If you’re a gold enthusiast like me, you’re probably feeling like you’re on top of the world.

Gold is breaking new records at an astounding pace.

Let’s look back at gold’s major milestones in recent years:

AU$2,000 in June 2019 (a month before my son Cyrus was born)

AU$2,500 in February 2020

AU$3,000 in March 2023

AU$3,500 in April 2024

AU$4,000 in October 2024

AU$4,500 in February 2025

AU$5,000 in April 2025

AU$5,500 in September 2025

We’re currently at around AU$5,700. It’s quite astounding when you look at it.

Gold’s astounding moves have led to gold stocks breaking out, with producers and larger gold mining companies delivering a windfall over the past 18 months. On the smaller end of town, a handful of explorers and early-stage developers are similarly catching fire and joining the parabolic move up.

The ASX Gold Index [ASX:XGD] closed at 15,585.7 points yesterday. It’s up by over 85% since the start of the year. Since the start of 2023, you can see the index rise by over 150%:

Source: Refinitiv Eikon

[Click to open in a new window]

Gold assets are all the rage right now. Even mainstream financial news that usually disparage and disregard the yellow metal are now covering it regularly.

How different is the market’s attitude to gold today than three years ago!

If you were a gold enthusiast like I am, you may still remember how gold was trading at around US$1,650 (~AU$2,500) an ounce. That wasn’t a low price by any measure. However, it was down by around 20% from the peak in August 2020.

Fast forward three years, and things are almost in reverse.

Talk about the tide turning! That’s the nature of commodity investing!

Chasing the gold bull market might seem tempting given that it’s in the headlines. There may still be opportunities to exploit the momentum.

However, let me show you a better way to invest.

Exploiting the vast riches of our land

Our country boasts immense wealth—gold, iron ore, copper, zinc, uranium, coal, and many other commodities. We rank in the top five for many materials, and we should be proud of it.

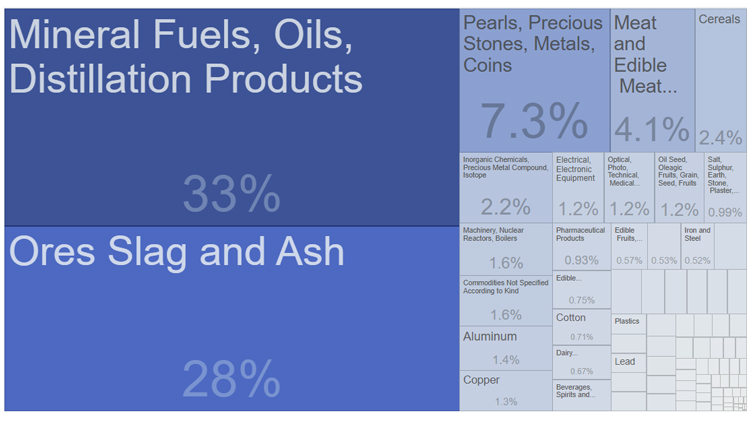

It’s hard for Australians to ignore commodity and mining assets. Mining comprises around 12% of our GDP. Moreover, it’s the most essential goods that we trade with the rest of the world. Based on Trading Economics, this is the breakdown of Australian exports by category in 2024:

Source: TradingEconomics

[Click to open in a new window]

Notice how commodities comprise around 70% of what we export. Don’t forget that we consume some of what we extract, too!

People rightly claim that commodities are limited in supply and scarce resources. However, Australia still boasts new discoveries of deposits cropping up in unexplored territory. This is in addition to the formidable, undeveloped resources dotted across our vast continent.

For this reason, many investors looking to generate outperforming returns will delve into commodity assets. They want to follow some of the country’s richest people who made their fortunes investing in commodities. Think of billionaires like Gina Rinehart from the Hancock mining empire, Andrew Forrest of Fortescue Mining [ASX:FMG], Chris Ellison of Mineral Resources [ASX:MIN], and the mercurial Clive Palmer, among others.

It’s easy to dream about wanting to be like one of them. However, the qualities and luck needed mean many who try to live out this dream end up caught in a nightmare if they’re not careful.

The secrets to successful commodity investing

Successful commodity investors are harder to come by than you can imagine. There are many factors that distinguish the successful ones from those who burn themselves trying. I believe it takes a combination of right timing, stock selection and discipline.

I may be simplifying this but grasping what this means could turn the game in your favour.

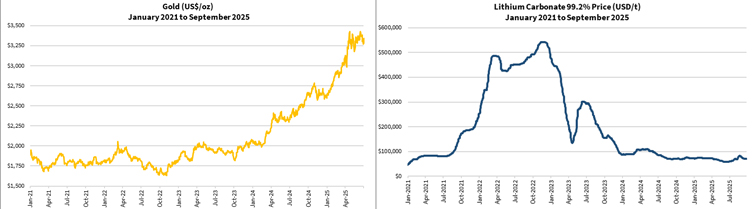

Let’s look at gold and lithium for example.

Here are their prices since 2021:

Source: Refinitiv Eikon

[Click to open in a new window]

Today gold is probably the hottest commodity, or at least one of the most popular. Meanwhile, lithium is slowly finding favour after experiencing a horrific two years when the bull market turned into a burning trainwreck.

It was literally the reverse three years ago. Gold was stuck in a narrow trend, coming off its highs after the Wuhan virus outbreak ravaged the world.

Investors pursued The Green Agenda and electrification. Lithium became the darling commodity, along with nickel, cobalt, copper, and rare earth elements.

Gradually the bubble in these critical minerals burst. The world realised that massive spending into renewable energy only increased its share of total energy output by a less than 5%. Fossil fuels, while demonised and sidelined in a ham-fisted fashion by foolish bureaucrats, continued to power much of the world. It will continue this way for much longer given the slow pace in transforming our power grid and developing nations continuing to favour cheaper energy sources.

The magnitude of the plunge in the price of lithium is perhaps outdone by the failure of the Green Agenda visionaries that pushed it on the world. Their track record of failed predictions, grandiose theories and dogged insistence to implement this to society’s detriment earned them scathing ridicule.

A friend circulated this meme to me yesterday that might squeeze a chuckle out of you:

Many investors who bought into the inevitability of this transformation felt the burn. Remember Galan Lithium [ASX:GLN] and Lake Resources [ASX:LKE] that soared to giddy levels? They plunged back to earth and turned many investors’ massive gains into losses. It’s natural for many to hold on in the hope they’d keep rallying. They forgot or didn’t want to take profits on the way up.

Getting ahead of the crowd to win

Could that happen to gold investors? Most certainly.

As a precious metals bull, I’ll say it as I see it. I have a feeling that the damage sustained by gold stock enthusiasts may outweigh that of the critical minerals bulls. That’s because gold is not just an investment, but a belief. The belief that we live in a flawed system with phony money breeding corrupt leaders.

Gold continues to shine now. It could for a while longer as the rate cut cycle lingers.

However, I believe that it’s important to remember how successful commodity investors make and keep their wins. They recognise the cycle, identify the right assets to trade, and don’t overstay their welcome.

If this resonates with you, let me introduce to you my colleague, James Cooper. He currently guides many Australian investors to exploit opportunities BEFORE the crowd finds out. As a geologist with experience in Australia and Africa, he combines the ability to review mine assets with analysing a company’s financial potential.

He’s recently presented his views on why some unloved commodities may be setting up for a comeback. Why not check out his presentation here and consider signing up to his newsletter, Diggers and Drillers?

God Bless,

Brian Chu,

Gold Stock Pro and The Australian Gold Report

The post How to master commodity investing appeared first on Fat Tail Daily.

daily.fattail.com.au (Article Sourced Website)

#master #commodity #investing