My latest head-to-head test pits two very different philosophies against each other: Trade Ideas is built for AI-driven real-time trade signals and automation, while FinViz focuses on blazing-fast visual screening and heatmaps.

Trade Ideas vs. Finviz Ratings

In my testing, Trade Ideas scores 4.7/5.0 and Finviz scores 4.3/5.0. Trade Ideas stands out with AI-generated, real-time trade signals, integrated backtesting, and automation, while Finviz excels in visual screening, heatmaps, and no-code backtesting in its Elite plan.

Trade Ideas: 22%-28% Discounts Live

☆ 28% Discount – Save Up To $912 On Premium Plans – Code: TRADEWORK28 ☆

☆ 22% Discount – Save Up To $456 On Basic Plans – Code: TRADEWORK22 ☆

Deal Ends In:

🏅Verdict: Trade Ideas vs. Finviz

Trade Ideas is ideal for active day traders who require real-time AI ideas, backtesting, and optional auto-trading capabilities. Its Holly AI engine, institutional-grade scanning, and Brokerage Plus automation justify the premium if you trade US stocks intraday.

FinViz wins for investors and swing traders who want a fast, mostly free way to filter markets, visualize leadership, and analyze sectors. FinViz Elite offers point-and-click backtesting and real-time data, but does not provide live trading capabilities.

Bottom line: If you live and breathe intraday setups, choose Trade Ideas. If you value speedy screening, heatmaps, and a generous free tier, choose FinViz.

Trade Ideas Screenhots

⚡Features

Trade Ideas is unapologetically US-equity, intraday, and execution-centric; the entire workflow assumes you want actionable alerts now. FinViz is a US-market research cockpit built for speed, clarity, and visual context; you slice the market instantly, spot leadership at a glance, and move watchlists forward.

Put plainly, Trade Ideas is designed to push you into trades with AI-assisted timing, whereas FinViz is designed to help you survey the battlefield and choose targets fast.

💸 Pricing

Trade Ideas’ Basic Plan costs $127/mo or $89/mo on an annual plan. It includes a live trading room, broker integration, streaming trade ideas, paper trading, and powerful scanning and charting. It excludes auto-trading and AI trading signals.

Although Trade Ideas Standard costs $127 per month, you can save $456 with an annual subscription, which costs $1,068 —a 25% discount.

The Premium Plan costs $254/mo or $178/mo on an annual plan, and adds AI trading signals, backtesting, customization, and auto trading. Trade Ideas Premium costs $254 per month, but you can save $912 by purchasing an annual subscription for $2136, a 25% discount.

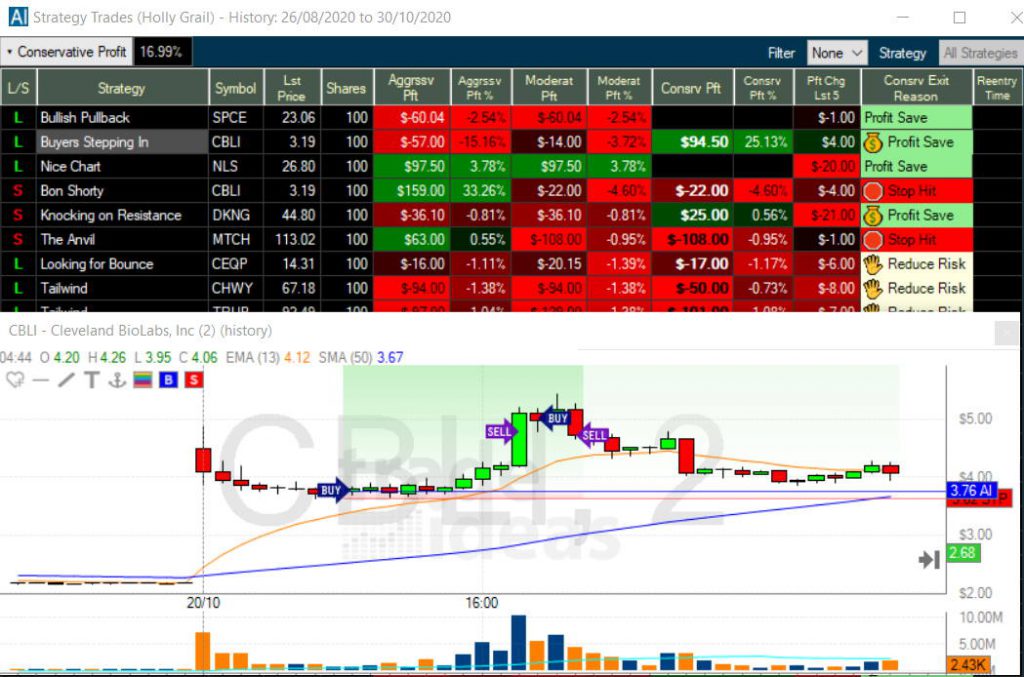

Premium adds Trade Ideas’ “1st Gen AI Signals” (Holly) on top of everything in Basic, plus backtesting, Smart Risk Levels, the Channel Bar’s curated templates, and the RBI/GBI windows for popular intraday setups. Holly delivers ready-to-use trade ideas with defined entries and exits in real-time.

Finviz’s Free Plan is ad-supported but provides great value for beginner investors. You can scan and screen over 10,000 stocks and utilize delayed charts, heatmaps, and a news stream. The free plan is ideal for beginner investors who want to explore the markets without any fuss.

The real power of Finviz is unleashed with the Elite Plan. It adds real-time data, flexible charts, alerts, excellent backtesting, and correlation charts. You can also export your screener results and access eight years of company financial statements. Elite is extremely cost-effective at $39.99/m or $24.96/m on an annual plan, saving you 37%.

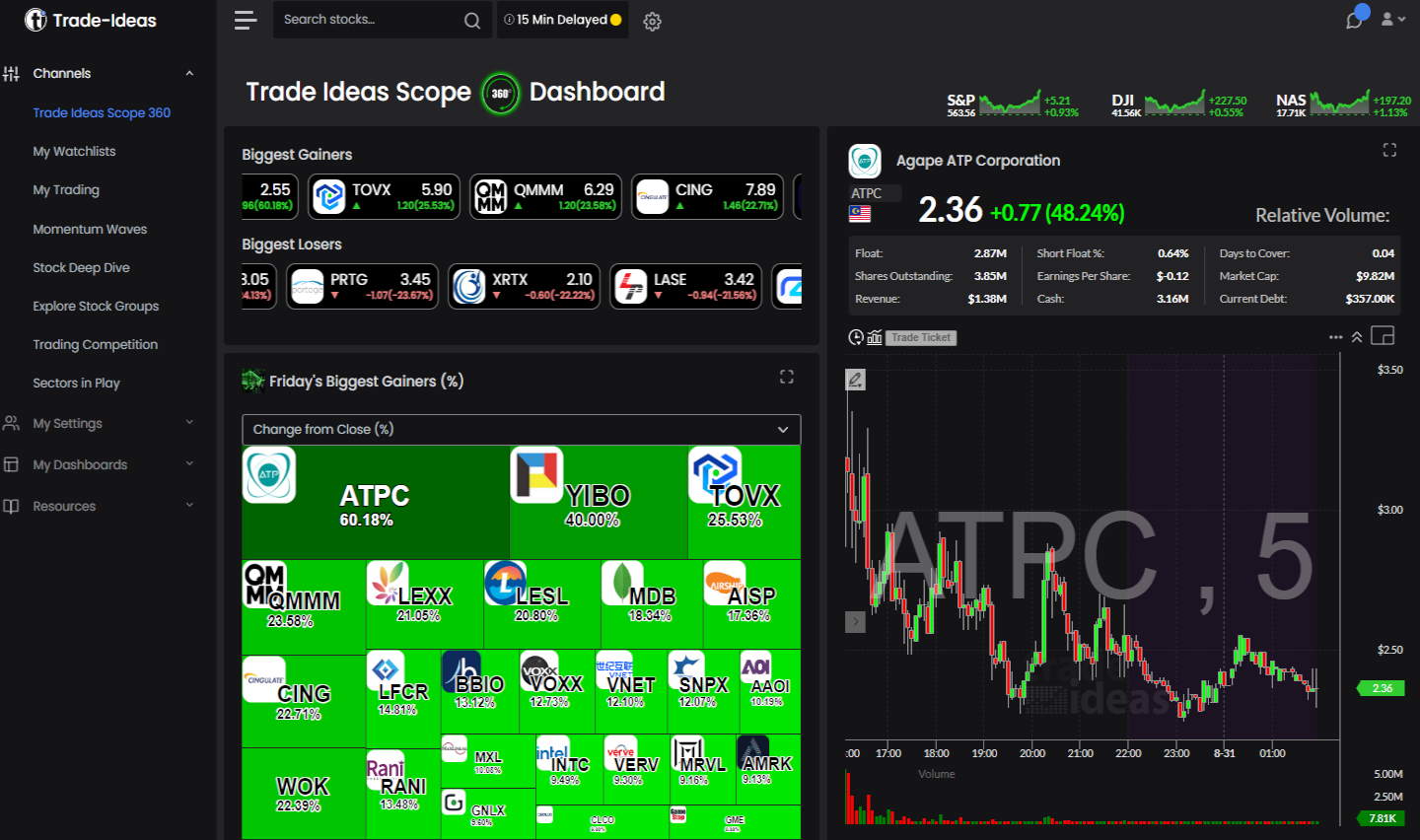

📡 Screening & Scanning

Trade Ideas emphasizes real-time, idea-generating scans—gaps, breaks, volume spikes, and predictive setups stream into channels that are ready for execution. Finviz emphasizes instant visual filtering—dozens of fundamental, technical, and descriptive filters collapse into readable tables, charts, and heat maps. If your priority is intraday signal firepower, Trade Ideas is stronger; if your priority is fast, intuitive market triage, FinViz is faster to value.

Finviz Screenhots

On volatile days, Trade Ideas’ scans prioritize immediacy—volume spikes, breakouts, and statistically favored patterns feed real-time alerts. FinViz’s workflow prioritizes overview—which sectors lead, which factors dominate, and which tickers pass your multi-filter screen. In practice, Trade Ideas is better for momentum hunters, while FinViz is better for general analysis.

🚦AI Signals & Automation

Trade Ideas provides AI strategies (Holly) that evaluate market conditions and surface buy/sell ideas, including entries and exits. Brokerage Plus allows you to semi- or fully automate chosen strategies with risk controls.

FinViz provides no AI signals and no automation. If you want the platform to tell you when and how to act—and even place the trades for you under your rules—Trade Ideas has it, while FinViz does not.

Trade Ideas streams real-time alerts tied to AI, patterns, and custom criteria, and those alerts are designed to push you toward action during market hours. FinViz Elite provides alerts on watchlists and conditions, supporting swing and position workflows rather than high-frequency decision-making. Put simply, Trade Ideas is better at alerting you to trades, whereas FinViz is better at alerting you to research targets.

Trade Ideas’ Holly engines continually evaluate market context to surface statistically informed ideas, including entries, exits, and risk guidelines. The practical benefit is timing: the platform helps you act when conditions align rather than hunt for setups after the fact. If you’ve struggled to keep up with fast markets manually, the AI layer can free you to focus on execution under a clear plan.

🔍 Backtesting

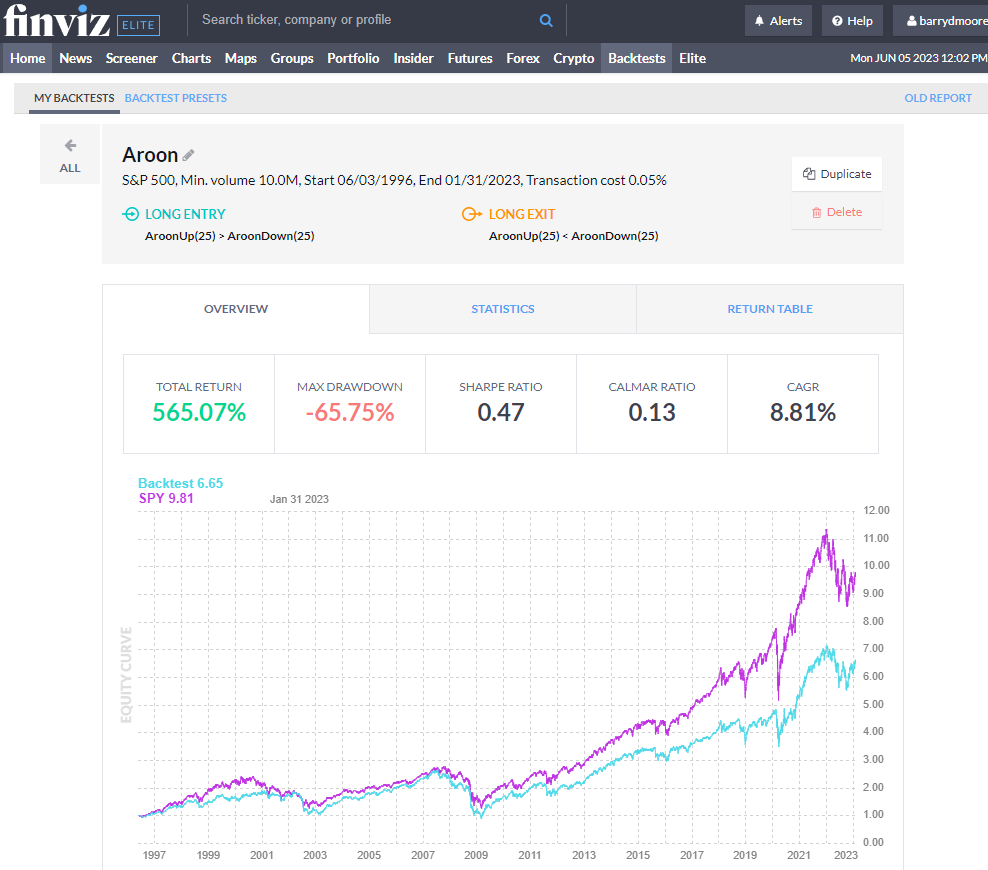

Trade Ideas integrates robust backtesting directly into its strategy loop so you can idea → test → deploy with minimal friction. FinViz Elite offers no-code, point-and-click backtesting across major US universes, making it ideal for quickly validating hypotheses and ranking simple rules without writing a single line of code. In short, Trade Ideas is better suited for strategy-to-automation workflows, whereas FinViz Elite is more suitable for rapid, bulk hypothesis testing.

Trade Ideas ties backtesting directly to strategies, which means you can iterate and deploy without jumping tools; if a configuration shows promise, you can hand it off to automation. FinViz Elite, by contrast, is ideal for rapid hypothesis checks—rank rules, compare variants, and assess robustness in minutes. Trade Ideas is better if you want research that feeds straight into execution, whereas FinViz is better if you want broad, quick validation without coding.

📈 Charts & Pattern Recognition

Trade Ideas offers capable charts that dovetail with its scans and alerts; they’re efficient and execution-oriented rather than artistically elaborate. FinViz has significantly improved charts and added pattern recognition in Elite, making it a credible choice for technicians who want screen-to-chart continuity.

If you want charting as a command center, neither replaces a full charting workstation, but FinViz has closed the gap for research, while Trade Ideas remains focused on trade timing.

🤖 Auto-Trading & Broker Connectivity

Trade Ideas integrates with brokers via Brokerage Plus so you can submit, manage, and automate orders—a pivotal advantage if you’re day trading with rules. Finviz has no direct broker trading; you research in Finviz and execute trades elsewhere. That single sentence summarizes a decisive difference: Trade Ideas is a signal-to-execution machine, whereas FinViz is a research dashboard.

Trade Ideas integrates broker connectivity and automation, so your workflow can be streamlined from signal to order, all under risk controls you define. FinViz does not connect to brokers, so your workflow is research → broker platform. If you need hands-off or rules-based execution, Trade Ideas is built for it; if you simply need to decide what to trade, FinViz is sufficient.

📰 News, Social & Community

Trade Ideas operates a live trading room that orients users around intraday setups; it is community-adjacent but not a social network. FinViz aggregates news, insider data, and ownership efficiently, but it does not include a social community. If you want real-time group focus on trading, Trade Ideas has a modest edge; if you want fast context with headlines, FinViz keeps things clean and quick.

📱Mobile, Speed & Usability

Trade Ideas is desktop-centric, with a learning curve; power users love the depth once channels, filters, and automation are set up. FinViz is immediately fast and clean; even first-time users get results in minutes. If you value tunable depth, Trade Ideas pays off; if you value instant clarity, FinViz feels effortless.

Comparison Table: Feature Snapshot

| Feature | Trade Ideas | FinViz |

|---|---|---|

| Focus | AI signals, day trading, automation | Fast screening, heatmaps, research |

| AI & Signals | Real-time AI strategies with entries/exits | None |

| Automation | Brokerage Plus auto-trading | None |

| Backtesting | Integrated, strategy-driven | No-code, point-and-click (Elite) |

| Screening | Intraday scans & channels | Lightning-fast visual screener |

| Charts | Execution-centric, efficient | Improved charts; patterns (Elite) |

| News/Social | Live trading room; not social | News aggregation; no community |

| Broker Trading | Yes | No |

| Price/Entry | Premium | Free tier + paid Elite |

| Best For | Day traders, scalpers | Investors, swing traders, researchers |

Popular Alternatives

TradingView is the better choice if you want global markets, a social community, and scriptable indicators; it’s a social-charting ecosystem. For US day-trading AI and automation, Trade Ideas maintains the edge.

TrendSpider excels in powerful AI, automated technical analysis, and multi-timeframe pattern detection; if you prioritize automated charting over AI signals, TrendSpider is compelling. For AI signals and execution, Trade Ideas remains the stronger option.

Who Should Choose Trade Ideas?

Pick Trade Ideas if you trade intraday and want AI-assisted entries/exits with the option to automate your playbook. The platform enables you to move from signal to test to execution faster than manual workflows, and the live trading room keeps you aligned with the day’s highest-probability themes. The cost only makes sense if you actually use the stack—run scans, validate edges, and execute with discipline.

Watch-outs:

- Learning curve: the UI is built for power users.

- It’s US-equities-centric, not a global, social charting network.

Who Should Choose FinViz?

Pick FinViz (Free or Elite) if you want instant market triage—heatmaps for leadership, groups for rotation, and filters for discovery—without the complexity of an automation suite. Elite’s no-code backtesting helps you sanity-check simple rules across large universes, and real-time data plus alerts give swing traders everything they need to move from idea to plan efficiently.

Watch-outs:

- No live trading or social community.

- While charts have improved, it’s not a full-blown charting workstation.

Pros and Cons in Plain English

Trade Ideas—What you’ll like: AI signals tailored to intraday trading; integrated backtesting that shortens the cycle from idea to action; and Brokerage Plus for semi- or full automation. What to watch: premium pricing and a learning curve; charts are functional rather than luxurious.

FinViz—What you’ll like: a fast, intuitive screener and heatmaps that make market context obvious; Elite adds real-time data, alerts, pattern recognition, and no-code backtesting. What to watch: no direct trading or social community; while charts have been significantly improved, the platform remains research-first.

My Recommendations by Use Case

- Full-time day trader (US stocks): Trade Ideas—leverage AI, backtesting, and automation to compress the loop between discovery and execution.

- Part-time swing trader/investor: FinViz Elite—enjoy fast screening, no-code backtesting, and real-time data without the overhead of an automation stack.

- New to market screening: Start with FinViz Free to learn filters and build watchlists; if you later need intraday signals and automation, graduate to Trade Ideas.

Final Verdict

Both platforms are excellent—they just serve different needs. Choose Trade Ideas if your goal is to generate intraday alpha from AI signals, with the option to automate your rules. That’s why it earns 4.7/5.0 in my testing.

Choose FinViz if you want a fast, visual, and affordable way to screen markets, with Elite unlocking no-code backtesting and real-time data. That’s why it earns 4.3/5.0 in my testing.

In short, Trade Ideas is your AI co-pilot for day trading, while FinViz is your market radar for research and swing decisions.

Methodology, Ratings & Transparency

All ratings reflect hands-on testing and the standardized scoring criteria I use across platform reviews, including pricing value, software depth, trading and broker support, screening, news/social, charts, backtesting, pattern recognition, and overall usability. I re-test tools and update scores to keep comparisons current.

www.liberatedstocktrader.com (Article Sourced Website)

#Test #Trade #Ideas #FinViz #Heres #2025s #Winner