Central bankers have rarely been friends to Main Street.

Their role in our economy seems almost paternalistic — always there to tell us that we’ve had too much sugar and need to calm down.

Meanwhile, politicians often wring their hands about overspending.

But this is often forgotten when the rubber hits the road, preferring stimulus to keep the good times rolling (and their party in power).

That’s why our political institution’s halfheartedly attempt to separate central bank decision-making from the government.

Without it, they inevitably borrow from the future to juice today’s returns.

Well, President Trump looks to be accomplishing just that.

After near constant pressure, he’s backed the US Fed into a corner and is already weighing his next replacement for Fed Chairman.

Why does this matter?

Well, he’s just demanded interest rates at 1%, and if he gets his way, we’re about to witness the mother of all asset bubbles.

Not just stocks. Not just housing. Everything.

After watching yesterday’s wholesale inflation surge yesterday — the first clear sign of tariff-induced price pressures — the timing couldn’t be more extraordinary.

Or terrifying, depending on where you’re sitting.

The Perfect Storm Brewing

Producer Price Index (PPI) just jumped to its highest number in three years. It was up 0.9% from the prior month, well over the expected 0.2%.

|

Source: Kobeissi Letter [Click to open in a new window] |

That’s a clear sign that importers and businesses are bearing the costs of tariffs…for now.

Let me paint you the picture forming right now.

Yesterday’s PPI data is a warning shot for one potential future.

Services inflation surged 1.1%, with machinery and equipment wholesaling margins some of the worst areas.

Wholesale fresh vegetables? Up an eye-watering 38.9% from the immigration crackdown and tariffs.

This is tariff-induced price pressure, the kind that monetary policy can’t reign in the usual way.

But now Trump wants the Fed to cut rates into this hot inflation. That’s like throwing petrol on a fire while complaining about the smoke.

The maths is seductive, though.

Trump’s argument runs like this: cut rates by 300 basis points across all US$29 trillion in public debt, and you save US$870 billion annually.

Plus, with a big chunk of that up for refinancing this year (roughly US$9.2 trillion), that’s roughly US$276 billion saved in one swoop.

Sounds clever, except it ignores one tiny detail — the inflationary spiral you’ve just unleashed.

If they’re not careful, the CPI could accelerate into the sun. We’re talking inflation back to the 4–5% range.

Borrowing From Tomorrow

Here’s what Trump understands that his critics don’t: he won’t be around for the reckoning.

This is his signature move, perfected over decades in real estate.

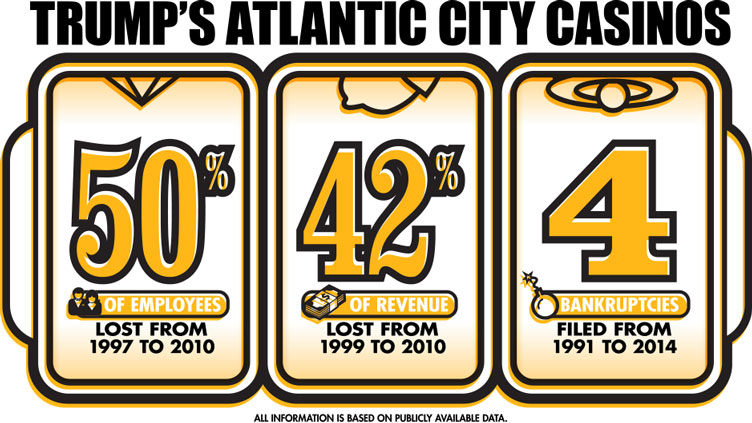

Extract maximum value today, and let someone else deal with the mess. It worked in Atlantic City (until he went bankrupt). It worked in his first term. Why not double down?

|

Source: Temple University |

The One Big Beautiful Bill Act alone will add US$3.4 trillion to the deficit over ten years, according to the CBO.

If the temporary provisions get extended — and when have tax cuts ever been allowed to expire?— that number climbs even higher.

JP Morgan’s CEO, Jamie Dimon, recently called this climbing debt ‘the most predictable crisis’ in history.

And while the deficit climbs, extreme rate cuts would see us finish with a blow-off top.

The insidious part? Every asset class benefits initially.

Stocks love lower rates. Real estate explodes when mortgages get cheaper. Commodities surge on inflation expectations.

This is how everything bubbles form. Not through stupidity, but through perfectly rational responses to terrible policy.

Let’s talk about what this means for Australia.

Your Australian Playbook

When US rates plummet to around 1% while our RBA sits somewhere around 3% the carry trade could go ballistic.

Hot money could flood into Aussie dollars, pushing our currency higher.

Our miners become the biggest winners initially. BHP, Rio, Fortescue —they’re selling commodities priced in inflating US dollars while reporting in strengthening Aussie ones.

Australian gold miners are the other obvious play. When inflation psychology grips America, gold becomes the release valve.

The ASX materials sector could surge in this scenario. Iron ore might fly again as Chinese stimulus meets American inflation.

Lithium producers, beaten down for two years, could see a violent reversal as the energy transition narrative returns with vengeance.

Critical minerals are the dark horse. Lithium, rare earths, copper —everything needed for the energy transition that inflation will accelerate.

The crypto angle is even more interesting. When US inflation runs hotter, and rates are beaten lower by a Trump lackey.

Bitcoin doesn’t need to do anything to win — it just needs to exist.

Forget trying to pick the top in US markets, you’ll likely miss it. Focus on what benefits from the chaos.

For crypto exposure, think beyond Bitcoin. Yes, own some, but the real gains might come from DeFi protocols or other assets not trapped in the centre of the storm.

If US rates hit 1%, earning 6–8% on USDC through Aave or Compound looks genius.

I wouldn’t even discount good old AUD in this scenario.

When this bubble pops, the US dollar could crater while the AUD holds relatively firm.

Our central bank isn’t taking orders from politicians. Our debt-to-GDP is half America’s. We have real assets backing our economy, not just financial engineering.

The everything bubble is coming. For Australian investors, there’s a huge opportunity to position for the aftermath.

It could be our next great boom.

When America finally faces its reckoning, the world will need real assets, real commodities, and currencies backed by more than political promises.

We’ve got all three. The question is whether you’ll position for it before the music stops.

Regards,

Charlie Ormond,

Alpha Tech Trader and Altucher’s Early-Stage Crypto Investor

The post Are You Ready for the Everything Bubble? appeared first on Fat Tail Daily.

daily.fattail.com.au (Article Sourced Website)

#Ready #Bubble