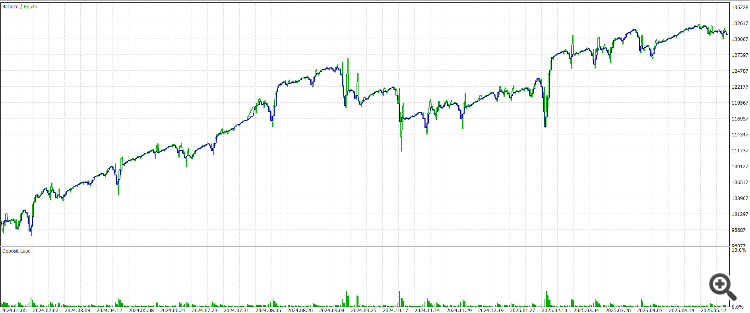

In this article, we explore a powerful and unique expert advisor (EA) designed specifically for the USDJPY pair: USDJPY Killer. Unlike most robots on the market that are hastily put together and sold to maximize profits from naive buyers, USDJPY Killer is built on a discretionary and psychologically sound approach to the market. This EA was not created to be a money-making product for mass distribution, but rather as a temporary release to raise capital for a larger goal: launching my own proprietary trading firm. Once that funding target is reached, the EA will no longer be available for sale. You can see here how the EA works on live https://www.mql5.com/en/signals/2305722

The Strengths of a Discretionary-Based Trading Robot

In the rapidly evolving world of financial markets, the rise of algorithmic trading has revolutionized the way investors and institutions operate. While most trading robots rely on fully automated, rule-based systems, a growing number of sophisticated platforms are embracing a discretionary approach—one that blends human-like judgment with computational efficiency. This hybrid model, often overlooked in favor of pure quant strategies, offers unique advantages that position it as a powerful tool for navigating complex and dynamic market environments.

1. Combining Human Intuition with Automation

A discretionary trading robot replicates the decision-making processes of skilled human traders, applying nuanced judgment instead of rigid rules. Unlike traditional algorithms that operate on fixed technical indicators or statistical thresholds, a discretionary robot evaluates a broader range of inputs—such as macroeconomic events, market sentiment, and geopolitical developments—to make informed decisions.

This flexibility mirrors the way seasoned traders operate. Human traders often succeed not because of rigid models, but due to their ability to interpret context, assess risk dynamically, and adapt their strategies in real time. A discretionary robot encodes this adaptive thinking into its core, offering a more intelligent and responsive trading engine.

2. Context-Aware Decision-Making

Market conditions are rarely static. A purely systematic trading bot might perform well in trending markets but fail during range-bound or volatile periods. Discretionary robots, on the other hand, can adjust their behavior based on market context. They incorporate real-time news feeds, volatility indicators, or even investor positioning data to weigh the probability of outcomes.

For instance, if a major central bank is expected to change interest rates, a discretionary system can reduce risk exposure ahead of the event or position the portfolio anticipating different scenarios. This anticipatory behavior—characteristic of human judgment—is what sets these robots apart from purely mechanical systems.

3. Reduced Overfitting and Improved Generalization

One of the greatest weaknesses of traditional rule-based bots is their vulnerability to overfitting. They are often optimized on historical data, which can lead to poor performance in out-of-sample periods. Discretionary systems, however, are designed to focus on principles and patterns that are more likely to persist over time, such as the market’s reaction to risk aversion, behavioral biases, or institutional flows.

Because discretionary bots emulate high-level decision-making frameworks rather than specific patterns, they tend to generalize better in new environments. This gives them a distinct edge in adapting to sudden regime shifts, like the onset of a financial crisis or the emergence of a black swan event.

4. Greater Transparency and Explainability

A common critique of black-box algorithms is the lack of interpretability. Portfolio managers and risk officers often struggle to understand why a purely systematic strategy makes certain trades. In contrast, discretionary trading bots—especially those built with interpretable models like decision trees or reinforcement learning agents with traceable logic—offer clearer rationales behind their actions.

This transparency is vital not only for internal risk management but also for client communications. Investors are more likely to trust systems that can explain their behavior using understandable logic, rather than obscure technical rules.

What Makes USDJPY Killer Different?

Many EAs rely on outdated logic or over-optimized technical setups that fail under real market conditions. USDJPY Killer is different: it uses psychological price levels—the key levels where traders and institutions alike tend to place orders. These levels are not static lines, but zones of price activity and reactions. USDJPY Killer is designed to read these zones using discretionary criteria encoded into the system.

The robot is built specifically to exploit trend periods on the USDJPY pair, which historically tends to move with conviction during macroeconomic cycles or interest rate differentials. Most EAs fail in trending markets due to their mean-reversion logic. USDJPY Killer thrives in them.

________________________________________

Not Just a Robot. A Strategy.

The core strength of USDJPY Killer lies in the fact that it is not just a code executing trades—it is a codified trading plan, tested and used by a real trader.

• It doesn’t trade all day long.

• It doesn’t chase price.

• It doesn’t rely on martingale or grid strategies.

Instead, it waits for high-probability setups around key psychological levels. These are manually selected, tested zones that serve as entry points. Once price reaches these areas, the EA looks for discretionary confirmations to engage the trade. This logic mirrors what a seasoned trader would do—and that’s what makes it powerful.

________________________________________

Discretion Built into Automation

While the strategy is rules-based, the criteria used are the result of discretionary trading experience. This includes:

• Volatility filter (avoids low liquidity traps)

• Confirmation candles near key zones

• Trend validation on higher timeframes

• Session-specific behaviors (Asian, London, New York)

Because USDJPY Killer combines these factors, it does not open frequent trades, but focuses on quality over quantity.

________________________________________

Image illustration :

________________________________________

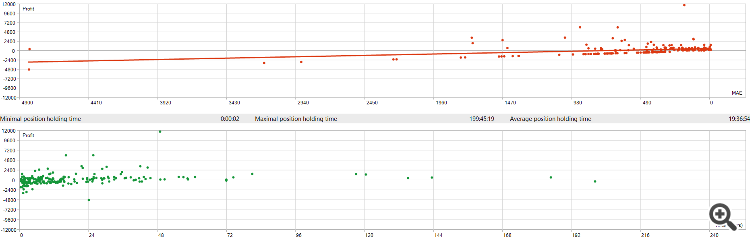

Explanation of the strategy

I specify one thing to be clear, I want to explain the system, how the EA manages the position, how it proceeds, but I will not explain why it opens the position. I make sure my configuration works, but if you use a completely crazy setting, I do not want to be responsible for that. Since I’ve been using EA, she’s never had more than 4 consecutive losses. However, as the financial markets are constantly changing, I advise you to use a position size that allows the EA to make 8 consecutive losses. In other words, for a capital of $100,000, use a maximum position size of 2 lots.

Overall, there are three main parameters for this psychological levels’ strategy.

1. The choice of the symbol

The EA can only trade on USDJPY, so before doing anything, make sure you write the name of your broker’s USDJPY symbol in the MY_Symbol parameter. You need to write exactly what the broker displays, whether in back testing or live trading. Otherwise, the EA will just open positions randomly. For example, my broker’s symbol for USDJPY is: USDJPY.i.

Yours can be USDJPY or USDJPY.e or USDJPY.w or …. Just make sure you write it as it appears on your MT4 or MT5 platform.

1. The choice of psychological levels

EA uses hidden psychological levels as they are major key levels and widely used by asset managers who generally act on a long-term basis. The choice is not given to the user for the selection of these psychological levels. The criteria used to select them are the result of discretionary trading experience.

2. Position management

EA uses several levels of confirmations to manage position, but all of them are hidden. The user is only allowed to act on:

– TSL_Trigger_Points : this is an integer number to activate the trailing stop. The higher this number is, the more the EA needs a good trend, but the fewer trades the robot will open. The lower the number, the more trades will be opened but with lower profit.

– Trailing_SL_Points : this is an integer number that sets the distance between the trailing stop and the current market price.

– Trailing_Step_Points : this is an integer number that moves the trailing stop each time the current market price reaches this distance.

3. The use of the partial closing

The user can choose to proportion of the position to close each time the EA reach a psychological resistance level. The user has just to modify the percentage settings that is set on 0.3 in default. This means the EA will close 30% of the position each time it reaches a possible resistance.

4. The Time

The EA is allowed to trade at any time and keeps position until it don’t touch the stop loss. This choice was made because the EA uses machine learning to know when to open the position, so it is not possible to know the best time level before opening the trade. It is therefore allowed to restrict the EA to trade certain period of time. This can improve his efficiency, but I do not use it. Also, like the EA enjoy surfing on big trend I do not force close on Friday, but sometimes it could be better to close on Friday to avoid weekends gaps.

________________________________________

A Word on Intent and Transparency

Unlike many developers who flood the market with EAs just to make a quick buck, my intention is very different. I am releasing this EA only for a limited time, and only to raise the capital needed to launch a proprietary trading firm. Furthermore, I’m not here to sell a dream of overnight riches. I’m here to offer a real trading tool to those who understand the market.

This is why USDJPY Killer is:

• Not overfitted

• Not over-optimized

• Not based on back test-only logic

It’s a tool I trust, and I use it myself.

________________________________________

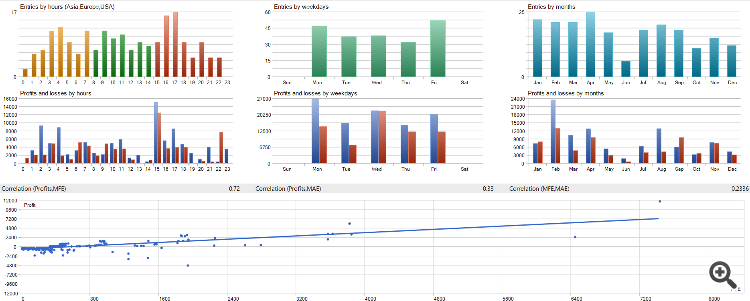

Back test of the strategy from 2024.01.01 to 2025.05.23

________________________________________

Who Is It For?

USDJPY Killer is designed for traders who:

• Understand risk management

• Seek real strategy-backed automation

• Prefer quality trades over frequency

• Want to benefit from USDJPY’s trending nature

It is not for gamblers, or traders looking for a “magic button.”

Trading is not about perfection—it’s about edge, discipline, and execution. USDJPY Killer was created with that mindset. If you are looking for a tool that embodies professional logic, respects market psychology, and is designed with a clear trading purpose, this EA may be what you need.

But remember: this EA will only be available temporarily. Once my funding goal is met, I will retire it from the market.

If you’re serious about your trading and want to be part of something real, now is the time.

A Message to Beginners in Trading

When I launched my first EA on mql5, I found that many people who bought it had no trading knowledge and were just looking for the miracle robot. So some, after only one loss, started to blame the efficiency of the EA without trying to understand the strategy and how to take advantage of the full potential of the EA. My question to them is: already, how can you select an EA more than another, if you do not know how the Forex works? Do you know how to make the numbers speak? Ratios? Profit factors? Statistics? Slippage? do you know that it is impossible to have a 100% win rate?

Others have even raised the point that some trades were different by a few points between the back test and the reality, as if the back test could reproduce the reality. I don’t judge you, but I invite you to learn about trading and programming if you need to and this even in a totally free way because all the information is available for free nowadays.

Having learnt from the philosophy of some of my clients, I decided to favor live results over back testing. This is why USDJPY Killer already has a proven track record (https://www.mql5.com/en/signals/2305722) which I believe is a lot more valuable than back testing that doesn’t always align with the live results. As you can see in the description, It’s all 100% automated trading, so my question to you is: do I want perfect back testing or actual steady live performance?

However, do not hesitate to back test as much as possible but know that the real conditions sometimes differ.

Please don’t hesitate to reach out for more information.

www.mql5.com (Article Sourced Website)

#USDJPY #Killer