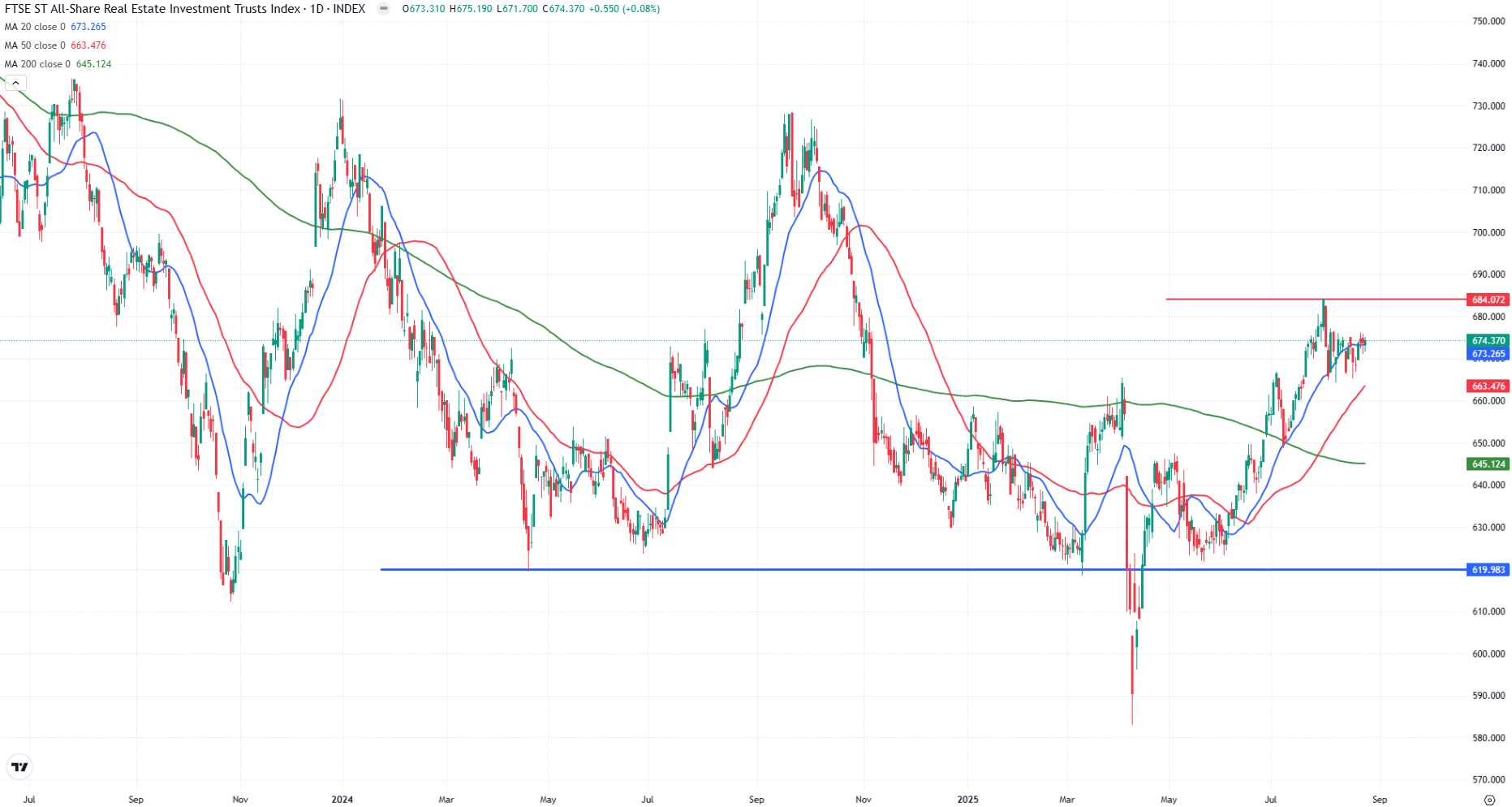

Technical Analysis of FTSE ST REIT Index (FSTAS351020)

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) increased from 660.49 to 674.37 (2.10%) compared to last month’s update. The index has recovered steadily since the April low, and is now consolidating just below the 684 level (previous high attained on 30 July). The 200D SMA is mostly reversed, suggesting improved market sentiment. Resistance around 675–680 has been for the past one month; a breakout above this zone could pave the way toward 700. The 50D SMA (663) and the 200D SMA (645) provide immediate support. Stronger support remains at 620, tested multiple times in 2024–2025.

- Short-term direction: Sideways

- Medium-term direction: Up

- Long-term direction: Sideways

- Immediate Support: 50D SMA, 200D SMA

- Immediate Resistance: 684

FTSE REIT Index Chart (2 years)

Previous chart on FTSE ST REIT index can be found in the last post: Singapore REIT Fundamental Comparison Table on July 17th, 2025.

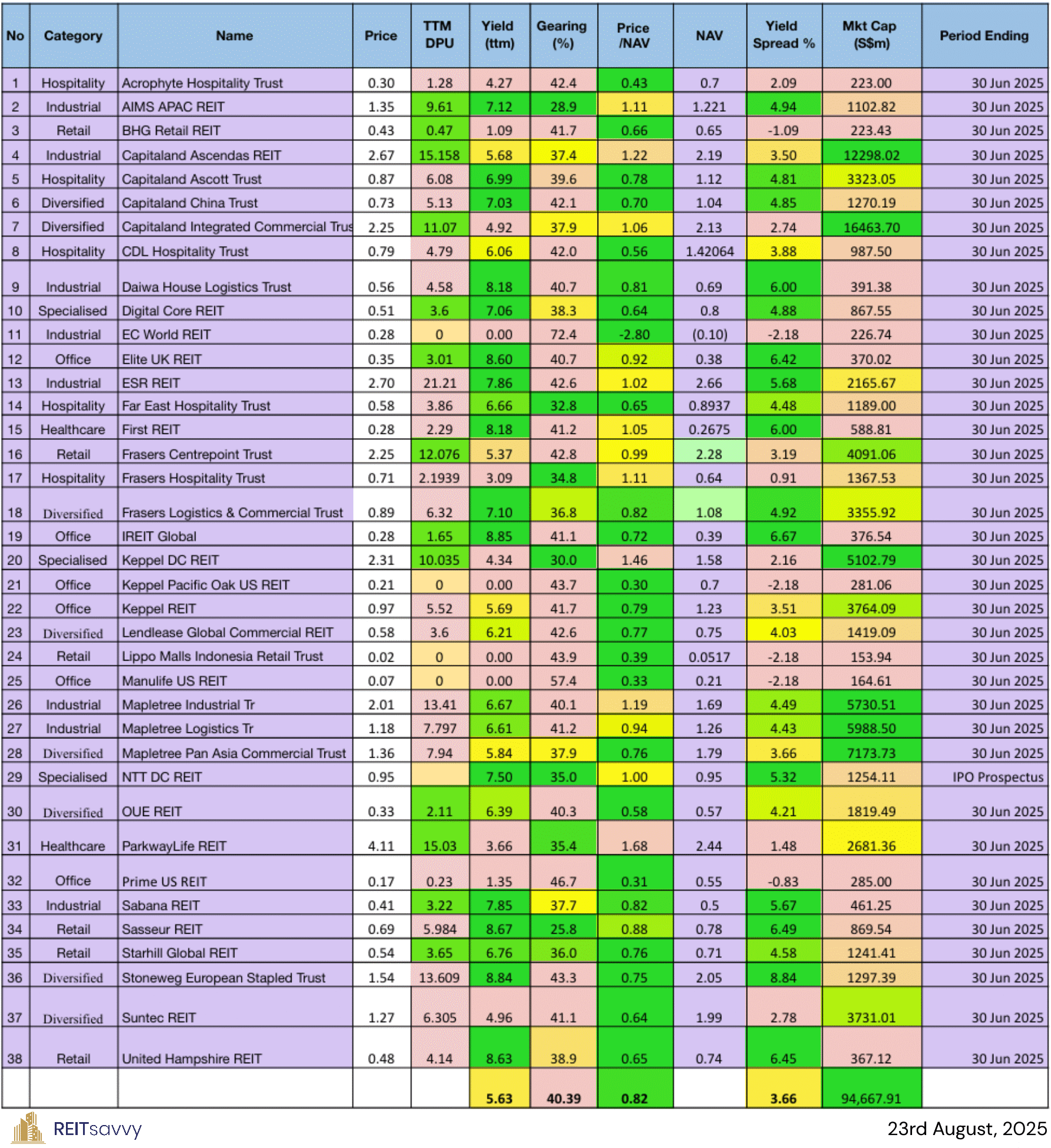

Fundamental Analysis of 38 Singapore REITs

The following is the compilation of 38 Singapore REITs with colour-coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio.

- The Financial Ratios are based on past data and these are lagging indicators.

- All REITs have the latest Q2 2025 values.

- I have introduced weighted average (weighted by market cap) to the financial ratios, in addition to the existing simple average ratios. This is another perspective where smaller market cap REITs do not disproportionately affect the average ratios. As of May 2025, I have removed EC World REIT from these calculations.

- Listed on 14th July, NTT DC REIT is now included in the calculations.

Data from REITsavvy Screener. https://screener.reitsavvy.com/

What does each Column mean?

- FY DPU: If Green, FY DPU for the recent 4 Quarters is higher than that of the preceding 4 Quarters. If Lower, it is Red.

- Yield (ttm): Yield, calculated by DPU (trailing twelve months) and Current Price as of August 22th, 2025.

- Gearing (%): Leverage Ratio.

- Price/NAV: Price to Book Value. Formula: Current Price over Net Asset Value per Unit.

- Yield Spread (%): REIT yield (ttm) reference to Gov Bond Yields. REITs are referenced to SG Gov Bond Yield.

As of May 2024, all REITs’ Yield Spread will be referenced to SG Gov Bond Yields, regardless of trading currency.

Price/NAV Ratios Overview

- Price/NAV increased to 0.82 (Weighted Average: 0.97)

- Increased from 0.78 from July 2025.

- Singapore Overall REIT sector is slightly undervalued

- Most overvalued REITs (based on Price/NAV)

ParkwayLife REIT 1.68 Keppel DC REIT 1.46 Capitaland Ascendas REIT 1.22 Mapletree Industrial Tr 1.19 Frasers Hospitality Trust 1.11 AIMS APAC REIT 1.11 EC World REIT is currently suspended and has a N.M P/NAV value.

- Most undervalued REITs (based on Price/NAV)

Keppel Pacific Oak US REIT 0.30 Prime US REIT 0.31 Manulife US REIT 0.33 Lippo Malls Indonesia Retail Trust 0.39 Acrophyte Hospitality Trust 0.43 CDL Hospitality Trust 0.56

Distribution Yields Overview

- TTM Distribution Yield decreased to 5.63%. (Weighted Average decreased to 5.58%)

- Decreased from 5.86% in July 2025. (Weighted Average was 5.74%)

- 14 of 37 Singapore REITs have ttm distribution yields of above 7%.

- Highest Distribution Yield REITs (ttm)

IREIT Global 8.85 Stoneweg European Stapled Trust 8.84 Sasseur REIT 8.67 United Hampshire REIT 8.63 Elite UK REIT 8.60 Daiwa House Logistics Trust 8.18 Reminder that these yield numbers are based on current prices.

- Some REITs opted for semi-annual reporting and thus no quarterly DPU was announced.

- A High Yield should not be the sole ratio to look for when choosing a REIT to invest in.

- Yield Spread tightened to 3.66%. (Weighted Average widened to 3.93%)

- Tightened from 3.90% in July 2025. (Weighted Average was 3.70%)

- From May 2024 onwards, all my yield spread measurements are now in relation to SG Gov Bond Yields, no longer a mix with US Gov Bond Yields.

Gearing Ratios Overview

- Gearing Ratio increased to 40.39%. (Weighted Average: 37.81%)

- Increased from 39.91% in July 2025. (Weighted Average: 37.88%)

- Gearing Ratios are updated quarterly. All values are based on the most recent Q2 2025 updates.

- S-REITs Gearing Ratio has been on a steady uptrend. It was 35.55% in Q4 2019.

- Highest Gearing Ratio REITs

EC World REIT 72.4 Manulife US REIT 57.4 Prime US REIT 46.7 Lippo Malls Indonesia Retail Trust 43.9 Keppel Pacific Oak US REIT 43.7 Stoneweg European Stapled Trust 43.3 MUST and EC World REIT’s gearing ratio has exceeded MAS’s gearing limit of 50%. However, the aggregate leverage limit is not considered to be breached if exceeding the limit is due to circumstances beyond the control of the REIT Manager.

Market Capitalisation Overview

- Total Singapore REIT Market Capitalisation increased by 3.16% to S$94.67 Billion.

- Increased from S$91.77 Billion in July 2025.

- This increase can be partially attributed (in addition to the bullish performance) to the listing of NTT DC REIT.

- Biggest Market Capitalisation REITs (S$m):

Capitaland Integrated Commercial Trust 16463.70 Capitaland Ascendas REIT 12298.02 Mapletree Pan Asia Commercial Trust 7173.73 Mapletree Logistics Tr 5988.50 Mapletree Industrial Tr 5730.51 Keppel DC REIT 5102.79

- Smallest Market Capitalisation REITs (S$m):

Lippo Malls Indonesia Retail Trust 153.94 Manulife US REIT 164.61 Acrophyte Hospitality Trust 223.00 BHG Retail REIT 223.43 EC World REIT 226.74 Keppel Pacific Oak US REIT 281.06

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. If you want to know more about investing in REITs, scroll down for more information on the REITs courses.

Top 10 Best/Worst Performers of July 2025

Refer to the Detailed 2024 S-REITs Performance Here.

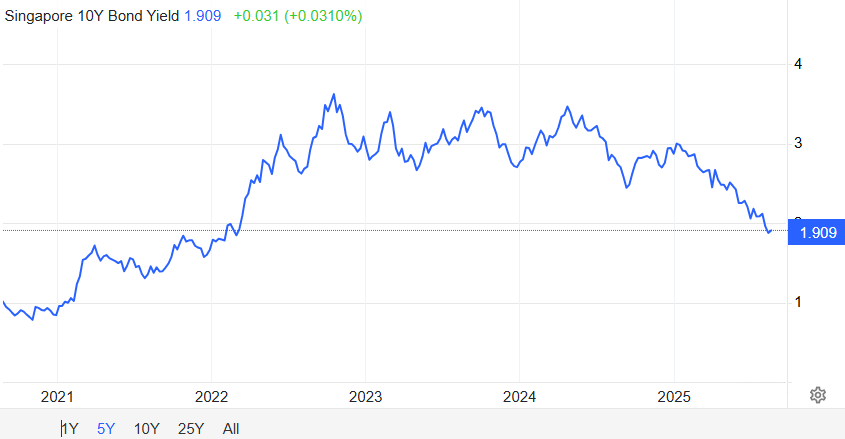

SG 10 Year Government Bond Yield

- SG 10 Year: 1.91% (decreased from 2.18%)

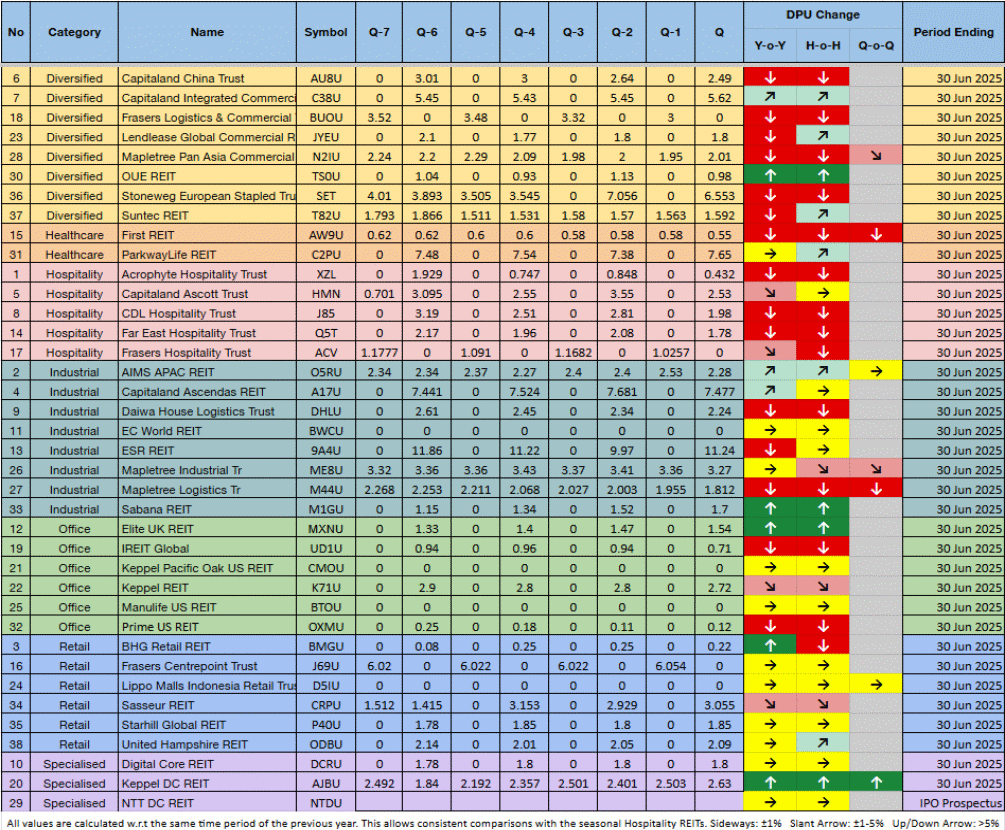

Earnings Summary for Q2 2025

The Earnings Season for the period ending 30 June 2025 has concluded, with relatively mixed to poor results.Hospitality REITs (and some Diversified REITs) posted mainly decreasing YoY and HoH DPUs, while Industrial and Data Centres performed better. Retail/Office were a mixed bag.

REITs with DPU changes within ±1% are classified as sideways.

Summary

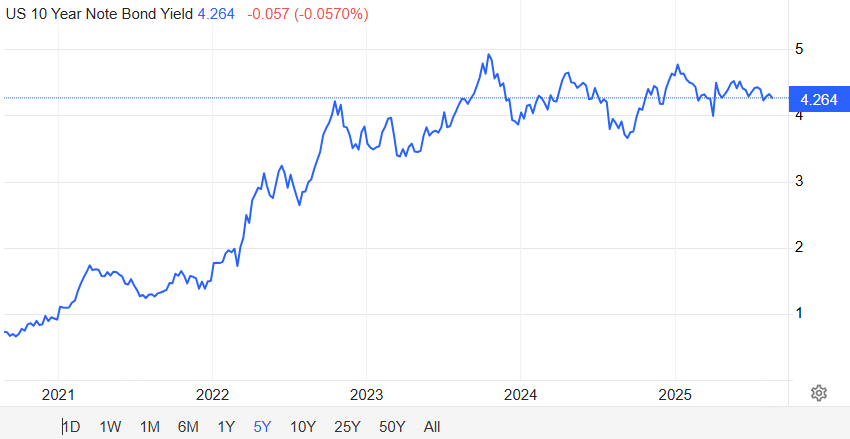

Singapore REITs sector is within a range between 663 and 684. This is a higher range than previously. The US 10Y Risk Free Rate has decreased slightly to 4.26%, while the SG 10Y Risk Free Rate decreased by 0.27% to 1.91%. However, average yield decreased due to the increase in the index, explaining the tightening of the Yield Spread w.r.t to the SG Risk Free Rate.

One to note is that while simple average Yield Spread tightened to 3.66%, weighted average Yield Spread widened to 3.93%. This is because larger-cap REITs saw relatively higher yield movements than smaller peers, and the market-cap weighting gave their underperformance greater influence on the weighted average figure.

Singapore REITs sector has very strong inversed correlation with US 10Y Risk Free Rate. We are seeing some early positive signs of the overall S-REIT index sentiment, also with the decreasing SG and US 10Y Risk Free Rate in the past month. It remains to be seen whether this positive trend can continue.

US 10 Year Risk Free Rate

Fundamentally, the S-REIT sector is trading at a 19% discount (3% if using weighted average) to its fair value, with an average trailing twelve-month (TTM) yield of 5.63%. Yield has come down but this is the natural result if the REIT index increases.

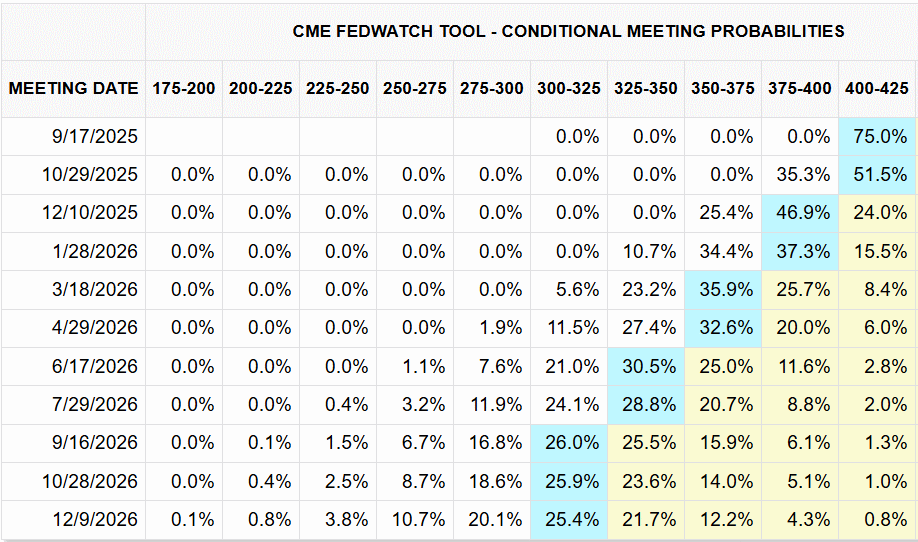

According to the current Fed Fund Rate projections from the CME Group, the market expects a 25 basis point cut by Q3 2025. The cut in interest rate will help to boost the DPU of the REITs which have shorter debt maturity profile and higher percentage of floating rate. However, the impact will only be reflected in the financial statement probably in Q3 or Q4 2025.

Kenny Loh is a distinguished Wealth Advisory Director with a specialization in holistic investment planning and estate management. He excels in assisting clients to grow their investment capital and establish passive income streams for retirement. Kenny also facilitates tax-efficient portfolio transfers to beneficiaries, ensuring tax-efficient capital appreciation through risk mitigation approaches and optimized wealth transfer through strategic asset structuring.

In addition to his advisory role, Kenny is an esteemed SGX Academy trainer specializing in S-REIT investing and regularly shares his insights on MoneyFM 89.3. He holds the titles of Certified Estate & Legacy Planning Consultant and CERTIFIED FINANCIAL PLANNER (CFP).

With over a decade of experience in holistic estate planning, Kenny employs a unique “3-in-1 Will, LPA, and Standby Trust” solution to address clients’ social considerations, legal obligations, emotional needs, and family harmony. He holds double master’s degrees in Business Administration and Electrical Engineering, and is an Associate Estate Planning Practitioner (AEPP), a designation jointly awarded by The Society of Will Writers & Estate Planning Practitioners (SWWEPP) of the United Kingdom and Estate Planning Practitioner Limited (EPPL), the accreditation body for Asia.

You can join his Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement

mystocksinvesting.com (Article Sourced Website)

#Singapore #REITs #Monthly #Update #August #23rd #Stocks #Investing