[ad_1]

With the market preparing to turn its attention to the start of winter heating demand, natural gas forwards at numerous Lower 48 hubs posted modest gains during the Sept. 29-Oct. 5 trading period, https://www.naturalgasintel.com/news/forward-look/”>NGI’s Forward Look data show.

Despite a small discount at benchmark Henry Hub, which shed 3.0 cents to $6.935/MMBtu, prices for November delivery climbed at a number of demand hubs. Strengthening in November basis differentials was widespread, including trading locations in the Northeast, Appalachia, Midwest and Rockies.

In New England, Algonquin Citygate basis climbed to plus $4.138 for November delivery, a 16.1-cent swing higher for the period.

[Is it really an energy transition? Liberty Energy CEO Chris Wright explains why he thinks robust natural gas demand will endure and why the “energy transition,” in his view, is not really a transition at all – but rather a gradual shift to more varied sources of energy that could take centuries to fully develop. Listen to NGI’s Hub & Flow podcast now.]

In the Midwest, Chicago Citygate basis added 14.8 cents for November, ending 37.6 cents back of the national benchmark.

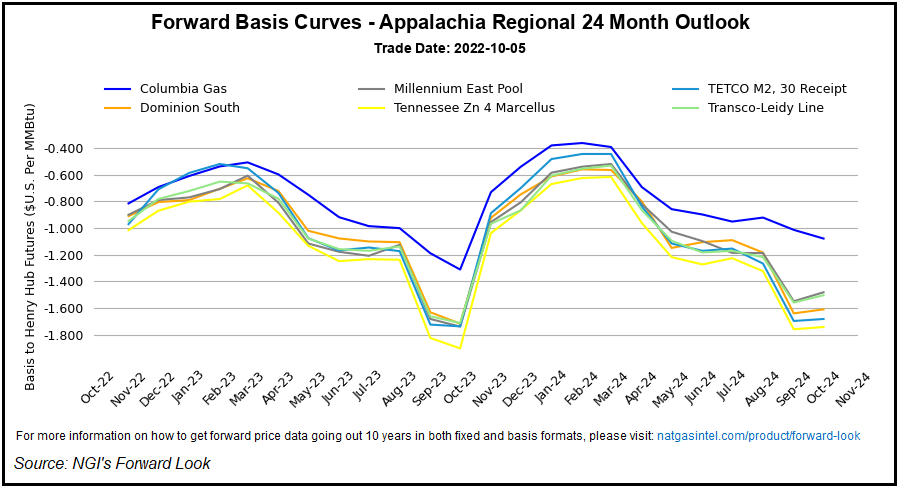

Several Appalachian hubs posted even stronger basis gains, including Eastern Gas South, where November basis rallied 30.2 cents week/week to minus 91.1 cents.

Out west in the Rockies, Cheyenne Hub narrowed the gap to Henry to minus 65.3 cents, an 11.7-cent gain.

Why Are Bulls ‘Buying The Dip’?

Meanwhile, after selling off sharply in recent weeks, Nymex futures showed signs of establishing a shoulder-season bottom during the period, a stretch that notably included a 36.7-cent rally in Tuesday’s session.

Traders shrugged off a hefty triple-digit storage build on Thursday to push the November contract another 4.2 cents higher to $6.972, just shy of the $7 mark.

Still, the Energy Information Administration’s (EIA) latest report, a whopping 129 Bcf injection for the week ended Sept. 30, served to temper the bullish case.

The print far outpaced the 87 Bcf five-year average, pushing stockpiles to 3,106 Bcf and cutting the year-on-five-year deficit to minus-7.8% as of Sept. 30, EIA data show.

In terms of factors potentially putting upward pressure on prices Thursday, “immediate-term gas demand will rise into the weekend, technicals are supportive of extended gains and seasonal upside risks outweigh downside,” according to EBW Analytics Group analyst Eli Rubin.

Storage builds over the next few weeks, though, are poised to shrink the deficit to the five-year average, the analyst said. This coupled with a “lack of cold weather may postpone attempts for Nymex gas to breakout to the upside.”

NatGasWeather said next week’s reported build “could be even larger than today’s, potentially climbing into the 130s Bcf.” With domestic production reaching record highs, “the supply/demand balance isn’t as scary as market participants were looking at a few months ago.”

And yet, “this hasn’t stopped bulls from again buying the dip,” the firm added.

The recent move higher might reflect technical or seasonal factors, or it might reflect “expectations U.S. and global supplies will tighten considerably this winter season,” NatGasWeather said.

Those holding such supply adequacy concerns “must be looking forward” given that “U.S. supplies will have increased more than 600 Bcf in just six weeks, smashing the previous fall shoulder season injection record,” NatGasWeather added.

Winter Risks For Europe

Looking overseas, with winter approaching in the northern hemisphere, natural gas markets in Europe have reason to feel “snug but by no means cozy,” according to a recent note from Rystad Energy vice president Emily McClain.

Recent damage to the Nord Stream 1 and 2 pipelines has further tightened global natural gas supply, the analyst noted.

“Europe’s gas market participants are now looking to storage injections to safeguard inventories through winter,” McClain said. “However, while European storage levels are shaping up nicely, an early or extended winter could yet send gas stocks sledding downward, pushing prices higher.”

As for Asia, with high storage levels “expected to last through December, most market focus has now shifted to January LNG imports,” McClain added.

Permian Basis Slips

Meanwhile, looking at regional trends in the domestic market, pipeline disruptions served to pressure Permian Basin forward prices lower during the Sept. 29-Oct. 5 period.

El Paso Permian basis for November delivery tumbled 25.0 cents lower, ending at minus $3.146, while Waha fell 20.6 cents to minus $3.201.

Wood Mackenzie reported a number of pipeline events impacting the Permian region during the period, including a force majeure on the El Paso Natural Gas (EPNG) system on its Line 1300 that was expected to impact roughly 180,000 MMBtu/d of flows.

EPNG was also scheduled to reduce westbound flows on its Line 1100 for maintenance starting Monday and continuing through Oct. 21, according to the firm.

https://www.naturalgasintel.com/natural-gas-forwards-mixed-but-market-shows-signs-of-shaking-off-shoulder-season-doldrums/”>