I write about tech and AI for a living.

So why am I telling you to look at copper, uranium, and energy?

Because the macro environment is shifting. And right now, real assets are one of the best hedges against what’s coming.

Yesterday, Australia’s inflation print came in at 3.4%. That’s below the 3.6% economists expected. Good news on the surface.

It takes pressure off the RBA ahead of the February meeting. A rate hike now looks less likely.

But zoom out, and the picture becomes complicated.

For Australia, Housing and energy costs remain stubbornly high. Overall, the trimmed mean (the RBA’s preferred measure) still sits at 3.2%, above the 2–3% target band.

The RBA’s next move now hinges on incoming labour data.

This local dynamic mirrors a global story. And I think it should be at the forefront of your investment strategy this year.

The Regime Has Changed

Here’s the big picture in four points.

First, money creation is through the roof. In 2025, global fiscal deficits and private sector leverage added approximately US$8.1 trillion of net liquidity and credit into the global system.

Some argue that this has peaked for the US in this cycle. That may be true, but globally, things are still running hot.

The US still runs massive deficits. Germany and Japan are loosening the purse strings. And AI capex is functioning like a quasi-fiscal stimulus, with trillions flowing into data centres, chips, and infrastructure.

Whether it’s governments or private equity, debt is piling up.

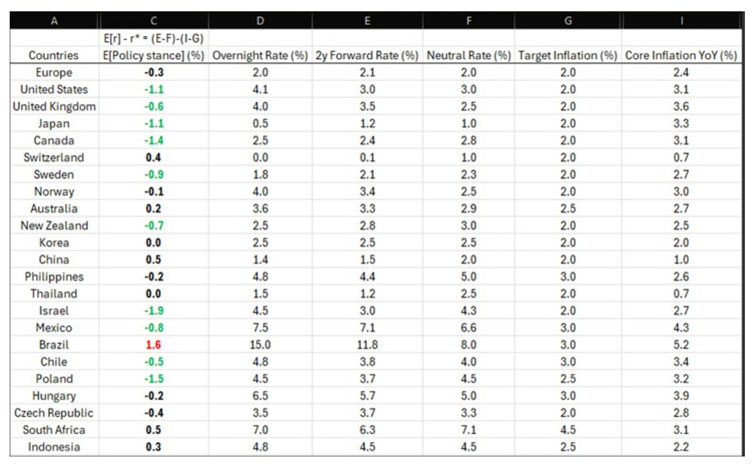

Second, central banks aren’t fighting it. Policy may be tight relative to the last decade, but it is still loose relative to real interest rates.

Take a look at the table below to see how many central banks are ‘neutral’ in black or loose in green. Only Brazil, in this sample, is tight.

Source: The Macro Compass

[Click to open in a new window]

Central banks applying ‘neutral’ monetary policy in the face of inflation above targets is, in fact, not neutral.

Third, inflation will stay sticky and elevated. In the US, housing disinflation will help, but services and wages will keep a floor of around 2.6–3.5% for the Yanks.

For Australia, we’ll likely hover a bit higher, but the idea remains the same.

Fourth, and this is the key point, nominal GDP growth will run at 5% or higher, even as real growth stays modest.

That gap between nominal and real is where the action is.

Nominal growth tracks dollars, real growth tracks output. Inflation is the gap.

Nominal GDP growth can make governments and companies appear healthier (and markets happy), but anaemic real growth is why we all feel poorer.

This is your main battle for 2026… and central banks aren’t going to throw you a line.

Why Many Central Banks Can’t Tighten

This isn’t the typical private debt regime seen in prior bull cycles, such as the dot-com or 1980s Japan.

Back then, money creation came mainly from private leverage. That’s mortgages and corporate debt. Central banks could tighten, trigger a credit crunch, and break the cycle.

Today, money creation comes from governments. Tightening doesn’t just slow growth, it threatens sovereign debt loads.

For Europe, Italy, Spain, and France are all carrying debt loads that become unmanageable if rates rise much further. Japan is in a similar bind.

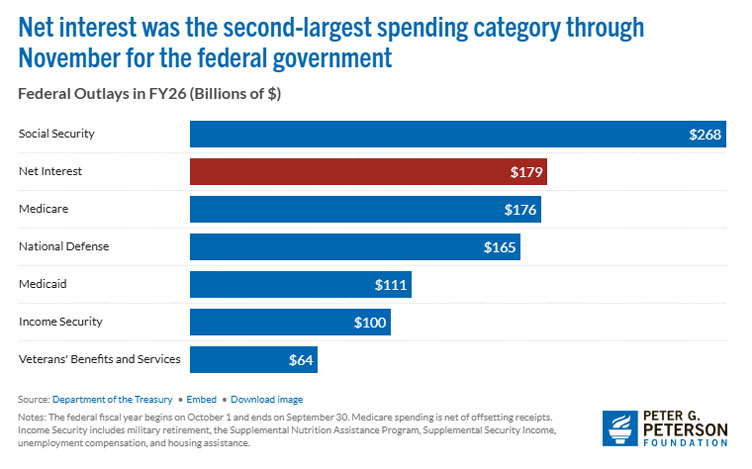

While in 2026, the US is expected to spend 3.2% of its GDP on interest payments for its US$38.4 trillion debt load. That eclipses the previous high set in 1991.

Source: Peterson Foundation

Central banks face an asymmetric constraint. They can loosen. But they can’t really tighten much more, not without risking a sovereign debt crisis and massive unemployment.

This is fiscal dominance, even if no one calls it that.

Your Old Portfolio Won’t Save You

The classic balanced portfolio, 60/40 stocks and bonds, assumes these move in opposite directions. Stocks fall, bonds rise. Growth slows, rates drop.

That assumption breaks in a nominal growth regime.

Stocks have been bid up to lofty prices. When those valuations cool, share prices fall.

But bonds will suffer too. Inflation erodes returns, and governments flooding the market with new debt drives prices down.

The result? Stocks and bonds start falling together. The old safety net of owning both stops working. Diversification fails.

This is where commodities come in.

Real Assets as the Hedge

Commodities aren’t just cheap trades relative to other sectors. They’re structural hedges against this regime.

They sit outside government balance sheets. They benefit from real asset scarcity. They soak up excess money when governments spend.

Plus, they reprice faster than policy can respond.

For many readers, this is familiar territory. The ASX is home to exactly the assets that benefit in this environment.

Three areas stand out.

Industrial metals: Copper and aluminium benefit directly from AI capex and infrastructure spending. Data centres need power. Grids need upgrading. Supply is tight, lead times are long, and demand is inelastic.

Energy: Venezuela’s situation and a warmer winter for the north are hurting oil and LNG prices. Those with a long-term investing view should see an opportunity.

Uranium deserves special mention here. Baseload power constraints are becoming all too real in many countries as AI electricity demand soars. Nuclear is back on the agenda globally.

Precious metals: Gold and silver are the classic hedge we’ve already seen run in 2025. I’m expecting a wild ride in 2026, but one that will ultimately end on a higher note.

The Bottom Line

I’m not abandoning tech. AI remains a transformative force.

But the macro regime has shifted. Fiscal dominance, sticky inflation, and constrained central banks create a structural case for real assets.

This isn’t a rotation. It’s a regime change.

The lower CPI print this week buys the RBA time. But it doesn’t change the bigger picture.

Money is being printed. Central banks can’t stop it. And real assets are one of the few places to hide.

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

The post Why This Tech Guy is Backing Commodities appeared first on Fat Tail Daily.

daily.fattail.com.au (Article Sourced Website)

#Tech #Guy #Backing #Commodities