— CHORUS

‘Why does this fear hover at the threshold of my heart? – hungry for signs of the future, singing some prophetic song uninvited and unwelcome.’

— CASSANDRA

Deep down, the chorus must sense…

— BLAKE

Yes, deep down, the chorus too knows the future.

— Cassandra (scene 5)

In Greek mythology, Cassandra was blessed with the gift of prophecy. Then cursed so no one would believe her.

She saw Troy’s destruction coming. She warned about that wooden horse. She was ignored.

As the passage above explores, it wasn’t that people thought she was crazy. They resisted the ugly truth that would bring them pain.

The Chorus (all of us) struggles with society’s collective denial and that unease sitting in the pit of many stomachs.

It’s an apt tale for a market wrestling with fear and speculation.

And not totally new. Warren Buffett dubbed Michael Burry ‘Cassandra’ back in 2010.

A few years earlier, Burry made over US$800 million betting against the US housing market while everyone called him insane.

The story became a book, and then a film, ‘The Big Short’ — both are worth your time.

Source: Wikipedia

Fifteen years later, Cassandra Unchained as he now calls himself on x.com, has become active again. Issuing fresh warnings about big tech and AI.

This time, folks are a bit more receptive. But to the market, Cassandra’s warning is still ‘uninvited and unwelcome.’

Recent filings show his hedge fund liquidated its entire stock portfolio this year and placed multi-million-dollar shorts against big tech names like Palantir and Nvidia — betting they would fall.

Instead, those companies rose double-digits in just the last quarter alone.

Last week, Burry liquidated Scion Asset Management. Shuttering the whole operation.

He sent investors their money back with a simple message:

‘My estimation of value in securities is not now, and has not been for some time, in sync with the markets.’

Translation: I can’t fight this madness anymore.

For us, there’s a sage lesson here in the folly of trying to pick a top.

The Oracle Who Cried Wolf

Burry’s been calling tops since at least 2021.

‘Greatest speculative bubble of all time in all things.’ That was four years ago. The S&P 500 is up 65% since.

He shorted Tesla at about US$600. It hit US$1,200.

He warned about meme stocks. They kept doubling.

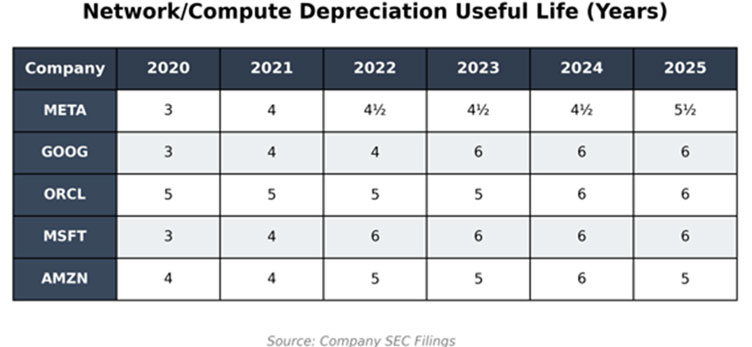

His latest crusade? Warning that Big Tech is cooking the books through depreciation tricks.

Claiming they’re overstating earnings by 20–30% by extending the useful life of AI chips that become obsolete in three years.

Source: Cassandra Unchained/x.com

He’s probably right.

This depreciation rate is something we’ve covered in the past at Fat Tail.

But here’s the thing: Being right doesn’t pay the bills.

Trying to pick a clear top can often leave you in the dust as the last leg of the run outperforms.

Shorting stocks is even more precarious. A stock’s price has no upper bound, so your potential losses have no limit.

‘Markets Can Stay Irrational

Longer Than You Can Stay Solvent’

That Keynes quote has rarely felt more relevant.

Burry spent years fighting the tape. Shorting Nvidia. Betting against Palantir. Warning about AI mania while both stocks went parabolic.

Here’s what kills me about Burry’s exit.

He’s probably right about the big picture. The concentration risk is insane. The accounting is sketchy. The AI spending is unsustainable.

JP Morgan estimates data centres will need US$3 trillion in investment by 2029. For chips that depreciate faster than your iPhone.

Microsoft, Google, and Meta are all extending depreciation schedules on equipment that Nvidia’s CEO jokes will be worthless when the next model ships.

It’s dot-com accounting all over again.

But the market doesn’t care about your spreadsheets. Or your fundamental analysis. Or your historical precedents.

The market cares about one thing: flows.

And right now, tens of billions of dollars a week flow into passive index funds that automatically buy more Apple, Microsoft, and Nvidia shares regardless of price.

Why Even Cassandra Goes Silent

Think about Burry’s position.

He saw the housing bubble in 2005. Waited three years bleeding premiums before vindication.

But that was different. Housing had catalysts. Subprime defaults. Clear triggers.

This bubble? It feeds on itself.

Every pension fund needs returns. Every index fund needs to match benchmarks. Every advisor needs to show clients they own the winners.

The more overvalued tech gets, the bigger its index weight. The bigger the weight, the more passive money floods in. The more money floods in, the higher prices go.

It’s a perpetual motion machine until it’s not.

For you, Burry’s capitulation should be sobering.

Our super funds are stuffed with US tech exposure. Our retail investors pile into these indexes and ETFs. We’re all riding this bubble whether we admit it or not.

But if one of the greatest short sellers just threw in the towel, what chance do you have of timing the top?

The depreciation issues Burry flagged are real. The concentration risk is heightened. Apple, Microsoft, and Nvidia account for 18% of the entire US market.

When this unwinds, the carnage will be spectacular.

But it might not unwind for some time.

We’ve seen markets wobble this past fortnight and fall hard again late this week.

The Fear and Greed index has fallen back to ‘Extreme Fear’.

For now, both the US and Australian markets have dialled back expectations of interest rate cuts.

This is hardly the blow-off top moment that you tend to see in sector-specific bubbles.

The Uncomfortable Truth

Burry’s liquidation letter said he’s on to ‘better things.’

My guess is he’s going to keep shorting this market with his own money.

No investors to answer to. No redemptions to manage. No monthly statements showing underperformance.

He knows he’s right. He just can’t afford to prove it with others’ money anymore.

That’s the curse of the modern Cassandra. You can see the disaster coming. You can warn everyone.

But if you bet against the madness, you’ll go broke before you’re proven right.

The market’s message to Burry, and to anyone else fighting this tide, is brutally simple:

We can stay irrational longer than you can stay solvent.

Even if you’re the guy who called 2008.

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

The post Cassandra Goes Unheard appeared first on Fat Tail Daily.

daily.fattail.com.au (Article Sourced Website)

#Cassandra #Unheard