Last week I told you about how we’ve secured our bid to buy our first home. That was quite a relief and something exciting for us.

Now comes the next challenge – settlement.

As I told you last week, we won’t take a mortgage to buy this home. Gold and gold stocks will fund this, with the bull market in the past 18 months really helping us. Now we need to line up our funds.

The recent pullback in gold, silver and gold stocks left me feeling a little nervous. Especially when tech stocks and bitcoin were also tumbling. Even last week, there were widespread fears that this could be it – the market is going to crash.

If that did happen, it’ll be a gut punch that’ll take me down, but hopefully not knock me out. We’ll still have enough funds to settle…but only by taking a bigger haircut than I’d like!

Fortunately, the mood of the market swung back again this week. Gold, silver and gold stocks appear to have turned the corner. This increase will allow us to secure more profits to put towards paying off the house.

How to harmonise my long-term

strategy and immediate needs

Besides dealing with what to sell, I noticed that we had sold down many of the biggest gold mining companies in our family portfolio in the last 12 months. These were the companies that held their ground best in the recent correction. They would’ve come in handy at this stage.

Looking at our portfolio’s largest holdings, we were holding a larger portion in the riskier producers, developers and a handful of explorers. These companies had growth potential for the next run up for gold and gold stocks, which I anticipate in 2026.

You might be wondering about our gold and silver holdings. We did secure some profits in gold and silver ETFs. What’s left held up well and we’ll be tipping that into the house as well.

Put aside what I’m doing with my portfolio for the property settlement, this is how I invested in the gold bull market.

Sell quality stocks in the early bull market, shift some into gold and silver ETFs for safekeeping. A bull market comes in waves, with corrections that interrupt the rally. These corrections give you an opportunity to buy back in. But it’s worth noting that the best growth potential moves down the hierarchy, from least risky to the highly speculative as the bull market matures. Therefore, I reinvest some of my wins into riskier companies for the next wave, ride them higher, and secure wins along the way!

But let’s look at the inevitable reality ahead for precious metals enthusiasts. Beyond the gold bull market, what’s next? And, what should you do to get ahead of it and continue to ride the victory train to the next set of tracks?

The hidden trap of a bull market

Every bull market sets up more losers than winners.

Bull markets lure in many who would otherwise not have invested in a particular asset. They merely jump on board because they heard about it and FOMO (fear of missing out) catches up with them.

Unlike the more familiar investors and loyalists, these Johnny come-latelys are often unaware of what they’re buying. They might have taken tips from pundits on TV, relatives and friends. Their rushing into these stocks sends the price soaring to beyond reasonable value, and help pad the wallets of astute investors who use them to head for the exit.

When more funds leave these assets, that marks the end of the bull market. Many are left holding the bag. Especially if the market got really bubbly.

They bought in as prices rose, believing that the crowd can’t be wrong. They also believed there’ll be some magical signal telling them to sell, bigger fools will join in after and they can walk out with their gains.

Yet the crowd is more often wrong. It doesn’t create the trend, merely perpetuating it. Many among that crowd won’t see the change until it’s too late.

A friendly reminder in this

raging gold bull market

Being a precious metals advocate, I believe my warning should bear some weight.

I like gold. I’m not going to sell all my gold. Fact is, there isn’t a more time-tested alternative to storing my wealth than the yellow metal.

But precious metals assets, silver, platinum, gold and silver mining stocks, aren’t the same as gold. These are assets whose value may follow gold’s cue, sometimes leading it, other times following it.

Since the bottom of the last secular bear market for gold when it traded at around US$1,045 an ounce (~AU$1,400), gold has gained over 300%:

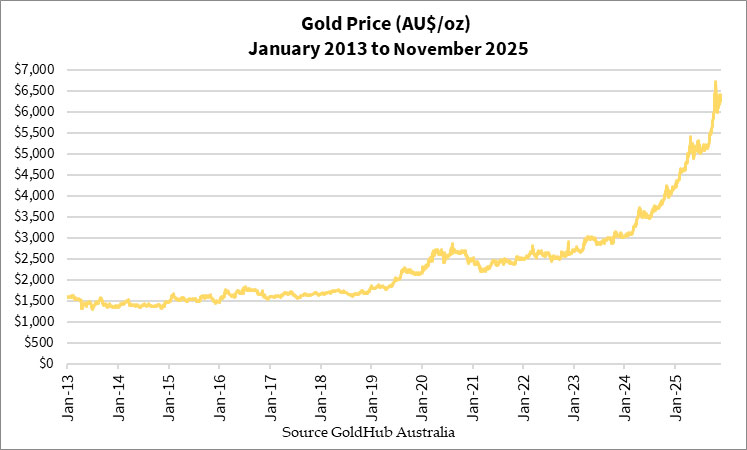

In Australian dollar terms, it’s enjoyed a slightly bigger increase from around AU$1,300 in late-2013 to AU$6,400 now. That’s almost 400% gains:

With gold stocks, the ASX Gold Index [ASX:XGD] has gained more than 300% from its September 2022 lows:

The phenomenal rally from 1st August to 17th October took the index up by over 60%. All this happened in just 10 weeks.

I recalled one evening at the 2025 Australian Gold Conference that took place on 13th-15th October, a veteran gold markets analyst, Keith Goode, specially asked me to find him in the morning as he wanted to show me something:

Source: Chatting with Keith Goode, Eagle Research Advisory

The next day, we chatted and he showed me his analysis of the historical trends of gold bull runs going back to the 1980s. He believed that we were near the end of the big run and a correction was due.

Well, he was right on target. Gold stocks peaked on 16th-17th October and quickly dived around 15% before finding its footing.

Sure this was coincidental, but there’s a reason why experienced markets analysts like Keith will more likely get the timing right. There’s some regularity and pattern in commodity assets. They may vary by days, even months, but there are signs you can follow to help you.

Don’t become the biggest fool

My point is, we’re one gold bull run closer to things ending. After that, I suspect that gold is worth holding on while the others precious metals assets could bring heartache to those who didn’t read the markets right. The higher they go, the harder they could fall. Even quality companies can’t shake off a market that has moved onto the next hot thing to pursue

So what will you do? Leave it all to luck and believe you can find a bigger fool to pass on your holdings? Or you can follow me on the journey to navigate the gold bull market to its glimmering top, and hold onto significant gains in the ascent.

If you like what you’ve read here, I invite you to consider becoming a member of The Australian Gold Report. Let me guide you to build your precious metals portfolio and learn the strategy of riding the gold price cycle, from bull to bear market and anything in between.

God Bless,

Brian Chu,

Gold Stock Pro and The Australian Gold Report

The post Don’t become the biggest fool appeared first on Fat Tail Daily.

daily.fattail.com.au (Article Sourced Website)

#Dont #biggest #fool