The exponential moving average (EMA) is a popular chart indicator considered to be better than the simple moving average. But according to our testing, it performs much worse. I advise against using the EMA as a trading tool as it is inaccurate and can lead to misguided decisions.

Can traders rely on EMA as an indicator? I tested 30 Dow Jones stocks and 4 EMA settings over 8 years, equalling 960 years of data, to analyze success rates in pursuit of an answer.

What is an Exponential Moving Average?

An exponential moving average (EMA) is a trend-following indicator that tracks the average price of an asset over a given period. The EMA is calculated by taking a certain percentage of the closing price and adding it to the previous EMA calculation. This method gives more weight to recent data points than older ones, making it more reactive to price changes than a simple moving average.

The EMA is used to smooth out short-term price fluctuations and filter out noise from the underlying trend.

Although traders have used the exponential moving average to identify market trends, this strategy falls short. It’s not recommended as a tool for determining when to buy and sell assets based on their historical performance.

Instead, it’s best used as a support or resistance indicator, offering insight into potential price movements. Remember, successful trading strategies incorporate multiple indicators for decision-making.

KEY TAKEAWAYS

- The EMA adds an exponential weight to the most recent price closes.

- EMAs work well on strongly trending markets and equities.

- EMAs tend to underperform in range-bound markets.

- Traders should use longer EMAs to identify the overall trend and shorter EMAs for more short-term price movements.

Understanding Exponential Moving Averages?

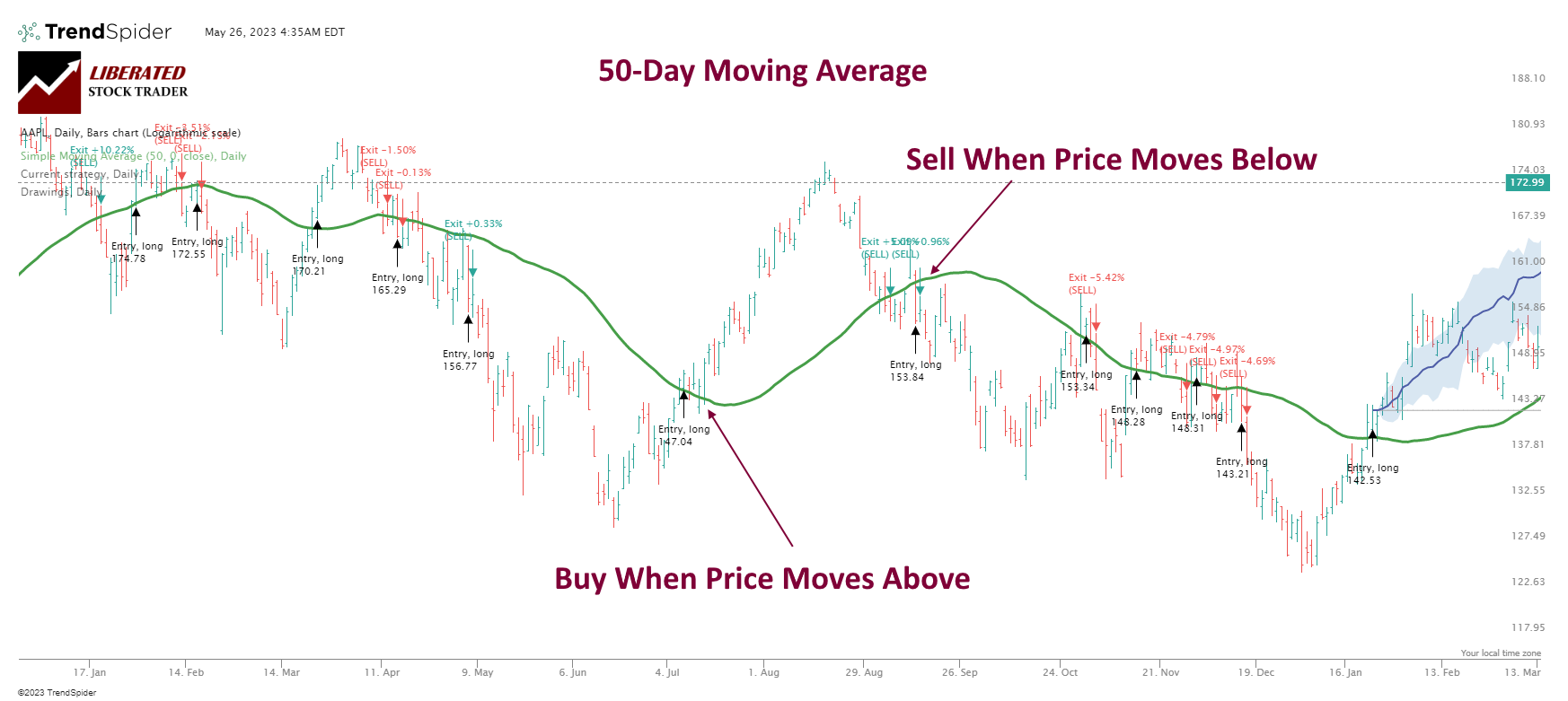

The exponential moving average (EMA) is a commonly used technical financial analysis tool that gauges a stock’s average price over a certain period. It provides insight into the direction of long-term asset price trends. If the price is above the EMA, it indicates a rising price trend, potentially a suitable time to buy. However, prices below the EMA may represent a good time to sell.

The moving average period is crucial in determining the reliability of stock price trends. Consider a 200-day moving average to determine general uptrends – if the price consistently sits above, you can expect a bullish signal. For those looking to sell, use a 50 or 20-day moving average and watch for when prices slip below the line.

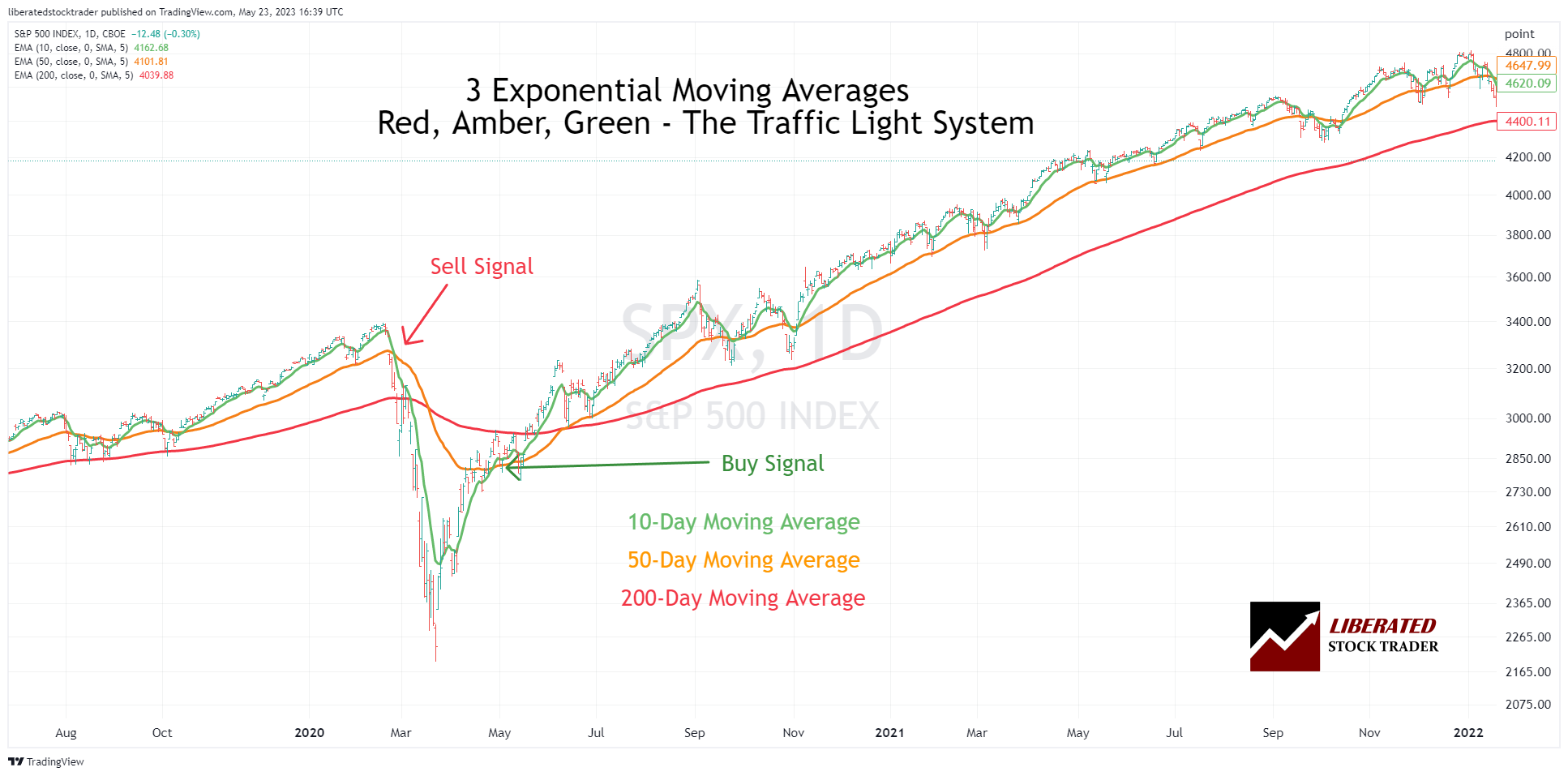

Example Chart: 3 Exponential Moving Averages

This chart shows the exponential moving average traffic light system. Three moving averages are plotted on the chart, the 10-period EMA in green, the 50-period EMA in amber, and the 100-period EMA in red.

Get Moving Average Indicators on TradingView

Exponential Moving Average Pros

One of the main advantages of using an exponential moving average is that it’s easy to calculate. Most charting software packages already have the calculations built-in, so there’s no need for complicated formulas or manual calculations. The EMA also provides a clear visual representation of price trends, which can be easier to interpret than other types of technical analysis.

Exponential Moving Average Cons

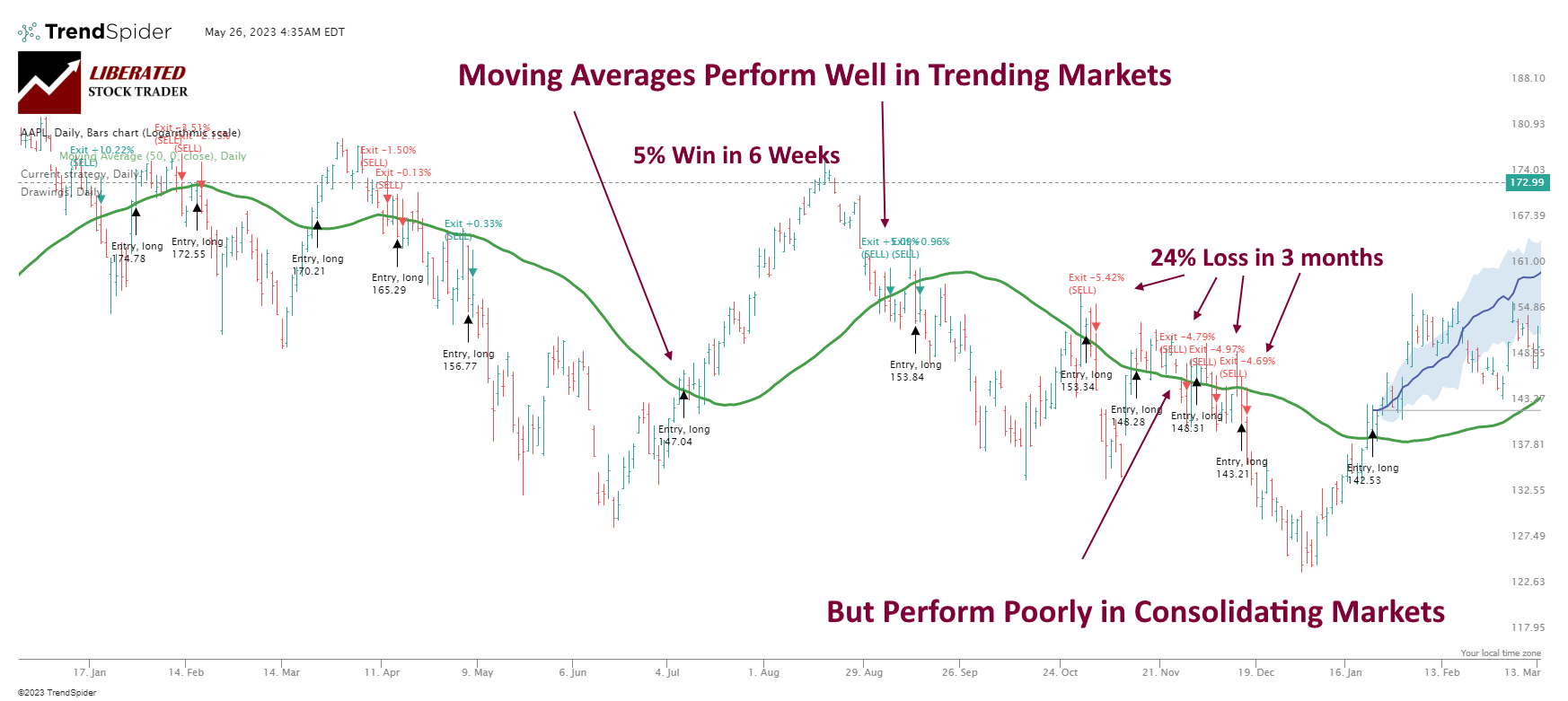

One major drawback of using moving averages is that they tend to underperform during market or stock price consolidation periods, which can translate to negative returns.

However, one of the drawbacks of using the EMA is that it doesn’t consider short-term volatility. Prices can gyrate wildly in the short term, but a long-term average like the 200-day EMA might not capture these swings. Investors relying solely on an EMA may miss important short-term buying and selling opportunities. Additionally, the EMA is a lagging indicator, meaning it can only confirm trends after they’ve already started. This means investors must use other indicators in conjunction with an EMA if they hope to stay ahead of the markets.

How to calculate an exponential moving average?

The formula for calculating an exponential moving average is:

EMA = (Closing price – EMA(previous day)) x multiplier + EMA(previous day)

Example: If we wanted to calculate the 5-day EMA, we would take the closing price on the latest trading day, subtract the 5-day EMA from the previous day, and then add the result to the 5-day EMA of the previous day. We would then multiply this sum by a multiplier based on the number of periods in our moving average (in this case, five). The resulting figure represents our current 5-day EMA.

The multiplier is calculated using the following formula:

2 / (number of periods + 1)

For example, in the case of a 5-day exponential moving average, the multiplier would be 2/6 = 0.33. Each day’s price will contribute one-third (0.33) of the overall EMA value.

Using this example, if Apple’s closing price on the current trading day is $200, and its 5-day EMA from yesterday was $150, we would calculate our 5-day EMA for today as follows:

($200 – $150) x 0.33 + $150 = $170

Therefore, the 5-day EMA for today is $170. We can use this figure to compare with Apple’s current trading price and determine if the stock is overbought or oversold. If the 5-day EMA exceeds the current trading price, the stock is oversold and may be a good time to buy. Alternatively, if the 5-day EMA is lower than the current trading price, the stock is overbought and may be a good time to sell.

How to trade using exponential moving averages

Traders often use EMAs as entry and exit points. When prices move above the EMA, it indicates an uptrend; when prices move below the EMA, it suggests a downtrend. Crossovers are also used as signals for entry or exit points. A buy signal is generated when the shorter-term EMA crosses above the longer-term EMA, and a sell signal is generated when the shorter-term EMA crosses below the longer-term EMA.

Example Chart: Trading Using an Exponential Moving Average

Is the EMA Indicator Accurate?

No, the exponential moving average indicator is inaccurate, averaging only a 12% win rate. The EMA causes many small losses when asset prices consolidate and miss good entry points. Backtesting the EMA indicator on 30 Dow Jones Industrial Average stocks over 8 years resulted in an average 12% win rate, meaning it underperformed a buy-and-hold strategy 88% of the time.

EMA Indicator Backtesting Methodology

To backtest the EMA indicator, I used TrendSpider, the leading AI stock trading software with pattern recognition and a codeless backtesting engine. Testing was configured using OHLC with an exit on the next open. The Heikin Ashi daily chart used the exit criteria next trading day HL2 (Price High + Low /2).

| Testing Criteria | Daily OHLC Chart | Daily Heikin Ashi Chart |

| Index: | DJIA | DJIA |

| Date Range | 8 Years/2000 Candles | 8 Years/2000 Candles |

| Settings: | 20, 50, 100, 200 | 20, 50, 100, 200 |

| Entry Criteria: | Price > EMA 20 | Price > EMA 20 |

| Exit Criteria: | Price > EMA 20 | Price > EMA 20 |

| Sell: | Next Open | High+Low/2 |

I test all indicators, including the EMA, on their standard recommended settings, on different timeframes, and using different chart types; this provides an unbiased result. Also, the entry and exit prices use an average of the high and low prices for the day, making the testing more realistic.

How to Set Up EMA Backtesting in TrendSpider

To set up backtesting in TrendSpider, follow these exponential steps. Register for TrendSpider, select Strategy Tester > Entry Condition > Add Script > Add Parameter > Condition > Price > Greater Than > EMA. For the Sell Criteria, select > Add Script > Add Parameter > Condition > Price > Less Than > EMA. Finally, click “RUN.”

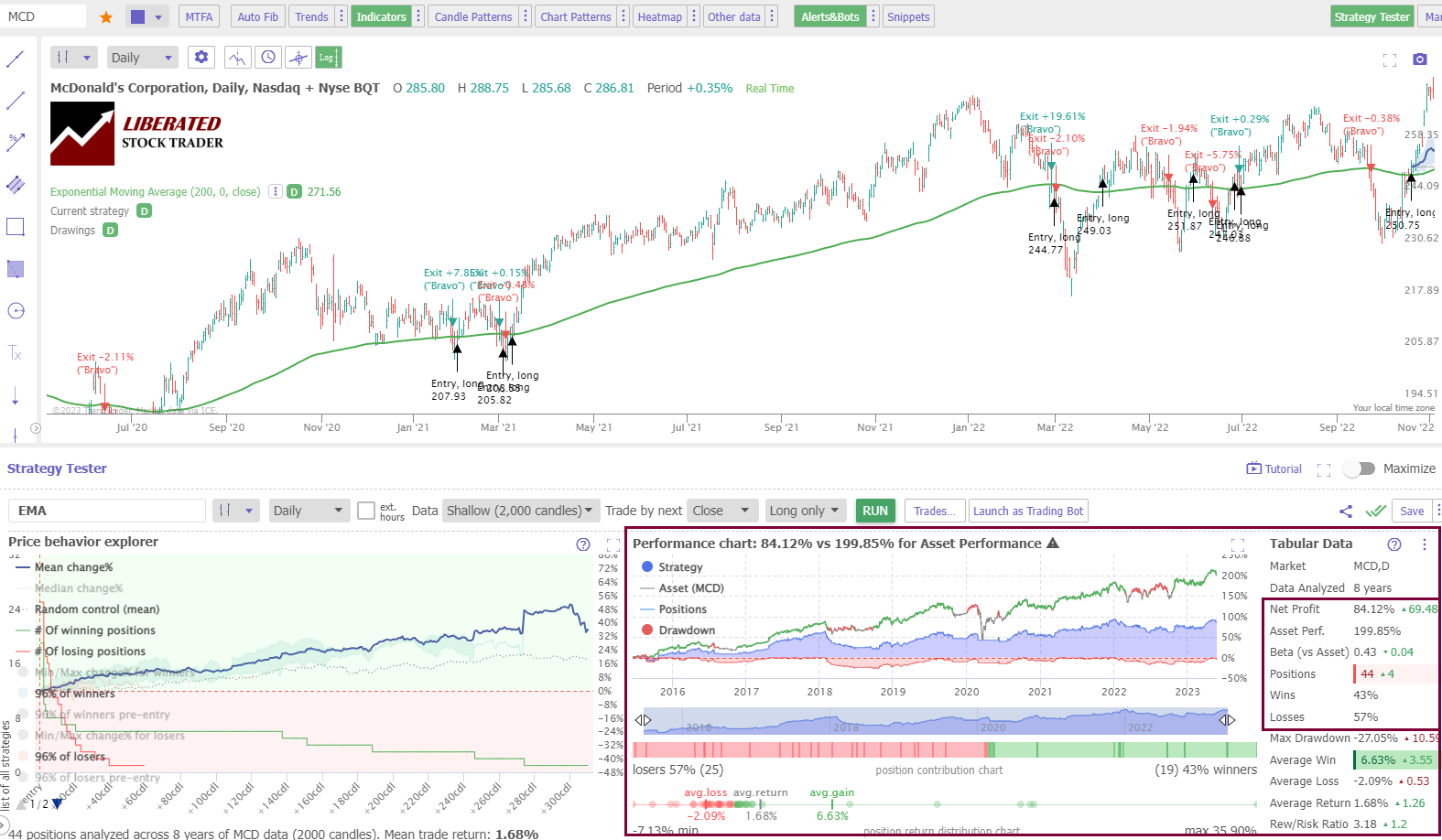

To set up backtesting, I used TrendSpider, our recommended trading software for serious traders. The screenshot below shows the exact configuration for our EMA backtesting.

Testing EMA on OHLC Charts

This is a typical example of a 200-day EMA on an OHLC chart. Over 8 years, a trader using the 50-day exponential moving average on Mcdonald’s Corp. (Ticker: MCD) would make 84%, but a buy-and-hold investor would have made 199%. The average results for the exponential moving average mean it is a poor choice for trading on candlestick charts.

Testing Performed With TrendSpider – The Best Software for Traders

Testing the standard EMA settings on a daily candlestick/OHLC chart proves this indicator is poor, with a 12% chance of outperforming a buy-and-hold strategy on all tested timeframes.

EMA Backtesting Results for Daily OHLC Charts

Testing 960 years of data shows the average win rate for exponential moving averages is 7%. The table below shows that the EMA 20 has a 23% chance of beating a buy-and-hold strategy, and the 200-day EMA only has a 0% chance of success.

| 8-Year Backtest OHLC Chart | % Win Rate | # Trades |

| Timeframe: | Daily | Daily |

| 20-Day EMA | 23% | 160 |

| 50-Day EMA | 3% | 73 |

| 100-Day EMA | 3% | 52 |

| 200-Day EMA | 0% | 23 |

| Average | 12% |

I tried many backtesting solutions, but this testing was only possible using TrendSpider.

Powerful Point & Click Backtesting With TrendSpider

Testing EMA on Heikin Ashi Charts

The exponential moving average performs better on a Heikin Ashi chart, but the results are still poor overall. If a trader used the 200-day moving average on Apple Inc. (Ticker. AAPL) over 8 years, they would have made a 592% profit beating a buy-and-hold strategy profit of 442%.

The table below shows that even using the advantages of Heikin Ashi charting, the exponential moving average indicator should be avoided.

EMA Backtesting Results for Heikin Ashi Charts

Testing 960 years of data shows the average win rate for exponential moving averages on a Heikin Ashi chart is 39%. This means 61% of stocks traded using this strategy will fail to beat a buy-and-hold strategy.

| 8-Year Backtest Heikin Ashi Chart | % Win Rate | # Trades |

| Timeframe: | Daily | Daily |

| 20-Day EMA | 83% | 111 |

| 50-Day EMA | 37% | 61 |

| 100-Day EMA | 27% | 51 |

| 200-Day EMA | 10% | 32 |

| Average | 39% |

Powerful Point & Click Backtesting With TrendSpider

Why are Heikin Ashi’s EMA results better?

Why do Heikin Ashi charts perform slightly better with EMA and other indicators like Keltner Channels and Price Rate of Change? I believe it is due to the price averaging removing the extreme price highs and lows associated with traditional OHLC bars. This means fewer trades in consolidating markets and fewer small losses.

Professional traders may assume, as I did, that the Heikin Ashi chart distorts the pricing because it averages the OHLC of the candles. But we can achieve realistic entry and exit criteria by using TrendSpider’s HL2 setting, meaning the average of the price candle high and low. I proof-checked individual trades, which were reasonable but not entirely realistic.

Combining EMA with Other Indicators

Incorporating the EMA with additional chart indicators, such as Price Rate of Change or bullish chart patterns, is optimal. The EMA excels in markets trending either up or down. However, it provides multiple false buy and sell signals during consolidation, leading to many minor trading losses. Therefore, avoid using this indicator in consolidating markets.

Can the EMA be used for Buy & Sell Signals?

Our research backtesting shows that the EMA is a poor indicator for identifying buy and sell signals. Over 960 years of data across 30 Dow Jones stocks, the EMA lost to a buy-and-hold strategy 93% of the time. This is a very poor indicator by a significant margin.

The Best Settings for EMA

Our research shows the best setting for the EMA indicator is a 20-day period on a Heikin Ashi chart. This is the only setting that outperforms a buy-and-hold strategy with an 83% win rate. All other settings on OHLC charts and timeframe produce losses and a failure rate of 67%.

Although EMA isn’t the most reliable indicator, the optimal solution is to choose the least bad option. If it is necessary to use this indicator, it is recommended to set it according to period 20 and utilize a daily Heikin Ashi chart.

For this indicator to be most effective, it’s best to use it when the asset moves in strong trends. Whenever the asset goes through a period of price consolidation, many small losses will likely be incurred.

Limitations of Using Exponential Moving Averages

The biggest limitation of moving averages is they produce 82% of their losses in consolidating markets. Markets only have 2 phases, trending and consolidation. Moving averages should not be used when an asset’s price is consolidating.

Summary: Trading Exponential Moving Averages

After testing for 960 years, it’s safe to say that using exponential moving averages as trading indicators for buying and selling is a losing strategy. Avoid it. You only have a 7% chance of outperforming a buy-and-hold strategy.

FAQ

TrendSpider Review 2023: We Test If Its The Best?

https://www.liberatedstocktrader.com/exponential-moving-average/”>

#Exponential #Moving #Average