Solana is gaining institutional momentum, with ETF inflows, bullish charts, and on-chain growth all pointing toward a potential breakout ahead of September.

Solana is quietly building a multi-layered comeback. From a 3-year high in Total Value Locked (TVL) to over $137 million in ETF inflows since mid-July. It’s not just the fundamentals that are turning heads; technicals are starting to align, too, with SOL pressing up against major resistance and forming the early signs of a potential breakout.

Solana ETF Inflows Signal Early Institutional Build-Up

Despite a brief pause in inflows over the last couple of sessions, Solana’s ETF performance is still carving out a compelling narrative. With a total of $137.4 million in net inflows since mid-July, the numbers speak to growing institutional confidence, even without the daily consistency seen in Bitcoin or Ethereum products. This quiet accumulation, spread over several days with often spikes like the $13.4M on July 24th, reveals there is sustained interest in Solana ETFs.

Solana racks up $137.4M in ETF inflows since mid-July, signaling growing institutional demand. Source: Jesse Peralta via X

The idea that Solana could become the third-best-performing crypto ETF isn’t just optimistic, it’s now backed by real capital flow. Even with a couple of flat days, momentum isnt likely to dry up. The ETF’s early inflow trajectory resembles a foundational build-up phase, much like what we’ve seen historically with maturing institutional products. If this pace holds or reignites in the coming weeks, SOL could solidify its position as the next big ETF story in crypto.

Solana Price Action Targets $205 as Channel Breakout Looms

Following the steady ETF inflows outlined earlier, Solana’s price chart is now lining up with that narrative on the technical side. The 4-hour timeframe shows SOL pushing directly into the descending channel resistance that has defined price action for the last few days. This repeated approach toward the upper band, combined with declining sell volume, signals that sellers may be losing control.

Solana tests key channel resistance with eyes on $205 breakout as sell pressure begins to fade. Source: Satoshi Flipper via X

A breakout from this structure could unlock a swift move toward the $200 to $205 region, as noted by Satoshi Flipper. What makes this level interesting isn’t just the psychological round number, but the confluence of prior breakdown levels and liquidity clusters stacked above. With ETF flows firming up and Solana pressing against key resistance, the technical setup looks increasingly primed to follow the fundamentals.

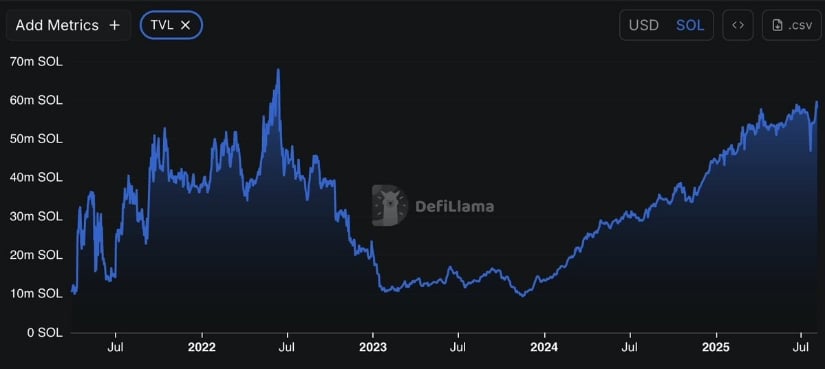

Solana TVL Hits 3-Year High

Adding to the momentum sparked by Solana’s ETF interest and technical structure, on-chain metrics are flashing strength too. According to DeFiLlama, Solana’s Total Value Locked (TVL) in SOL terms has reached its highest point in over three years. This isn’t just a dollar-denominated bounce, it reflects increasing user commitment and protocol activity on the chain.

Solana’s TVL in SOL terms hits a 3-year high. Source: DeFiLlama via X

This new TVL high in SOL terms shows that more native assets are being staked, borrowed, or deployed across DeFi protocols than at any point since the last cycle’s peak. It’s a different signal from ETF flows or price charts, but it complements them perfectly.

Solana Price Prediction Eyes All-Time Highs By September

Building on the recent strength seen across different fronts, Solana’s price action is now aligning with a broader Elliott Wave-based bullish structure. As outlined by EasychartsTrade, the current channel remains intact and is supporting a potential move towards previous all-time highs by late August or early September. The price recently bounced from a key Fib cluster around $160 and appears to be in the early stages of a new impulsive wave, with $214 and $250 marked as Fibonacci extension targets.

Solana forms early impulsive wave with $214–$250 targets in sight, supported by Elliott Wave structure. Source: EasychartsTrade via X

This setup also reinforces the ongoing narrative: ETF flows may be leading the institutional charge, but technicals like these are starting to validate that shift on the chart. From a Solana price prediction standpoint, the structure reflects both a corrective base and emerging strength.

Solana’s Pullback Flags Opportunity as Bullish Indicators Resurface

Even with Solana posting a 10% dip this week, the market structure isn’t showing panic; in fact, it’s flashing several stabilizing signs. According to Wise Crypto, exchange balances are down 10%, hinting at reduced sell pressure, while CME futures remain steady, suggesting institutional players are not unwinding their positions. These are the kind of subtle but important cues that can mark the end of a correction phase rather than the start of a larger breakdown.

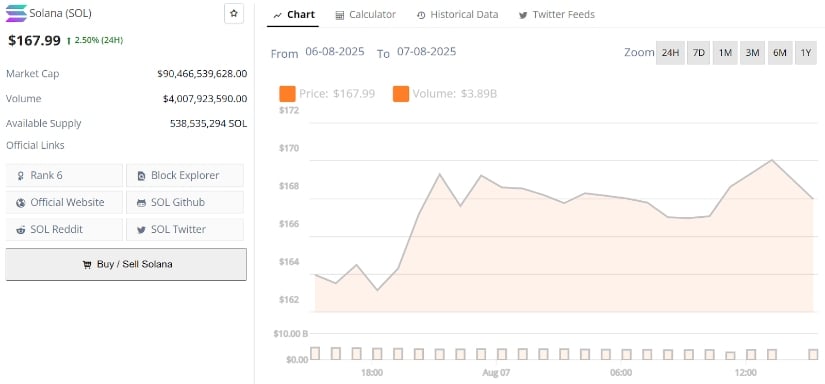

Solana is trading at around $167.99, up 2.50% in the last 24 hours. Source: Brave New Coin

Technically, the daily chart also shows a golden crossover beginning to form, a classic bullish momentum signal. As noted in prior sections, institutional ETF inflows and long-term structures have already laid a strong base. Now, shorter-term confirmation levels are coming into play. If SOL can reclaim $176, it could trigger a renewed leg higher toward prior highs. On the flip side, the $155 support remains the key risk zone to watch.

Final Thoughts: Is Solana Quietly Prepping for Its Next Big Move?

Solana’s recent pullback hasn’t broken the larger bullish setup; it may have strengthened it. ETF inflows are holding firm, exchange balances are shrinking, and TVL just hit a 3-year high in SOL terms. These aren’t just surface-level metrics, they signal that both users and institutions are getting more involved.

If SOL can reclaim $176 and hold above that level, the door opens for a rally toward $205 and possibly higher. With on-chain strength, bullish chart patterns, and fresh capital backing the narrative, Solana’s price prediction heading into September remains tilted to the upside.

bravenewcoin.com (Article Sourced Website)

#Solana #Price #Prediction #SOL #Eyes #September #ETF #Inflows #TVL #Fuel #Breakout #Setup #Brave #Coin