Imagine a seasoned trader spotting a pattern in the stock market that defies the textbooks. Back in the 1980s, savvy investors noticed stocks surging in January after a December dip. They pounced, turning this quirk into profits. This is the world of market anomalies, deviations from the Efficient Market Hypothesis (EMH), which assumes prices reflect all available information instantly. In reality, markets aren’t always efficient. Behavioral biases, information lags, and structural quirks create opportunities.

These anomalies matter because they give traders an edge. Quantitative funds like Renaissance Technologies have built empires by exploiting them. Yet, many fade over time as more people catch on, leading to arbitrage. In this article, we’ll explore four key anomalies: momentum, value, size, and January effects. We’ll dive into their origins, real-world examples, and how traders can use them. Plus, we’ll touch on risks and strategies to stay ahead. By the end, you’ll see how these patterns can boost your trading game, but always with caution.

Traders often blend these with technical analysis. For instance, questions like “what are long wicks” in candlestick charts arise when spotting potential reversals in anomalous trends. Long wicks signal indecision, which can amplify or undermine these effects.

Key Market Anomalies and Their Exploitation

Momentum Effect

The momentum effect is a powerhouse anomaly. It suggests that assets performing well over the past 3 to 12 months tend to keep rising, while laggards continue to fall. This flies in the face of EMH, which predicts random walks.

Research by Narasimhan Jegadeesh and Sheridan Titman in 1993 backed this up. They analyzed U.S. stocks from 1965 to 1989 and found buying recent winners and shorting losers yielded about 1% monthly excess returns. Why? Behavioral finance points to underreaction to news and herd mentality.

Traders exploit this through momentum strategies. Scan for stocks with strong relative strength, buy the top decile, and hold for months. In 2020, Tesla’s stock rocketed from $86 to over $400 pre-split, rewarding momentum chasers. Crypto traders apply it too, riding Bitcoin surges.

But beware reversals. During the 2008 crash, momentum strategies tanked. Use trailing stops and diversify across sectors to mitigate.

Value Effect

Value investing shines here. This anomaly shows that cheap stocks, measured by low price-to-earnings (P/E) or price-to-book (P/B) ratios, outperform glamorous growth stocks over time.

Eugene Fama and Kenneth French’s three-factor model in the 1990s quantified it. Historical data from the 1920s reveals value stocks beating the market by 3-5% annually, adjusted for risk.

Warren Buffett embodies this. His purchase of Coca-Cola in 1988, when it traded at a low multiple, turned into a multibillion-dollar win. Today, value screens on platforms like Finviz help spot bargains.

To exploit, build a portfolio of undervalued firms with solid fundamentals. Avoid value traps—companies in dying industries like coal. Combine with quality metrics like return on equity for better results.

Risks include prolonged underperformance, as seen in the 2010s tech boom when value lagged. Patience is key; rebalance annually.

Size Effect

Smaller companies pack a punch. The size effect claims small-cap stocks deliver higher returns than large-caps, compensating for extra risk.

Rolf Banz’s 1981 study on NYSE stocks from 1926 to 1975 found small firms outperforming by about 0.4% monthly. The Russell 2000 index often beats the S&P 500 in bull markets.

Post-2008 recovery highlighted this. Small-caps soared as economies rebound, with funds like iShares Russell 2000 ETF capturing gains.

Traders exploit by allocating to small-cap baskets. Look for emerging sectors like biotech. In volatile times, pair with large-caps for balance.

Downsides? Higher volatility and liquidity issues. Small stocks crash harder in downturns. Diversify and use limit orders.

January Effect

January often brings cheer to stocks. This seasonal anomaly sees prices rise, especially for small-caps, after December tax-loss selling.

Sidney Wachtel noted it in 1942, but Rozeff and Kinney’s 1976 paper solidified it with data showing 3.5% average January returns on NYSE from 1904 to 1974.

Traders buy beaten-down stocks in late December and sell in February. In the early 2000s, this worked well for micro-caps.

Why does it persist? Tax strategies and year-end bonuses fuel buying. But it’s weakening as awareness grows.

Exploit cautiously; focus on tax-sensitive markets. Monitor fiscal policy changes.

Comparative Overview of Anomalies

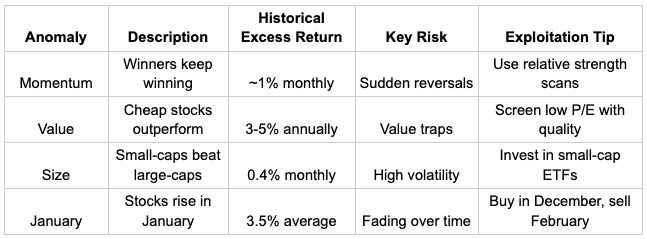

To visualize these, here’s a table summarizing key features:

This table draws from studies like Fama-French and Jegadeesh-Titman. It highlights how each anomaly offers unique edges.

Risks and Strategies for Minimization

No anomaly is foolproof. Data mining bias means some “discoveries” are statistical flukes. Markets evolve; anomalies like January have diminished since the 1990s due to arbitrage.

Broader risks include black swan events. The COVID-19 crash wiped out momentum plays overnight.

Mitigate by diversifying across anomalies. Backtest strategies on tools like QuantConnect. Quant funds use machine learning to adapt, combining momentum with value for robust portfolios.

Start small with paper trading. Always size positions to limit losses.

Conclusion

Market anomalies like momentum, value, size, and January effects reveal the market’s human side—flawed and exploitable. From Buffett’s value bets to quant funds’ algorithms, they’ve created fortunes. Yet, they’re not guarantees; risks lurk in every trade.

In today’s AI-driven world, new anomalies emerge in crypto and ESG spaces. Stay educated, use data wisely. Beginners: Test on simulators before real money. Remember, trading involves risk—consult professionals.

Ultimately, anomalies aren’t glitches; they’re invitations for sharp traders to thrive. Dive in, but trade smart.

The opinions and assessments expressed in the text are the views of the author of the article and may not represent the position of Cryptogeek. Do not forget that investing in cryptocurrencies and trading on the exchange is associated with risk. Before making decisions, be sure to do your own research on the market and the products you are interested in.

cryptogeek.info (Article Sourced Website)

#Market #Anomalies #Traders #Exploit