CLICK HERE to get APEX EDGE — Scalping Blade with AI Risk Shield

———————————————————–

OVERVIEW

———————————————————–

The highlight of Apex Edge lies in its built-in AI-driven machine learning module, which actively monitors both market trends and account risk in real-time. It aims to capture quick scalp profits while safeguarding your account from major losses. We’ve implemented 4 meticulously designed risk management system that work together to protect your capital. This manual will walk you through how they function, so you know exactly what you’re getting into before purchasing our EA.

———————————————————–

ABOUT BACKTESTING

———————————————————–

Before making a purchase, we strongly recommend you running a high-precision historical backtest using Every Tick mode. This ensures the simulation is as close to real-market conditions as possible.

We advise starting from the year 2020, as gold’s volatility was relatively low before that. Despite how it appeared on charts, price movements were often just a few hundred points. Since 2020, multi-thousand point swings in gold prices have become the norm. As scalping strategies rely heavily on high volatility, pre-2020 data doesn’t offer much practical insight.

As for the initial deposit, it’s entirely up to you. You can start with as little as $1,000, but obviously, the larger your capital, the better your risk tolerance. For example, with $5,000 to $10,000 or more, your stop-loss level is wider and drawdowns are typically smaller.

If you notice drawdowns like this during backtesting, don’t panic. That’s the stop-loss algorithm doing its job to protect your account during abnormal market conditions. Losses are part of the game. No EA is 100% profitable. What matters is long-term profitability, and Apex Edge is built for that. Stay patient, profits will come.

Different backtest periods and initial capital sizes will cause different results, and that’s completely normal. One of our stop-loss rules triggers when losses exceed a certain percentage of your equity. That means smaller accounts hit stop-losses more frequently, but there’s a flip side, you can exit bad trades faster and recover quicker. Conversely, larger accounts enjoy more room to absorb drawdowns.

The EA also comes with a Money Management feature. When enabled, your position size grows as your capital grows. This increases your profits, but also enlarge drawdowns.

Please complete a full backtest and find a configuration that works best for your trading goals. If you’re unsure which parameters to change, stick with the default settings, because we’ve already run hundreds of backtests under various conditions.

There will always be market conditions that the EA is not optimized for. If you encounter issues, please reach out to us directly before leaving negative feedback. This allows us to support you better and continue improving the product.

———————————————————–

SETUP GUILDLINES

———————————————————–

Recommended Pair: XAUUSD

While the EA can theoretically profit from any highly volatile asset including EURUSD, GBPUSD, USDJPY, and even cryptocurrencies, XAUUSD consistently delivers the best performance. The default parameters are optimized specifically for gold, so we suggest trading only XAUUSD and USDJPY.

Timeframe: M1

For intraday scalping, lower timeframes like M1 offer more trading opportunities.

Broker: ICMarkets or Bybit are recommended due to their low spreads, which are critical for high-frequency intraday trading.

If you use another broker, just make sure their spreads are reasonable. The EA can generate hundreds or even thousands of trades per day, and high fees will eat into your profits fast.

———————————————————–

RISK CONTROL – HOW WE PROTECT YOUR ACCOUNT

———————————————————–

In order to protect your account, we have racked our brains to provide you with a complete solution. The following is a detailed explanation of how we can help you achieve risk control.

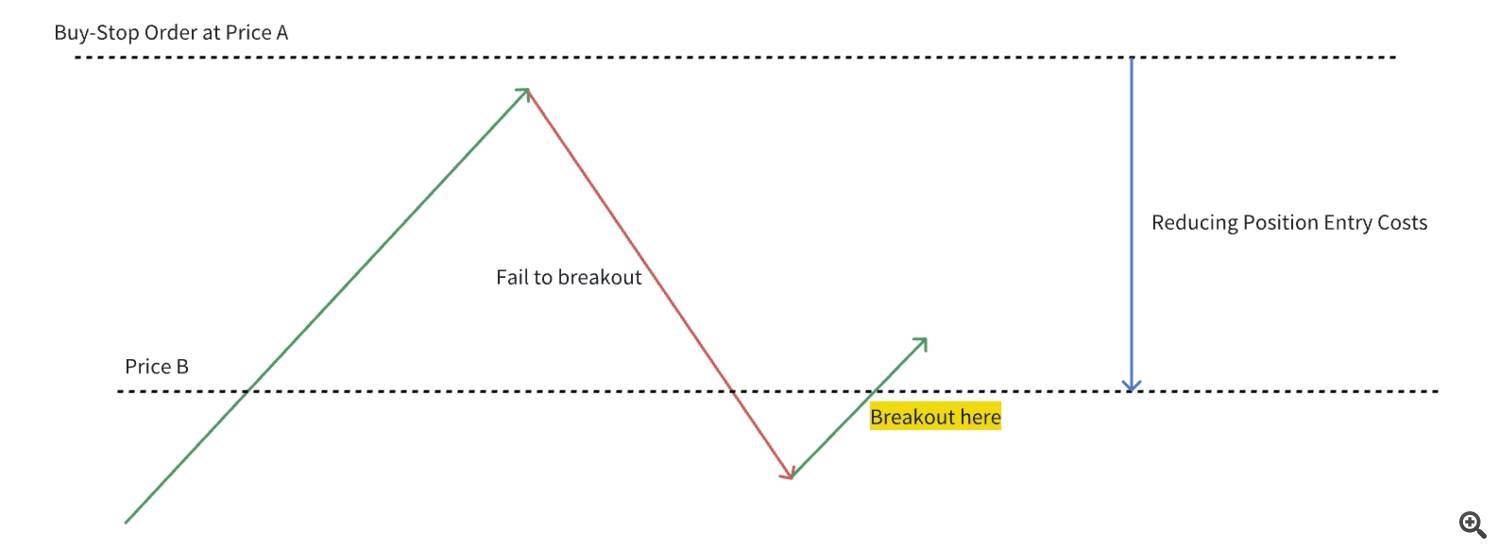

1. Price Adjustment Algorithm

The built-in AI monitors price action in real-time and adjusts pending order prices accordingly.

For example, if the EA detects a potential breakout, it places a buy-stop order at Price A. But if the price pulls back instead of breaking out, the EA lowers the pending order to Price B. This reduces trade costs.

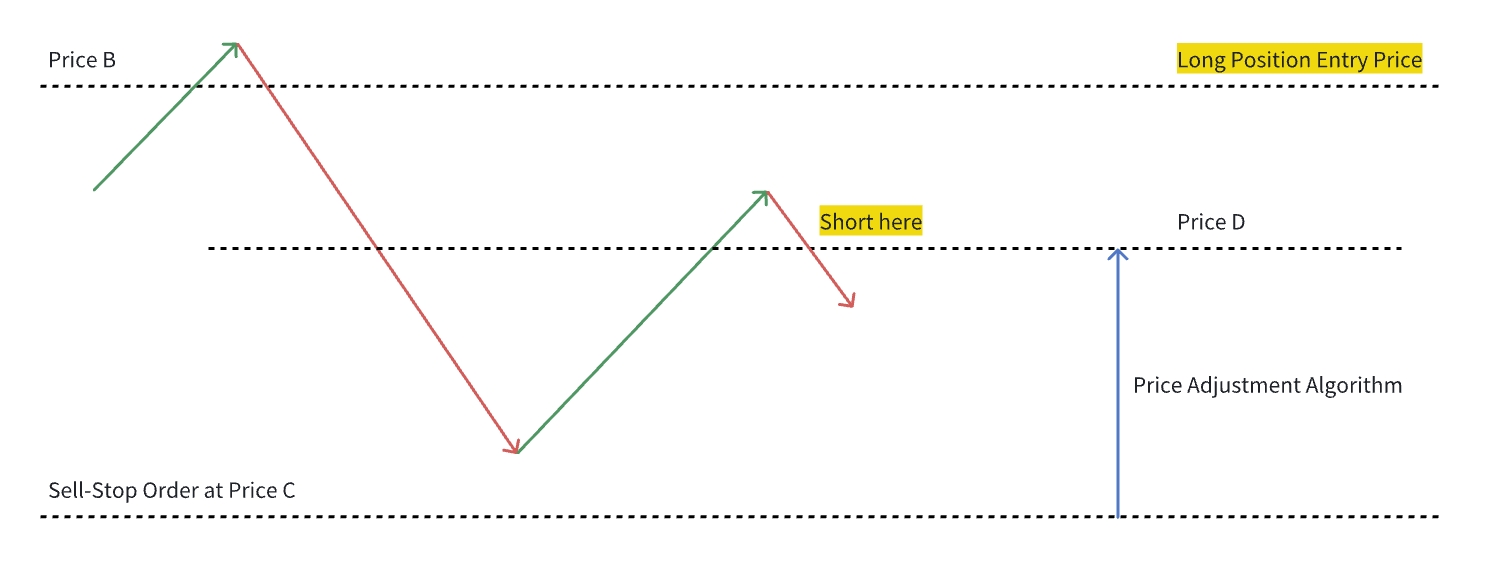

2. Hedge Protection

Let’s continue the story. If the market reverses after entry and continues in the opposite direction, the EA automatically opens a hedging sell-stop order at Price C to limit further losses. If prices rebound to point D before entry, the price adjustment algorithm ensures you short at a more favorable level.

3. Smart Account Monitoring

The EA constantly monitors your account in real-time, including overall profit/loss, open positions, and risk exposure. If it detects dangerous imbalances, it triggers a full or partial auto-close to preserve your gains.

The final safety net is based on account drawdown. If losses exceed a certain threshold which calculated by AI, the EA will immediately close all positions to prevent a complete wipeout, even if other risk controls have failed.

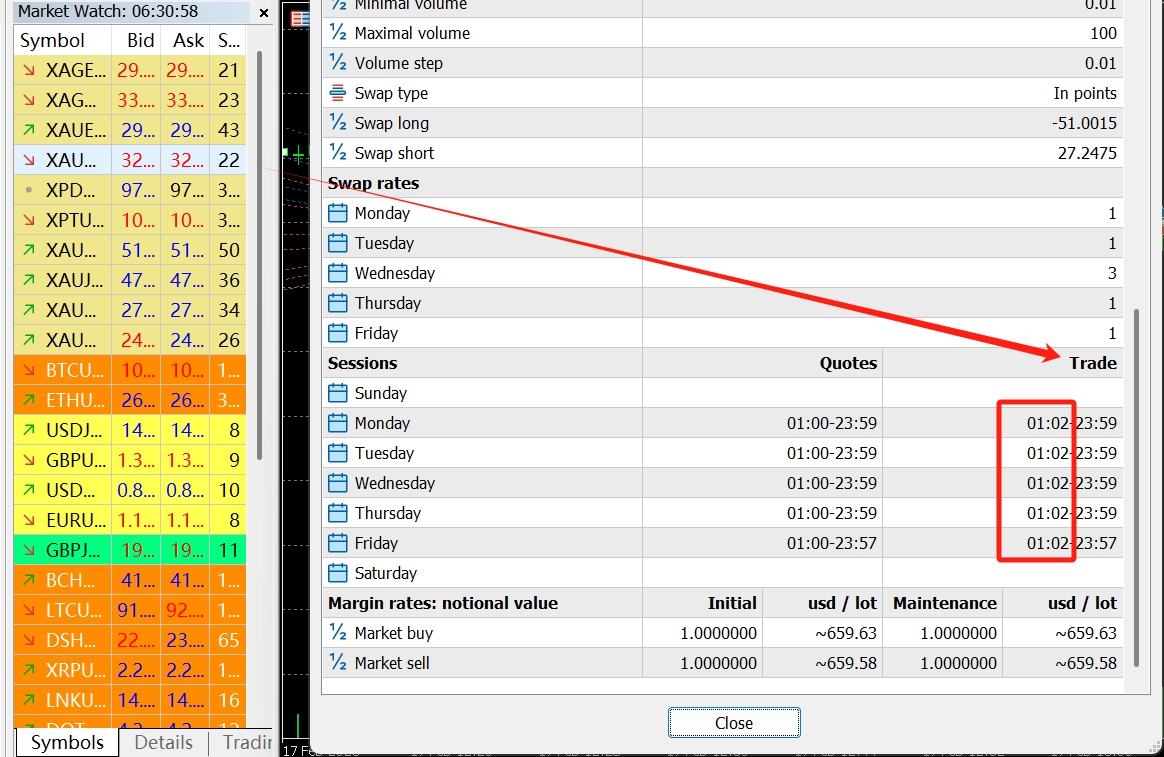

4. Trading Session Control

To further reduce risk, we limit trading to safer time periods. Gold is heavily influenced by USD and typically sees the most stable behavior during New York evening hours. We recommend trading between 5:30 to 13:30 UTC+2, which is equivalent to 10:30 PM – 6:30 AM New York time. These hours are usually quieter, minimizing the chance of sudden black swan events.

However, be mindful of geopolitical tensions in the Eastern Hemisphere during this time, if anything major happens, e.g., India-Pakistan and Middle East conflict, it’s best to pause the EA and wait for calm.

IMPORTANT:

ICMarkets and Bybit use UTC+2. If your broker uses a different time zone, be sure to adjust the EA settings accordingly.

———————————————————–

PARAMETERS

———————————————————–

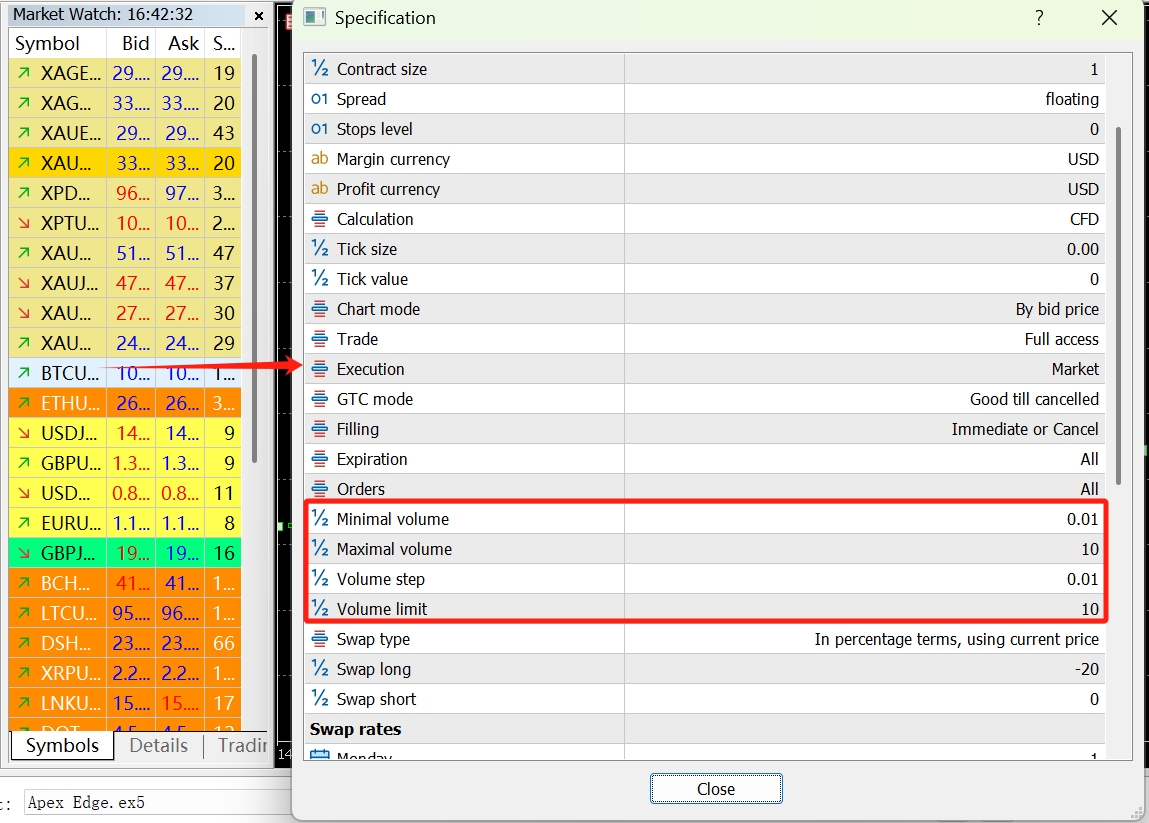

- Lots: Initial lot size, default = 0.01.

- Max Lots: Maximum allowable lot size. If you use Money Management mode, you can increase it to 10+ according to your account size.

- Lot Multiplier: Multiplier for adding positions.

- Max Orders: Max number of positions the EA can hold.

- Decimals: Decimal precision for lot sizing

- Steps: Lot size increment step, default = 0.01.

The above information must be the same as your broker’s, such as the maximum number of lots allowed, the maximum order volume, as well as decimal points, step length, etc. You can view the specifications of the symbol in the trading software.

- Breakout Points: Distance in points from current price to place a buy/sell stop order.

- Pyramiding Points: Number of points price must retrace before adding to position.

- Alternate Pyramiding Points: If the loss of the account exceeds a certain amount, the EA will automatically increase the distance for adding positions and increase positions at a slower rate.

- Total Profit Target: Total floating profit that triggers a full exit.

- Position Profit Target: Profit per position to trigger partial exit.

- Position Stop Loss: Loss per position that triggers stop-loss exit.

- Price Adjustment Sensitivity: The lower, the more frequent price adjustments.

- Session Start Time: The daily start time of trading provided by your broker, which you can also check in the specifications. In fact, if you use our default night trading mode, then this variable is actually useless, but if you want to try all-day trading, you need to fill in the time provided by the broker here.

- Don’t Trade on Weekend: Must remain true to avoid weekend gap risks, except crypto.

- Positions Close Time on Friday: If you use the all-day trading mode, then be sure to set this number to prevent you from leaving open positions on weekends. Note that the number of hours filled in here is the 24-hour system. The default number 19 means that the EA will gradually close the positions after 19:00 on Friday. But if you use the default night trading mode, this variable can be ignored.

- Start Trading Time & End Trading Time: These two parameters are very important! Because we limit trading to night time, we avoid the most risky time period, so you can trade with peace of mind, and you don’t have to worry about the guys on Wall Street suddenly releasing breaking news that causes black swan events, because they are dreaming at this time. After our continuous testing, we believe that the safest time is from 10:30 pm New York time to around 6:30 am the next day. But it should be noted that all the time parameters in our EA refers to the broker’s time zone! So please make sure to find out the time zone of your broker and convert it. For example, for ICMarkets, 10:30 pm~6:30 am New Your time corresponds to 05:00~13:30 on the MT4/MT5.

- Money Management: It determines whether to use the fund management mode. If true, the number of lots will increase according to the expansion of the total funds. However, we found that the fund management mode does not seem to be a good idea, because large lots means high leverage, which leads to high risk and causes the system to stop loss frequently. Although the EA can eventually make a profit, frequent stop losses cause too much cost. Moreover, it is always right to maintain a conservative trading attitude, because the first priority of making money is safety, not getting rich overnight, so this parameter defaults to false, and we do not recommend you to change it. If your capital is large enough and you are not satisfied with the initial lot of 0.01 lots, you can divide the funds into multiple accounts. For example, if you have 10,000 US dollars, divide it into 5 accounts, each with 2,000 US dollars. In fact, you can also get 5 times more income than before, which is both safe and reduces risks.

We not only recommend you NOT to trade with too many lots, on the contrary, we also recommend you:

When you make a profit every month, it’d better you take out at least half of the profit and put it in the bank, and never invest it in the market again.

If you have green mountains, you will not be afraid of running out of firewood.

We have tested the EA hundreds of times and tried various parameters, so we recommend you keep all the parameters above as default.

———————————————————–

SUPPORT & FEEDBACK

———————————————————–

If you encounter any problems, please send me a private message as soon as possible, which will help us better understand your problem and provide solutions, so as to create a win-win situation. Giving negative feedback and poor ratings directly will not only fail to solve problems effectively, but also bring great pressure to the team and affect work efficiency and morale, and also makes it impossible for us to solve your problem, which is a lose-lose situation for both of us. If you like our products and look forward to our updates, please give us positive feedback and 5-star rating. Thank you.

www.mql5.com (Article Sourced Website)

#APEX #EDGE #USER #MANUAL