PJM’s power market is a high-stakes arena of volatility and opportunity. With Enverus Short-Term P&R Forecast now expanded to PJM, market participants gain a powerful edge through automated production cost modeling, congestion decomposition and fundamental forecasts, delivering transparent, physics-based insights to conquer PJM’s complexity. In this blog, we explore PJM’s unique dynamics and show how our Short-Term P&R Forecast empowers traders, utilities, and grid operators to stay ahead.

Understanding Power Market Dynamics

Power markets like PJM are complex systems driven by a mix of physical, economic and operational factors. Operating across a vast region with diverse stakeholders, these markets present unique challenges managing grid forecasting for prices and congestion. Key drivers of volatility include:

- Generation variability: Power plants cycle on and off due to maintenance, fuel availability, or economic decisions, leading to price fluctuations.

- Transmission dynamics: Grid interconnections face constraints from outages—planned or unexpected—requiring redispatch that can significantly impact congestion costs.

- Renewable integration: Intermittent sources like wind and solar introduce rapid changes in supply, affecting grid stability and prices.

- Demand fluctuations: Weather patterns, seasonal changes, and varying consumption patterns reshape load profiles.

- Fuel price volatility: Shifts in fuel costs, such as natural gas price surges, can alter generation economics and market outcomes.

- Ancillary services: Requirements for reserves and regulation services adjust dynamically to maintain grid reliability, influencing prices.

If traders are using a purely statistical model, they can spot patterns, but they can’t “think” like a control room.

The Value of Short-Term P&R Forecast in PJM

Navigating PJM’s volatility requires a robust, transparent, and automated grid forecasting solution. Our Short-Term P&R Forecast stands out with three key differentiators that empower PJM market participants to make informed decisions:

1. Automated Production Cost Modeling

Enverus leverages more than 20 years of market expertise and proven technology to deliver an automated production cost modeling system. This system regenerates high-quality inputs multiple times a day, ensuring forecasts reflect the latest market conditions without requiring extensive IT resources or specialized expertise.

2. Congestion Decomposition

Our P&R Forecast provides detailed decomposition reports that break down forecasts into their fundamental elements, revealing the key drivers of congestion and price volatility. Unlike traditional machine learning approaches, which often lack transparency, our platform offers clear insights into what’s driving market outcomes in PJM to help users make better decisions.

3. Fundamental Forecasts

P&R Forecast uses a fundamentals-based approach to simulate PJM’s grid, modeling the physics of power flow and market operations. By solving a mixed-integer optimization problem—balancing generation costs, transmission limits, energy balance, and ancillary service requirements—we produce transparent, supported results. This method allows users to easily identify the factors driving prices at specific nodes, such as congestion costs or resistive losses, allowing traders and asset managers to make more confident decisions.

A Peek Under the Hood: A Physics-Based Engine

At its core, running the electric grid is nothing more than solving a big mixed‑integer optimization problem. The objective of the engine is to pick the combination of generators that meets demand at the lowest total cost. It works within the following constraints:

- Energy balance: Total generation must equal total load.

- Transmission limits: Power flowing through any line can’t exceed its rating.

- Unit operating rules: Power plants must adhere to constraints like minimum run times, ramp rates, start‑up costs, maximum capacity and minimum load.

- Ancillary service requirement: System must meet needs for regulation up, regulation down, non-spinning reserves and other reliability services.

Penalties if the engine can’t satisfy everything perfectly, say a line overloads after a contingency or a reserve requirement, it’s allowed to “bend” a rule, but only by paying a stiff penalty in the objective function. That economic pressure nudges the model to find the least‑cost trade‑off while still honoring physics and reliability.

The locational marginal price (LMP) isn’t an input: it’s what the optimization outputs. Think of it as the “receipt” for the very last, and most expensive, megawatt needed to keep the lights on. The LMP is made up of three key parts:

- Energy cost: The price of producing one more megawatt of power from the next available plant.

- Congestion cost: The extra cost when adding a megawatt causes crowding on power lines, based on how much those lines are used.

- Loss cost: The cost of energy lost as heat when a megawatt travels through lines, requiring extra power to make up for it.

Powered by High-Quality Data

Accurate forecasts start with reliable data. Our Short-Term P&R Forecast platform pulls together a comprehensive set of information tailored to PJM’s market, ensuring our predictions reflect real-world conditions. We combine the following key data sources to power our models:

- Hourly demand forecasts: Precise predictions of electricity needs across PJM’s region.

- Wind and solar outlooks: Detailed forecasts for renewable energy production at individual plants.

- Transmission network updates: Real-time data on the grid’s structure, including outages.

- Generator operating status: Current information on power plant performance, powered by our engine.

- Ancillary service needs: Up-to-date requirements for reserves and reliability services, like regulation and spinning reserves.

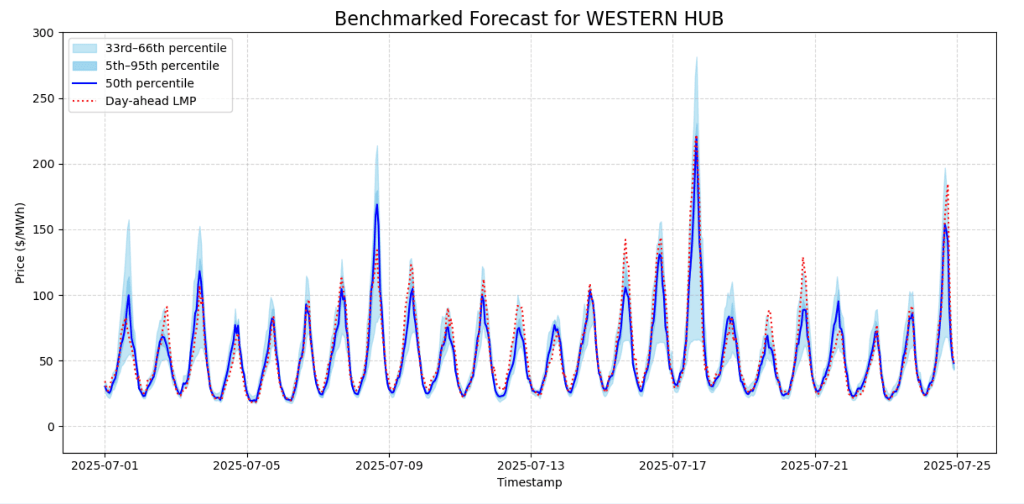

These data streams feed seamlessly into Mosaic, our user-friendly application. Traders gain access to intuitive tools like constraint-flow charts, generation versus demand breakdowns, and clear price trend visuals, such as those shown in our PJM congestion forecasts below.

Why P&R Forecast Is Essential for PJM Participants

PJM’s market is a high-stakes environment where precision is critical. Our Short-Term P&R Forecast equips participants with automated, transparent and physics-based insights to anticipate price spikes, manage congestion and capitalize on opportunities. Whether you’re a trader optimizing bids, a utility managing load or a grid operator ensuring reliability, our platform’s key differentiators—automated production cost modeling, congestion decomposition and fundamental forecasts—deliver the clarity to succeed in PJM.

Ready to unlock the full potential of PJM’s market with P&R Forecast? Contact us today to learn more.

About Enverus Power and Renewables

With a 15-year head start in renewables and grid intelligence, real-time grid optimization to the node and unparalleled expertise in load forecasting that has outperformed the ISO forecasts, Enverus Power and Renewables is uniquely positioned to support all power insight needs and data-driven decision making. More than 6,000 businesses, including 1,000+ in electric power markets, rely on our solutions daily.

www.enverus.com (Article Sourced Website)

#NextLevel #Grid #Forecasting #PJM