The Altus Trader Manifesto: A New Standard for Conquering the Gold Market

Let’s be honest: trading Gold is unlike anything else. It’s a market of exhilarating highs and gut-wrenching lows. One moment, it’s the ultimate safe-haven asset, a bedrock of stability when the world seems to be falling apart. The next, it’s a volatile battleground, whipsawing on the latest inflation report, interest rate decision, or geopolitical headline. This is the reality of trading XAUUSD—immense opportunity wrapped in significant risk.

For years, automated trading systems, or EAs, have promised a solution: a way to trade this complex market with discipline and without emotion. Yet, how many of them actually deliver? The truth is, the vast majority of EAs are built on a shaky foundation, destined to fail when real money is on the line. They fall into two major traps:

The “Black Box” Problem: Most EAs are sold as a mystery. You’re expected to trust a system without ever truly understanding how it makes decisions. This isn’t trading; it’s gambling. When you can’t see the logic, you can’t manage risk, and you can’t build the confidence needed to weather the inevitable drawdowns.

The “Curve-Fitting” Epidemic: This is the big one. Developers create strategies that look absolutely perfect on a historical chart. But what they’ve really done is “over-optimize” the system to fit the past, essentially memorizing old price movements rather than learning a genuine, repeatable market edge. The moment you run it on a live account, the beautiful equity curve shatters, because the live market is never an exact replica of the past.

These failures aren’t just technical flaws; they are philosophical ones. They stem from the misguided belief that a single “perfect” strategy can exist. It can’t. The Gold market is constantly changing. A strategy that thrives today might fail tomorrow.

Altus Trader was born from this frustration. It’s not just another EA; it’s a complete rethinking of what an automated gold trading system should be. It’s built on a foundation of strategic diversity, radical transparency, and architectural robustness—principles designed not just to trade, but to conquer the gold market for years to come.

Part 1: The Power of 300 Strategies – Your Personal “Fund of Funds”

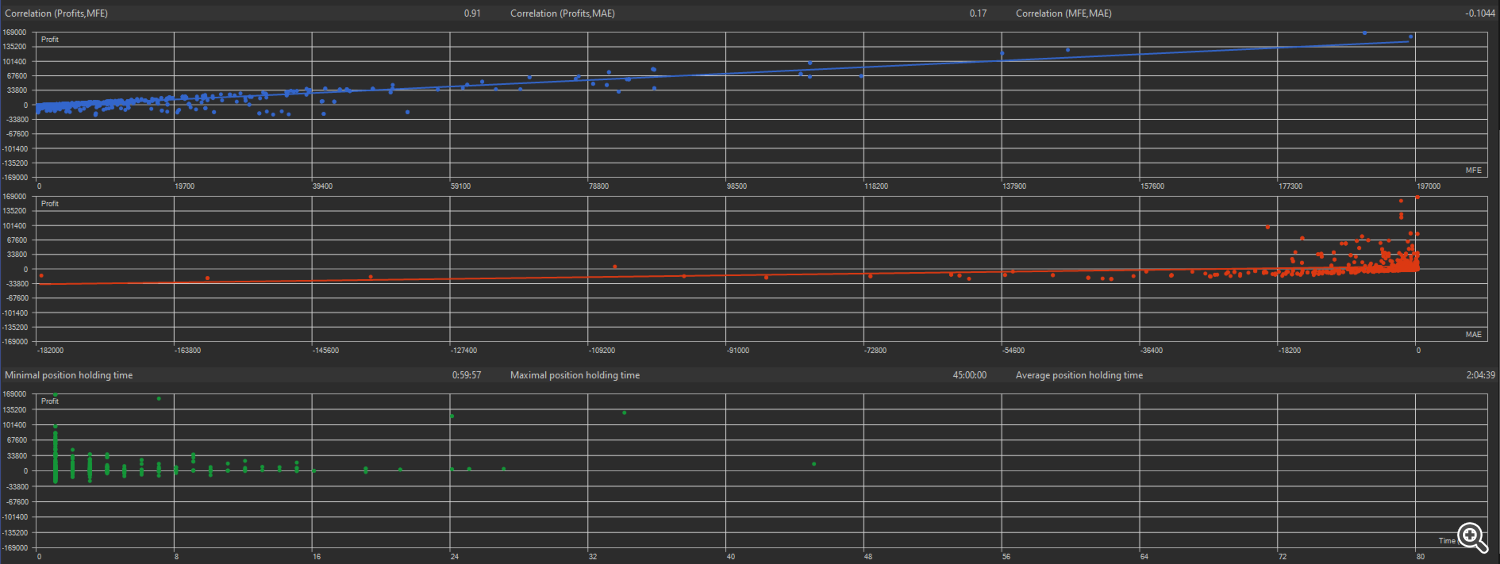

Forget the search for a single “holy grail” strategy. The world’s most successful hedge funds don’t rely on one magic formula. They build a diversified portfolio of multiple, uncorrelated strategies. This is the secret to smoother returns and reduced risk, and it’s the exact principle at the heart of Altus Trader.

Altus Trader isn’t one strategy; it’s 300 unique strategies working in unison. Think of it as your own private, automated “fund of funds,” with each strategy acting as a specialist, designed to excel in a specific market condition:

- Powerful Trends: When Gold is making a decisive move up or down, our trend-following strategies activate to capture the momentum.

- Choppy Consolidation: When the market is moving sideways, our mean-reversion and range-bound strategies take over, finding profits in the chop.

- Volatility Breakouts: When a period of quiet erupts into a sudden burst of activity, our breakout strategies are there to capitalize on the explosion.

This diverse arsenal means Altus Trader doesn’t need to predict what the market will do next. It simply reacts to what the market is doing right now. This is a critical distinction. While a single-strategy EA is fragile, relying on one specific market condition to occur, Altus Trader is adaptive and resilient. It’s designed to have a tool ready for any job, ensuring it’s never caught off-guard. This multi-strategy approach harmonizes key metrics like trade frequency, win rate, and return vs. drawdown, creating a more stable and trustworthy performance curve over the long haul.

Part 2: The Glass Box Philosophy – Unmatched Transparency and Control

We believe that trusting your trading tool is non-negotiable. That’s why we rejected the “black box” model in favor of a “glass box” philosophy. With Altus Trader, you are never in the dark.

At the heart of the system is the Advanced Strategy Management Dashboard. This isn’t just a trade history log; it’s your command center. For the first time, you can see real-time performance metrics for every single one of the 300 strategies inside the system. You can monitor:

- Net Profit & Profit Factor: See exactly which strategies are your star performers.

- Win Rate & Return/Drawdown: Understand the risk and reward profile of each approach.

- System Quality Number (SQN): Get a professional-grade assessment of a strategy’s health and reliability.

We’ve also designed the logic to be as intuitive as possible. The signals for long and short positions are symmetrical, meaning the conditions for a buy are the direct inverse of the conditions for a sell. This makes it incredibly easy to understand why a strategy is taking a trade, whether the market is rising or falling.

This transparency changes your role from a passive user to an active, informed portfolio manager. You can see which strategies are thriving in the current market and which are holding back. This level of insight builds genuine, verifiable confidence in your trading tool.

Part 3: Built to Last – An Architecture of Robustness

A trading system is only as good as its foundation. We’ve engineered Altus Trader from the ground up to be robust and reliable, addressing the two biggest points of failure for most EAs.

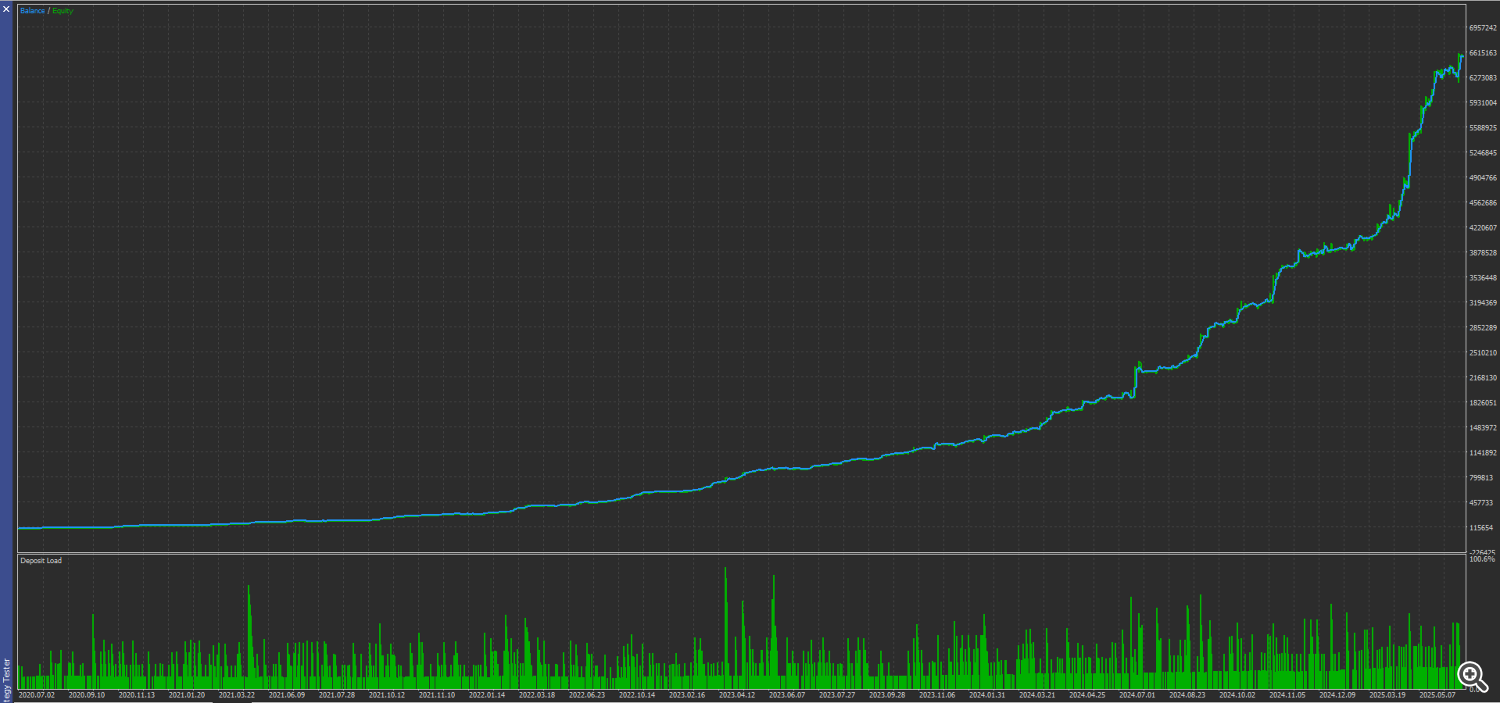

1. The Knowledge Base: 20+ Years of Multi-Broker Data

Most EAs are tested on data from a single broker, making them vulnerable to that broker’s specific data feed. Altus Trader was forged in a much tougher environment. We’ve tested and refined its logic across over 20 years of historical data from a diverse pool of top-tier brokers, including Eight cap, Black bull, Darwin Ex, FTMO, and Dukas copy.

This multi-broker validation process forces the EA to learn the true, underlying behavior of the gold market, rather than just the quirks of one data set. It ensures the strategies are not fragile and can perform confidently, regardless of the broker you choose.

2. The Execution Logic: Precision on the New Bar

Have you ever had an EA that performed brilliantly in back tests, only to fall apart in live trading? This is often because “every tick” back testing relies on simulated price movements within a candle, which can never be perfectly replicated.

Altus Trader takes a smarter, more reliable approach. It operates exclusively on new bar formation. The system analyzes the chart once every hour, at the opening of the H1 candle, and makes all decisions based on the confirmed data of the previous, closed bar. This isn’t a limitation; it’s a deliberate choice for reliability. It ensures that the conditions that trigger a trade in a back test are identical to the conditions in live trading, dramatically closing the gap between tested performance and real-world results. This efficient logic also allows the massive 300-strategy system to run smoothly without bogging down your terminal.

Part 4: A Masterclass in Dynamic Risk Management

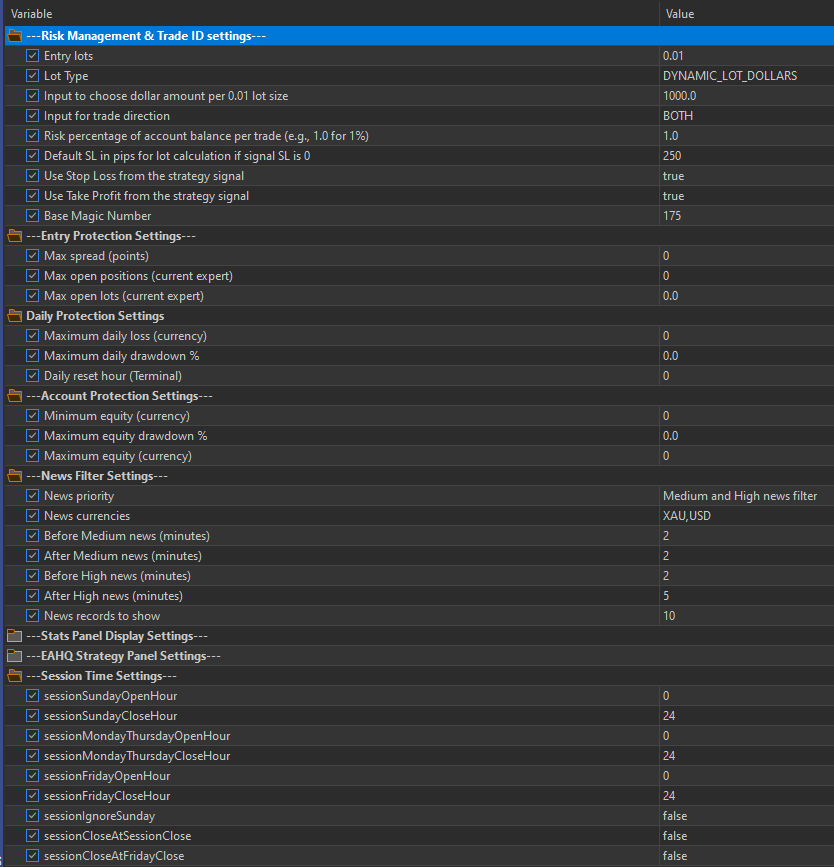

A great entry signal is worthless without an ironclad defense. Altus Trader gives you a suite of professional-grade risk management tools, putting you in complete control.

We’ve moved beyond only relying on the outdated static stop-loss, which is vulnerable to market noise and predatory “stop hunts.” Instead, Altus Trader uses a multi-layered defense system:

- Intelligent, Dynamic Exits: Each strategy has its own unique exit indicators. This means trades are closed based on changing market conditions, not an arbitrary price level. This is a more adaptive and intelligent way to manage trades.

- Absolute Account-Level Protection: You have ultimate control with a master suite of safety features:

- Exposure Controls: Set the max open positions, maximum spread, and max open lots to fit your risk tolerance.

- Daily Drawdown Limits: Use currency or percentage-based daily DD limits as a “circuit breaker” to prevent a bad day from turning into a disaster.

- Time-Based Rules: Control which days and hours the EA trades and choose to close all trades before the weekend to avoid gap risk.

- Dedicated News Filter: Don’t get caught in the volatility of major news releases. Our easily configurable news filter allows you to halt trading around high, medium, or low-impact news events for any symbol you choose.

- Flexible Position Sizing: Choose from fixed lots, dynamic lots, or the professional standard of Risk Percentage, where the EA automatically calculates the position size to risk a fixed percentage of your account on every trade.

The Bottom Line: Your Partner for Conquering Gold

Altus Trader is more than just an EA. It’s a complete, institutional-grade trading framework designed for the serious gold trader. It’s the culmination of years of research and development, built to provide a durable, long-term edge in one of the world’s most challenging markets.

With its diverse 300-strategy portfolio, transparent “glass box” design, robust architecture, and comprehensive risk controls, Altus Trader delivers a level of sophistication and reliability that was once out of reach for retail traders.

It’s time to stop gambling on black boxes and fragile strategies. It’s time to partner with a system that is as serious about your success as you are. Welcome to the new standard in gold trading. Welcome to Altus Trader.

www.mql5.com (Article Sourced Website)

#Altus #Trader #Manifesto #Standard #Conquering #Gold #Market