‘Can Aussies buy US shares?’

Believe it or not, my brother, Cam, asked me that question this morning.

‘Yes,’ I said. ‘It’s actually very easy.’

‘Oh,’ he replied. ‘I thought only US citizens could buy US shares.’

Hey, don’t laugh, he’s an electrician!

Cam has the odd speculation on the ASX. But he’s more of a property man.

That said, I expect more Aussies to buy more US shares.

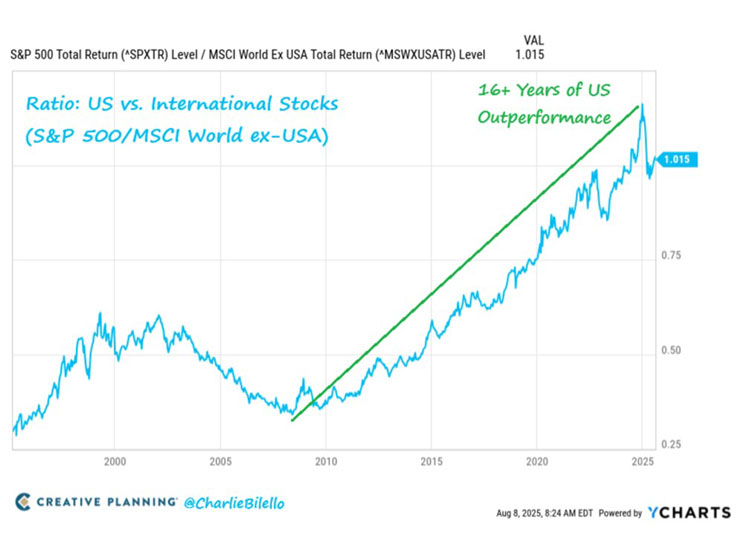

People chase performance. And it’s a simple fact that US shares keep trouncing Australia, and, to be fair to us, the rest of the world too.

Here’s a chart from Charlie Bilello to see this in action…over the last 16 years!

|

|

Now, as we know, past performance is no guarantee of future performance.

But the ASX is an odd market.

The Top 50 is utterly dominated by the big banks and the big miners. Neither seem like firing much in the next 12 months.

Then we have a spread of REITs, industrials and retailers. None of them scream excitement. Most of them are legacy firms that are hardly on the cutting edge of innovation.

I like the ASX for the mid and small cap sectors.

Many people will tell you this is “risky”. I don’t automatically agree. All shares come with risk…at all times!

Case in point right now is ASX blue chip CSL ($CSL).

Many a fund manager and financial advisor have happily recommended this stock for years.

It fell 17% after its earnings announcement this week. Its share price has gone sideways for 5 years.

I’m not saying it’s a bad company. But there’s a difference between a good business…and good investment opportunity.

CSL is indicative of the problem we can find in Australia. We know the name CSL. We trust it. We feel safe with our money in it. But so often know we’re buying more brand than ‘buck’.

Look at the outrageous bid on CBA. There’s very little earnings growth driving the rally, which, to me, makes it more brittle than it appears.

Shares do best when they’re underpinned by real and growing earnings.

US shares, generally speaking, provide this in bucketloads, because so many firms can either target the huge domestic US market…or worldwide.

That’s not so easy to do on the ASX.

There are some. ResMed ($RMD) springs to mind.

Life360 ($360) has been a star over the last 2 years for this reason. There’s Zip Co ($ZIP) as well. I could probably list a dozen or more, connected to the US in some way.

However, when I look at some of the emerging industries now – AI, genetic editing, stablecoins, autonomous vehicles – Australia doesn’t really give us much to work with.

Of course, it depends on what type of investor you are too. If you’re looking for income and dividends, the ASX has a lot of solid options.

We have a good range of ‘speculative’ opportunities too. I’m thinking of pre-revenue and pre-profitability plays like early miners or small cap biotechs.

But there’s a limit to how big you can go with these types of names.

$1000 or $10,000 – ok. But $1 million? Probably not.

US markets are deep and liquid too. Many a trader I know has converted to the US market because the potential upside and volume is just so much better.

I’m not saying you can’t make money or find opportunity in Australia.

But I think it’s worth having two portfolios now – one for the ASX and one for the US. I know my colleague Chewie does this.

I remember chatting with him a while ago. His US portfolio was booming away…and his ASX one barely budging.

That was last year, from memory. Odds on both are up since.

For spread of opportunity, I can’t help but get excited by this idea.

The portfolio we launched and run for Altucher’s Investment Network is all US shares. Most of the names are sitting on very solid gains already.

Now, my colleague Murray Dawes is going to do something similar. He’s going to bring his technical analysis and years of experience to the US markets.

His average gain for his Aussie portfolio is currently north of 40%. He’s had some outstanding trades in gold, lithium and rare earths this year.

I can’t wait to see him bring his A level game to what the US offers.

Make sure you check out some of his introductory ideas here.

Best Wishes,

Callum Newman,

Small-Cap Systems and Australian Small-Cap Investigator

***

Murray’s Chart of the Day –

US Yield Curve

Source: Tradingview

[Click to open in a new window]

James Hardie Industries [ASX:JHX] disappointed the market this morning with a terrible set of results.

This was from their announcement:

Speaking to the Company’s market outlook, Mr. Erter said, ‘Presently, demand in both repair & remodel and new construction in North America is challenging. Uncertainty is a common thread throughout conversations with customer and contractor partners.

Homeowners are deferring large-ticket remodelling projects like re-siding. Affordability remains the key impediment to improvement in single-family new construction, where more recently, homebuilders are moderating their demand expectations and slowing starts to align their home inventory with a decelerating pace of traffic and sales.’

So it looks like high mortgage rates are slowing down activity in US real estate and things will get worse before they get better.

Apparently new single family homes have the highest inventory for sale since 2007.

With expectations of falling interest rates over the next year there must be many people praying mortgage rates drop sharply as well.

US 30-year fixed mortgage rates remain stubbornly high at around 6.70%.

They are usually priced off US 10-year bond yields because they match the duration of a 30-year mortgage.

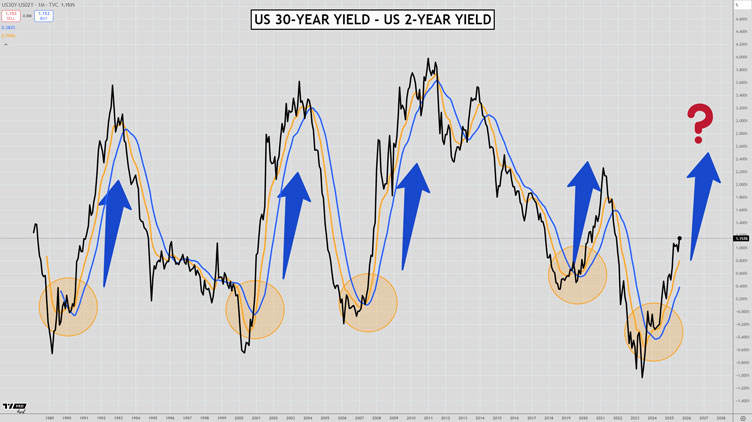

The chart above shows you US 30-year bond yields minus US 2-year yields so you can see a representation of the steepness of the US yield curve.

Notice since 1989 that there have been five times when the long-term trend turned up (orange circles).

In three out of four instances the steepness of the yield curve kept rising to a level of around 3.50-4.0% before topping out.

With inflation bubbling away as a result of Trumps tariffs and immense pressure on the Fed to cut rates as employment figures disappoint we may be on the cusp of seeing the yield curve steepen even further.

Trump wants to put in a yes-man next year to replace Powell.

What happens then?

Does she/he cut rates to the bone despite all warnings that inflation is rearing its head again?

Investors will demand more compensation for holding duration.

Long bonds such as 10-year to 30-year bonds may in fact sell off instead of rally as the Fed cuts rates, which would see mortgage rates go up instead of fall!

That would create quite the conundrum.

Perhaps James Hardies poor results are a canary in the US coalmine that we should keep in the back of our minds as we move forward.

All eyes are on Powell on Friday as he delivers his Jackson Hole speech. His views on the future path of rates can spur the equity rally on or spark a correction.

If you want to start trading stocks overseas during these exciting times then be sure to check out my free five video crash course in offshore trading which will show you how it’s done from Australia.

Regards,

Murray Dawes,

Retirement Trader

The post ASX Trap: more brand than buck appeared first on Fat Tail Daily.

daily.fattail.com.au (Article Sourced Website)

#ASX #Trap #brand #buck