If I had done NOTHING in the last 30 years of investing except buy the stocks out of the Lundin Group of Companies, I would be a very very wealthy man.

And I would have done it with so much less stress! This storied mining family, from Sweden, have built many mines and sold a few of their projects to majors. They’re also big into oil and gas and to a degree, renewables.

Their flagship public companies are Lundin Gold (LUG-TSX; which has gone from $9.50 – $116 in the last three years) and Lundin Mining (LUN-TSX), which has moved up from $6.50 – $22 in the last three years).

Faraday is a junior copper stock in their family portfolio–and it has a huge copper resource, in the United States (Arizona) just as a couple of the largest copper mines in the world are having problems. And did you notice the US gov’t start buying equity in these junior base metal / industrial mineral companies–like Perpetua (antimony) and Lithium Americas (lithium)–which are or were all listed in Canada at one point. So this stock has a lot of trends going its way right now.

Of the 206 million shares out on Faraday (PRE FINANCING), I think they own 24 million, or just over 10%. The other big shareholders here are Canada’s oil and gas king, Murray Edwards, (Calgary) and Pierre Lassonde, (Toronto) who is a gold king. Lots of Canadian resource royalty here! Between these three groups, they own just a hair under 40% of the company right now. (The Lundins bought a pro-rata share of the last financing)

Not every deal of theirs is a big winner (I sat on Bluestone for a long time before eventually selling…), but many are.

They just took over Fireweed (FWZ-TSXv) in the last year—a big zinc play in the Yukon–and the stock has doubled. They had Filo Mining (FIL-TSX) which went from $2 in early 2021 to $32/share buyout, and NGEX Minerals (NGEX-TSX) which has gone from 23 cents to $15 in 6 years–have done very well.

I alerted subscribers at 99 cents in July, as they received a long awaited permit to do more exploration on their wholly owned Copper Creek project. The stock has now doubled, trading over $2/share on millions of shares a day. This article is what I sent out to subscribers that day.

The Lundin’s have a reputation for taking on hard-to-solve problems in mining (think big asset in tough jurisdiction).

Faraday’s Copper Creek project in Pinal County, Arizona has a unique combination of high-grade breccia and large-scale porphyry deposits—giving Faraday the potential for a huge, low-cost, and long-life copper operation.

There’s lots of upcoming catalysts, with key updates slated for H2 25.

Faraday has an established copper resource—4.25 billion pounds—in Arizona, so no jurisdictional risk here. But a new permit—an Exploration Plan of Operations (EPO) from the US Bureau of Land Management (BLM) on June 30 has allowed the stock to hit new 52 week highs, breaking through 80 cents. This EPO allows 67 new drill pads!

Permitting is a big part of every junior mining story, and the new Republican gov’t gives this project a big tailwind

US President Trump has made it a priority to speed up the production of important metals like copper in the United States. This is happening through special orders that are meant to make it easier and faster for mining projects to get the necessary permits.

Faster Permit Approvals: The government is pushing agencies to quickly approve mining projects and issue permits. This means projects that have already submitted plans for approval are being looked at very fast.More Federal Land for Mining: The President’s orders also aim to allow more federal land to be used for mining activities. This is good news for Copper Creek, as parts of the project are on federal land.

Less Difficult Permits: For Faraday Copper, this new focus has meant that approvals for new drill pads are being processed quickly. The company even hopes to avoid a very hard-to-get permit (called a Section 404 permit) if the Army Corps of Engineers confirms that certain water areas are not on their property. This would make the permitting process much simpler.

Government Support for Domestic Supply: The government’s actions show a clear desire to make sure the US has its own supply of important metals. This is a good sign for Faraday Copper’s future permit applications.

That’s it for politics! Back to GEOLOGY!!

Copper Creek Project Overview

The Copper Creek Project is a 3-kilometer-long porphyry copper deposit in Pinal County, Arizona, roughly 70 kilometers northeast of Tucson AZ.

It is located at the intersection of major northwest-trending and east-northeast-trending copper belts, which include well-known mining districts like Miami-Globe, Ray, and the former BHP Kalamazoo Mine. Faraday controls 100% of the 73 km2 property.

Arizona is a top mining jurisdiction, and Copper Creek has access to mining infrastructure, including nearby high-voltage power supply, dual site access roads, and potential rail access with loadout facilities.

The main Copper Creek deposit is open in all directions, and the 73 km2 property hosts multiple breccia and porphyry copper deposits. Over 560 drill holes and more than 200,000 meters of drilling completed so far.

There are more than 300 known breccias, with fewer than 40 drill-tested and only 17 included in the current Mineral Resource Estimate. SO LOTS OF UPSIDE HERE!!!!

Project History

Exploration and mining dating back to the 1860s with the discovery of the Bluebird mine. Massive outcropping breccias, many containing visible green copper oxide minerals, are the main reason that about 360,000 tonnes of high-grade ore have been extracted over the site’s mining history.

More recent historical milestones include:

1966-1970: Newmont Exploration Limited (NEL) and Magma Copper Company drilled 30 deep core holes, demonstrating a significant copper-mineralized zone at depth beneath the American Eagle Area.

1971: Humble Oil (now Exxon Corporation) joined Newmont and Magma, and their drill hole HN-12 discovered the third (north) finger of the Childs Aldwinkle pipe.

1972-1981: Ranchers Exploration and Mining Company recovered over 5,478 tonnes of cement copper from an in-situ leaching operation at the Old Reliable mine.

1995-2001: Arizona Mineral Technology (AMT) acquired the property and conducted extensive drilling programs, including 37 angled diamond core holes at Childs Aldwinkle and 24 angled and seven vertical drill holes defining the Mammoth pipe.

2005-2018: Redhawk Copper acquired AMT’s property, consolidated data, and conducted further drilling, leading to updated resource estimates in 2006, 2007, and 2008. Redhawk also entered into a joint venture with Anglo American from 2014 to 2016.

2018: CopperBank acquired Redhawk Copper Inc., making Copper Creek its flagship project.

2022: CopperBank was renamed Faraday Copper Corp. and initiated a Phase I drill program.

2023: Faraday Copper delivered a Preliminary Economic Assessment (PEA) and an updated Mineral Resource Estimate (MRE). They also completed a Phase II drill program and commenced a Phase III program.

Geology and Mineralization

Copper Creek is in copper elephant country–Arizona. It has several styles of copper, molybdenum, silver, and gold deposits, and many have high primary copper grades (greater than 1% Cu). The mineralization occurs in three fundamental styles:

1. High-grade Breccia-hosted Mineralization:

o Predominant in breccias near the present-day surface.

o Characterized by chalcopyrite and pyrite cementing breccias.

o Examples include Mammoth-Keel, Childs Aldwinkle, Copper Prince, Copper Giant, Glory Hole, Holly, and Old Reliable breccias.

o Over 400 breccia occurrences have been mapped, but only 17 are included in the current MRE (Mineral Resource Estimate)—so there’s LOTS of exploration upside.

o Recent drilling in the American Eagle area, which is important for finding more open-pit copper, shows that there is a continuous layer of oxidized copper near the surface. This could lead to more copper being taken out early in the mine’s life and make digging out the deeper sulfide copper cheaper.

2. Magmatic Cupola-style Cu-Mo Mineralization (e.g., Keel Zone):

o Located deeper in the system.

o Lots of intense quartz stockwork veining and potassic alteration.

o Lots of cavities filled with K-feldspar, anhydrite, bornite, chalcopyrite, and molybdenite.

3. Early Halo (EH)-style Porphyry Cu-Mo Mineralization (e.g., American Eagle Zone):

o These types of deposits form very deep underground (more than 5 kilometers down)

o They have thin veins surrounded by areas altered with biotite and K-feldspar, with copper minerals spread throughout.

o The main copper minerals are chalcopyrite, bornite, and molybdenite. There isn’t much gold in these deeper parts, which is typical for deposits formed so deep

o The sulfide minerals show a pattern where pyrite is more common near the surface, and then deeper down, there’s more chalcopyrite and bornite.

Only a small amount of the near-surface copper has turned into oxidized minerals. The top 20 meters or so are fully oxidized, and then there’s a mix of oxidized and sulfide minerals down to about 30-40 meters. Because there’s not much oxidation and the rock structures are well-preserved, Copper Creek is different from other copper deposits in the area

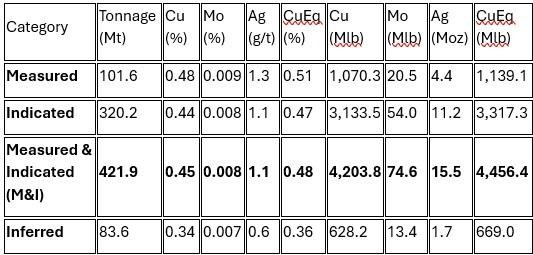

The MRE shows 421.9 Mt of Measured and Indicated resources at an average grade of 0.45% copper, containing 4.2 billion pounds of copper. The resource remains open at depth and laterally.

Preliminary Economic Assessment (PEA)

The May 2023 PEA for Copper Creek is mostly inferred resources, not mineral reserves—but does show positive economics for the project.

Key Economic Highlights (Post-Tax, 7% Discount Rate):

Net Present Value (NPV): $713 million

Internal Rate of Return (IRR): 15.6%

Payback Period: 4.1 years

Mine Life: 31.7 years

Average Annual Copper Production: 106 Mlb (Years 1-29)

Average Life-of-Mine (LOM) Cash Costs: $1.67/lb Cu

Average LOM All-in Sustaining Costs (AISC): $1.85/lb Cu

Initial Capital Costs: $798 million

Total LOM Capital Costs: $2.657 billion

The project is designed as a combined open pit and underground operation. Surface mining will provide mill feed until Year 11, followed by a four-year ramp-down–coinciding with the underground production ramp-up.

Steady-state underground production will be achieved by Year 12 and continue until Year 29. The last three years of mill feed will come entirely from low-grade stockpiles.

Oxide material, recovered near-surface in the early years, will be processed separately in a heap leach facility (HLF) with a nameplate capacity of 6,850 t/d. This oxide material, grading 0.29% Cu, is expected to drive higher copper cathode production early in the mine life.

Sulfide and transitional materials will be processed in a concentrator at a nominal rate of 30,000 t/d (11.0 Mt/a).

In a big project like this, economics are most sensitive to changes in commodity prices, head grades, and recovery rates, and less sensitive to operating and capital costs.

Recent highlights include:

Metallurgical Test Results (February 2025): Tests on rock samples from the American Eagle area showed that the copper from these new areas can be processed in a similar way to the copper from the known deposits. This means the plan for how to process the copper is likely to work well.

The tests also showed that a method called Coarse Particle Flotation (CPF) could work, which might help the mine process more material and cost less to build and run. Finding gold that can be sold in these expanded areas should also help the project make more money.

Site Visit Information (March 2025): A visit to the Copper Creek project confirmed the good progress being made. The process to get permits is moving faster because of the current US government’s focus on getting critical metals from within the country. A positive sign is that the Army Corps of Engineers may soon say that there are no “Waters of the US” on the property, which would mean the company would not need a very difficult permit.

Copper from Oxidized Rocks (May 2025): New drill results from the Phase III program confirmed that there is a continuous layer of oxidized copper near the surface. This is good because it means more copper can be produced early in the mine’s life, and it can also make it more economical to remove the material that covers the deeper sulfide deposits

*Phase IV Approval (July 2025): The Bureau of Land Management has approved the company’s plan for exploration, including 67 new drill pads

Upcoming Key Milestones:

Updated Mineral Resource Estimate (late Q3 2025): This MRE will incorporate an incremental 40,000 m of drilling from Phases II and III.

Updated Preliminary Economic Assessment (Q3 2025): This will be released concurrently with the MRE update and will incorporate new resource data, updated metallurgy, and other test work.

Commencement of Phase IV Drill Campaign (Q3 2025): Details of this campaign are yet to be announced.

CONCLUSION–this is the type of project that the Lundins should be able to do. I’m thinking this EPO is an inflection point for the stock. So I got long!

I have not yet spoken to management.

HERE IS THE Feb 2023 Mineral Resource Estimate (combined Open Pit and Underground; 43-101 compliant)

Note: CuEq is calculated using commodity prices of $3.80/lb Cu, $13.00/lb Mo, and $20.00/troy oz Ag (Copper is now $5/lb, AG is $36/oz and Moly (Mo) is $5/lb), with variable metallurgical recoveries applied based on material type (sulfide, transitional, oxide).

The MRE shows 421.9 Mt of Measured and Indicated resources at an average grade of 0.45% copper, containing 4.2 billion pounds of copper. The resource remains open at depth and laterally.

EDITORS NOTE--my radar for high potential junior stocks never stops. But I’ve located a micro-cap AI data center company just finishing its third acquisition…all with cash flow. I think it has a great shot at growing into my next big win–click HERE to subscribe and get my report

oilandgas-investments.com (Article Sourced Website)

#FARADAY #COPPER #COPPER #PLAY #BIG #CATALYSTS #FALL