Coal miners didn’t bring canaries underground because they liked their singing.

They brought them because canaries die first when danger is near.

In financial markets, we have our own canaries. And right now, one of the most important is wheezing.

US employment data has long served as an early warning system for the global economy.

When American workers start losing jobs, trouble tends to follow…For markets, for Australia, and eventually for your portfolio.

So, what’s the canary telling us today?

Mixed Signals

On the surface, things look fine. The US unemployment rate sits at 4.4%. That’s hardly alarming. It’s been higher nearly three-quarters of the time since 1948.

The share of prime-age workers in employment has held steady at around 80%. That’s near record highs.

But dig a little deeper, and a more troubling picture emerges.

Job openings have been edging down for three years. Amazon and other major companies are announcing plans to axe tens of thousands of workers.

Meanwhile, private-sector firings spiked in November, with the ADP employment figures falling by 32,000. Some blame AI for the shift.

I think this only tells half the story.

Recent data from the Census Bureau suggests AI adoption rates have begun to flatten out across firms of nearly all sizes.

Source: Apollo

[Click to open in a new window]

This is just one metric in the broader story. Regardless of cause, this creeping malaise within the US jobs market needs to be on your radar for 2026.

The Fed has noticed. Many of Jerome Powell’s recent speeches have mentioned this problem. While September’s rate cuts were justified as ‘risk management’ to address this — i.e. insurance against a deeper downturn.

When central bankers start buying insurance, you should probably check your own policy.

Follow the Sequence

Here’s what most market commentary misses when talking about jobs: the economy doesn’t weaken all at once.

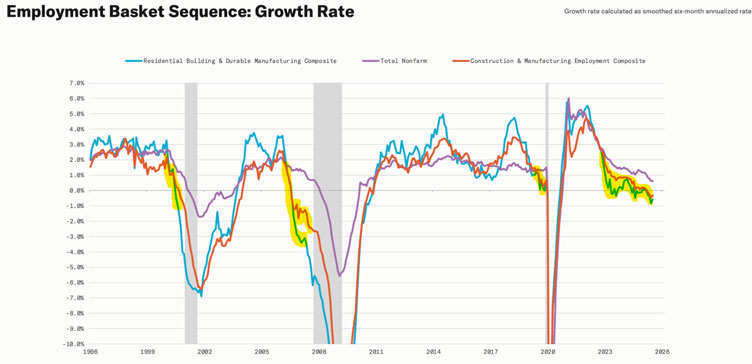

It follows a sequence. And that sequence almost always starts in the same two places: construction and manufacturing.

These sectors are the most sensitive to interest rates and credit conditions. When monetary policy tightens, they feel it first and worst.

In the chart below, you can see total ‘nonfarm’ employment (in purple) is consistently front-run by losses in construction and manufacturing (highlighted in yellow) before recessions (grey areas).

Source: EPB

[Click to open in a new window]

This rule isn’t universal, but it holds in most cases. Since the 1910s, there have been 22 recessions in the US.

- 68% (15 of these) began with both construction and manufacturing rolling over.

- 86% began with at least manufacturing weakening first.

That’s a concerning strike rate, considering those signals are currently flashing amber.

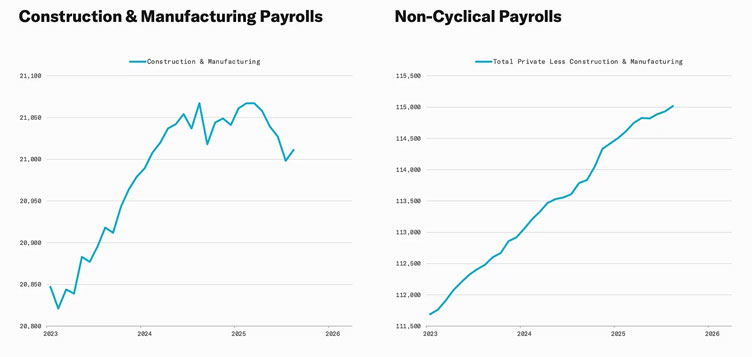

Employment growth in residential construction and durable goods manufacturing has turned negative. Meanwhile, services and other ‘non-cyclical’ sectors still look healthy.

Source: EPB

[Click to open in a new window]

This is precisely the pattern we’ve seen before major downturns in the past century.

There is, of course, a great deal of nuance around the broader macro picture that I’m brushing over.

The uncertainty around Trump’s tariffs likely played the biggest role. With such huge structural shifts to global trade, many companies sat on their hands while waiting for clarity.

Despite Trump’s longer-term goals of bringing manufacturing back to the States, the shorter-term impact of tariffs has been the loss of 59,000 blue-collar jobs since he took office.

Simultaneously, US homeowners have been reluctant to shift from their current houses and give up their lower 30-year mortgage rates.

This has caused a slowdown in new builds and the broader construction industry, which is now reflected in employment figures.

So the canary is breathing a bit heavier. Not dead by any means. But not healthy either.

Why You Should Care

You might be wondering why US employment matters for your portfolio.

Simple: when America sneezes, we catch a cold.

US consumer spending drives global demand. When Americans lose jobs, they spend less. That ripples through to Chinese manufacturing, commodity prices, and ultimately Australian exports.

On top of that, our sharemarket takes its cues from Wall Street. A US recession would likely drag the ASX down with it, regardless of what’s happening locally.

Then there’s the ivory towers of the central banks to consider. Our Reserve Bank watches the Fed closely.

If US rate cuts accelerate, the RBA’s current stance of ‘higher for longer’ may become more untenable — with all the implications that brings for Aussie property, banks, and the dollar.

Positioning for Uncertainty

So what should you do?

First, don’t panic. The canary isn’t dead. There are still buffers in the US economy.

US GDP growth remains solid. Corporate balance sheets are healthy, and US consumers are still buying.

But this isn’t the time for complacency either.

Early data from the holiday period showed US consumers spending US$6.4 billion on Thanksgiving and US$11.8 billion online for Black Friday.

Both were record highs and well above last year’s figures. But total order volume fell by about 1%, while average prices rose 7%. Meaning a lot of that growth was due to inflation rather than buoyed shopping enthusiasm.

It’s a murky picture. But many of these signals point to fading momentum.

Perhaps it’s time to consider quality stocks over pure growth plays.

If I were to pick one sector, I’d say healthcare has some great opportunities for those willing to look past the short-term weakness.

As Buffett would say, ‘Price is what you pay, value is what you get,’ and there’s some good value on the floor in that sector.

Beyond that, maybe it’s worth keeping some powder dry. If the canary does keel over, you’ll want cash to deploy into any weakness.

Will that come soon? Who knows.

I’m not calling for a top, especially as the Fed looks to be loosening the reins. 2026 could be a stellar year, as far as I know.

Still, the canary is sending a signal. Whether we listen is up to us.

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

The post The Canary is Coughing appeared first on Fat Tail Daily.

daily.fattail.com.au (Article Sourced Website)

#Canary #Coughing