mechanism to make token swaps possible. It was released in September 2020 by a group of anonymous developers. PancakeSwap is also a permissionless DEX, allowing anyone to list their tokens on the exchange as long as they build a liquidity pool for the token.

PancakeSwap provides its users with a wide range of features like token swaps, liquidity provision & farming, perpetual trading, staking, lottery, NFT marketplace, launchpad, etc.

It’s one of the few DEXs that provides users access to a range of financial products in a single interface, offering a well-rounded DeFi experience, typically seen in centralized exchanges that work with large operational teams and financing.

According to DeFi Tracking Platform https://defillama.com/protocol/pancakeswap” target=”_blank” rel=”noreferrer noopener nofollow”>Defi Llama, PancakeSwap is now the largest DEX and DeFi application (by TVL) on the BSC network, with an estimated $3.05 billion in assets stored on the platform. PancakeSwap features its own governance token, ‘CAKE,’ which enables its users to vote on proposals and is often given to liquidity providers and stakeholders as a reward.

CAKE Token

CAKE is PancakeSwap’s native governance token, as well as its rewards and utility token. CAKE holders can vote on governance decisions, get rebates on trading fees for perpetual futures, get access to IFOs, buy lottery tickets, etc.

CAKE’s current total supply is 315,268,578, with a maximum supply of 750,000,000. CAKE currently has a market cap of $481.8 million and an emission rate of 13.75 CAKE/block.

PancakeSwap Key Features

PancakeSwap offers the following key features to its users:

- CAKE, PancakeSwap’s native token, is a BEP20 token built on BSC.

- Faster transactions and lower fees than other Ethereum-based Decentralised Finance (DeFi) platforms.

- It’s an Automated Market Maker, similar to ERC20-based platforms such as SushiSwap and Uniswap.

- It enables users to trade digital assets against a variety of liquidity pools while also collecting yields.

- It allows users to lend their digital assets to liquidity pools in exchange for liquidity tokens, which they can stake to gain even more digital assets.

- It lets users trade other BEP20 tokens in addition to using cryptocurrencies to add liquidity to exchange pools, enabling them to earn extra tokens.

- With CAKE, users can earn more tokens or other tokens based on the BSC, like DODO, UST, or LUNA, by using the native token in SYRUP liquidity pools.

- “Know Your Client” (KYC) and/or Anti-Money Laundering (AML) aren’t required.

- CertiK has audited and verified PancakeSwap to ensure its legitimacy and security.

- It features a 40 CAKE reward per block; however, 15 CAKE is burnt, making the effective value substantially lower.

Binance Bridge

To trade ERC-20 tokens on PancakeSwap, you must first wrap them on the Binance Bridge and convert them into BEP-20 assets. On the Binance Bridge, connect your digital wallet. The transaction must then be verified on the Ethereum network for some Ether known as gas fees.

While the high Ethereum gas fees may make this expensive, once you’ve wrapped and bridged your crypto assets to BSC, PancakeSwap’s low fees will save you a lot of trading expenses. After you’ve finished your transactions on PancakeSwap, just use Binance Bridge to transfer your BEP-20 assets back to ERC-20. As a result, you can use BSC to buy tokens like ApeCoin using this bridge.

PancakeSwap Exchange: Products and Services

PancakeSwap has been holding on to the status of “largest DEX on the BSC chain” for so long because of its capacity to offer a wide range of financial products and services through a single interface. Most of this is feasible due to the hard work of its development team behind the scenes. PancakeSwap has extended its services from basic token swaps to an on-chain derivatives market in less than two years.

The following is a list of its current services:

- Spot Trading

- Perpetual Futures Trading

- Yield Farming

- IFO – Initial Farm Offering

- Prediction Market

- Lottery

- Syrup Pools (Staking)

- NFTs

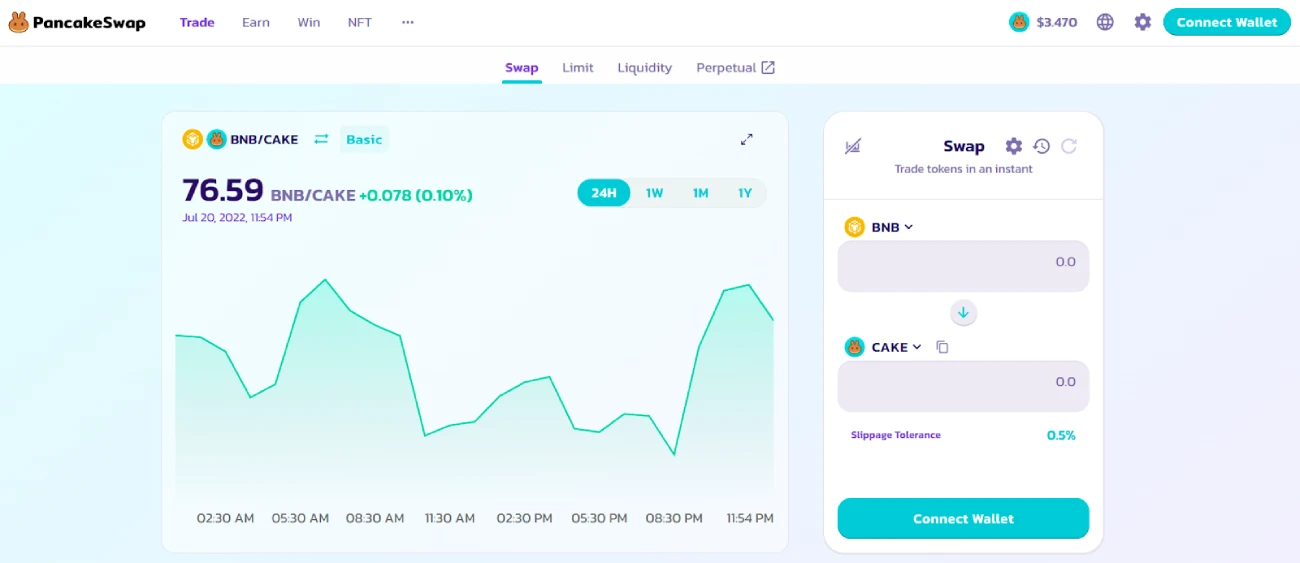

PancakeSwap Spot Trading

Spot trading on PancakeSwap is carried out by swapping assets in a liquidity pool via an automated market maker (AMM). AMM swaps are often done live, with the price defined by the ratio of assets in the pool; users have no decisive influence over the price at which they buy or sell assets.

PancakeSwap offers a solution to this problem by allowing users to pre-set orders using the limit order function on its interface. Unlike centralized exchanges, this does not imply matching one order against another. Instead, once the pre-set price objective is met, the AMM executes a swap on its liquidity pool.

However, remember that PancakeSwap doesn’t accept limit orders for tokens with a fee/tax on the ‘transfer’ of tokens. Open limit orders will stay open forever unless they are executed or canceled by users. Soon, a customizable expiration date functionality is planned.

Furthermore, as PancakeSwap is based on the BSC network, transaction speeds are substantially faster and less expensive than on Ethereum. When completing swaps on PancakeSwap, ensure to use the V2 swap, as the previous version (V1) is more prone to slippage, which results in financial loss.

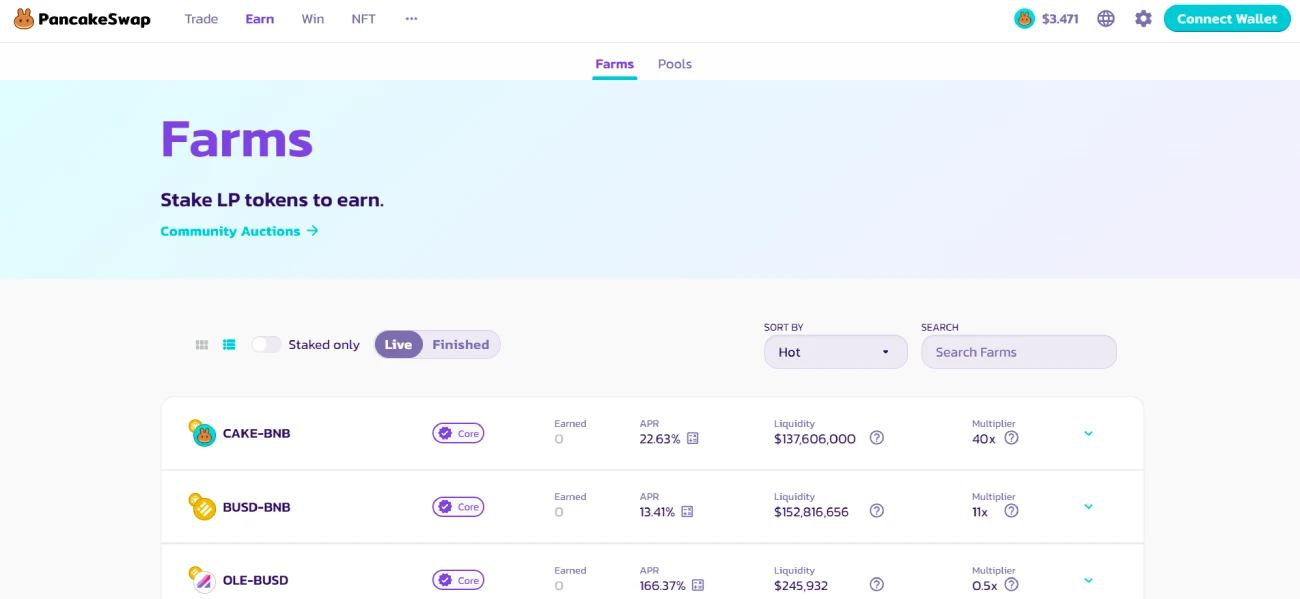

PancakeSwap Yield Farming

Users can farm rewards in the form of CAKE tokens by supplying liquidity to PancakeSwap’s Liquidity Pools. PancakeSwap features several yield farms, which require you to stake two tokens to obtain the LP tokens associated with the specific farm. Each farm on PancakeSwap has its own yield rate and multiplier, so before supplying liquidity, ensure to know which farm you want to profit from. For example, the CAKE-BNB farm has a 40x multiplier, which means it earns 40 CAKE for every block produced.

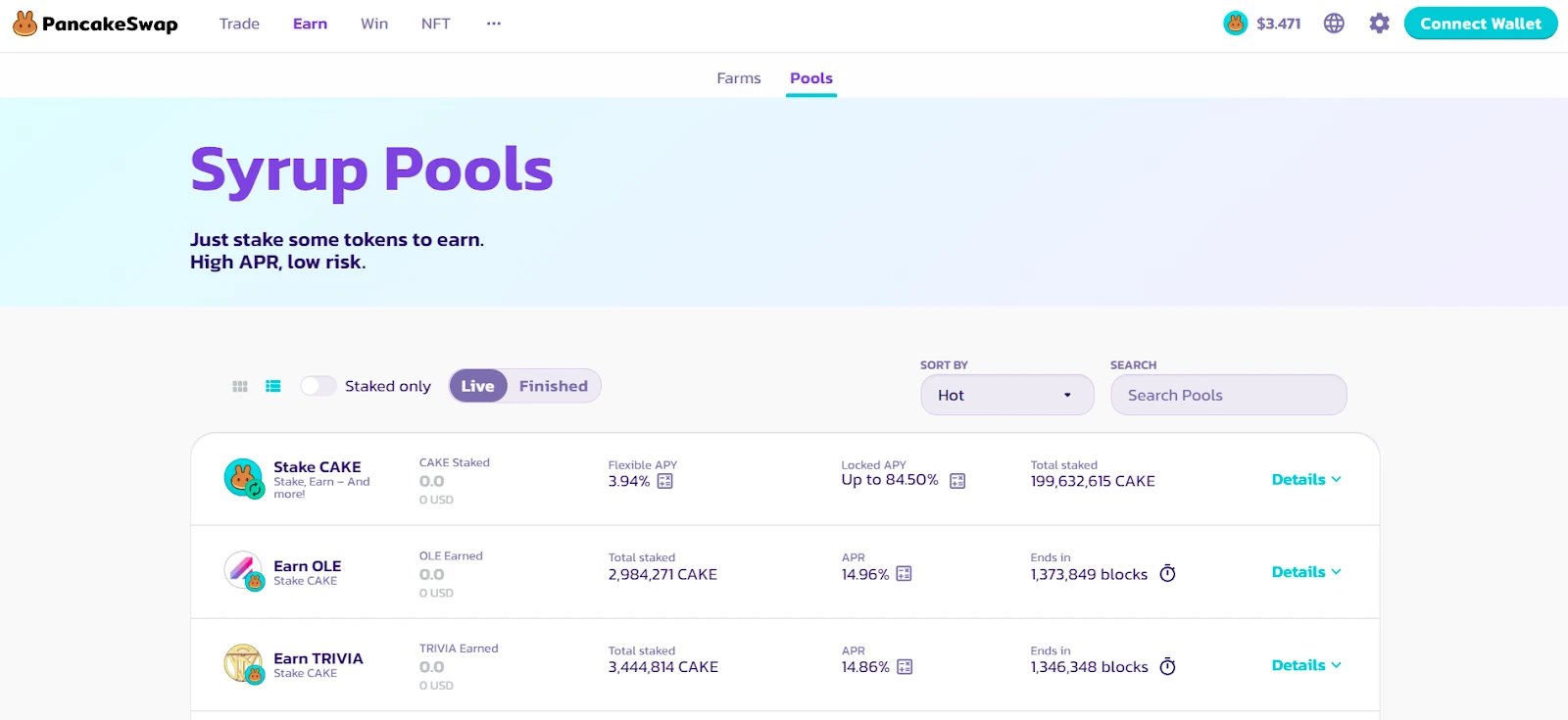

PancakeSwap Syrup Pools (Staking)

Syrup Pools let users stake CAKE and gain rewards in the form of CAKE or other tokens. The CAKE Syrup Pool, for instance, allows users to choose between flexible and locked staking. The locked staking option offers a high APY but requires users to lock their tokens for a predetermined period. The flexible staking option provides a lower APY but lets users withdraw their tokens anytime.

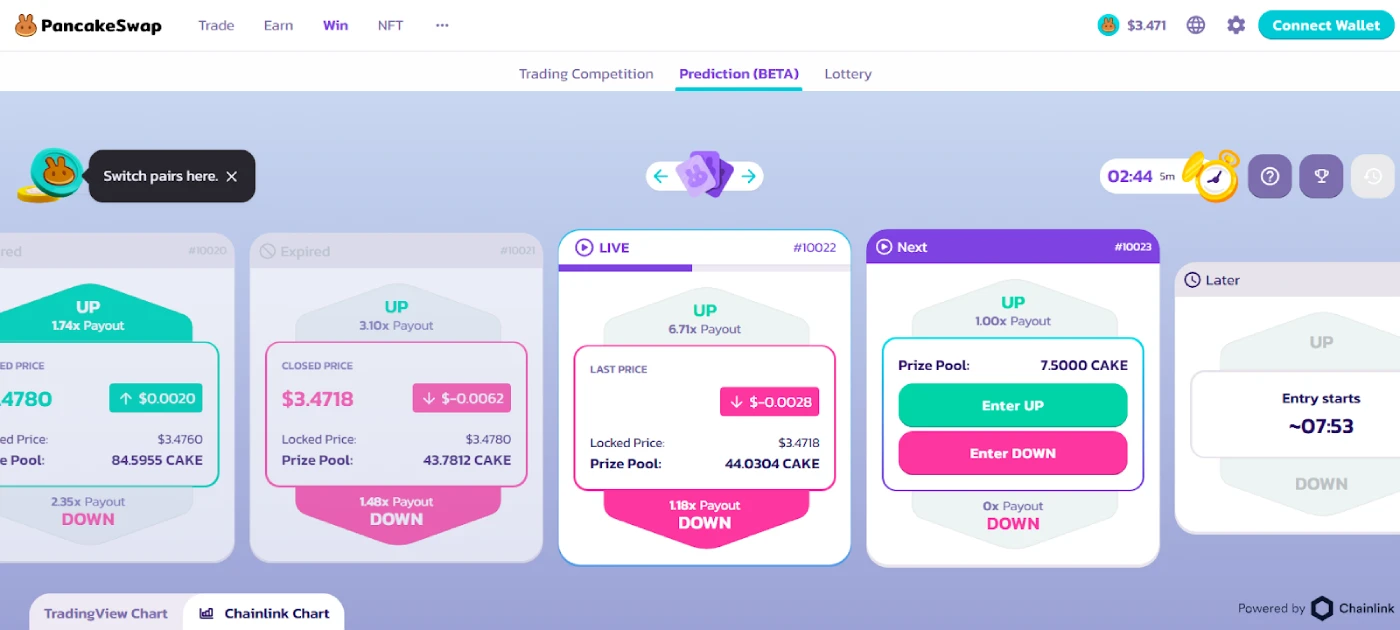

PancakeSwap Prediction Market

PancakeSwap’s prediction market lets users earn tokens by correctly predicting the price movement of BNB-USD or CAKE-USD pairs. Users can bet on whether the price of https://coinstats.app/blog/how-to-buy-binance-coin-bnb/” target=”_blank” rel=”noreferrer noopener”>BNB or https://coinstats.app/blog/how-to-buy-pancakeswap-cake/”>CAKE will rise or fall in the next five minutes.

Results will be calculated, and rewards will be distributed based on the closing price at the end of the round.

PancakeSwap Lottery

Users can purchase lottery tickets for the PancakeSwap Lottery, and each ticket has a unique 6-digit combination. A random six-digit combination is generated at the end of each lottery session, which lasts between 12 – 36 hours.

Users must have tickets that match the winning combination from left to right to win. The closer your number is to the winning combination, the higher your payout.

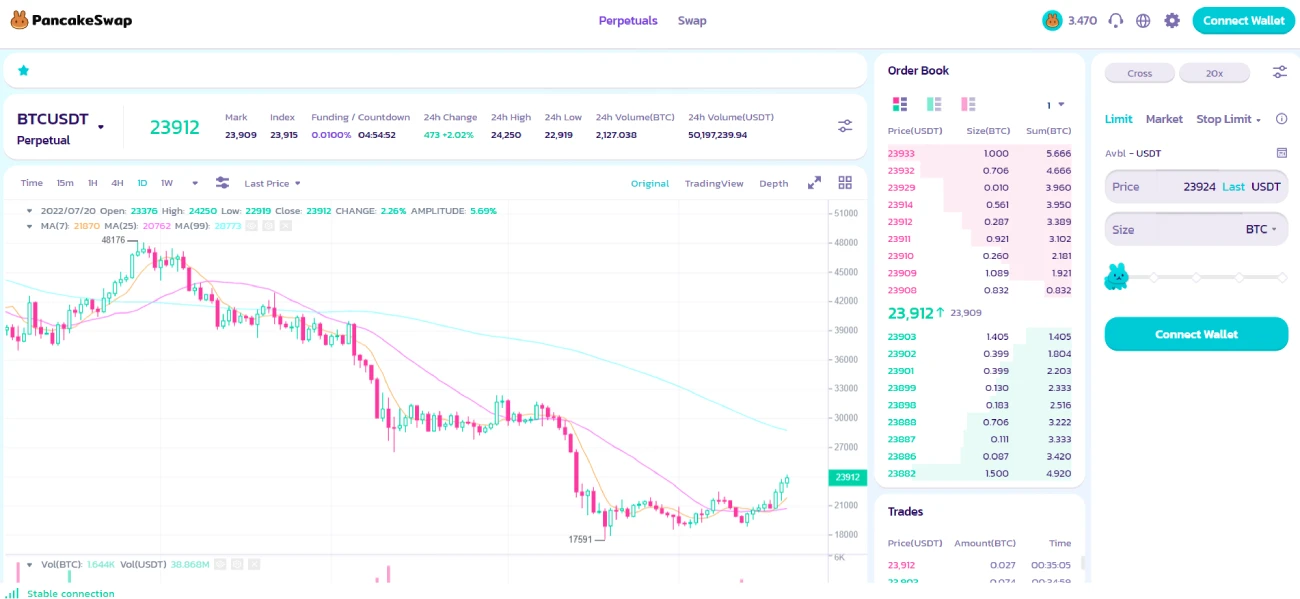

PancakeSwap’s Perpetual Futures Trading

PancakeSwap has collaborated with ApolloX Finance to allow customers to trade perpetual futures contracts using its interface. The trading infrastructure is built with off-chain order-book matching and on-chain settlement, allowing for critical trading features such as different order types (such as limit orders, stop orders, and post-only orders) while preserving privacy and security of a DEX. I.e., it doesn’t require KYC or use intermediaries when engaging with smart contracts.

PancakeSwap Initial Farm Offerings (IFO)

Initial Farm Offering, or IFO, is a novel Initial Coin Offering (ICO) concept introduced by PancakeSwap. Users must create a “profile” on PancakeSwap to participate in an IFO. Users can then commit CAKE tokens to the IFO pool to buy the token. The number of iCAKE a user owns determines the amount of CAKE a user can commit. iCAKE is a numerical metric used to calculate the quantity of CAKE staked in the fixed-term CAKE staking pool as well as the overall staking duration of your current fixed-term staking position.

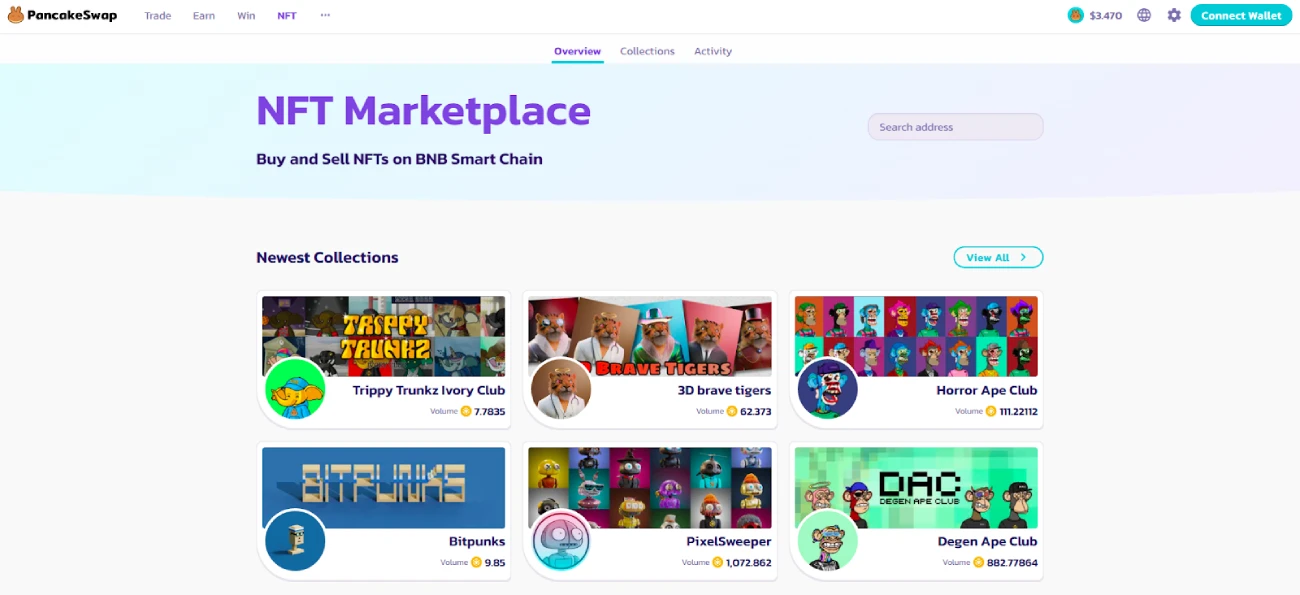

PancakeSwap’s NFTs and NFT Marketplace

PancakeSwap is staying ahead of the competition by launching its own NFT collections and allowing users to create personalized profiles on the exchange by linking them to an NFT. PancakeSwap also has its own NFT marketplace for trading white-listed NFT collections.

NFTs can be won through team trading games, where traders compete to see who has the greatest trading volume in a period, or via PancakeSwap airdrop events.

PancakeSwap Farming and Staking

PancakeSwap Liquidity pools are funded with users’ deposits, and in exchange for their contributions, users get Liquidity Provider (LP) tokens, also known as FLIP tokens. These LP tokens can be used to reclaim their share and a percentage of the trading fees.

PancakeSwap also allows users to farm CAKE and SYRUP tokens. Users can deposit their LP tokens on the farm to get rewarded with CAKE. CAKE tokens can then be staked to get SYRUP, which has extra utility as a governance token and can be used as tickets in different lotteries.

CAKE holders are given a fixed quantity of CAKE for each built block, and users can stake them to earn incentives. CAKE is distributed as BEP20 tokens to those offering liquidity to the network, and users may earn 170 percent APY by staking CAKE in the pool. Users need a Metamask wallet or a Binance Chain Wallet with both CAKE and (Binance Coin or BNB) to pay for gas on the exchange to stake CAKE.

Users can begin staking by following these steps:

- Go to the PancakeSwap website under “Finance” and click the “Connect” button in the upper righthand corner of the homepage.

- Users can choose “Connect” or “Binance Chain Wallet,” which will open the wallet.

- The user can choose “Pools” from the left-hand menu to see a list of active pools ready to accept a stake, such as the CAKE Pool.

- After identifying the pool, the user can click “Approve CAKE,” which will access the user’s wallet.

- The user can then click “Confirm” and wait for the transaction to be confirmed on the blockchain, which takes around 3 seconds.

- The pool’s format has changed, and the user can now select the “+” option on the CAKE Pool. Users may now input the amount they want to stake and click “Confirm.”

- The user’s wallet will appear, allowing them to verify the transaction details before clicking “Confirm,” which will take a few seconds to approve on the blockchain.

- Once completed, the user’s stake and CAKE balance will be updated. From here, the user may “Harvest” to claim their CAKE rewards or “Compound” to reinvest them by choosing the corresponding option offered.

PancakeSwap Fees

One of the primary reasons users may be tempted to PancakeSwap is its lower fees compared to other DEXs. You’ll be charged a 0.25% trading fee for swapping a token on PancakeSwap. Surprisingly, a large portion of trading fees is refunded to liquidity providers, incentivizing them to offer liquidity to the platform.

The 0.25% transaction fee is distributed as follows:

Sent to the PancakeSwap Treasury – 0.03%

CAKE buyback and burn – 0.05%

Return to Liquidity Pools as an incentive for liquidity providers – 0.17%

Also, remember that certain tokens may have a “tax” on transfers or sales of the token, in addition to the fees mentioned above.

Perpetual Futures Market Fees

PancakeSwap’s perpetual futures market employs an off-chain order book and an on-chain settlement method, meaning that users must pay “maker” and “taker” fees. Trading fees are 0.02% of the notional amount for makers and 0.07% for takers. CAKE will be the default payment method for fees, followed by APX (ApolloX’s token) and USDT. Users who pay their trading fees in CAKE will receive a 5% reduction, equating to 0.019% for makers and 0.0665% for takers.

PancakeSwap Deposits and Withdrawals

PancakeSwap platform exclusively accepts deposits and withdrawals from users who want to utilize PancakeSwap’s perpetual futures trading product. By depositing funds, you are granting the protocol permission to use your funds as collateral for any margin transactions you do. This collateral will be liquidated if you do not repay or close positions before certain critical price levels.

Currently, deposits are only accepted in USDT, BUSD, APX, or CAKE. To withdraw deposited funds, close any open trades and click the withdraw option under the assets tab.

PancakeSwap Supported Wallets

Users of PancakeSwap have a variety of wallet options to select from, including MetaMask, MathWallet, WalletConnect, TokenPocket, and Trust Wallet. MetaMask is an ERC-20 wallet that can also be configured to hold BEP-20 assets.

You can also choose from several other wallets in the crypto market that you can connect to PancakeSwap.

PancakeSwap Security

PancakeSwap is an open-source project that has undergone many security assessments by Certik, Peckshield, and SlowMist. The official documentation lists a total of 9 security audits.

PancakeSwap also follows standard practices in security by employing multi-signature for all contracts and setting a time-lock option for them. Furthermore, for maximum transparency, the majority of PancakeSwap’s code is publicly available, and all of their contracts are checked on BscScan.

Mobile Apps

PancakeSwap does not have its own mobile app. Instead, you can access the PancakeSwap ecosystem on mobile by downloading several Android or iOS applications. Apps that are supported include WalletConnect, Trust Wallet, and Ledger Nano.

PancakeSwap Customer Support

PancakeSwap doesn’t officially provide customer support for you to get in touch with. Users can access the troubleshooting page on the PancakeSwap website, which covers typical issues such as “price impact is too large” or “PancakeSwap router has expired,” as well as workarounds and an explanation of why they occurred.

While there is no official customer service, users can seek assistance from the community through the different chat rooms on Telegram and Discord. We found PancakeSwap’s Telegram more entertaining and responsive than its Discord Channel. However, be aware that you’ll be bombarded with ‘support lines’ and ‘customer service’ scammers claiming to be able to assist you with your problem. DO NOT PARTICIPATE IN THESE CHATS. The best thing to do is change your privacy settings to more favorable ones to block these calls from coming through.

ApolloX offers a ‘support ticket system’ for PancakeSwap’s perpetual futures market users to ensure they always get prompt support.

FAQs

1. Is PancakeSwap Legit

Yes, PancakeSwap has undergone an audit by CertiK, demonstrating that it’s a trustworthy exchange. Your funds won’t be at risk of being stolen by hackers if a breach occurs because the exchange doesn’t hold any of your assets.

2. What Cryptocurrencies Can I Trade

PancakeSwap allows you to swap a wide range of cryptocurrencies, including Elongate, Kabosu, USDT, Doge/Dogecoin, Ethereum, Zilliqa, and Zeppelin Dao, as well as gems like Safemoon. As long as the cryptocurrency exists as a Binance Smart Chain token, it’s available on PancakeSwap.

3. What Is Slippage Tolerance on PancakeSwap Exchange

The difference between the expected price of a trade (what you see) and the price at which the deal is executed (what you get) is called slippage tolerance. This occurs because trading is not immediate, and an asset’s price might vary during the processing of a transaction. When you specify the slippage tolerance, your transaction will fail if the slippage exceeds the amount you specified, protecting you from getting less for your swap than you desired.

4. Is PancakeSwap Better Than Uniswap

This is a difficult question to answer. PancakeSwap and Uniswap are both excellent crypto exchanges, but they operate on different networks. PancakeSwap is the ideal option for BEP-20 token owners who want to continue using Binance Smart Chain. While Uniswap is the preferable option if you want to keep your activity limited to the Ethereum blockchain.

PancakeSwap Review: Our Verdict

PancakeSwap is a well-designed DEX that provides several ways to make money through tokens, farms, and pools. It’s a safe and reliable exchange, audited by CertiK and enabling users to profit from the turbulent cryptocurrency market. Although no customer service is offered on the PancakeSwap website, there are several social media platforms where users can get in touch with the team or community.

If you’re looking for detailed steps to buy CAKE tokens, you can check out our guide on How to Buy PancakeSwap.

You can also visit our https://coinstats.app/blog/” target=”_blank” rel=”noreferrer noopener”>CoinStats blog to learn more about wallets, https://coinstats.app/portfolio/” target=”_blank” rel=”noreferrer noopener”>portfolio trackers, tokens, etc., and explore our in-depth reviews on various cryptocurrency exchanges such as https://coinstats.app/blog/bkex-review/” target=”_blank” rel=”noreferrer noopener”>BKEX, https://coinstats.app/blog/changenow-review/” target=”_blank” rel=”noreferrer noopener”>ChangeNOW, https://coinstats.app/blog/bybit-review/” target=”_blank” rel=”noreferrer noopener”>Bybit, http://Crypto.com” target=”_blank” rel=”noreferrer noopener”>Crypto.com, https://coinstats.app/blog/bitmex-review/” target=”_blank” rel=”noreferrer noopener”>BitMEX, https://coinstats.app/blog/finexbox-review/” target=”_blank” rel=”noreferrer noopener”>FinexBox, https://coinstats.app/blog/binance-review/” target=”_blank” rel=”noreferrer noopener”>Binance, https://coinstats.app/blog/wazirx-review/” target=”_blank” rel=”noreferrer noopener”>WazirX, etc.

Want to dig deeper? Discover the origin of decentralized finance, blockchain technology, and cryptocurrency with our articles What Is DeFi, How to Buy Cryptocurrency, and more.

Investment Advice Disclaimer: The information contained on this website is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any securities, financial product, or instrument mentioned in the content, nor does it constitute investment advice, financial advice, trading advice, or any other type of advice.

Cryptocurrency is a highly volatile market sensitive to secondary activity, do your independent research, obtain your own advice, and only invest what you can afford to lose. There are significant risks involved in trading CFDs, stocks, and cryptocurrencies. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider your own circumstances and obtain your own advice before making any investment. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.

https://coinstats.app/blog/pancakeswap-review/”>