Bitcoin just took a beating.

The world’s largest cryptocurrency has plunged 24% from its October peak of US$126,296, sliding below US$94,000 for the first time since May.

That’s a seven-month low. And the fear is palpable across crypto markets.

But here’s the thing. The current phase of crypto feels more like a shakeout than the start of another winter.

Fear, but not panic

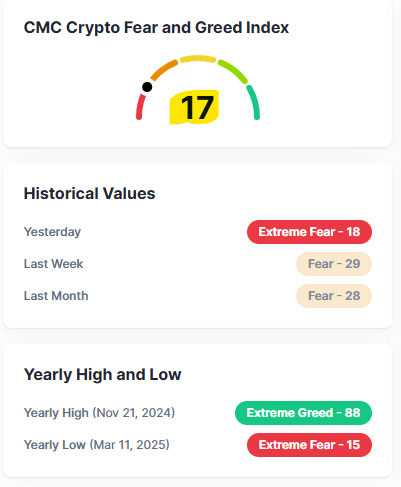

Right now, there’s plenty of fear in the crypto market.

Source: CoinMarketCap

The Fear & Greed Index currently sits at 17, that is “extreme fear” territory. But that’s still not the lowest reading this year, which was 15.

I don’t think we’re yet seeing the capitulation that typically marks a true market bear market or a “crypto winter”.

I may well be proved wrong on this.

But I’ve got one straightforward point.

Central bankers still have significant ammunition to cut rates further.

So let’s start with the monetary ammo.

As risk assets, cryptocurrencies should benefit from those cuts. The US Federal Reserve has already cut rates twice this year, bringing the funds rate down to 3.75-4.00%.

They’ve got plenty of room to ease further if needed.

There are other fundamentals at play too..

The ribbon tells a story

I want to draw your attention to some important charts:

BTC Difficulty Ribbon

Source: Glassnode

[Click to open in a new window]

The first is Glassnode’s BTC Difficulty Ribbon dating back to the advent of BTC.

When the multi-coloured ribbon compresses, mining becomes harder, meaning fewer newly minted coins hit the market.

Compression often signals various market tops, as you can see in the historical chart.

But look at what’s happened over the last three years. You can see two compressions, two tops, and now (as of Friday last week)? A widening of the ribbon.

BTC Difficulty Ribbon (Last 3 Years)

Source: Glassnode

[Click to open in a new window]

For me, this suggests we could be in for a potentially rocky spell over the next six months.

BTC is the lifeblood of the cryptocurrency market. Many traders and institutions leverage into altcoins against their BTC holdings.

When that gets chipped away, it creates ripple effects across the market as altcoin positions get deleveraged.

Reasons for optimism

Now, there are also reasons for optimism.

Total Value Locked in DeFi

Source: DeFiLlama

This chart shows Total Value Locked (TVL) across the Decentralized Finance (DeFi) world. It represents all the money tied up in decentralized finance.

I use this as a barometer of altcoin health.

You know, those ultra speculative coins most people have no idea about?

It’s been trending strongly for the last three years.

The US regulatory moves afoot

Here’s a big reason why I don’t think we’re heading into another crypto winter just yet.

The United States isn’t sitting idle. In July 2025, President Trump signed the GENIUS Act into law, creating the first comprehensive federal regulatory framework for stablecoins.

This matters enormously. The law requires dollar-backed stablecoins to be fully backed by US dollars and short-term Treasuries.

It legitimises stablecoins as formal components of the US financial system.

More importantly, it ensures global stablecoin adoption happens on American terms. Using sweet, sweet US dollars.

Then in March 2025, Trump established the Strategic Bitcoin Reserve via executive order. All government-held Bitcoin obtained through forfeiture will now be held as strategic reserve assets rather than sold.

The US government currently holds around 198,000 BTC. They’re not selling. They may even develop strategies to acquire more.

This is the US government explicitly backing crypto as a strategic asset. That’s a complete reversal from previous policy.

Not your father’s crypto winter

Remember the last crypto winter? The 2022 collapse?

That period was characterized by a particularly difficult regulatory environment. The SEC and CFTC were launching aggressive enforcement actions.

Regulators worldwide were scrambling to figure out how to handle crypto, mostly through punishment. The regulatory uncertainty was suffocating innovation.

This time is fundamentally different.

The US has passed major pieces of crypto legislation in 2025. The GENIUS Act for stablecoins. Regulatory frameworks for digital assets.

Together, these laws position crypto, particularly stablecoins, as instruments of dollar dominance rather than threats to the financial system.

JPMorgan, once led by a CEO (Mr. Jamie Dimon) who called Bitcoin a “hyped-up fraud,” is now allowing large investors to use Bitcoin and Ethereum as collateral for loans.

That’s institutional adoption at the highest levels.

Bitcoin’s fall from US$126,000 to below US$94,000 hurts. The next six months could be rocky.

But this isn’t 2022. The regulatory environment has flipped from hostile to supportive.

The US government has vested interests in crypto’s success now.

They’ve created frameworks to channel global stablecoin adoption through dollar-backed systems. They’re holding Bitcoin as a strategic reserve asset.

Meanwhile, BRICS nations are building alternative payment rails that will drive more demand for digital currencies.

So yes, we’re in a shakeout. Fear is elevated. Prices are falling.

But crypto winter?

For me, not yet.

The fundamentals have changed too much for that.

Maybe BTC will recede to say US$50K and stay there for a year a two.

I’ll happily eat humble pie.

Feel free to taunt me then.

However, if BTC rips on a US Fed Rate cut, I’ll also say:

“Told you so”

Such is the fate of a market analyst.

Have a good start to your week.

Best Wishes,

Lachlann Tierney,

Australian Small-Cap Investigator and Fat Tail Micro-Caps

***

Murray’s Chart of the Day – Silver

Source: TradingView

[Click to open in a new window]

Last weeks price action in precious metals was interesting, and I think it points to weakness ahead.

After a stellar run over the past year, silver is showing signs of fatigue.

Last week saw a sharp rally to retest the all-time high near US$55.00 hit in October.

But the sellers were waiting in the wings and a sharp reversal occurred late in the week.

That sets up a few lines in the sand worth watching as we move forward.

It won’t take much to negate my bearish view. All we would need to see is a weekly close above the all-time high and I will happily fall on my sword.

But until then I am leaning bearish and consider US$52.00-53.00 as a high risk spot where sellers should be waiting to pounce (current price is US$50.76).

A failure below the recent low near US$45.50 brings the 10-month EMA near US$40 into play.

The big picture can remain bullish, even if we see a correction of that magnitude.

Cryptos are under pressure and there are also signs of stress in US overnight lending markets.

The Fed met with large banks last week asking them why they weren’t tapping the Fed for money through the Standing Repo Facility (SRF).

As reported in the Financial Times:

New York Federal Reserve president John Williams convened a meeting with Wall Street dealers this week over a key short-term lending facility, underscoring officials’ concerns about strains in US money markets.

The hastily arranged meeting, which has not been previously reported, took place on the sidelines of the Fed’s annual Treasury market conference on Wednesday, according to three people familiar with the matter.

It comes at a time when banks, investors and officials are concerned about signs of stress in an arcane, but vital corner of the US financial system…

Lenders are often loath to use the facility, fearing that it could signal to the market that their institutions are under pressure even though names of borrowers are only made public two years after they tap the facility.

‘Repo is all about trust,’ said Thomas Simons, chief US economist at Jefferies. ‘If any borrower gets the reputation of being riskier, it creates this perverse incentive for all the lenders to pull back at once, even if it is not deserved . . . once you get the stink on you, it’s hard to recover,’ he said.

If there are strains in the plumbing of the financial system we may be headed towards a risk off event before the Fed is forced to step in and stop the rot.

Precious metals and crypto often fall in those situations as investors raise much needed cash levels.

Regards,

Murray Dawes,

Retirement Trader and International Stock Trader

The post Bitcoin’s Rocky Descent: Why This Isn’t Winter (Yet) appeared first on Fat Tail Daily.

daily.fattail.com.au (Article Sourced Website)

#Bitcoins #Rocky #Descent #Isnt #Winter