Click here to listen to the Audio verison of this story!

In 2024, Rystad’s Vice President/North America Oil and Gas Matthew Bernstein spoke at a conference where he said the oil industry was entering “Shale 4.0,” reaching a mature and long-term industry view that had been lacking before.

Matthew Bernstein

Dan Michalik

Similar to a child pressing through live-for-the-moment growing pains then settling into a more mature view of the future, shale has settled down in its outlook. Here we will learn more about what “4.0” looks like, from Bernstein as well as from Dan Michalik, who is Director, Fitch Ratings, and a Permian expert. And the boots-on-the-ground view will come from NexTier’s Renee LeBas and Matt Niemeyer, discussing how this new philosophy plays out in the field.

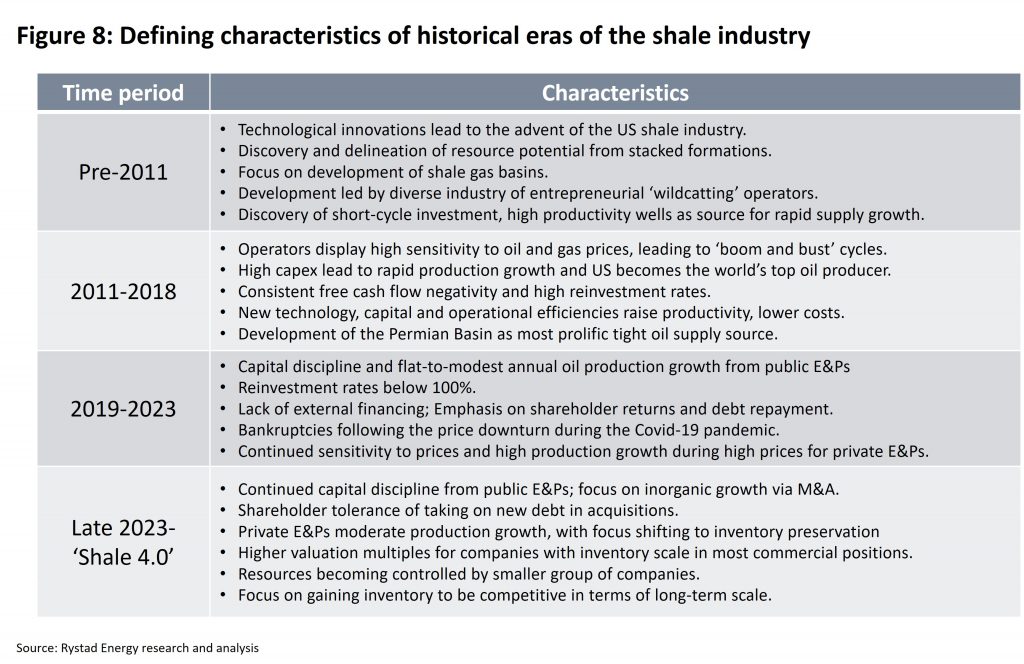

For Bernstein, Shale 1.0 was about the excitement of discovering and improving technology to reach resources that had been known but unprofitable until around 2000. Early development was led by “wildcatting operations.” For a deeper dive into each “point-0,” see the accompanying chart.

By 2011, the long decline of U.S. production and growth of OPEC imports began to reverse.

In “2.0,” “Drill, baby, drill” was the battle cry, with high capex and low cash flow on balance sheets. Equity investors injected capital in order to grow a company then sell at a profit. Technology advances reduced production costs and flooded the market with new production. But the results were repeated boom and bust cycles, making this model unsustainable.

Then came Shale 3.0, featuring newfound capital discipline, in 2019. The survivors of the boom-bust overgrowth era began to consolidate and reassess their assets and their goals. As Bernstein said, “Three-point-0 being really as those normalized well results started to deteriorate. You lose this venture capital-like paradigm in the market where equity investors and debt investors are willing to finance this growth for no returns and that gets into capital discipline 3.0.”

Starting in 2023 with 4.0, companies are showing their investors that “we’re consistently able to generate cash on hand from our operations through disciplined activity and to issue returns via dividends and buybacks.” The huge consolidations of 2023 and 2024 are part of this new return-on-investment view.

Since the start of 4.0, things have morphed further. Said Bernstein, “One of the things I’ve seen this year, as some of these deals have happened, is that it goes beyond pure consolidation and really becomes about how do you preserve this business model for the long term.” That is less about unlimited drilling and more about consolidating assets, efficiencies, and growing a company’s returns.

Those mega deals involving ExxonMobil/Diamondback, Chevron/Hess, and others showed him that investors were becoming more forgiving of rising short-term debt levels if the long-term view was sustainability in the economic sense.

OPEC+: Pump, Baby, Pump?

During high oil price times, that debt is manageable—there’s enough cash flow to both pay the debt and send dividends or share buybacks to shareholders, such as in 2023 and ’24. But as OPEC+ has boosted production (Pump, Baby, Pump?) and prices have dropped recently, Bernstein has observed, “What we’ve seen some companies have to do is take on debt not just for acquisitions but to actually be able to finance the shareholder payouts that you’re promising your investors.”

How About 5.0?

The biggest mergers may be done—maybe—but for the future Bernstein thinks there will be yet more consolidation. “You have depleting inventory, declining productivity, and increased consolidation [in view],” he said. And there are concerns about peak oil production and peak oil demand. But on the natural gas side, especially in light of Trump Administration agreements with the EU and others to buy more, the future appears brighter.

Weighing down oil’s outlook is the concern that the best prospects have been drilled. Bernstein believes there are still good ones remaining, but if a company can’t reach those through M&A, moving beyond the lower 48 states may be necessary.

Currently, he said, “Companies are not so much paying attention to the front end of the curve as they are the back end of the curve.” And “The back end of the WTI curve is still in the $60s in (20)26.” With the prices in August (this writing), hovering just above $63 for WTI, the margins are tight—but mobile. Tariffs, political changes/unrest, and other global events can bring changes, some temporary and some long-term.

Merging Traffic Ahead

Among those seeing a shift in the field is Fitch Ratings, a global provider of credit ratings, commentary, and research across a number of markets including oil and gas. Dan Michalik is director of Fitch Ratings and is the company’s primary analyst for Permian Resources, which they have rated highly in this scenario.

As Bernstein discussed ROI, Michalik added another wrinkle in the M&A scenario—economies of scale, built around credit, which also dovetails with Bernstein’s view. Said Michalik, “Particularly during this time of M&A and consolidation, adding scale in a credit-accretive manner is favorable for credit ratings and longevity, which is why we do expect consolidation to continue.”

Immediately post-pandemic, most M&A activity was equity funded, which gave the buyers “headroom under their leverage sensitivity tolerances.”

More recently, the consolidation funding has shifted somewhat more toward debt, “which has reduced that headroom.” Specifically for Permian Resources, Michalik said they have remained closer to the post-pandemic mode. “In that nearly all of their recent M&A deals have been majority equity funded. The management team has also demonstrated its commitment to conservative financial policies, which was one of the reasons for the recent upgrade to ‘BBB-’.”

Fitch expects more companies to increase their debt-based funding in the near future, which could edge them toward a lower rating temporarily, but “with the expectation of de-leveraging post-close.” In other words, divesting of some assets to reduce debt, a type of move that has been common this year already. Michalik noted that if Fitch is confident in the buyer’s ability to sell assets and reduce debt in a reasonable manner, such a purchase would not affect the company’s ratings.

Under 2.0’s high capex and production growth, many private equity (PE) firms were part of the cash flow, hoping for fast returns—a hope that was usually dashed by price volatility. Today, Michalik said, there may still be some opportunities for equity partners, “although it may not be as large or direct as it was previously. We saw more prominent exits of the space in 2020-2021 from certain equity investors and banks who shifted toward renewables and many have returned.” Returns are at least in part because of the new administration’s preference for oil over renewables in policy and funding decisions.

There could be other equity openings, however. “Further investments in certain sub-sectors, including midstream, infrastructure, and services could provide more opportunities.”

Regarding those administration changes, especially in streamlining access to federal lands, Michalik sees little effect in the Permian. “There’s relatively low exposure to federal leaseholds in the Permian and it seems like those who had exposure took steps to alleviate it during the Biden administration.”

Pressure to Perform in the Field

Matt Niemeyer

In the field, Shale 4.0 pushes efficiencies across the board. Multiple fracs, tight coordination of logistics, longer laterals from each hole, and other avenues are the rule.

In the field, Shale 4.0 pushes efficiencies across the board. Multiple fracs, tight coordination of logistics, longer laterals from each hole, and other avenues are the rule.

For NexTier’s Renee LeBas, PE, VP of Frac, and Matt Niemeyer, VP of Engineering and Sustaining, their company’s Emerald Fleet Technology for completions is checking a lot of boxes, especially as Permian companies struggle with power grid issues.

Fleet Technology for completions is checking a lot of boxes, especially as Permian companies struggle with power grid issues.

Emerald can use basically any type of conditioned field gas or compressed natural gas (CNG) for various options, including either direct drive gas power or gas-powered electricity generation for electric fracs.

Niemeyer explained, “We help operators thrive by delivering leaner, more capital efficient completions with our Emerald fleet, which enables 100 percent diesel displacement by utilizing stranded field gas and CNG, cutting both their fuel costs and their emissions.” Direct-drive, with the Caterpillar Gas Mechanical System (GMS), also increases efficiency over gas-powered electric generation because it reduces the energy loss inherent in any conversion of one form of energy (gas) to another (mechanical vs. electrical to mechanical).

LeBas explained that Emerald allows field gas use options never before available. “We can utilize field gas in ways that you previously haven’t been able to do in terms of conditioning on the fly and integration of CNG.”

With simul and trimul fracs on the rise, Niemeyer added that their completions systems offer higher horsepower, up to 5000 hp per trailer. This minimizes the equipment required onsite as horsepower demands grow. “NextTier’s not just a service provider in this space,” he said. “We’re more of a strategic partner.”

Previous frac systems required 20-30,000 hp per spread, now they’re doubled to 40-60,000, making the need for higher power density in each trailer very clear.

All shale versions, from 1.0 to 4.0, have been about continuous technological evolution, said LeBas. With 4.0 involving not only higher horsepower jobs, but more sand, more water, and longer laterals for each well, “Being able to execute that efficiently is really key to optimizing the entire operation. That’s where the horsepower density comes in. It’s also where the integration that NexTier delivers can really drive efficiencies.” As hydraulic horsepower requirements rise dramatically, advanced power systems like GMS play an increasingly vital role in meeting those demands.

The company’s PTEN integration systems enable communication across the entire pad, between power, wireline, frac, and all the equipment, giving the company a clear view of logistical needs. That maximizes uptime by reducing waits for equipment arrival and servicing or supplies like sand or water. Said LeBas, “We’re keeping up with the evolution very well, and what the customers are demanding with the job designs and the more difficult work” that goes beyond the ‘drill, baby, drill’ of previous iterations.

NexTier utilizes the Caterpillar Gas Mechanical System, a direct drive approach, in its Emerald Fleet to provide 100 percent gas-powered operations.

Right-Sizing Power

One benefit of onsite power such as Emerald is its flexibility. Niemeyer pointed out that the frac process requires much more power than either drilling or production. So rather than contract with a utility for a level of power only needed for a short time, the producer can pay just for long-term grid infrastructure and make up the difference in frac needs with the as-needed gas-powered system.

Paul Wiseman

PAUL WISEMAN is a long-time writer in the energy industry.

The post Four-Point-O is the term to know appeared first on Permian Basin Oil and Gas Magazine.

pboilandgasmagazine.com (Article Sourced Website)

#FourPointO #term