How Much is a Bitcoin Worth?

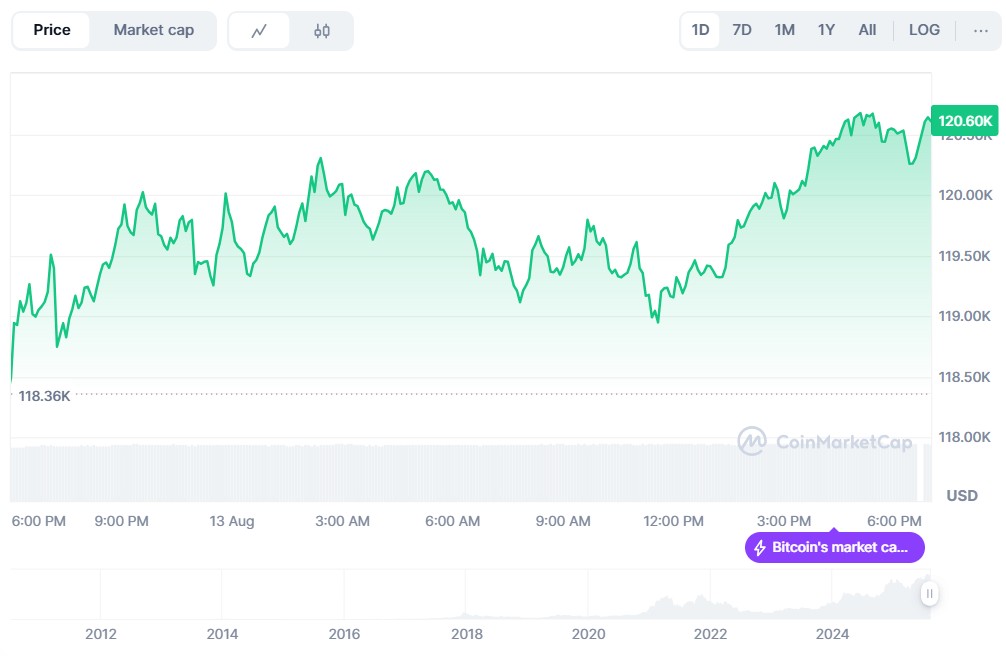

From a bold experiment to a global financial powerhouse, Bitcoin’s journey has been nothing short of remarkable. Now valued at $120,550.98 with a market cap nearing $2.40 trillion, it has rebounded strongly from its 2022 slump, reaffirming its leadership in the crypto world. With expanding adoption, innovative protocol upgrades, and supportive global trends, Bitcoin continues to shine as a cornerstone of the digital asset ecosystem.

Bitcoin (BTC) Price and Technical Analysis

Price and technical analysis play a crucial role in anticipating market trends. Most traders rely heavily on price movements and a variety of technical indicators to guide their buy or sell decisions.

By studying historical price patterns and market data, traders gain valuable insights into potential trends and shifts in market sentiment. This knowledge allows them to make well-informed, strategic decisions. Over time, these methods have become essential tools in a trader’s toolkit, helping them navigate the fast-paced and ever-changing world of financial markets with greater confidence and precision.

Bitcoin records a 24-hour trading volume of $73.67 billion, with 19.90 million coins currently in circulation. On the technical side, its 14-day RSI stands at 63 on the daily chart, indicating steady market momentum.

Read more: What is Bitcoin Mining

A Snapshot of Key Bitcoin Metrics

| Current Price | $120,550.98 |

| Market Capitalisation | $2.40 trillion |

| 50 Day SMA (1 day) | $114,694 |

| 100 Day SMA (1 day) | $110,003 |

| 200 Day SMA (1 day) | $99,973 |

| 24-hour volume | $73.67 billion |

| 14-day Relative Strength Index (1 day) | 63 |

| Bitcoin All-Time High | $123,236 |

| Bitcoin Circulating Supply | 19.90 million BTC |

| Total Supply | 21 million |

Historical Price Movement of Bitcoin

Since its launch in 2009, Bitcoin has evolved from a niche experiment in digital currency to one of the most influential financial instruments in the world. Over the years, it has attracted institutional investors, inspired regulatory discussions, and cemented its place as the flagship of the crypto market. Although short-term volatility remains a defining trait, its long-term performance tells a story of resilience and sustained growth. For investors aiming to understand this journey, logarithmic charts serve as a valuable tool. By compressing extreme price movements and filtering out market noise, they allow a clearer view of Bitcoin’s overall trajectory, helping market participants focus on macro trends rather than being swayed by daily price fluctuations.

What Affects the Value of Bitcoin?

The price of Bitcoin is influenced by several key factors:

1. Market Demand and Supply: Similar to traditional assets, Bitcoin’s price is determined by the basic principles of supply and demand. When more people want to buy Bitcoin than sell it, the price rises, and vice versa. Also, Bitcoin is a deflationary asset with its supply reducing over time. If the market demands remain constant or grow, the price should increase because the supply is decreasing.

2. Adoption and Acceptance: Wider adoption of Bitcoin as a means of payment or store of value can positively impact its price. Acceptance by businesses and institutions can boost investor confidence.

3. Regulation: Government regulations and policies significantly affect Bitcoin’s price. Favourable regulations can encourage investment and drive up prices, while restrictive measures can have the opposite effect.

4. Technological Developments: Changes and advancements in the underlying technology of Bitcoin, like upgrades to the blockchain, can influence investor sentiment and price movements.

5. Market Sentiment: News, social media, and public perception can sway sentiment quickly, causing rapid price fluctuations. Positive news often leads to price increases, while negative news can trigger sell-offs.

6. Global Economic Events: Economic crises, inflation fears, and currency devaluation concerns can drive individuals and institutions to seek alternatives like Bitcoin, boosting its price.

7. Whale Activity: Large holders of Bitcoin, known as “whales,” can impact the market by buying or selling substantial amounts.

8. Market Liquidity: Thin trading volumes can lead to price manipulation and sharp price swings. Increased liquidity can stabilize prices.

9. Competition: The presence of other crypto tokens and digital assets can affect Bitcoin’s market dominance and, consequently, its price.

Read more: What Is Bitcoin Halving

Bitcoin Price Prediction 2025

Following two successful years in the price cycle, BTC is foreseen to attain a price greater than $135,000, according to predictions.

Bitcoin Price Prediction 2026

If major macroeconomic factors remain stable, experts predict the price of Bitcoin will continue to rise and can touch the $150K mark at the end of 2026.

Bitcoin Price Prediction 2027

Experts predict BTC will continue its bullish trend, with some predicting its value to touch $160K.

Bitcoin Price Prediction 2028

As per experts, the lowest price of BTC will be around $174K and the maximum price will be about $191K by the end of 2028.

Bitcoin Price Prediction 2029

Crypto analysts predict the upward price trend will continue in 2029. They predict the minimum price of BTC will be around $200K, and the maximum price could touch $240,000 by the end of 2029.

Bitcoin Price Prediction 2030

Although the crypto market is volatile, experts predict the value of BTC will grow in the long term. They predict the price of BTC to touch $340,000 with a minimum value of $270K if global macroeconomic factors remain constant.

Is Bitcoin a Good Investment?

Bitcoin continues to hold its position as a dominant force in the ever-evolving crypto landscape. As 2025 progresses, its price movements remain a focal point for investors, traders, and analysts worldwide, reflecting its far-reaching impact across financial markets. Yet, it is important to remember that crypto assets, including Bitcoin, are inherently volatile and carry significant risks. This content is not intended as financial advice—always assess your personal risk tolerance, stay informed about market conditions, and conduct thorough research before making any investment decisions.

Read more: Crypto Trading Strategies

Should I Invest in Bitcoin?

Deciding whether Bitcoin fits into your portfolio ultimately depends on your individual risk tolerance and investment horizon. Institutional interest continues to gain momentum, with major players such as BlackRock, Fidelity, and ARK Invest expanding their exposure through Bitcoin ETFs. Market sentiment has further improved under Donald Trump’s presidency, as the regulatory environment shows signs of becoming more favorable. Adding to the bullish outlook, over 60% of Bitcoin’s supply has remained untouched since early 2022—a clear indicator of strong holder confidence and long-term conviction in the asset’s value.

You can now buy Bitcoin on ZebPay. Keep yourself up to date with the latest crypto news on ZebPay blogs!

FAQs on Bitcoin Price Prediction

What will Bitcoin be worth in 2025?

Market analysts say the current crypto cycle will peak in 2025, and the price of BTC could touch $135,000 at the end of 2025.

What will Bitcoin be worth in 2026?

The price of BTC will continue to trend upwards and touch $150,000 in 2026, if macroeconomic conditions remain constant.

What will Bitcoin be worth in 2027?

Crypto experts predict that the price of BTC can touch the $160K mark again in 2027, if global economic and political conditions remain stable.

What will Bitcoin be worth in 2028?

Experts say the value of Bitcoin can reach a maximum of $191K and a minimum of $174K in 2028.

What will Bitcoin be worth in 2029?

The value of BTC can reach a maximum of $240K, if market conditions are favorable, and the minimum value could be around $200K in 2029.

What will Bitcoin be worth in 2030?

Experts predict the value of Bitcoin could go past $340K, if global macroeconomic factors remain constant.

How is Bitcoin price prediction done?

BTC price prediction is done by analyzing technical and fundamental factors in the crypto market. You should also analyze the global macroeconomic conditions, as they affect the future price of Bitcoin. But please note that this research is done internally and should not be taken as investment advice. Investors should conduct thorough research before deciding to buy or sell.

You can buy BTC on ZebPay and start your crypto investment journey today!

Disclaimer:

Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Each investor must do his/her own research or seek independent advice if necessary before initiating any transactions in crypto products and NFTs. The views, thoughts, and opinions expressed in the article belong solely to the author, and not to ZebPay or the author’s employer or other groups or individuals. ZebPay shall not be held liable for any acts or omissions, or losses incurred by the investors. ZebPay has not received any compensation in cash or kind for the above article and the article is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information.

zebpay.com (Article Sourced Website)

#Bitcoin #Price #Prediction #ZebPay