Silicon Valley’s AI giants are cracking under pressure. And they’re about to give away the keys to the kingdom.

Within months, the most powerful AI model makers from OpenAI, Meta, and newcomer Thinking Machines will release open-source AI.

Free for anyone to download and build upon.

This isn’t charity. It’s survival.

They’ve watched China’s DeepSeek force an entire industry to open source with its breakthrough moment.

Now, another Chinese lab, Moonshot AI, shows that DeepSeek wasn’t a fluke.

Its latest AI beats OpenAI’s model at coding while costing a fraction of the price (85% cheaper on average).

If DeepSeek is the West’s Sputnik moment, then Moonshot is Pearl Harbour. The undeniable event that forces immediate total mobilisation.

I’m convinced that the West needs its own DeepSeek moment. Fast.

The Open Source Wave

OpenAI just delayed its open-source model again.

Sam Altman says they need more safety testing. The real reason? They’re terrified.

When Moonshot released Kimi K2 last Friday, it changed everything. The model beats GPT-4.1 at coding tasks, yet it charges a fraction of its Western counterparts.

|

Source: Artificialanalysis.ai |

That’s not a pricing error. It’s the future.

Mira Murati sees this clearly. The former OpenAI CTO just raised US$2 billion for her new Thinking Machines Lab.

Her promise? A frontier model with ‘significant open source components’ within months.

She’s not alone. In March, Google released its latest open-source attempt with Gemma 3. But as they’ll even admit — China’s are better.

The math is simple. Why pay thousands monthly for online AI access for your business when you can run the same intelligence locally, or for cents rather than dollars?

Hardware costs are plummeting. Nvidia’s H200 chips make running large models 70% cheaper than last year.

By Christmas, any startup can run GPT-4 level AI on a $10,000 server.

Soon, machine intelligence will be as interchangeable as electricity — you won’t care which place generates it.

The Great AI Commodification

But what happens when intelligence becomes as cheap as electricity?

We’re about to find out.

Right now, AI companies trade compute for dollars. OpenAI charges US$20 monthly for ChatGPT. Anthropic wants US$25 for Claude. Microsoft bundles AI into Office subscriptions.

This business model has months, not years, left to live.

When every developer can download high-level intelligence for fractions of a cent, the pricing floor drops to zero. Just like email. Just like web browsers. Just like video calls.

The commodification pattern is predictable. First, prices collapse. Then, margins evaporate. Finally, value migrates up the stack.

Think about cloud computing. Amazon didn’t make billions selling raw servers with Amazon Web Services (AWS). They made it packaging compute with databases, analytics, and developer tools.

AI will follow the same path. Raw intelligence becomes near-free. But intelligence applied to specific problems? That’s worth trillions.

Meta understands this. That’s why they’re paying US$100 million salaries to poach talent. Not to build better models. To build better products.

As I wrote about a few weeks back, OpenAI is busy securing new revenue streams and tax breaks to reduce its reliance on Microsoft.

China gets it. Kimi K2 isn’t just cheap. It’s designed specifically for coding tasks. They’re not competing on raw intelligence. They’re competing on utility.

Where Smart Money Goes

The AI model makers are desperately trying to find value beyond their AI.

Companies charging for raw AI access will watch helplessly as customers switch to cheap alternatives. Just like newspapers watched readers abandon print for free online content.

Except faster.

OpenAI’s US$157 billion valuation assumes they maintain pricing power. But how do you charge for something that’s nearly free everywhere?

There’s a historic pattern here — those who build infrastructure for tech advancements. And those that work at the ‘use case’ or application layer.

The real opportunity for investors has always been further up the chain. Yes, yes, ‘picks and shovels’ investments have made people millions.

But empires have been made by the users, not the creators. You know the name Rockefeller because he used railroads — not because he built them

Just like with the internet boom of the early 2000s. Netscape gave away web browsers. Jeff Bezos and Amazon used them to build a US$2 trillion empire.

So, this is what I mean when I talk about today’s AI revolution.

It’s not the company that comes out with it first — it’s the company that can monetise the infrastructure.

Today’s equivalent? Companies using commodified AI to create new disruptors.

Take Perplexity (private, but rumoured to go public next year). They don’t build foundation models. They use open-source AI to reimagine search.

Revenue hit US$100 million this year, up from US$20 million in 2024. Users pay for an experience Google can’t match. Not because Perplexity has better AI. Because they applied it better.

With a new round of funding yesterday, they are now worth US$18 billion. Double their early 2025 value.

Or look at Harvey.ai, the legal AI startup. They fine-tune open models on proprietary legal data. Their edge isn’t the technology. It’s understanding how lawyers actually work.

They just raised at a US$5 billion valuation. Annual recurring revenue (ARR) grew 4x last year. Every major law firm wants in.

The pattern is clear. As AI commodifies, three things create value: domain expertise, proprietary data, and customer relationships.

The AI itself? Just another utility, like electricity, water or bandwidth.

Investors are already moving. Enterprise software companies using AI have been the primary targets during this most recent bull run.

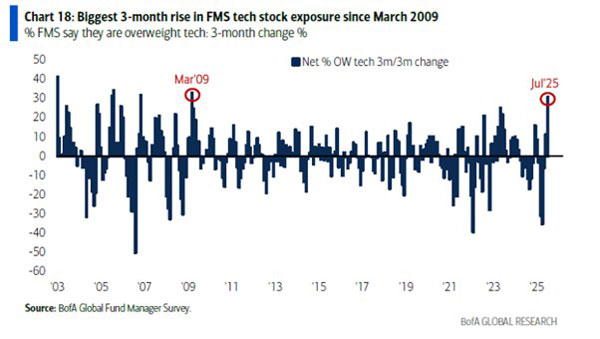

Fund managers in the latest survey (FMS) are placing their bets on tech and AI.

|

Source: BofA Global Research |

The market knows what’s coming. A flood of cheap, open, and powerful AI that makes today’s closed models uneconomical.

Companies charging for raw AI access will suffer the same fate as long-distance phone companies. Remember when calls cost dollars per minute? Now they’re free. The value moved to smartphones and apps.

But companies using cheap AI to solve expensive problems? They’ll mint money for decades.

Healthcare diagnostics. Financial fraud detection. Industrial optimisation. Legal research. These markets are worth trillions.

And they’re about to be disrupted by companies wielding cheap, commodified intelligence.

The West’s latest DeepSeek moment isn’t a threat. It’s the greatest investment opportunity since the internet’s disruption.

Just make sure you’re betting on the application layer.

Because when intelligence costs nothing, everything built on top of it becomes the real value.

Regards,

|

Charlie Ormond,

Editor, Alpha Tech Trader and Altucher’s Early-Stage Crypto Investor

The post Is ChatGPT Dead? appeared first on Fat Tail Daily.

daily.fattail.com.au (Article Sourced Website)

#ChatGPT #Dead