Financial services is a trust-heavy, highly regulated industry where acquisition costs are high and customer lifetime value can be substantial. That makes a long-term, measurement-driven marketing playbook essential. Below are ten strategies compiled by our financial services marketing agency team that consistently deliver, whether you’re a bank, insurer, wealth manager or fintech.

We have included practical notes on when and how to use these evergreen strategies to grow your finance firm, no matter how big your organisation is or which sector you operate in.

1. Paid search: Meet users where they’re actively searching

Search remains the most intent-driven channel: people searching for mortgages, pensions, or business insurance are already in consideration mode. Invest in a blended approach: high-intent paid search to capture near-term demand, and SEO to own evergreen informational queries (e.g., “how does income protection work?”). Use precise keyword segmentation for product, intent and funnel stage and protect margins with strict negative keyword lists and audience bidding.

Read our 6 multilingual PPC keyword research must-dos.

Tip: For this channel, there are several things you can test to reach users not only at the top or middle of the funnel, but also at lower stages. For example, you can use RLSAs to target users who have already interacted with the brand and should receive more specific messaging or a tailored landing page when searching for information. If they are already aware of the brand, direct them to comparison tools or more in-depth content, even if they are using broad search terms.

Why it matters: Consumers turn to search in pre-purchase research, owning the informational to transactional queries shortens sales cycles and lowers CAC.

2. Programmatic for scale and precision

Programmatic buys let financial brands target audiences across screens, retarget in-market segments, and use dynamic creative for contextual relevance. Lean on guaranteed deals and curated inventory to preserve brand safety and comply with sector rules.

Whether you’re running programmatic guaranteed deals or taking a real-time bidding approach, maintaining an always-on presence in key industry publications will help you raise awareness continuously.

Stat: Programmatic continues to grow as advertisers move budgets into automated buying, programmatic revenue saw a strong increase in recent industry reporting. Data from IAB shows:

3. Content & SEO as a long-term conversion engine

In financial services, where users compare products carefully, seek credible information, and often require multiple touchpoints before converting, content and SEO form one of the most durable and cost-efficient growth engines. High-quality content educates, builds trust, and nudges prospects through the decision journey long before they reach a sales form or speak to an advisor.

Why content matters in financial services

Financial decisions such as pensions, insurance, investments, are high-risk and high-commitment. Users want guidance, clarity, and reassurance. Content allows you to:

- Answer complex questions in plain language,

- Reduce friction during research,

- Build brand authority in a trust-heavy category, and

- Support both acquisition and retention.

That’s why you should create content for every stage of the journey.

Top-of-funnel:

- Educational guides (e.g., “what is income protection?”)

- Explainers and glossaries

- “How it works” articles

- Market or policy updates

Mid-funnel:

- Product comparisons

- Scenario-based examples (“If you’re self-employed…”)

- Eligibility checklists

- Cost calculators

Bottom-of-funnel:

- Application walkthroughs

- FAQs written in compliance-friendly language

- Case studies and testimonials

- Interactive tools that increase confidence before applying

When creating financial content, keep the need to demonstrate E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) in mind. Learn more about E-E-A-T for financial services SEO in our guide to YMYL trust.

4. Paid social: precision targeting and scalable impact

Paid social remains one of the most effective channels for reaching highly specific financial audiences, from SME owners researching key-man insurance, to consumers comparing banking or investment products. Platforms like LinkedIn, Meta, TikTok, and Reddit offer granular targeting options based on demographics, interests, behaviours, job titles, and life events.

Our experts recommend finance firms use paid social to:

- Prospect efficiently using lookalikes and interest-based audiences.

- Retarget site visitors, video viewers, and high-intent engagers.

- Segment messaging by product line, industry, or decision-maker role (e.g., HR vs. Finance for B2B finance), depending on the platform.

- Reach users at the different stages of the funnel: Drive education with short video explainers and carousel formats, or generate leads with LinkedIn native lead form ads, for example.

- Run controlled experiments (creative variations, CTA testing, landing-page optimisation) to understand users’ behaviour and validate value propositions.

5. Influencer marketing: credibility, reach, and education at scale

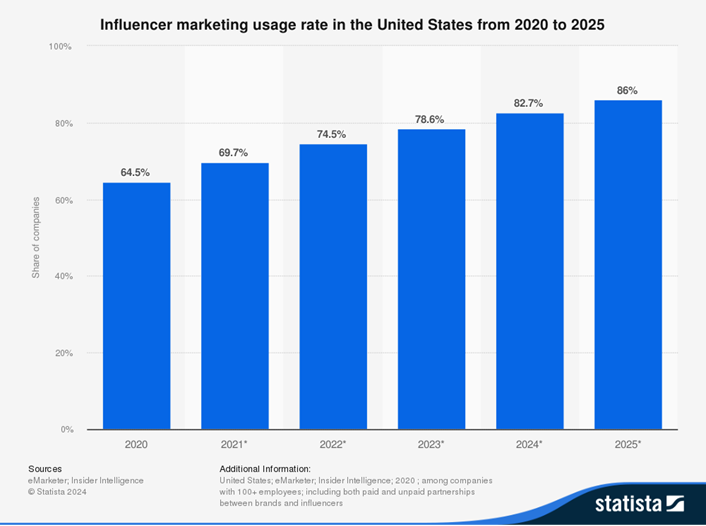

Influencer marketing is not as widely used in the world of finance as it is in fashion, beauty, travel, fitness and even healthcare. But it is gradually becoming a powerful tool for financial services brands, especially as consumers increasingly turn to experts for explanations, reviews, and simplified advice.

While social algorithms and rising ad costs are making traditional posts less efficient, influencers provide an alternative path to reach highly engaged audiences with authentic, human-centred content.

Why influencers matter in financial services

Financial topics can be complex, intimidating, or overlooked by users scrolling through their feeds. Influencers, whether they’re personal finance educators, small-business creators, lifestyle personalities, or niche experts, bridge that gap. They simplify complex topics, demonstrate real-life use cases, and create content people actively choose to watch.

On platforms like TikTok, influencers also facilitate content creation in a native format and style, which is something finance brands often struggle with. Our finance social media marketing agency team recommend you use influencer marketing for:

- New product launches,

- Awareness and education campaigns,

- Simplifying difficult concepts (pensions, insurance, credit, investments),

- Reaching younger consumers who distrust traditional ads, and

- Reaching SME decision makers through business or productivity creators.

Platform, tone, and creator niche matter. Here are some general guidelines for social media tactics:

- TikTok & Instagram for younger audiences, quick explainers, and personal finance creators.

- YouTube for longer-form educational content, deep dives, and testimonial-style videos.

- LinkedIn for B2B FS products, SME propositions, and thought leadership collaborations.

Match the creator to both your compliance requirements and your audience’s information needs

If you work in B2B fintech, partnering with influencers and investing in SEO can help you build trust and scale rapidly. You can also review the top B2B fintech SEO strategies of some of the leading fintechs.

6. DOOH for awareness with modern targeting

Digital Out Of Home (DOOH) advertising is an often-overlooked but essential channel for fintech & insurtech scale-ups and traditional finance services brands that are looking to build trust, reinforce credibility, and drive large-scale awareness with precision.

Unlike traditional Out Of Home (OOH) advertising, DOOH allows brands to activate dynamic messaging, use audience data for targeting, and measure performance more accurately, making it far more effective for complex, consideration-heavy financial products.

Why DOOH works for financial services

Financial decisions often require repeated exposure before a user takes action. DOOH delivers that through:

- High-frequency brand exposure in premium, trusted environments.

- Large-format creative that boosts perceived credibility and sophistication.

- Broad reach across commuters, shoppers, and professionals.

- Contextual relevance, e.g., business districts for B2B, retail areas for consumer lending or insurance.

How finance brands can use dynamic & contextual creative

DOOH supports dynamic messaging that adjusts based on a number of contextual and situational factors, such as:

- Time of day (“Start planning your retirement today, speak to an advisor before 6pm”).

- Weather (“Protect your home during storm season”).

- Financial calendar moments (tax year end, ISA season, open enrolment).

- Real-time data like stock tickers, mortgage rates, or currency updates.

These contextual cues boost message relevance, especially for products with seasonal or market-driven demand.

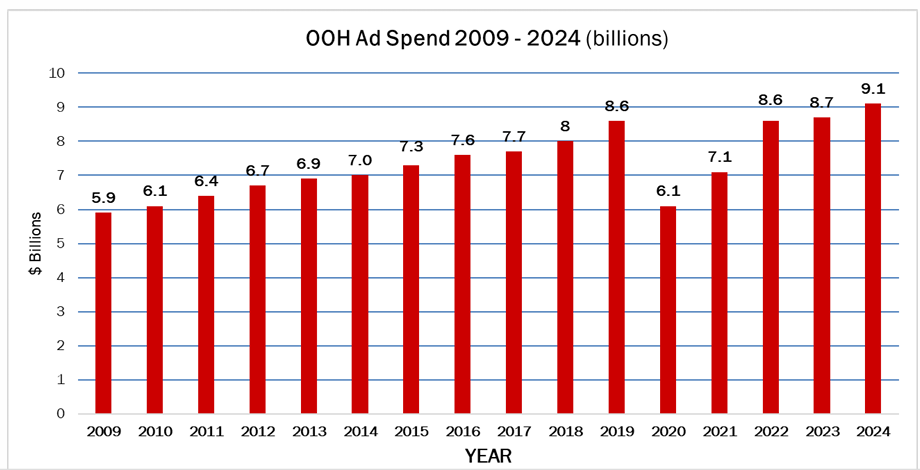

Stat: Data from OAAA+1 found DOOH accounted for a growing share of OOH ad spend, and was a major growth driver in recent OOH industry reports.

7. CRM, lifecycle & automation

In the finance industry, decisions involve long research phases, often with multiple decision-makers, all of whom have high trust requirements. CRM and lifecycle marketing are essential for turning early interest into warm, sales-ready leads.

Unlike paid media, which captures intent in the moment, automated CRM-led journeys deliver ongoing education, reassurance, and personalised nudges that guide customers through every step of the buying process. Rather than relying on manual outreach or single-touch messages, automation allows you to create structured sequences at key conversion points.

Common lifecycle flows for financial services brands include:

- Welcome journeys after initial download, form fill, or brochure request.

- Lead nurturing sequences that educate prospects over time.

- Quote follow-up flows for insurance, lending, or investment products.

- Abandoned application recovery (one of the highest-ROI FS automations).

- Renewal reminders for policy-based products.

- Onboarding flows that improve customer satisfaction and reduce support demand.

- Upsell/cross-sell journeys (e.g., adding income protection to life insurance).

Each flow provides relevant, timely content that nudges the customer toward the next logical step.

Practical tip: Map the sales cycle lengths – keeping in mind that many FS sales can take weeks or even months – and align nurture cadence to realistic decision windows.

8. Partnerships, referral & distribution

Strategic partnerships with aggregators, comparison platforms, trade associations, or niche industry communities can significantly broaden your visibility and put your offer in front of intent-rich audiences. These partners often have well-established trust and reach, making them powerful channels for both awareness and lead acquisition.

However, this increased visibility typically comes with an economic trade-off, whether in the form of higher CPLs, revenue-share agreements, or fixed placement fees. It’s important to treat these partnerships as performance channels with clear benchmarks: assess the quality of the traffic they provide, understand the true cost per converted lead, and ensure they complement rather than cannibalise your existing paid media efforts.

Partnerships are also a great way to build links that boost domain trust and authority. Read our guide to link building in regulated financial markets to learn more.

When managed strategically, the right partners can accelerate penetration into high-value segments and enhance credibility through association, while still maintaining control over efficiency and ROI.

9. Organic social: trust, education, and brand credibility

Numerous online publications will tell you how organic social media reach is falling, and how platforms force brands to pay for visibility. That is true. However, organic social is a long-term trust and reputation engine for financial brands. While it may not drive immediate conversions, it shapes perception, educates customers, and reinforces credibility, critical factors in a high-trust category.

Our finance social media marketing team recommend the following organic social media marketing best practices:

- Educate with bite-sized content: definitions, tips, regulatory changes, product explainers.

- Humanise the brand through advisors, experts, or behind-the-scenes content.

- Build authority with thought leadership, insights, and commentary on market trends.

- Engage communities by responding to questions and simplifying complex topics.

- Support customer service, providing quick answers and redirecting to official channels.

- Strengthen recruitment and employer brand, especially important for financial institutions.

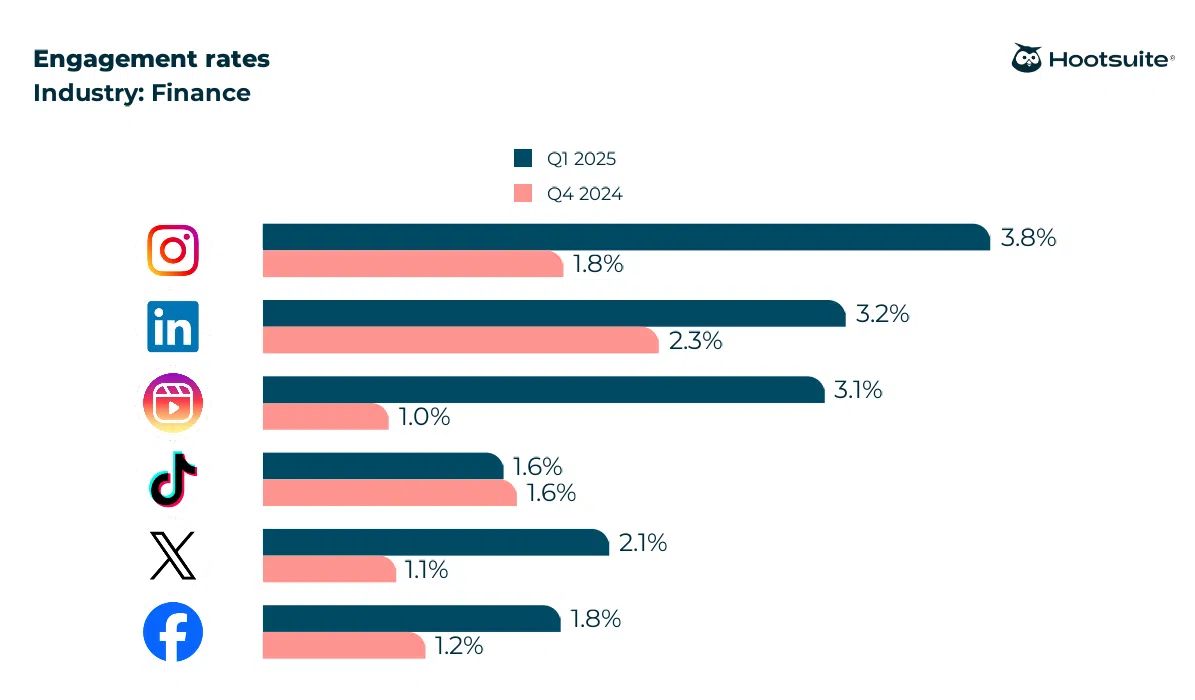

According to Hootsuite, these are social media engagement rates for the finance industry. Benchmark your performance against industry averages, and pick the channels that work best for your business.

10. Generative Engine Optimisation: preparing for AI search

Generative search (Google SGE, Bing Copilot, Perplexity, ChatGPT Search) is changing how users discover financial products. Instead of receiving 10 blue links, users now get a synthesized answer, and brands must ensure they’re visible and cited (where appropriate) with the right sentiment in those summaries.

Generative engine optimisation – GEO (aka AIO, AEO, LLMO) – is now an essential strategy. And given the growth trajectory of AI, GEO is likely to become a staple part of any finance marketing roadmap for the foreseeable future. We strongly recommend upskilling in-house teams, and working with a GEO agency that can invest resources into staying on top of this rapidly-changing field.

While AI search is in a continuous state of flux, we have found certain core truths remained the same over the past year or two. Our GEO experts who have worked on a number of finance brands recommend focussing on:

a) Structured, factual content. AI models pull from authoritative, fact-driven sources. Ensure your site publishes:

- Clear definitions

- Consistent terminology

- Verified product information

- Schema markup (author, FAQ, product, organisation)

b) Entity optimisation. Generative engines rely on entity relationships. Strengthen:

- Brand mentions across reputable sites

- Consistent naming conventions

- Author expertise profiles (E-E-A-T signals, FS credibility)

c) Answer-ready content. Write in ways that AI can directly quote:

- Step-by-step guides

- Short definitions

- Comparison tables

- Scenario-based explanations (“If you earn X…”)

d) Compliance + clarity. Generative answers avoid ambiguous or misleading sources. Clear, regulated content has a higher chance of being surfaced.

Google reports that over 15% of queries each day are new, one reason why generative systems now handle more exploratory and multi-step financial queries.

We recommend starting with a GEO workshop, followed by a benchmarking exercise to help your team work through the complexities of GEO layered on SEO.

Conclusion

Expanding your financial services offering, growing your business, or launching into new markets requires more than isolated tactics. It demands an integrated, insight-driven strategy that blends performance, brand, content, data, and distribution. When each channel supports the others, you build the trust, visibility, and relevance needed to win in highly regulated and increasingly competitive environments.

Ready to accelerate growth? You need a team with the right set of capabilities, experience and expertise to support your ambitions. This can be achieved by working with a specialist finance marketing agency, or growing your in-house team through training and strategic hiring.

Finding the right talent and upskilling your in-house team will be critical to deal with the rapidly evolving digital marketing landscape. If you want a smarter, more scalable approach to market expansion, get in touch – we love a new challenge!

About the Author

Ruben is a digital marketing consultant at AccuraCast, in charge of developing and executing effective digital marketing strategies. His specialities include digital strategy, paid media and programmatic for financial services brands.

www.accuracast.com (Article Sourced Website)

#Evergreen #Finance #Marketing #Strategies #AccuraCast