We’ve been hearing a lot more about the US Federal Reserve lately.

Normally it’s about their decision to raise, hold, or cut interest rates. And their economic outlook.

Recently, there have been calls for more scrutiny on what else the Federal Reserve is up to. Aside from a renewed request to audit the Fed, there are now potential criminal charges against the Chair, Jerome Powell, for perjury.

This is a new twist. One of the global economy’s biggest movers is accused of giving false testimony over renovating the Federal Reserve building. The construction that went well over budget. It was supposed to cost US$1.9 billion. But ended up costing $2.5 billion.

As this drama slowly unfolds, there are bigger implications to consider:

Could Jerome Powell resign over this scandal?

Who will President Trump appoint to replace him?

Will Congress expand the investigation and audit the Federal Reserve?

We could try and predict what’ll happen next. And speculate over the outcomes. But it’s just talk.

What’s more worthwhile is to think about positioning yourself to benefit from what could unfold.

That’s what I’ll talk about today.

The slippery slope of the Federal Reserve’s credibility

For many decades, the Federal Reserve enjoyed much awe and reverence.

It was possibly the most powerful institution on earth. At least in the eyes of the general public. The decisions made by the Federal Open Market Committee would drive the global economy.

Gone are the days of Paul Volcker and Alan Greenspan, who many considered deft operators giving us around two decades of relative stability. We’ve gone off the rails. And things are falling apart quickly.

As an aside, I’m not saying they were deft operators. I always disliked the notion of people getting too much power and making decisions with far-reaching consequences. Especially when these people base their decisions on questionable theories and will unlikely feel their impact.

We’ve seen how the Federal Reserve created the housing bubble in the early 2000s, culminating in the subprime crisis in 2007-09. It then engineered an even bigger bubble with the zero-interest rate period that took us where we’re at now. Each interest rate rise cycle led to an abrupt reversal of the policy because the global debt threatened to crunch the financial system.

What’s embarrassing for the Federal Reserve, and central banks worldwide for the matter, is that the economists who run it have revealed themselves as incapable and detached from reality. That’s a dangerous combination.

They can bamboozle the ordinary folks with big theories and data, but their actions span from a lack of real-life experience. Therefore, their decisions come with unintended and harmful consequences, creating a bigger mess than they claim to clean up.

We can see how the Federal Reserve inflated our financial system over the years, destroyed living standards, and saddled many under a colossal pile of debt. Their tool to try and deal with this is by meddling with the Federal Funds Rate and currency supply.

And a fat lot of good that has done for us! Just think how earning a six-figure salary nowadays doesn’t mean you can raise a family and keep your head above water!

Look at the figure below showing how much an average employee from NSW earns in blue. It looks like we’re getting rich. But in red you can see how much gold that salary can buy. When measured in real money, we’re in decline:

|

Source: GoldHub Australia [Click to open in a new window] |

I’m sure you feel it in your bottom line, one way or another…

Déjà vu… the Federal Reserve on the wrong side of history again

Our world today thrives on 24-hour news cycles, causing the markets to behave the same. It’s focusing on the next Federal Reserve meeting, which takes place this week.

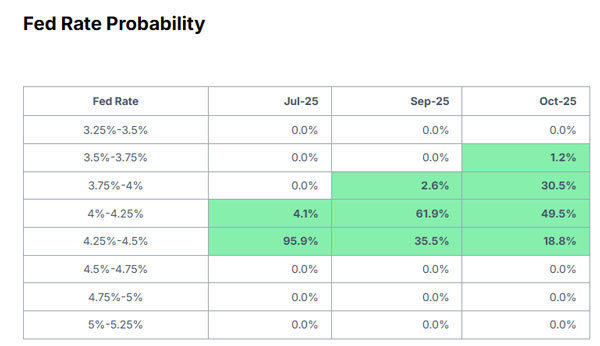

Markets are now pricing in a hold on the Federal Funds Rate:

|

Source: GoldHub Australia |

Around two months ago, there was an expectation of a rate cut:

|

Source: Polymarket |

But the Federal Reserve and many economists have dug in their heels that the tariffs from the Trump administration will lead to inflation. They also have warned of a market decline.

How did things play out since Liberation Day?

Investors were initially spooked. They held their breath and watched cautiously during May to see how things would unfold. By the end of May, the broad market indices had bounced back before making a new high in June. You can see below how it’s still climbing:

|

Source: Refinitiv Eikon |

Meanwhile, the headline economic figures coming out of the Bureau of Labour Statistics showed that last month’s core inflation started turning higher from 2.8% year on year from March to May to 2.9%. The lower price of oil has helped to keep inflation under control, as geopolitical tensions remained stable despite threats of escalating tensions in the Middle East, Ukraine, and South Asia.

That’s why President Trump is openly taunting Jerome Powell as being ‘too late’ Powell. He’s bringing to everyone’s attention that the Federal Reserve is on the wrong side of the Trump administration’s policies, and possibly, history.

Don’t forget that President Trump outwitted Jerome Powell and the Federal Reserve in 2018-19 when he forced them to cut the interest rate. What is the likelihood of this happening again?

Odds favour gold if history repeats

In my view, it’s not a matter of ‘if’ the Federal Reserve will lose this staring contest with the Trump administration. It’s a matter of ‘when’ it will receive its proverbial backside on a platter.

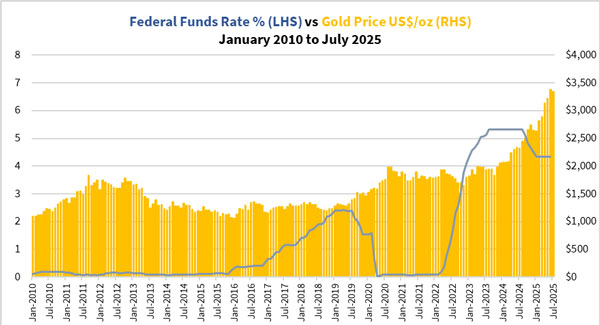

History shows that gold, among other assets, stands to benefit when the Federal Reserve cuts rates. Have a look at the figure below that shows how the Federal Funds Rate and gold performed in the last 15 years:

|

Source: Eikon Workspace |

During the last 15 years, the Federal Reserve cut rates twice, in 2019-20, and again in 2024. Look at how gold performed each time. It not only rallied but made new highs.

If you think that gold’s rise since late-2023 makes it a bubble, just remember that the Federal Funds Rate currently sits at 4.25-4.5%. There’s still plenty of room for it to fall.

And that’s great news for gold enthusiasts. Not to mention the fact that central banks in the West are starting to buy gold after shunning it for decades. They know that their economic playbook has run its course. A transition in the financial system isn’t far away.

Do you see the writing on the wall? What will you do about this?

If you want to learn more about how to prepare for this, I would like to invite you to find out about a plan that combines gold with our fast-changing technology.

Check out this video here and act now to secure your wealth in this colossal financial showdown:

|

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

The post How Jerome ‘too late’ Powell boosts gold appeared first on Fat Tail Daily.

daily.fattail.com.au (Article Sourced Website)

#Jerome #late #Powell #boosts #gold